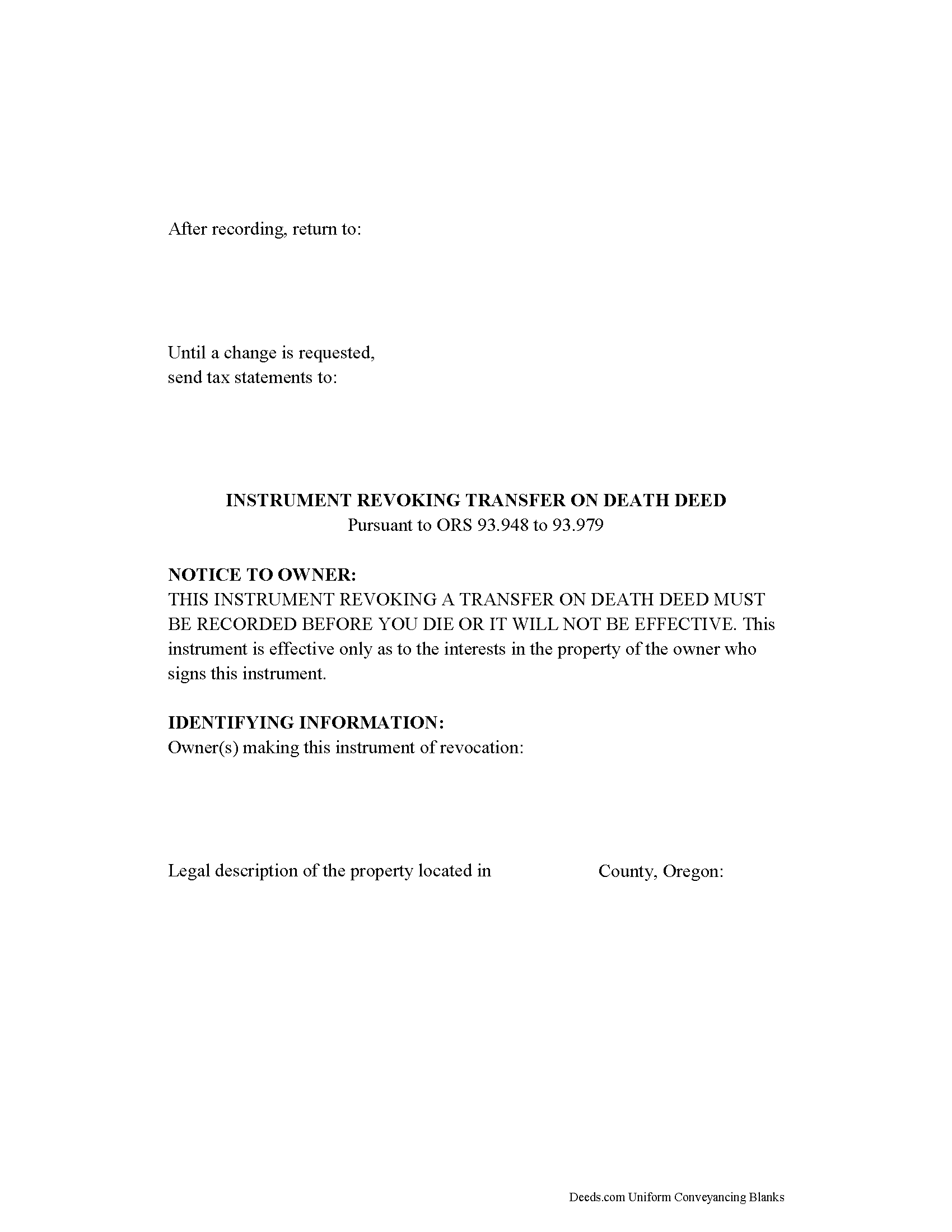

Washington County Transfer on Death Revocation Form

Washington County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

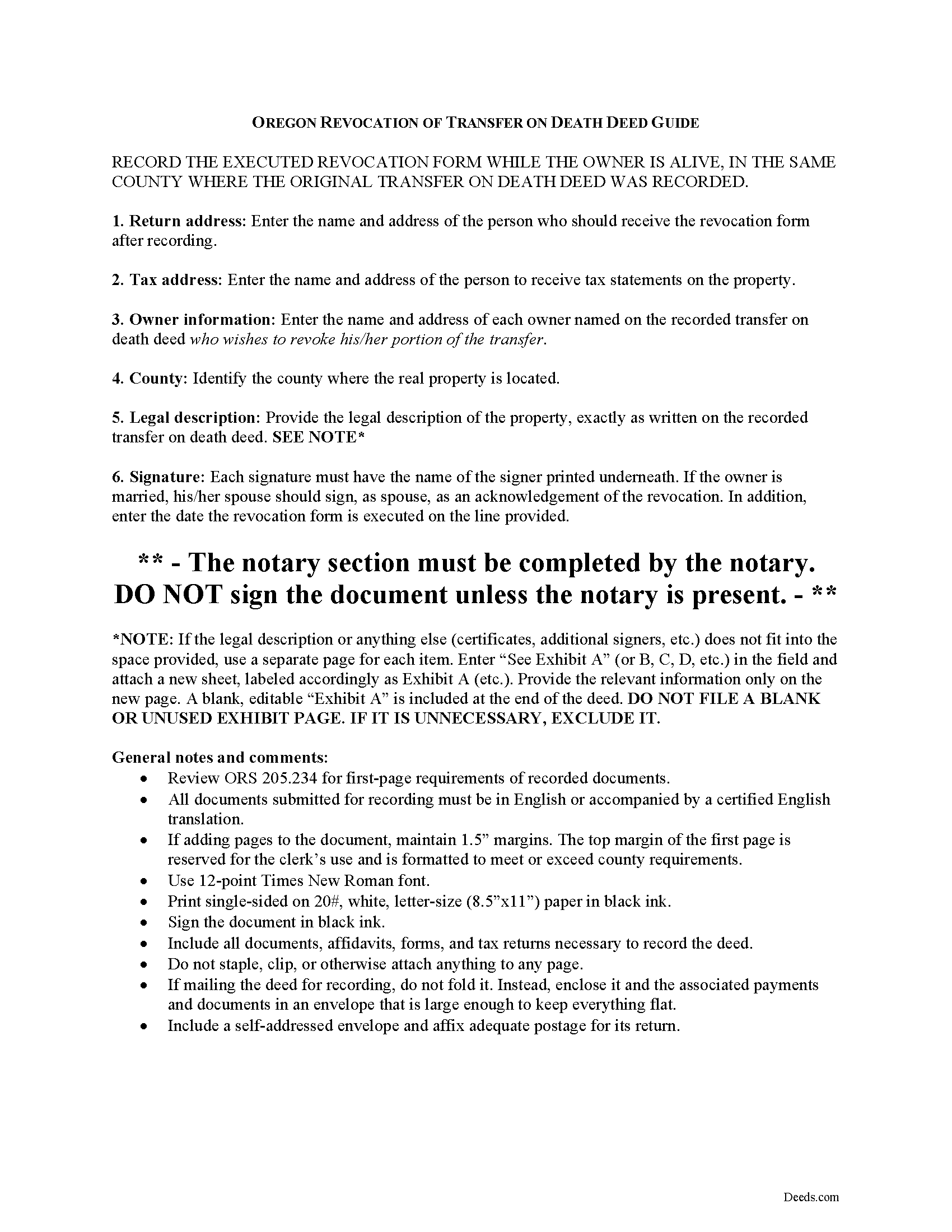

Washington County Transfer on Death Deed Revocation Guide

Line by line guide explaining every blank on the form.

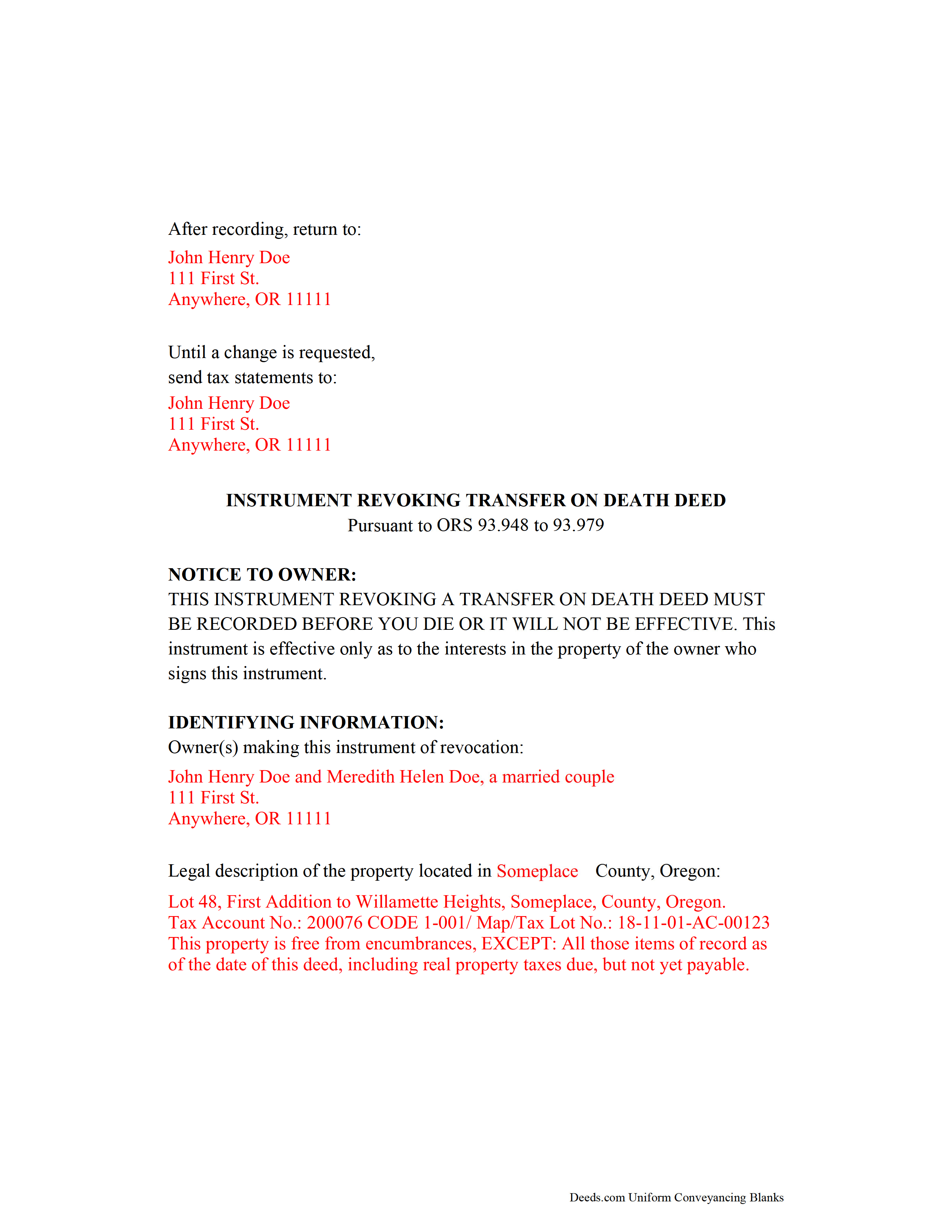

Washington County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Washington County documents included at no extra charge:

Where to Record Your Documents

Assessment & Taxation Department: Recording Division

Hillsboro, Oregon 97124

Hours: 8:30 to 4:30 M-F

Phone: (503) 846-8752

Recording Tips for Washington County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Washington County

Properties in any of these areas use Washington County forms:

- Banks

- Beaverton

- Buxton

- Cornelius

- Forest Grove

- Gales Creek

- Gaston

- Hillsboro

- Manning

- North Plains

- Portland

- Sherwood

- Timber

- Tualatin

Hours, fees, requirements, and more for Washington County

How do I get my forms?

Forms are available for immediate download after payment. The Washington County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Washington County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Washington County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Washington County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Washington County?

Recording fees in Washington County vary. Contact the recorder's office at (503) 846-8752 for current fees.

Questions answered? Let's get started!

Revoking a Transfer on Death Deed in Oregon

Based on the Uniform Real Property Transfer on Death Act and located at ORS 93.948-93.979 (2011), this statute governs the use and applications of TODDs in the state of Oregon.

Estate plans are most effective when they're kept up to date. Flexible tools like transfer on death deeds help real estate owners control the distribution of what is often their most significant asset. While most deeds involve permanent, immediate transfers of a present interest in real property, TODDs allow the transferor the opportunity, during life, to readjust or even revoke the potential future interest to be conveyed at death ( 93.955 ).

The statutes set forth the rules for revoking a transfer on death deed at 93.965. Just as with a TODD, the revocation MUST be recorded while the owner is still alive or it has no effect. Once recorded, any modifications must be made by instrument. There are three primary ways to change or revoke a TODD: 1) executing and recording a new TODD that changes the details of the previous deed; 2) executing and recording an inter vivos deed, such as a warranty deed or quitclaim deed, conveying the owner's interest in the property to someone else---the transferor no longer owns the property, so it cannot be conveyed at death; or 3) executing and recording an instrument of revocation, thereby cancelling the entire TODD.

Note that all documents related to revoking a transfer on death deed must be recorded in the same county where the land is located.

(Oregon TOD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Washington County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Washington County.

Our Promise

The documents you receive here will meet, or exceed, the Washington County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Washington County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Norma J H.

April 27th, 2022

Your forms have been very helpful. I thank you very much for making them easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Aldona P.

April 9th, 2020

Awesome Job! thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

J O.

July 18th, 2020

It's okay, seems you need to make it easier to search deeds on properties without having to go through a lot of researching issues, make it simple!

Thank you!

Sheryl B.

March 2nd, 2019

Great forms. Just what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jerry G.

September 21st, 2023

I found the document confusing and I don't think I can use it.

Thank you for your feedback. We recognize that do-it-yourself legal documents may not be suitable for everyone. We always advise all our customers to seek assistance from a legal professional familiar with their specific situation for any form they do not completely understand. For your convenience, we have canceled your order and processed a refund.

Tamara R.

May 2nd, 2021

Easy to use and clear instructions.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Junior S.

December 22nd, 2022

Good

Thank you!

Mercedes B.

February 16th, 2020

Great site. It lets your fingers do the walking. It took me half a day to get deed info a couple of years ago. Thanks Deeds.com

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen S.

March 18th, 2021

This is awesome. Making sure not only that everything is worded correctly but also formatted correctly is great. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Frank C.

April 17th, 2019

It was easy

Thank you Frank.

Judith H.

May 22nd, 2023

This site was so easy. Got my documents in minutes. downloaded and they work perfectly and accurately. I LOVE THIS SITE AND COMPANY!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Rhonda P.

February 23rd, 2021

Very quick and easy! Didn't even have to leave the house and I didn't have to send via USPS which is nice since we are in a pandemic. The convenience of this site is worth the extra money. Would definitely use this site again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James M.

January 3rd, 2023

It would be helpful to have a joint tenant example.

Thank you!

tamica l.

March 31st, 2022

Excellent Service! Fast and friendly. Thank you will use again!

Thank you!

Carol W.

March 14th, 2021

The only reason for the low review was I could not find the form that I needed.

Sorry to hear that we did not have what you needed. We hope you found it somewhere. Have a wonderful day.