Jefferson County Transfer on Death Revocation Form

Jefferson County Transfer on Death Revocation Form

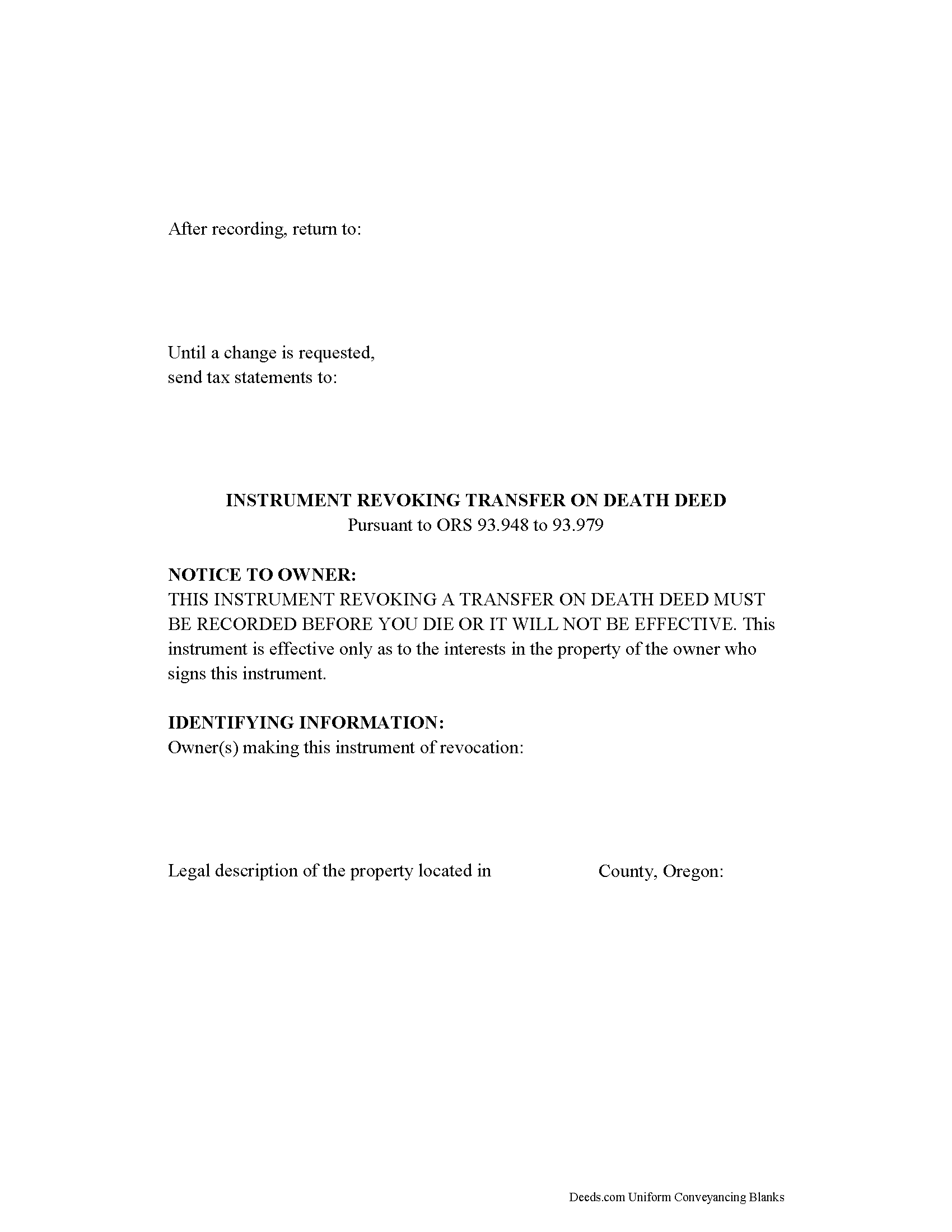

Fill in the blank form formatted to comply with all recording and content requirements.

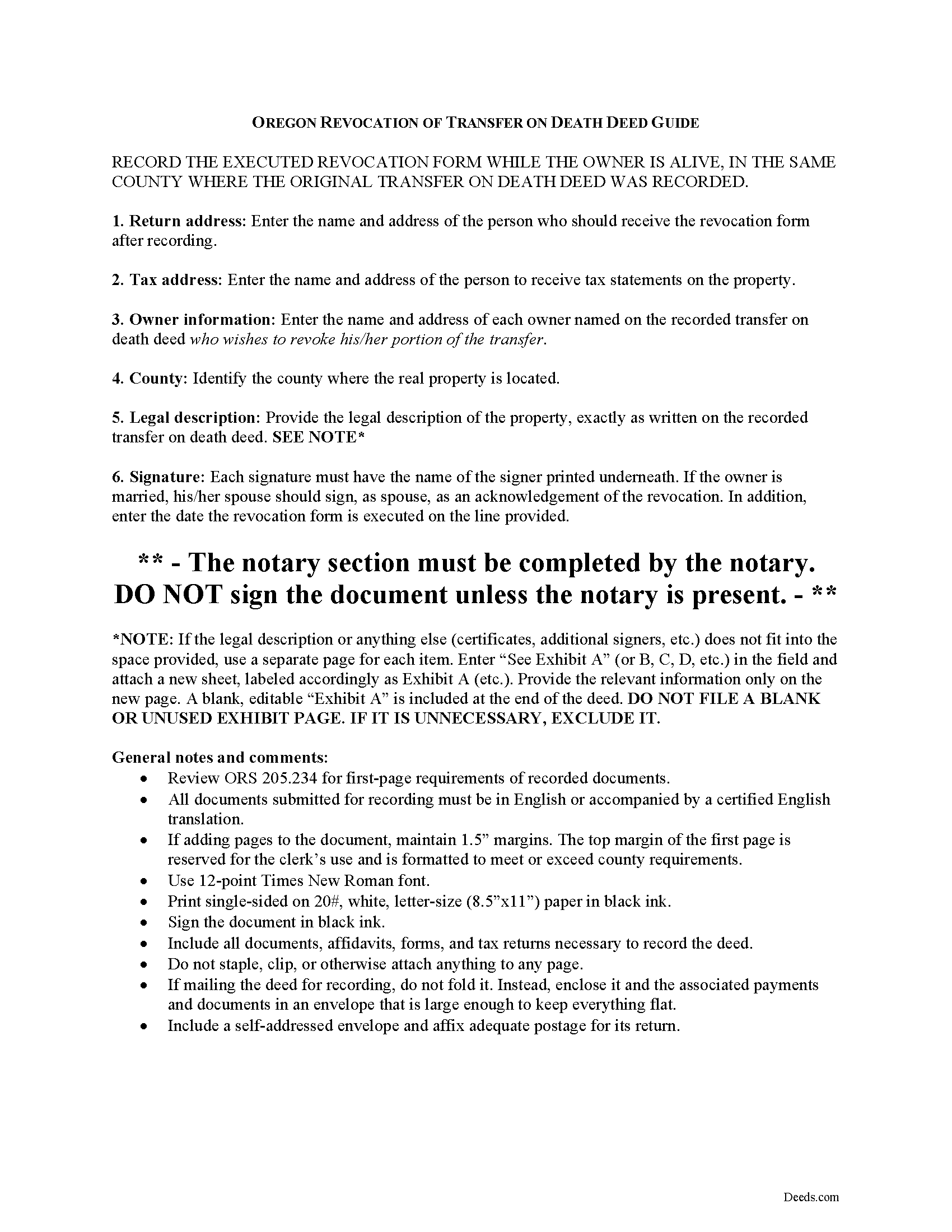

Jefferson County Transfer on Death Deed Revocation Guide

Line by line guide explaining every blank on the form.

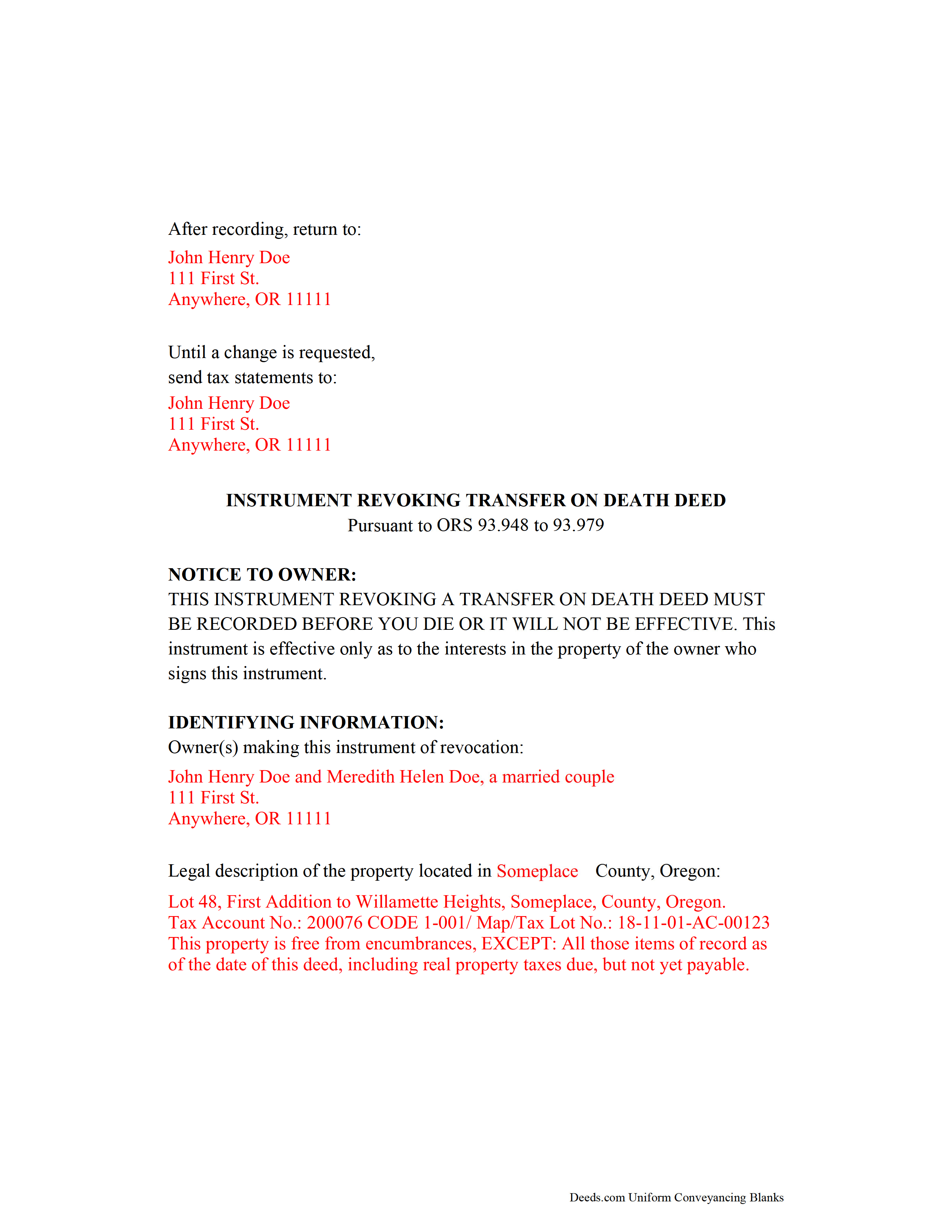

Jefferson County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Jefferson County documents included at no extra charge:

Where to Record Your Documents

Jefferson County Clerk

Madras, Oregon 97741

Hours: 8:00 to 5:00 M-F

Phone: (541) 475-4451

Recording Tips for Jefferson County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Ask about their eRecording option for future transactions

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Jefferson County

Properties in any of these areas use Jefferson County forms:

- Ashwood

- Camp Sherman

- Culver

- Madras

- Terrebonne

- Warm Springs

Hours, fees, requirements, and more for Jefferson County

How do I get my forms?

Forms are available for immediate download after payment. The Jefferson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jefferson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jefferson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jefferson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jefferson County?

Recording fees in Jefferson County vary. Contact the recorder's office at (541) 475-4451 for current fees.

Questions answered? Let's get started!

Revoking a Transfer on Death Deed in Oregon

Based on the Uniform Real Property Transfer on Death Act and located at ORS 93.948-93.979 (2011), this statute governs the use and applications of TODDs in the state of Oregon.

Estate plans are most effective when they're kept up to date. Flexible tools like transfer on death deeds help real estate owners control the distribution of what is often their most significant asset. While most deeds involve permanent, immediate transfers of a present interest in real property, TODDs allow the transferor the opportunity, during life, to readjust or even revoke the potential future interest to be conveyed at death ( 93.955 ).

The statutes set forth the rules for revoking a transfer on death deed at 93.965. Just as with a TODD, the revocation MUST be recorded while the owner is still alive or it has no effect. Once recorded, any modifications must be made by instrument. There are three primary ways to change or revoke a TODD: 1) executing and recording a new TODD that changes the details of the previous deed; 2) executing and recording an inter vivos deed, such as a warranty deed or quitclaim deed, conveying the owner's interest in the property to someone else---the transferor no longer owns the property, so it cannot be conveyed at death; or 3) executing and recording an instrument of revocation, thereby cancelling the entire TODD.

Note that all documents related to revoking a transfer on death deed must be recorded in the same county where the land is located.

(Oregon TOD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Jefferson County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Jefferson County.

Our Promise

The documents you receive here will meet, or exceed, the Jefferson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jefferson County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Anita C.

November 3rd, 2021

I found this site when looking for help filing a quitclaim deed to change my property deed to my married name. I received the correct forms, an example filled out, and a guide specific to my state. I have already submitted it for review to my county assessor's office (they were extremely helpful also) and it looks as if it should sail through. Thank you Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Paul S.

March 18th, 2021

Very satisfactory

Thank you!

marc g.

April 13th, 2021

Nice product and Fillable PDF's :) Thanks Deeds!!

Thank you for your feedback. We really appreciate it. Have a great day!

Adriane L.

November 20th, 2024

great experience. Great communication and very fast turn around ty Adriane

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Gerald M.

November 25th, 2021

So easy to do. The examples and guides are well worth the few $$ this cost. Highly recommend!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ralph m.

March 1st, 2019

Overall the experience was pleasant and the services were delivered In a timely fashion

Thank you Ralph. Have a great day!

Truc T.

October 19th, 2021

great DIY site.

Thank you!

Joy Lynn W.

December 31st, 2020

Timely response and helpful....good job!

Thank you!

John C.

April 14th, 2019

Excellent find (Deeds.com) from a google search, first hit. This was exactly what we were looking for. It also got me to upgrade Adobe to be able to fill in the forms. Will be back for follow up as needed, but I think I got everything we needed in the first downloads. Appreciate a well done site like yours. Thanks John

Thank you for your feedback. We really appreciate it. Have a great day!

Andrew S.

October 14th, 2020

This is fast and easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

janice b.

April 29th, 2021

This is a very helpful site when you don't know exactly what to do. Very clear in explaining the wording on deeds. Thank you it made a big difference knowing the right way to do things.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda I.

August 16th, 2023

So far so good. It was reasonably easy to download and complete the form using information found in my closing paperwork. I haven't yet had my form notarized but plan to do so this week and submit the packet to my county auditor.

Thank you for your feedback. We really appreciate it. Have a great day!

Elaine S.

April 19th, 2021

Being new at this, the system was somewhat difficult to understand at first. It took a couple of tries before I got it. It seems to be somewhat slow as well. However, it's a wonderful idea to have documents recorded from the comfort of your home, especially in the times that we are in with COVID19. I definitely don't mind paying the fee which I thought was reasonable.

Thank you!

John W.

September 30th, 2020

You charge too much for a form. Your business model is shortsighted. I would not try to use your service again. You got $20 from me this once, but I would try very hard to not use your service again. Your model does not encourage serial or professional usage.

Thank you for your feedback John. We do wish that you had decided our product was too expensive prior to purchasing and using so that there was no remorse. Have a wonderful day.

Linda J.

December 8th, 2021

I was referred to you by a recording service for Walton County, Florida. I registered on your website, and 48 hours later I received a copy of a recorded deed. Easy and Fast!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!