Hood River County Quitclaim Deed Form

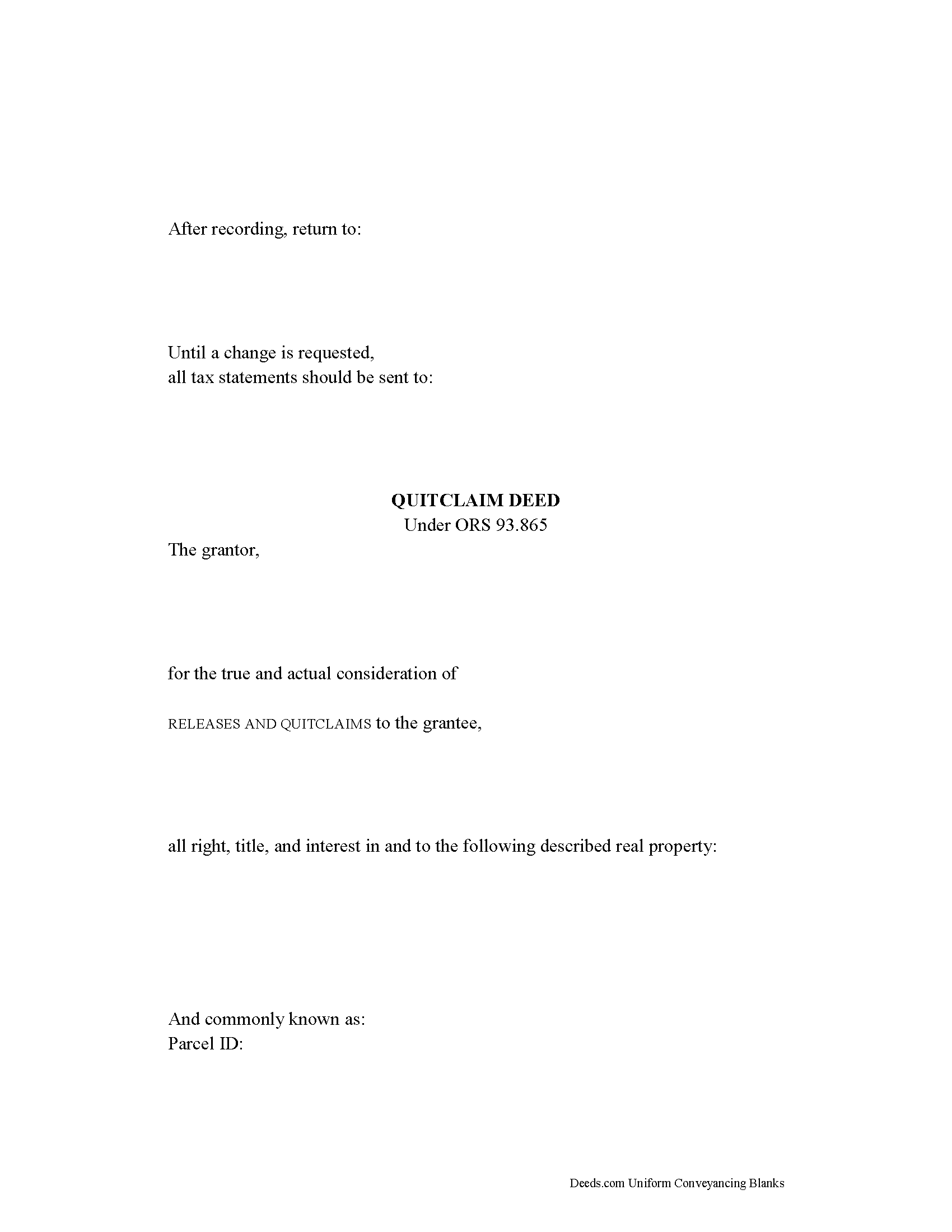

Hood River County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Oregon recording and content requirements.

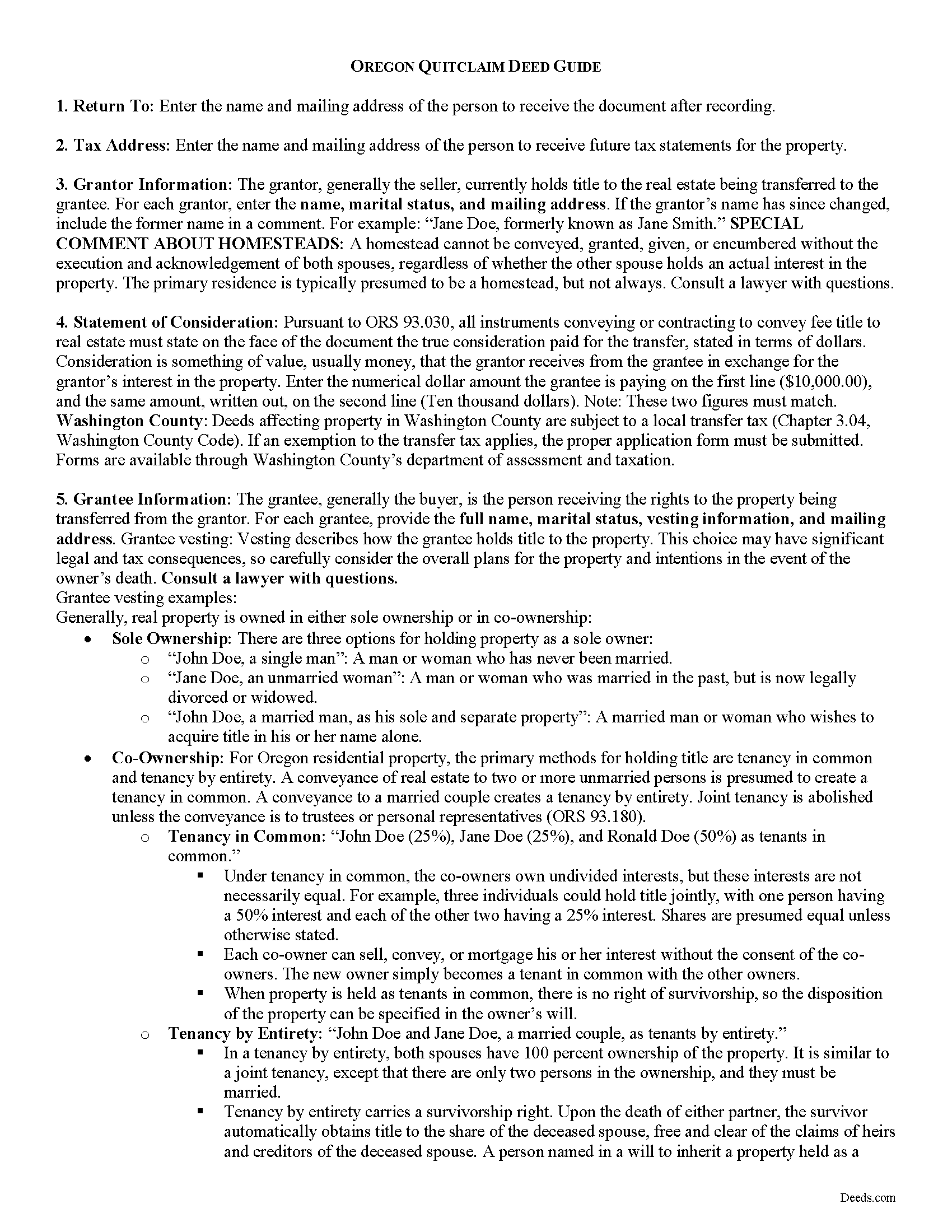

Hood River County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

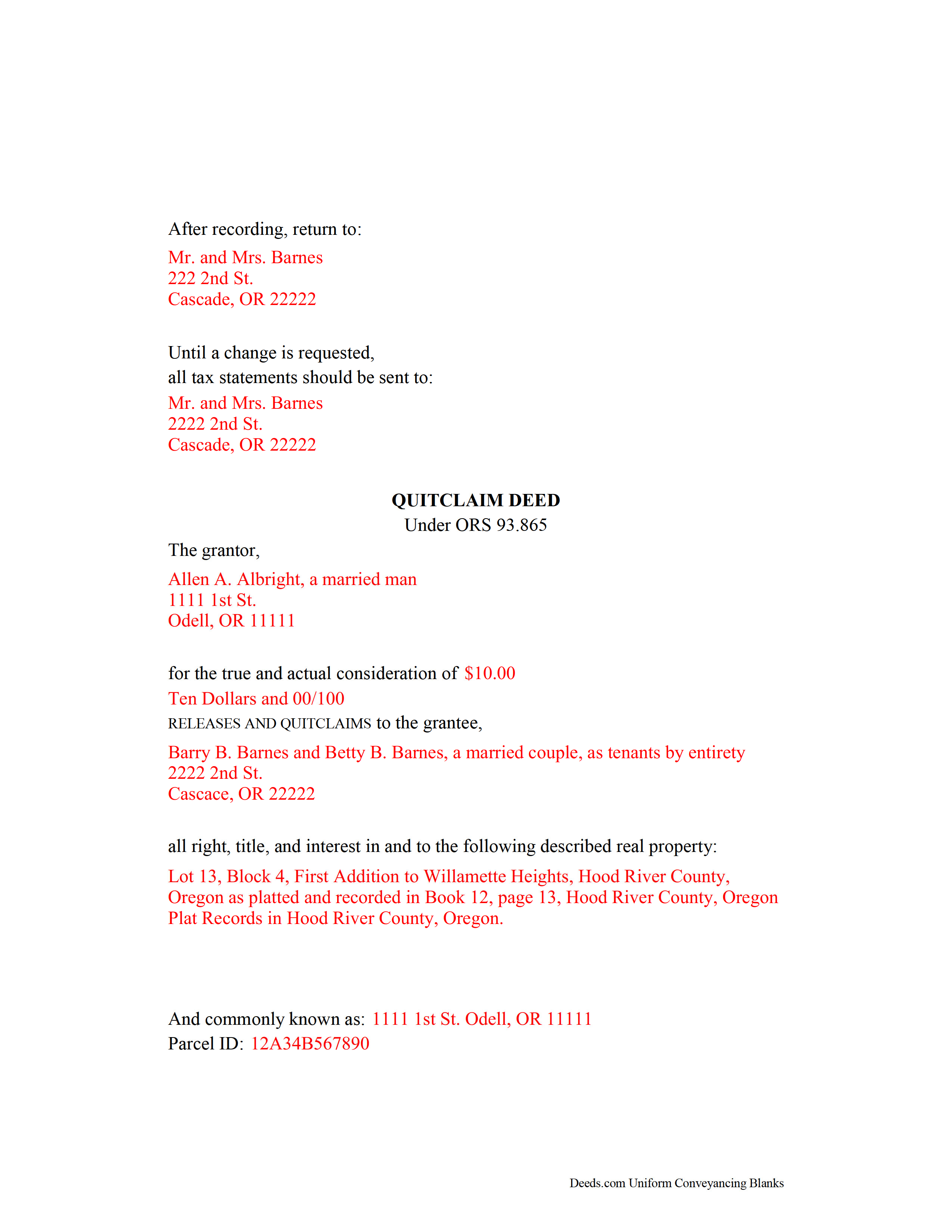

Hood River County Completed Example of the Quitclaim Deed Document

Example of a properly completed Oregon Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Hood River County documents included at no extra charge:

Where to Record Your Documents

County Department of Records

Hood River, Oregon 97031

Hours: 8:00 to 5:00 M-F / Recording: 9:00 to 4:00

Phone: (541) 386-1442

Recording Tips for Hood River County:

- Documents must be on 8.5 x 11 inch white paper

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

- Avoid the last business day of the month when possible

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Hood River County

Properties in any of these areas use Hood River County forms:

- Cascade Locks

- Hood River

- Mount Hood Parkdale

- Odell

Hours, fees, requirements, and more for Hood River County

How do I get my forms?

Forms are available for immediate download after payment. The Hood River County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hood River County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hood River County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hood River County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hood River County?

Recording fees in Hood River County vary. Contact the recorder's office at (541) 386-1442 for current fees.

Questions answered? Let's get started!

In Oregon, title to real property can be transferred from one party to another by executing a quitclaim deed. Quitclaim deeds are statutory in Oregon under ORS 93.865, and they convey real property in fee simple with no warranties of title. This type of deed only conveys the interest the grantor has at the time the deed is executed, and it does not guarantee that the grantor has good title or right to the property.

In Oregon, a lawful quitclaim deed includes the grantor's full name, mailing address, and marital status; the true consideration paid for the transfer (ORS 93.030); and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Oregon residential property, the primary methods for holding title are tenancy in common and tenancy by entirety. A conveyance of real estate to two or more unmarried persons is presumed to create a tenancy in common. A conveyance to a married couple creates a tenancy by entirety. Joint tenancy is abolished unless the conveyance is to trustees or personal representatives (ORS 93.180).

As with any conveyance of realty, a quitclaim deed requires a complete legal description of the parcel. Detail any restrictions associated with the property. The completed deed must be acknowledged by the grantor (and his or her spouse, if applicable) in the presence of a notary.

Deeds affecting property in Washington County are subject to a local transfer tax (Chapter 3.04, Washington County Code). If an exemption to the transfer tax applies, the proper application form must be submitted. Forms are available through Washington County's department of assessment and taxation.

Record the original completed deed, along with any additional materials, at the clerk's office in the county where the property is located. Contact the same office to confirm accepted forms of payment.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact an Oregon lawyer with any questions related to the transfer of real property.

(Oregon QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Hood River County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Hood River County.

Our Promise

The documents you receive here will meet, or exceed, the Hood River County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hood River County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Emily P.

March 25th, 2020

Used the quitclaim form and the erecording service. Very smooth transaction, everything worked as it should.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy B.

August 6th, 2020

This was the easiest, quickest, most understandable way I've seen yet to retrieve deeds from various counties. The government websites are "clunky" and each one seems different than the other. I like this service and will use them again in the future. NANCY

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa W.

December 19th, 2019

Great E-Service Provider!

Thank you!

DAVID H.

March 13th, 2020

perfect. follow examples. no problem at court house. good deed layout.

Thank you for your feedback. We really appreciate it. Have a great day!

Victoria S.

March 13th, 2021

Deed.com is AMAZING! I only had about 2 weeks to get my quit claim deed recorded by my county office before my refinace due date approached. When I uploaded my quit claim to Deed.com I got it electronically recored by county register's office in "24 hours"!!! Deed.com is quick and efficient and I will dedinitely be using Deed.com again if I ever need a document recorded again.

Thank you for your feedback. We really appreciate it. Have a great day!

Rhobe M.

May 8th, 2023

Very user friendly site. I was able to get the information I needed fast.

Thank you!

Dianne J.

January 23rd, 2021

Thought we would just do a quit claim to remove a name on a deed but after read your instruction and all that is needed we decided to meet with a lawyer. Appreciate all the info that you supplied.

Glad to hear that Dianne. We always recommend seeking the advice of a professional if you are not completely sure of what you are doing. Have a great day!

Barbara Y.

December 14th, 2020

I found your instructions and sample for completing a quit-claim deed in Arizona to be simple and easy to follow with one exception. The website to use in order to determine the code for the reason for exemption of fees was incorrect, as a result of which I had to contact the County Recorder to obtain that information.

Thank you for your feedback. We really appreciate it. Have a great day!

Janet B.

July 28th, 2020

Review: Very user friendly and that is very important to me. Quick, easy and clear instructions. I would highly recommend deeds.com for your online filing services.

Thank you for your feedback. We really appreciate it. Have a great day!

Ronnie W T.

September 16th, 2022

Very fast and efficient as soon as we paid for the document, it was downloaded to us immediately.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

april m.

February 7th, 2019

Could not give me any deed history prior to 1986, when our company bought the property, so this was a bust.

Thank you for your feedback April. Have a great day.

Deborah C.

February 1st, 2019

I would recommend these forms to others.

Thank you!

Keith L.

March 15th, 2019

Great to have a downloadable form, rather than a cloud solution that gives no guarantee of privacy. Appreciated the sample.......but all of that still left me with open issues about how to tweak the form to serve my particular needs......for example: how to ensure that survivor rights were properly characterized; how far back I should go with the "Source" section + how I should layer my own additions to the chain of ownership, etc. Nonetheless, an overall happy experience. Thank you for your help

Thank you for your feedback. We really appreciate it. Have a great day!

TAMARA B.

December 17th, 2020

Great service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debra W.

January 13th, 2021

I was trying to get a lien released for the last 3 month with Maricopa County and once I utilized your system it was complete within 24 hours of my filing. Great company and customer service, thank you!

Thank you for your feedback. We really appreciate it. Have a great day!