Morrow County Assignment of Trust Deed by Beneficiary or Successor in Interest Form

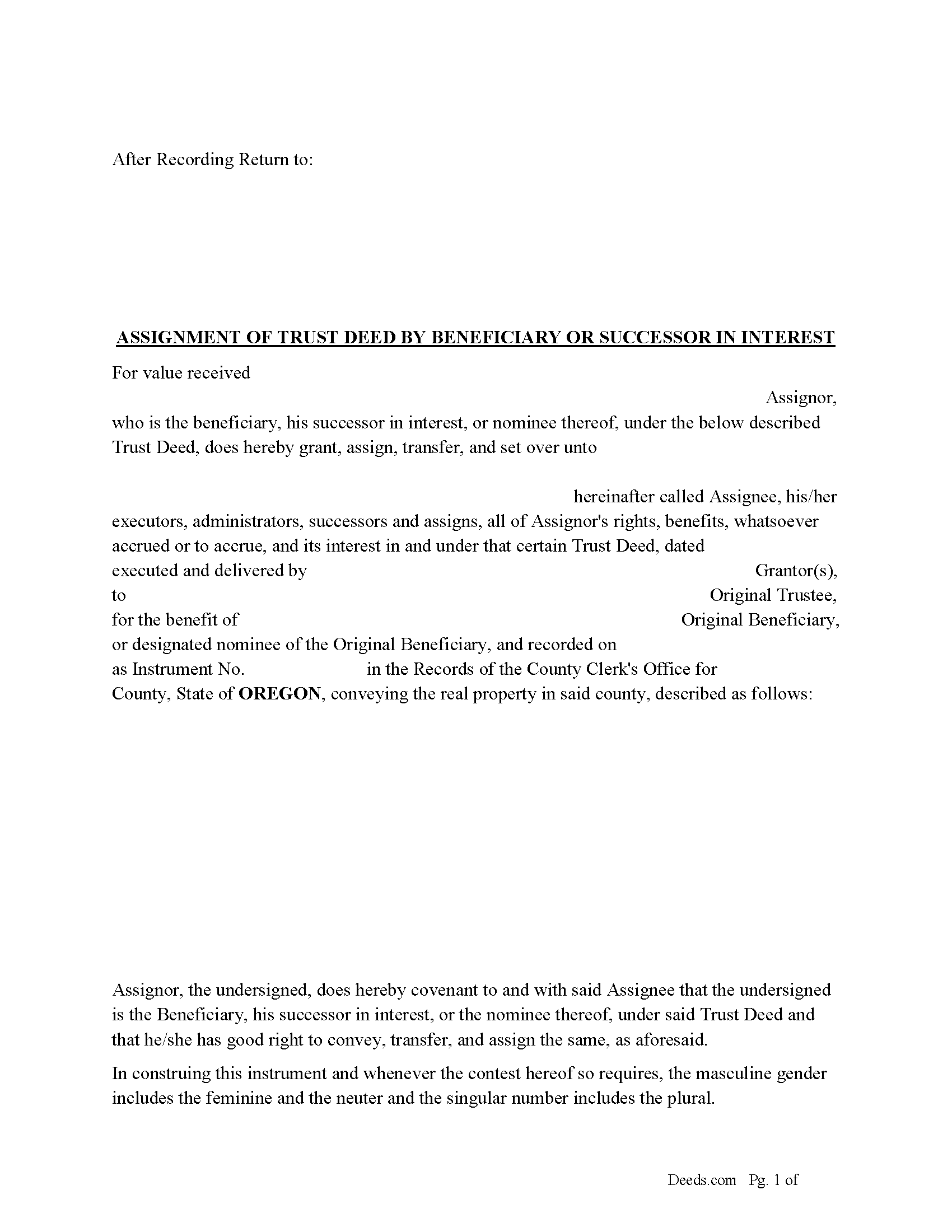

Morrow County Assignment of Trust Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

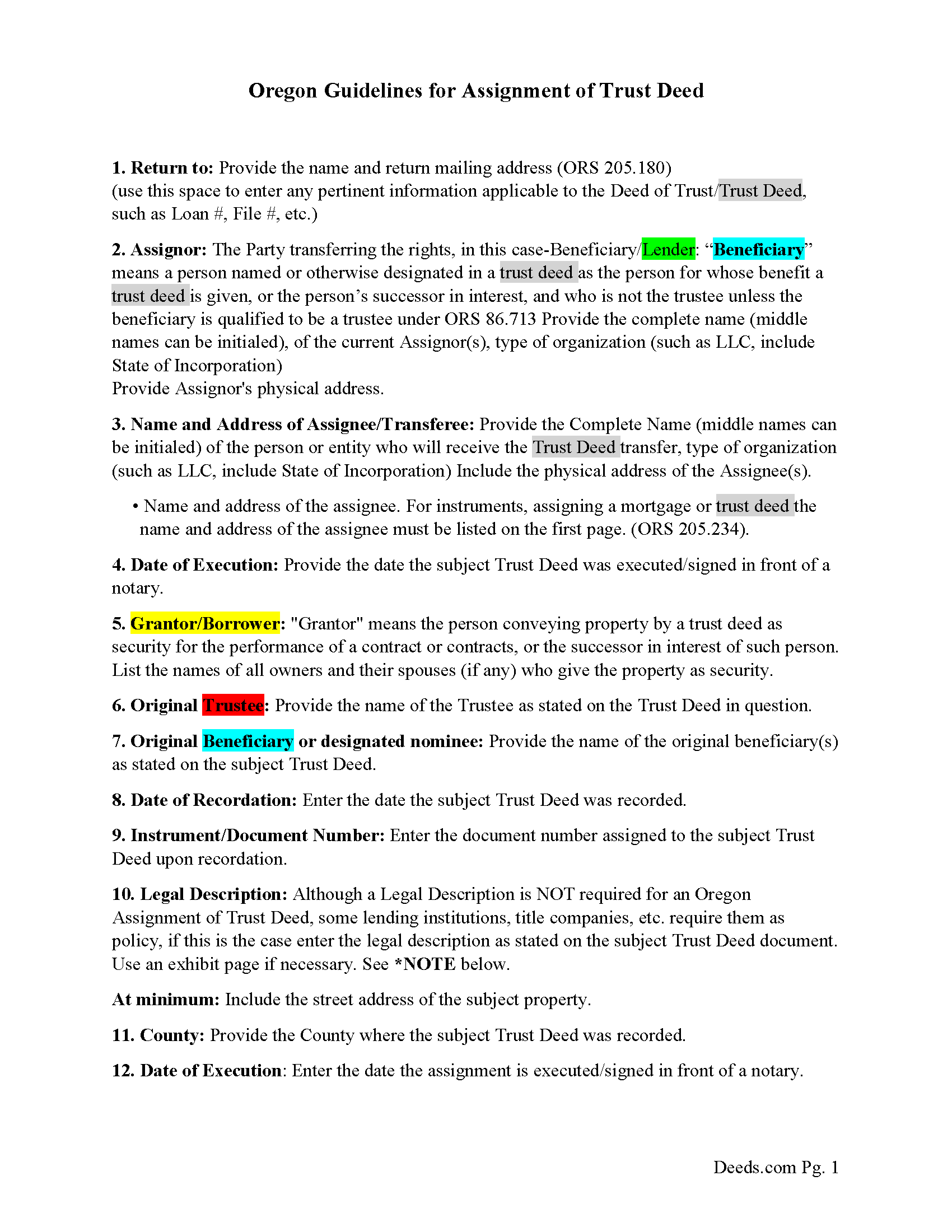

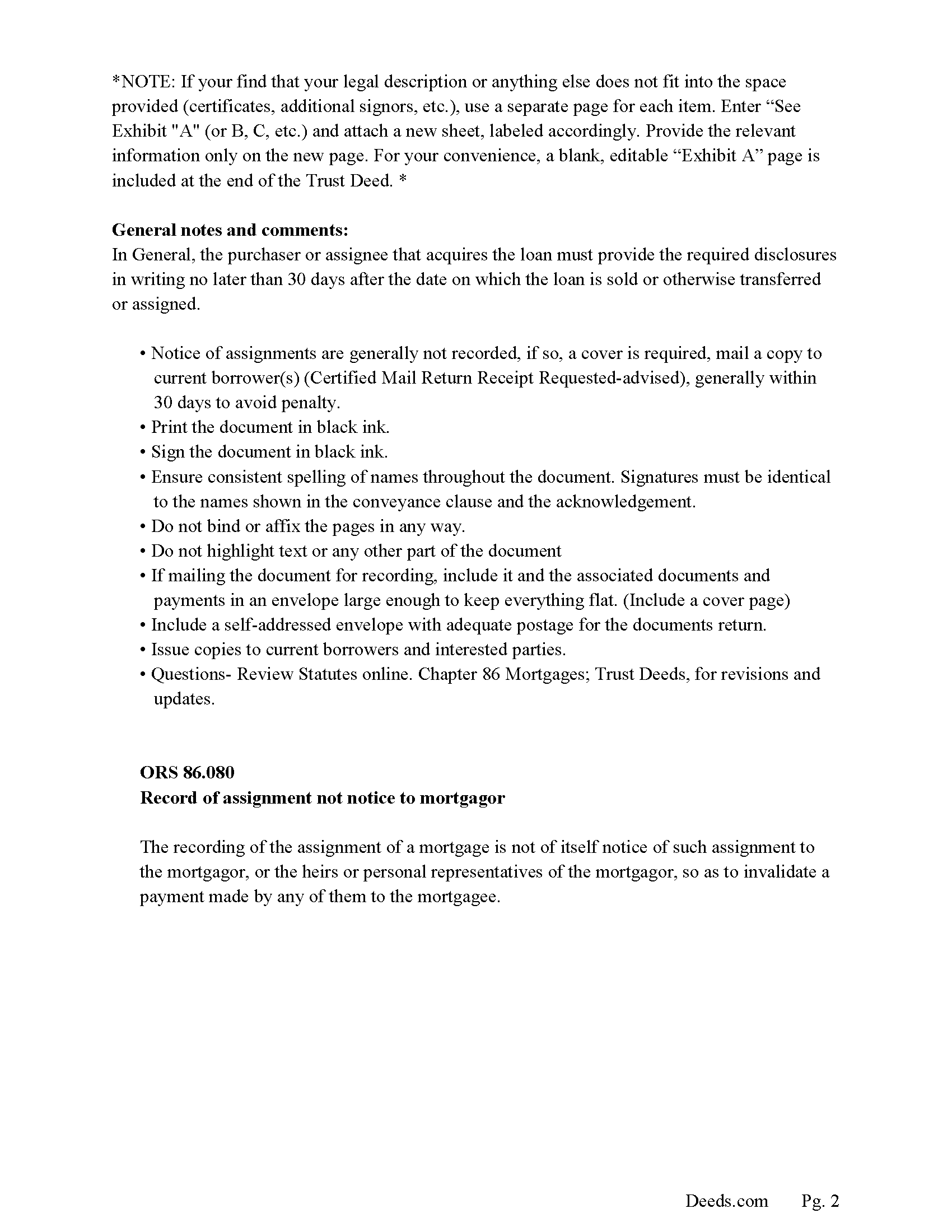

Morrow County Assignment of Trust Deed Guidelines

Line by line guide explaining every blank on the form.

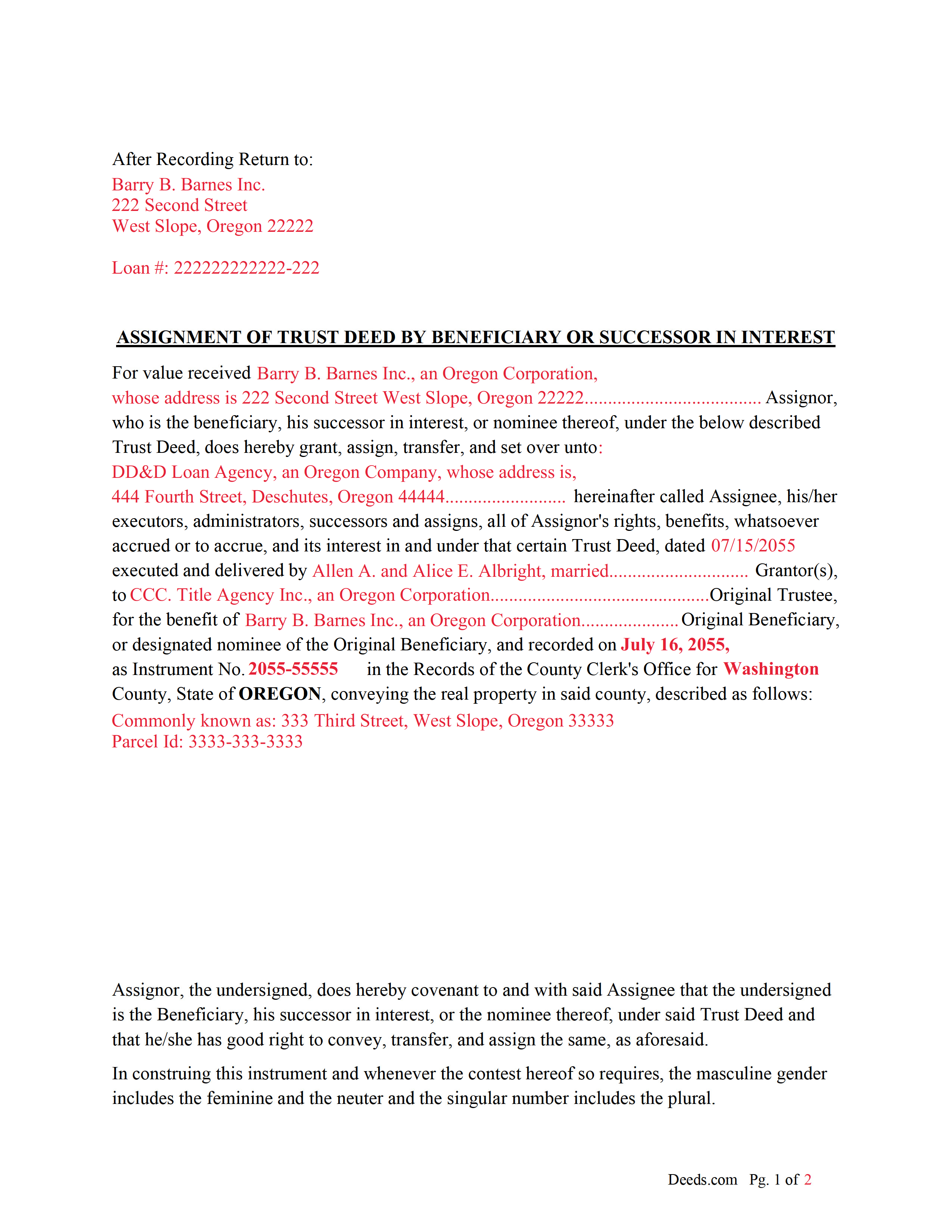

Morrow County Completed Example of Assignment of Trust Deed Document

Example of a properly completed form for reference.

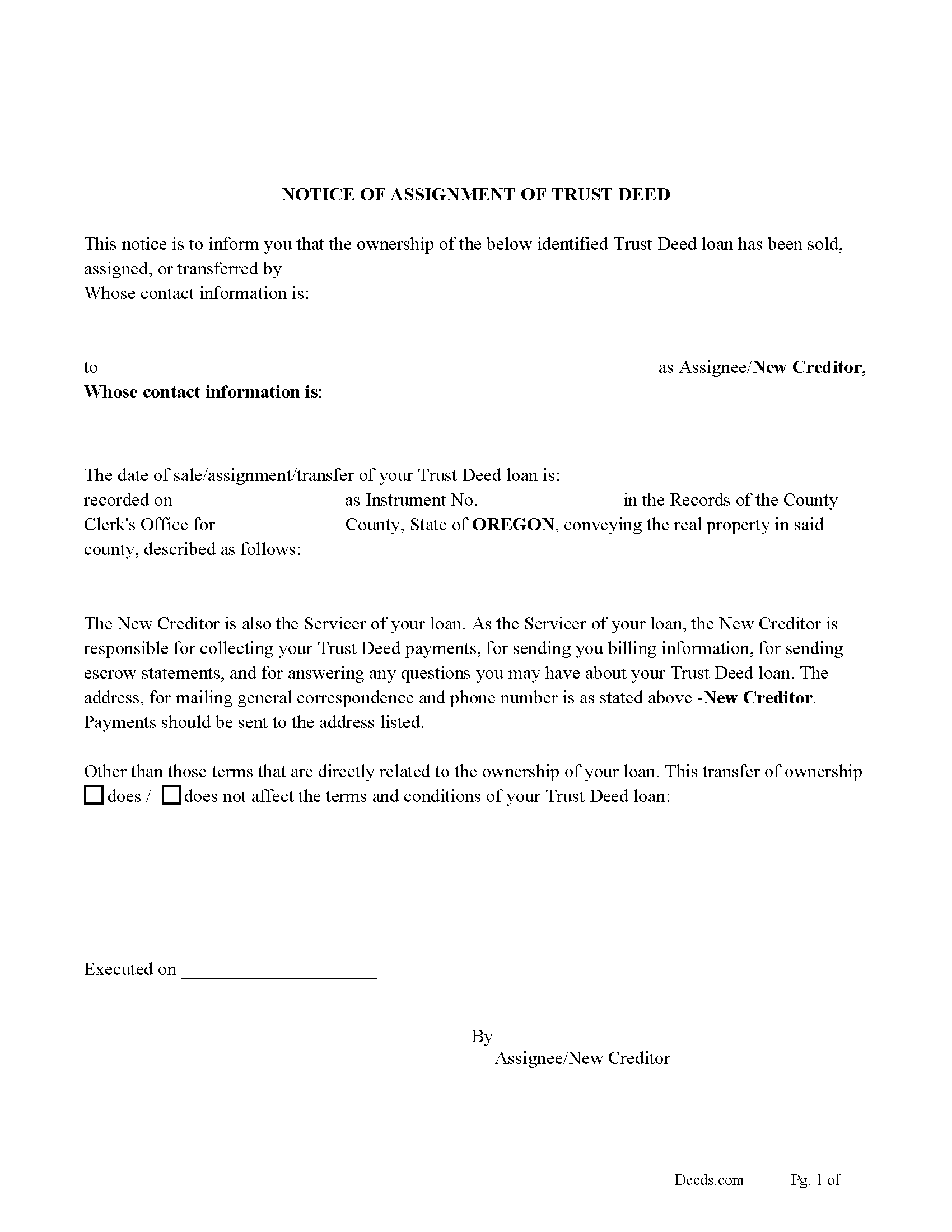

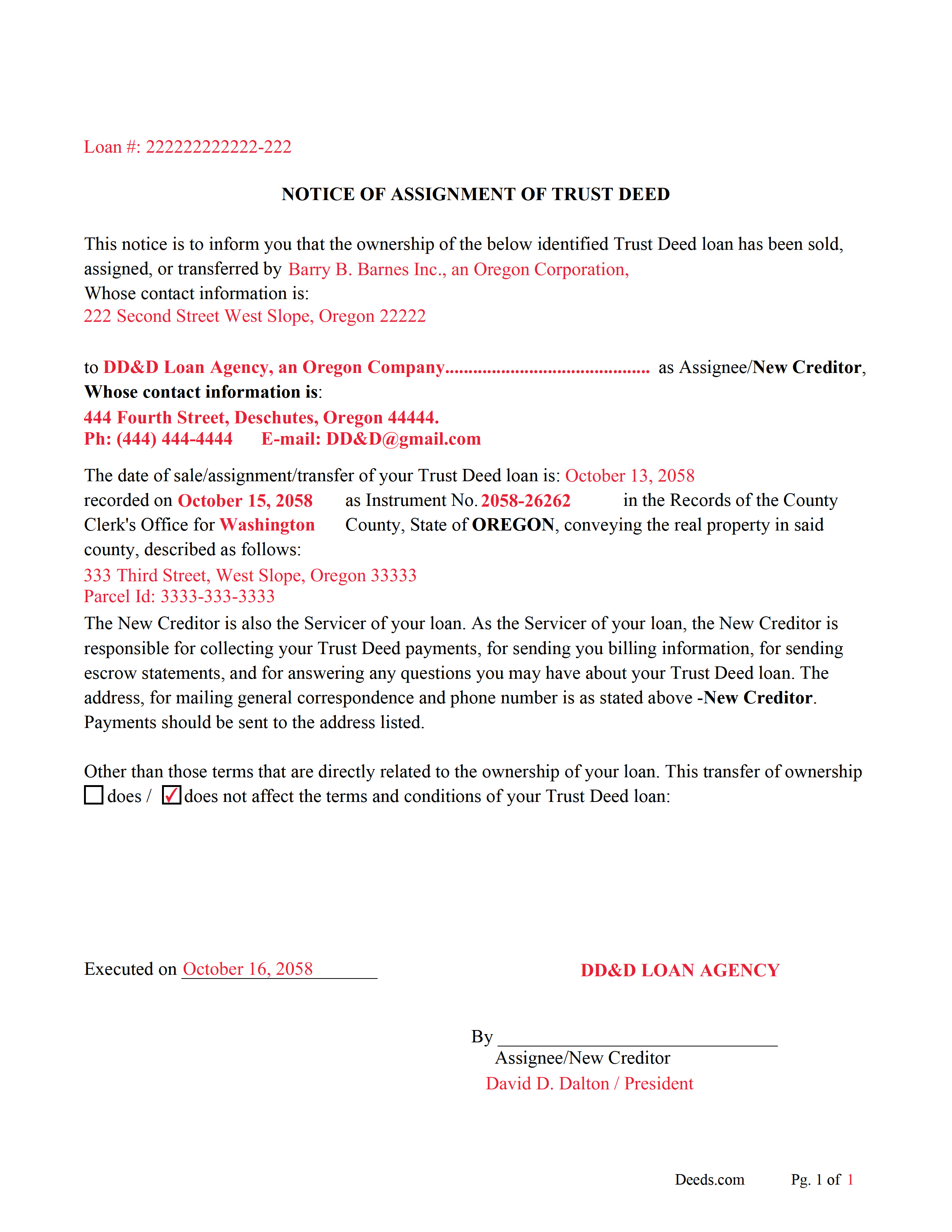

Morrow County Notice of Assignment of Trust Deed Form

Fill in the blank form formatted to comply with content requirements.

Morrow County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

Morrow County Notice of Assignment-Completed Example

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Morrow County documents included at no extra charge:

Where to Record Your Documents

Morrow County Clerk

Heppner, Oregon 97836

Hours: Monday - Friday 8am-12pm, 1pm-5pm

Phone: (541) 676-5604

Irrigon Satellite Office

Irrigon, Oregon 97844

Hours: only Thu 9:00 to 4:00

Phone: (541) 676-5604

Recording Tips for Morrow County:

- Bring your driver's license or state-issued photo ID

- Make copies of your documents before recording - keep originals safe

- Recorded documents become public record - avoid including SSNs

- Have the property address and parcel number ready

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Morrow County

Properties in any of these areas use Morrow County forms:

- Boardman

- Heppner

- Ione

- Irrigon

- Lexington

Hours, fees, requirements, and more for Morrow County

How do I get my forms?

Forms are available for immediate download after payment. The Morrow County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Morrow County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Morrow County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Morrow County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Morrow County?

Recording fees in Morrow County vary. Contact the recorder's office at (541) 676-5604 for current fees.

Questions answered? Let's get started!

In this form the assignment/transfer of a Trust Deed/Deed of Trust is made by the beneficiary/lender or successor in interest.

("Trust deed" means a deed executed in conformity with ORS 86.705 (Definitions for ORS 86.705 to 86.815) to 86.815 (Time within which foreclosure must be commenced) that conveys an interest in real property to a trustee in trust to secure the performance of an obligation the grantor or other person named in the deed owes to a beneficiary.) (ORS 86.705(8))

("Beneficiary" means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).) (ORS 86.705(2))

ORS 86.060 Assignment of mortgage Mortgages may be assigned by an instrument in writing, executed and acknowledged with the same formality as required in deeds and mortgages of real property, and recorded in the records of mortgages of the county where the land is situated.

ORS 86.715 Trust deed deemed to be mortgage on real property A trust deed is deemed to be a mortgage on real property and is subject to all laws relating to mortgages on real property except to the extent that such laws are inconsistent with the provisions of ORS 86.705 (Definitions for ORS 86.705 to 86.815) to 86.815 (Time within which foreclosure must be commenced), in which event the provisions of ORS 86.705 (Definitions for ORS 86.705 to 86.815) to 86.815 (Time within which foreclosure must be commenced) shall control. For the purpose of applying the mortgage laws, the grantor in a trust deed is deemed the mortgagor and the beneficiary is deemed the mortgagee.

Included are "Notice of Assignment of Trust Deed" forms. The current Mortgagor/Borrower/Grantor must be notified of the assignment, generally within 30 days to avoid penalty.

ORS 86.080 Record of assignment not notice to mortgagor

The recording of the assignment of a mortgage is not of itself notice of such assignment to the mortgagor, or the heirs or personal representatives of the mortgagor, so as to invalidate a payment made by any of them to the mortgagee.

(Oregon Assignment Package includes form, guidelines, and completed example) For use in Oregon only.

Important: Your property must be located in Morrow County to use these forms. Documents should be recorded at the office below.

This Assignment of Trust Deed by Beneficiary or Successor in Interest meets all recording requirements specific to Morrow County.

Our Promise

The documents you receive here will meet, or exceed, the Morrow County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Morrow County Assignment of Trust Deed by Beneficiary or Successor in Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

THEODORE P.

August 28th, 2024

You were very helpful and patient with me in learning your portal. I now understand your process.

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Equity S.

June 2nd, 2021

I love the service you provide. Very helpful and saves a ton of time.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janet J.

December 15th, 2022

These forms were very easy to both download and print, as well as fill out on the site and then print. The instructions are clear and concise. We have not yet been to the County to file them, but we are expecting no issues.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Liliana H.

July 21st, 2025

I had a great experience using Deeds.com to file my legal document. The whole process was simple and easy to follow. The website walks you through each step, and everything is explained clearly. At one point, I had to resubmit my documents, but even that was quick and easy. There were clear instructions, and I had no trouble making the changes and sending them again. The communication was great too. I was kept updated the whole time, and any questions I had were answered fast. If you need to file legal documents and want a stress-free way to do it, I definitely recommend Deeds.com. They made the whole process smooth from start to finish.

Thank you, Liliana! We really appreciate you taking the time to share your experience. We're glad everything went smoothly and that our team could support you when needed. It means a lot to know you'd recommend us!

Max P.

February 26th, 2021

Excellent. Timely. Efficient. Smooth. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ken B.

August 9th, 2022

Instructions were easy to follow

Thank you!

Christy Z.

July 18th, 2019

Very thorough forms received and very quick service. Thank You!

Thank you for your feedback. We really appreciate it. Have a great day!

Beatrice V.

August 27th, 2020

I was in despair as I needed to file two (2) very important documents with the County. Due to Covid the office was closed and my only recourse was to E-Fie with a service provider. I was fortunate enough to hear about Deeds.com. They were specific, courteous, patient and most of all productive. My documents will take awhile for the final filing but that is because the County happens to have a slow turn around time. Otherwise, I am now relieved that this part is over. Thank you Deeds.com. You are awesome.

Thank you for the kinds words Beatrice.

John F.

May 30th, 2019

Excellent service, very reliable.

Thank you for your feedback. We really appreciate it. Have a great day!

Lori W.

January 24th, 2020

Disclaimer letter was just what I needed. Download worked without a hitch.

Thank you for your feedback Lori, we really appreciate it. Have a fantastic day!

Andrew H.

November 11th, 2020

Very efficient does what it says on the box.

Thank you!

Nicole P.

February 13th, 2021

The forms are great. I kinda expected the guide to be bigger, maybe have some more information. Overall I'm satisfied thus far.

Thank you!

RICHARD H.

October 29th, 2020

Wonderful

Thank you!

Eddy C & Tina H.

May 11th, 2021

did not use, much to expensive.

Thank you for your feedback. We do hope that you found something more suitable to your needs elsewhere. Have a wondaful day.

Larry H.

December 23rd, 2020

Nice

Thank you!