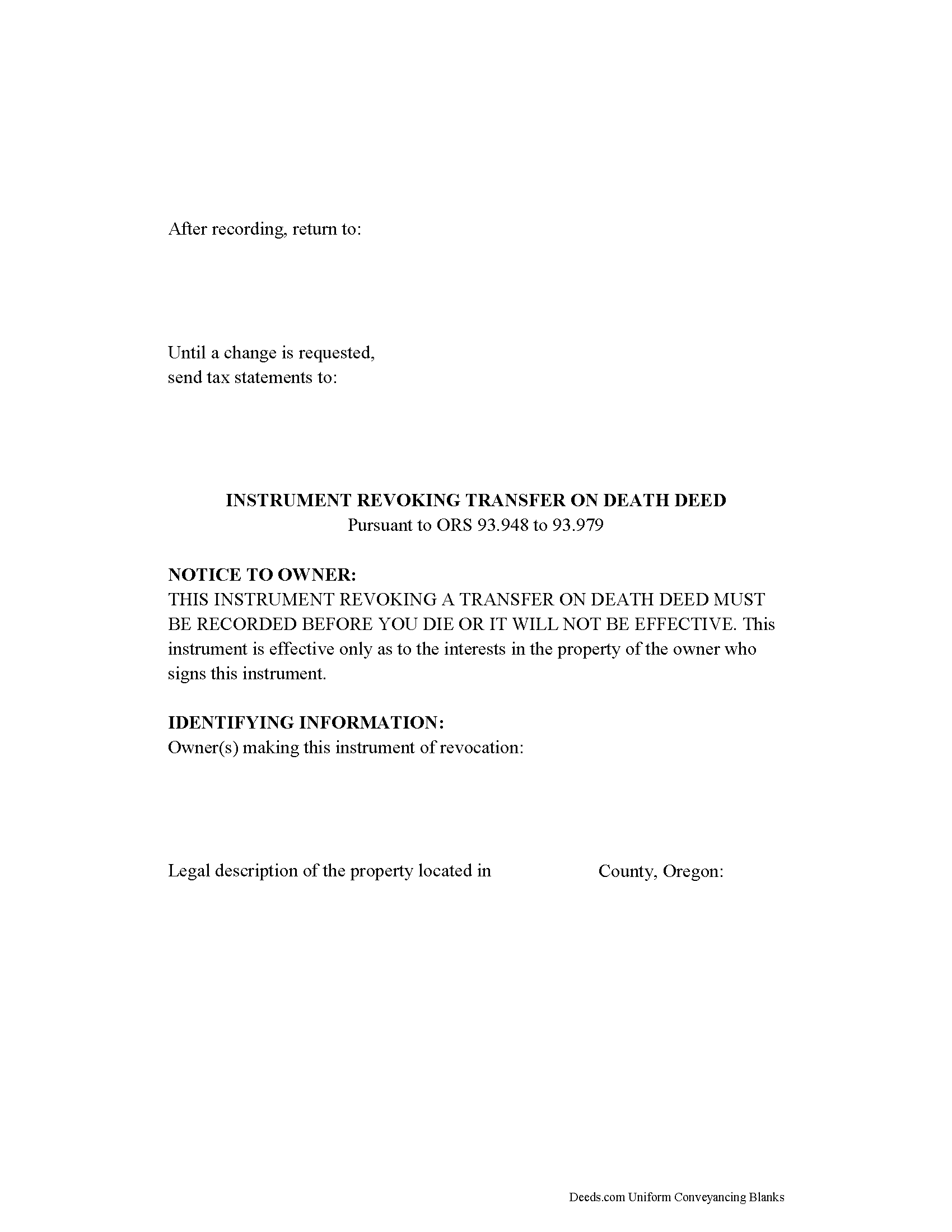

Baker County Transfer on Death Revocation Form

Baker County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

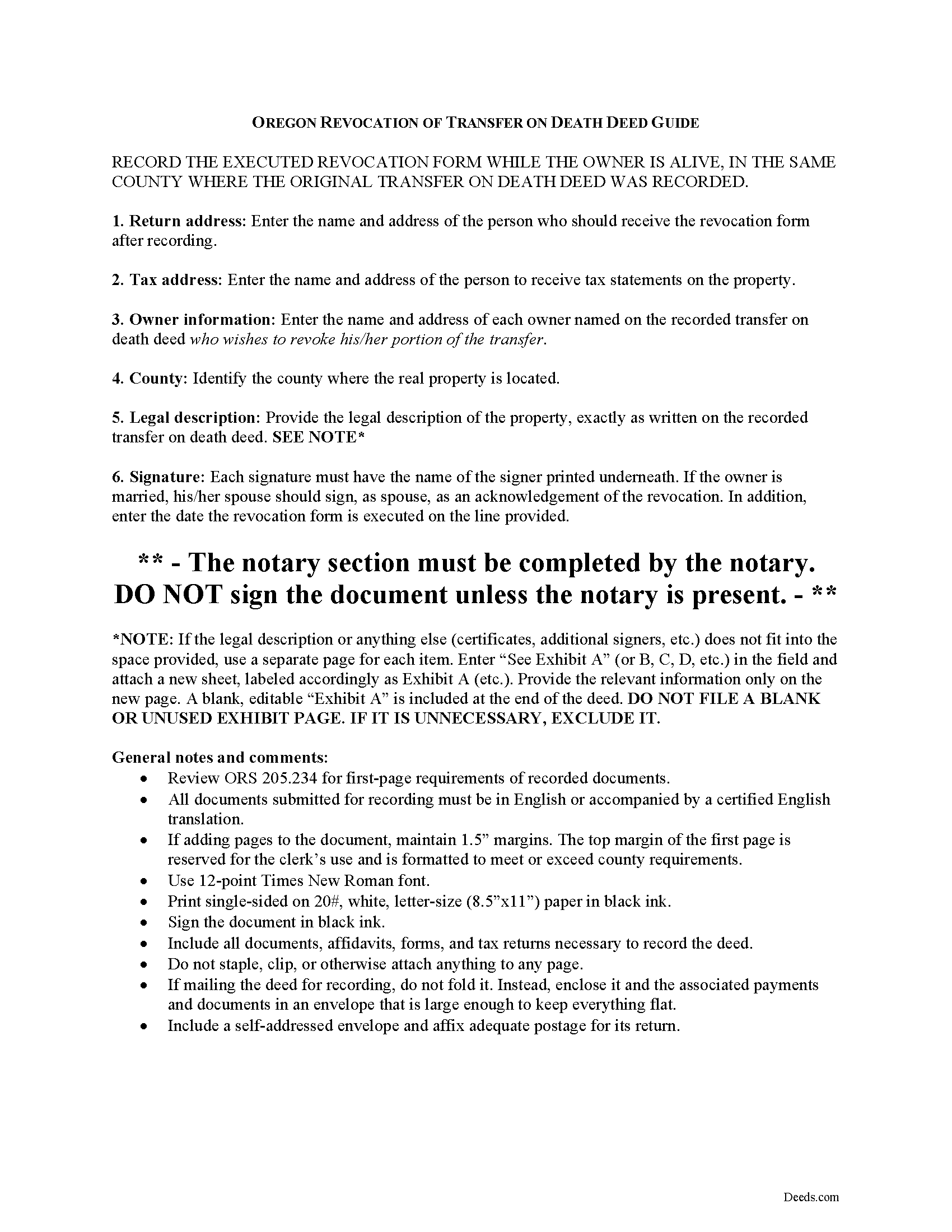

Baker County Transfer on Death Deed Revocation Guide

Line by line guide explaining every blank on the form.

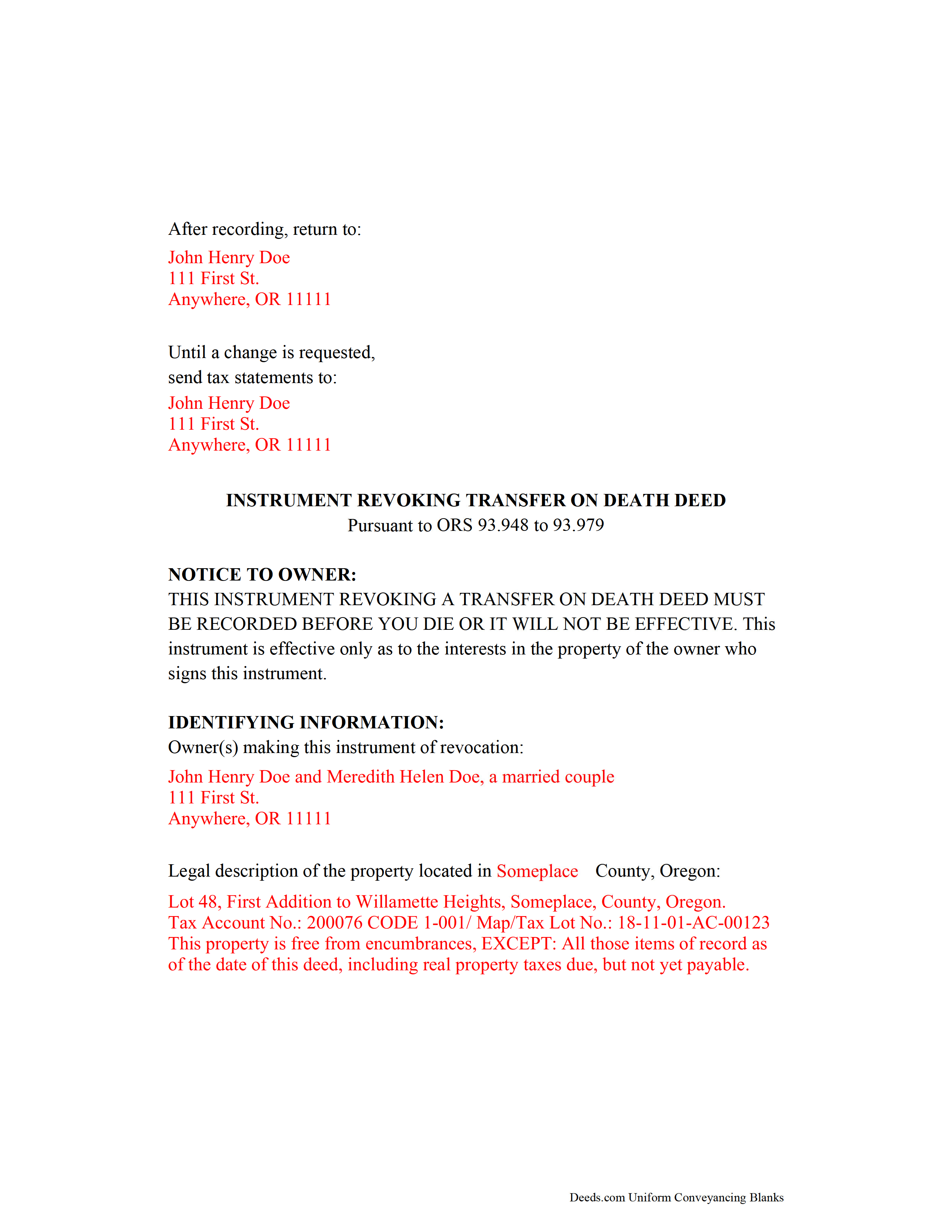

Baker County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Baker County documents included at no extra charge:

Where to Record Your Documents

Baker County Clerk

Baker City, Oregon 97814

Hours: 8:00am to 4:30pm.M-F

Phone: (541) 523-8207

Recording Tips for Baker County:

- Bring your driver's license or state-issued photo ID

- White-out or correction fluid may cause rejection

- Leave recording info boxes blank - the office fills these

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Baker County

Properties in any of these areas use Baker County forms:

- Baker City

- Bridgeport

- Durkee

- Haines

- Halfway

- Hereford

- Huntington

- Oxbow

- Richland

- Sumpter

- Unity

Hours, fees, requirements, and more for Baker County

How do I get my forms?

Forms are available for immediate download after payment. The Baker County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Baker County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Baker County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Baker County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Baker County?

Recording fees in Baker County vary. Contact the recorder's office at (541) 523-8207 for current fees.

Questions answered? Let's get started!

Revoking a Transfer on Death Deed in Oregon

Based on the Uniform Real Property Transfer on Death Act and located at ORS 93.948-93.979 (2011), this statute governs the use and applications of TODDs in the state of Oregon.

Estate plans are most effective when they're kept up to date. Flexible tools like transfer on death deeds help real estate owners control the distribution of what is often their most significant asset. While most deeds involve permanent, immediate transfers of a present interest in real property, TODDs allow the transferor the opportunity, during life, to readjust or even revoke the potential future interest to be conveyed at death ( 93.955 ).

The statutes set forth the rules for revoking a transfer on death deed at 93.965. Just as with a TODD, the revocation MUST be recorded while the owner is still alive or it has no effect. Once recorded, any modifications must be made by instrument. There are three primary ways to change or revoke a TODD: 1) executing and recording a new TODD that changes the details of the previous deed; 2) executing and recording an inter vivos deed, such as a warranty deed or quitclaim deed, conveying the owner's interest in the property to someone else---the transferor no longer owns the property, so it cannot be conveyed at death; or 3) executing and recording an instrument of revocation, thereby cancelling the entire TODD.

Note that all documents related to revoking a transfer on death deed must be recorded in the same county where the land is located.

(Oregon TOD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Baker County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Baker County.

Our Promise

The documents you receive here will meet, or exceed, the Baker County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Baker County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Audra W.

December 16th, 2021

Excellent source for obtaining documents and instructions.

Thank you!

Arthur T.

September 9th, 2021

Thanks

Thank you!

ALICIA G.

January 16th, 2022

To set the service was incredibly easy and the results came back very fast. Very reasonable price.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeffrey G.

January 10th, 2022

We had a one-time-only recording to make in the District of Columbia. We could not have e-filed the document without the assistance Deeds.com! The service they provided was wonderful.

Thank you for your feedback. We really appreciate it. Have a great day!

Ron B.

September 16th, 2020

Most complete and affordable documents that I was able to locate online. Excellent printed out presentation. Very professional. More than happy with results.

Thank you!

Mark C.

November 29th, 2023

WOW! I am so pleased the County Registrar’s office recommended Deeds.com. From start to a very quick finish Deeds.com worked to ensure my documents were correct and they immediately filed them. The Warranty Deed was accepted by the County and registered within a hour. Deeds.com’s communication was superb. I will use this handy resource every time I am in need.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Jeffrey W.

October 20th, 2021

You should add a button to cancel a package. I uploaded a document for e-recording, but wanted to cancel because I got a more clear copy.

Thank you!

Kathleen T.

March 25th, 2020

Perfect in every way, the guide was a big help in a few areas that I had questions on. Overall the average person should have no issues with the forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gregory K.

October 18th, 2021

Easy to work with. Fair price. Nice, efficient service. Would definitely use Deeds.com again for any legal documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James C.

February 5th, 2019

An excellent resource for users.

Thank you!

Beryl B.

January 5th, 2019

This was an easy and convenient site to obtain documents. I really appreciated the fact that after paying the fee, the site stayed available to me for access to samples, examples, forms, etc

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cassandra C.

February 7th, 2022

I was easy fast and easy to order and download.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Zachary F.

February 1st, 2022

I am a lawyer and purchased a specialized type of deed for a special scenario. The product received was functional, but not great. Wording is slightly clunky and the form layout was not convenient for making a professional final product. The wording also didn't contemplate a remote-state probate, which is a common scenario. Something about the PDF prevented me from doing cut and paste, so I had to do OCR to get the relevant text for inserting in my existing draft deed. Finally, while the site claims it is customized for the exact state and county, it does not appear to be well-customized for that purpose and I had to use other language (not sourced from the deeds.com document) to meet local norms.

Thank you for your feedback. We really appreciate it. Have a great day!

David D.

February 11th, 2019

Quick, easy, thorough, reasonable price. Much better than trying to contact a paralegal (who do not usually respond quickly, it seems)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jayne S.

December 20th, 2023

Simple and quick -- just what we needed!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!