Baker County Correction Deed Form

Baker County Correction Deed Form

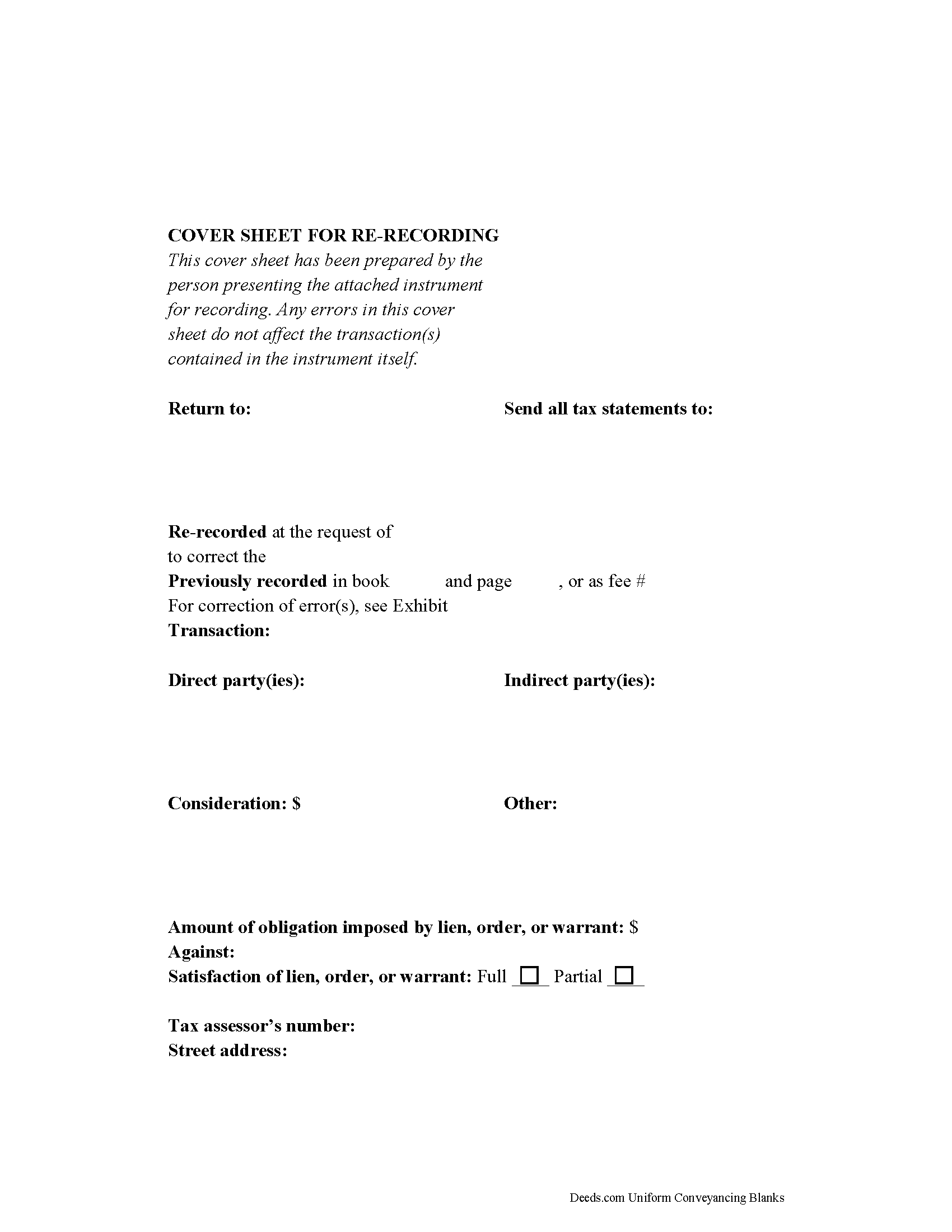

Fill in the blank form formatted to comply with all recording and content requirements.

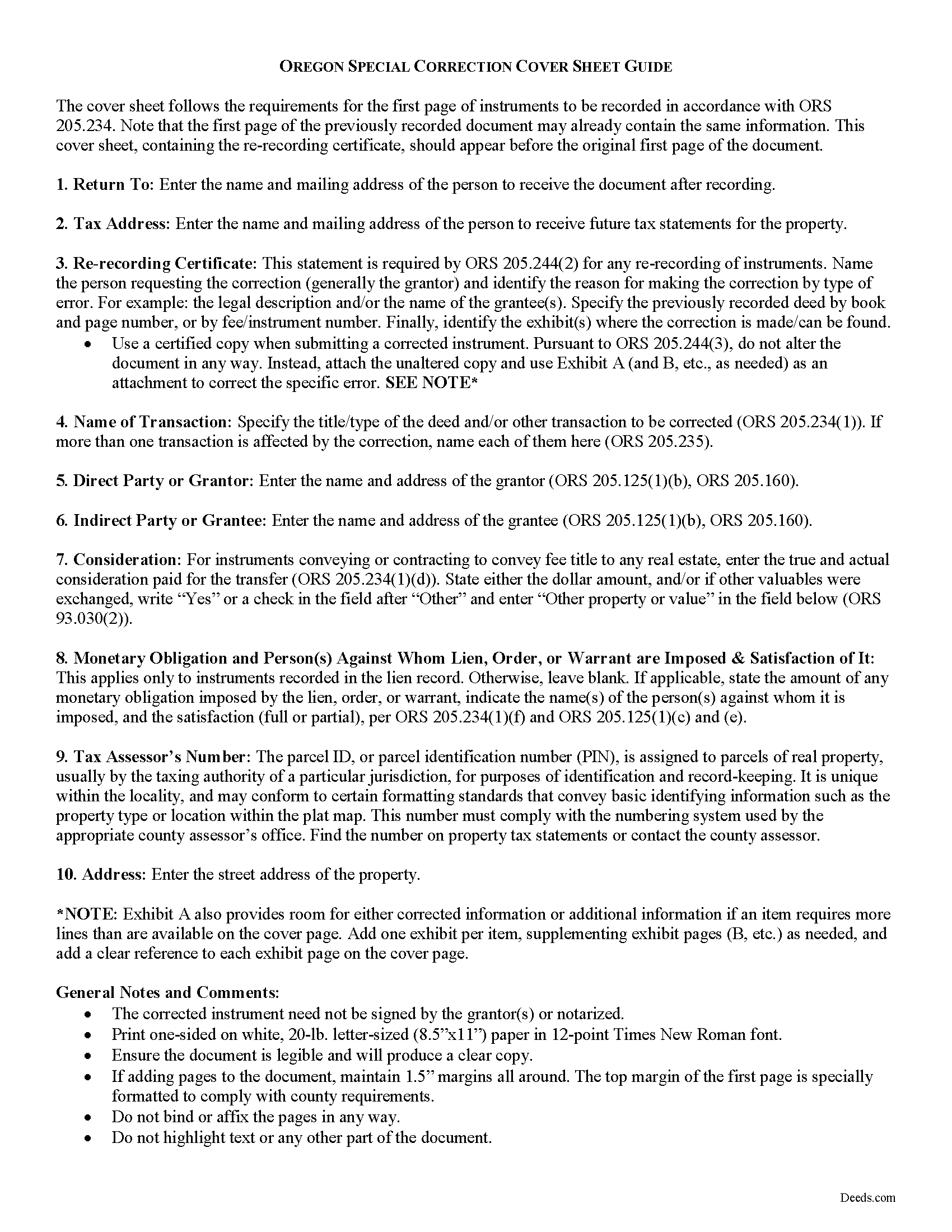

Baker County Correction Deed Guide

Line by line guide explaining every blank on the form.

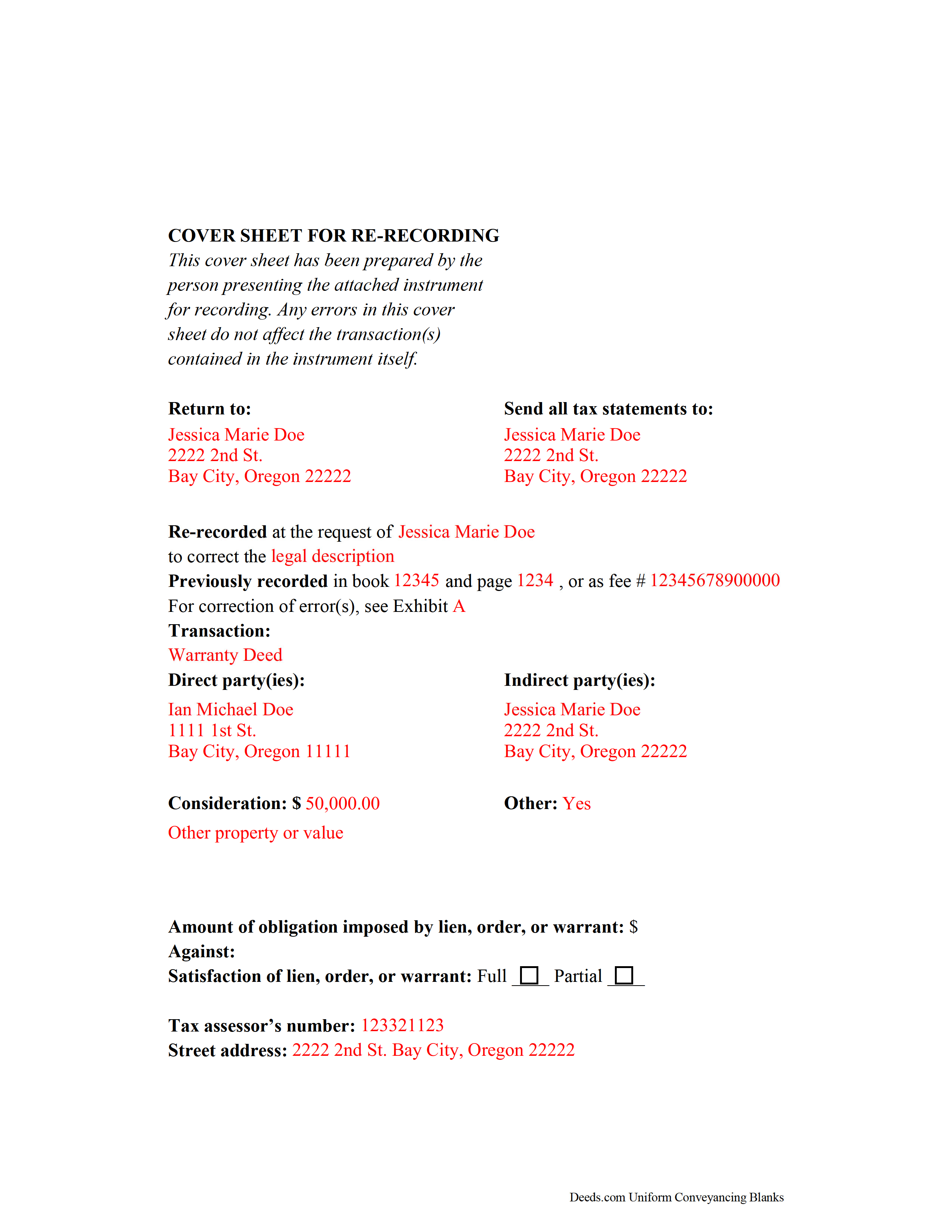

Baker County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Baker County documents included at no extra charge:

Where to Record Your Documents

Baker County Clerk

Baker City, Oregon 97814

Hours: 8:00am to 4:30pm.M-F

Phone: (541) 523-8207

Recording Tips for Baker County:

- Ask if they accept credit cards - many offices are cash/check only

- Verify all names are spelled correctly before recording

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Baker County

Properties in any of these areas use Baker County forms:

- Baker City

- Bridgeport

- Durkee

- Haines

- Halfway

- Hereford

- Huntington

- Oxbow

- Richland

- Sumpter

- Unity

Hours, fees, requirements, and more for Baker County

How do I get my forms?

Forms are available for immediate download after payment. The Baker County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Baker County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Baker County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Baker County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Baker County?

Recording fees in Baker County vary. Contact the recorder's office at (541) 523-8207 for current fees.

Questions answered? Let's get started!

Correcting Recorded Documents in Oregon with a Re-recording Certificate

If an instrument is recorded and later found to have missing, incomplete, or incorrect information, Oregon law requires that a statutory statement referencing the prior deed -- called a re-recording certificate -- appear either on the first page of the original document or on an attached cover sheet of a re-recorded instrument (ORS 205.244). The re-recording certificate must identify the person requesting the re-recording, the specific error corrected by the re-recording, and the location where the original deed was recorded (ORS 205.244(2)).

If the re-recording certificate appears on a newly generated cover sheet, the cover sheet must meet first-page requirements under ORS 205.234(2), which include the return address, name of transaction, grantor and grantee information, the true and actual consideration for the transfer, and, if applicable, the lien amount and satisfaction.

When re-recording a certified copy of a previously recorded instrument, no alterations may be made to correct the document (ORS 205.244(3)). Instead, make the necessary correction on an attachment and include it, along with the unaltered copy and the cover sheet, and identify these attachments on the cover sheet.

Oregon does not require reacknowledgement of the deed (ORS 205.244(2)). Contact the local county clerk's office with questions related to re-recording a specific document. Re-record the deed in the same office where the original deed was recorded.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an Oregon lawyer with any questions related to correction deeds and cover sheets.

(Oregon CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Baker County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Baker County.

Our Promise

The documents you receive here will meet, or exceed, the Baker County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Baker County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Diane O.

September 1st, 2022

Filling out forms was easy....so far, I am happy !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jamie B.

July 14th, 2020

Deeds.com made the recording of our Deed in a county where we do not reside, VERY easy! Customer service was great with all my questions answered immediately via my account portal. Very user friendly service! I wish the available documents were a little less pricey, but all in all, to get the job done right, I'll probably utilize the document downloads in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Lindsey B.

January 21st, 2025

The e-recording service was invaluable. This was my first experience recording a document in any capacity. The feedback I received was useful, concise, and presented kindly. I cannot imagine having to try to record by mail, or without the guidance that was provided to me.

We are delighted to have been of service. Thank you for the positive review!

Bohdan F.

June 23rd, 2023

Quick, efficient and the instructions were clear. Thank you

Thank you!

Muriel S.

October 5th, 2023

The three people we dealt with were courteous and helpful.

Thank you!

Carol S.

May 7th, 2022

Needed a Quit Claim Deed and am so happy I went to Deeds.com. Completed my forms - they looked professional and had no problem submitting them to Assessor's office. PERFECT!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bryan C.

August 2nd, 2019

Fast and just as promised

Thank you for your feedback. We really appreciate it. Have a great day!

Bonnie M.

May 26th, 2022

I received what I requested. Then I didn't need it after all.

Thank you for your feedback. We really appreciate it. Have a great day!

TRACEY W.

April 18th, 2019

The system is very easy to use. I wasn't able to access what I needed but my fees were refunded without issue.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James K.

May 15th, 2024

Looks like a very professional site. I just don’t know what it would cost using this site.

Thanks for the kind words about the website James, sorry to hear that you could not find pricing information, we will try harder.

Vicki J.

November 17th, 2020

Reasonably priced and Extremely easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott W.

February 5th, 2024

Quick and simple.

Thank you!

Micael J.

August 28th, 2021

Easy to follow and fill out forms online.

Thank you for your feedback. We really appreciate it. Have a great day!

Helen M.

June 10th, 2019

I was quite pleased with Deeds.com. I got the information I requested instantly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

edward m.

February 27th, 2019

I would rate it 5 stars also. Eddie M.

Thank you!