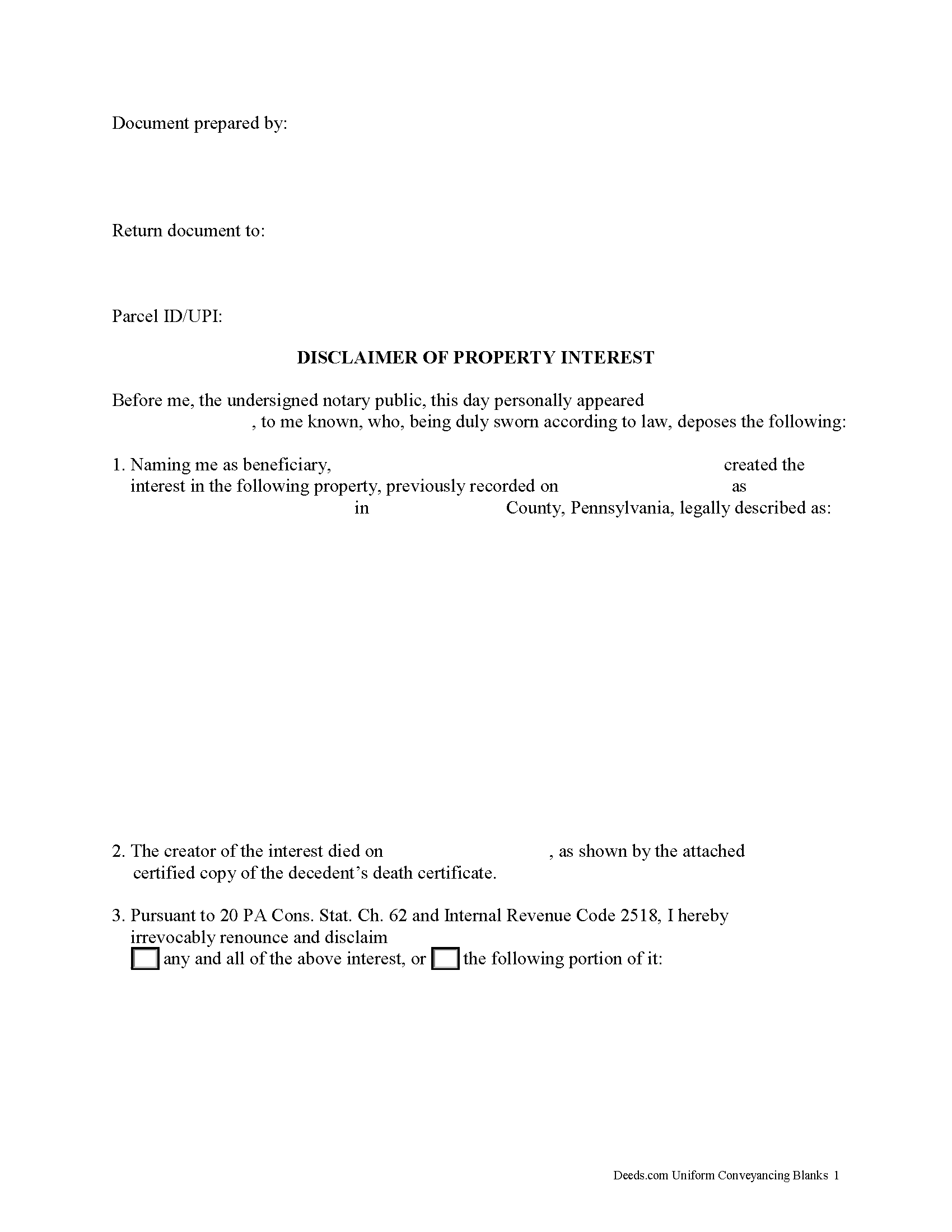

Bradford County Disclaimer of Interest Form

Bradford County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

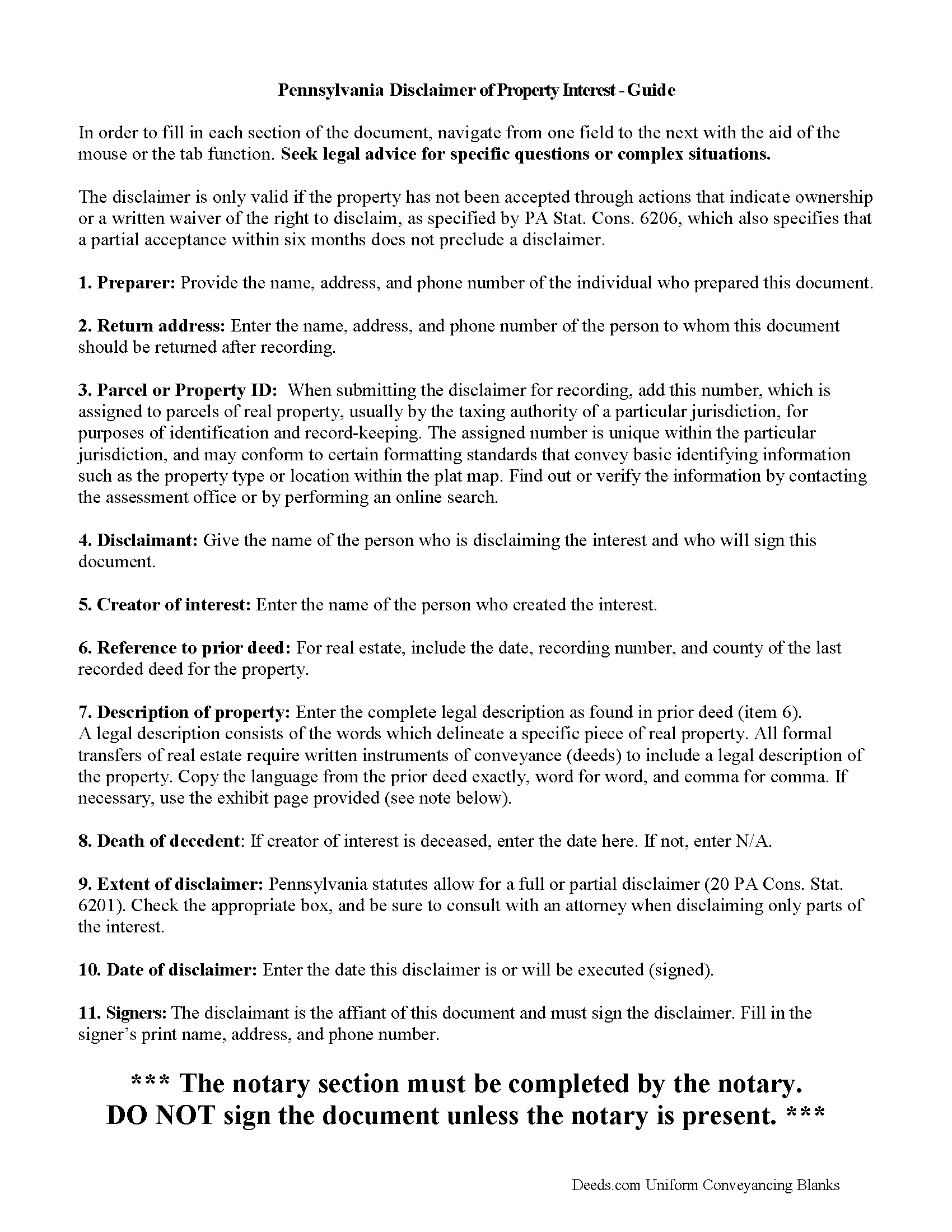

Bradford County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

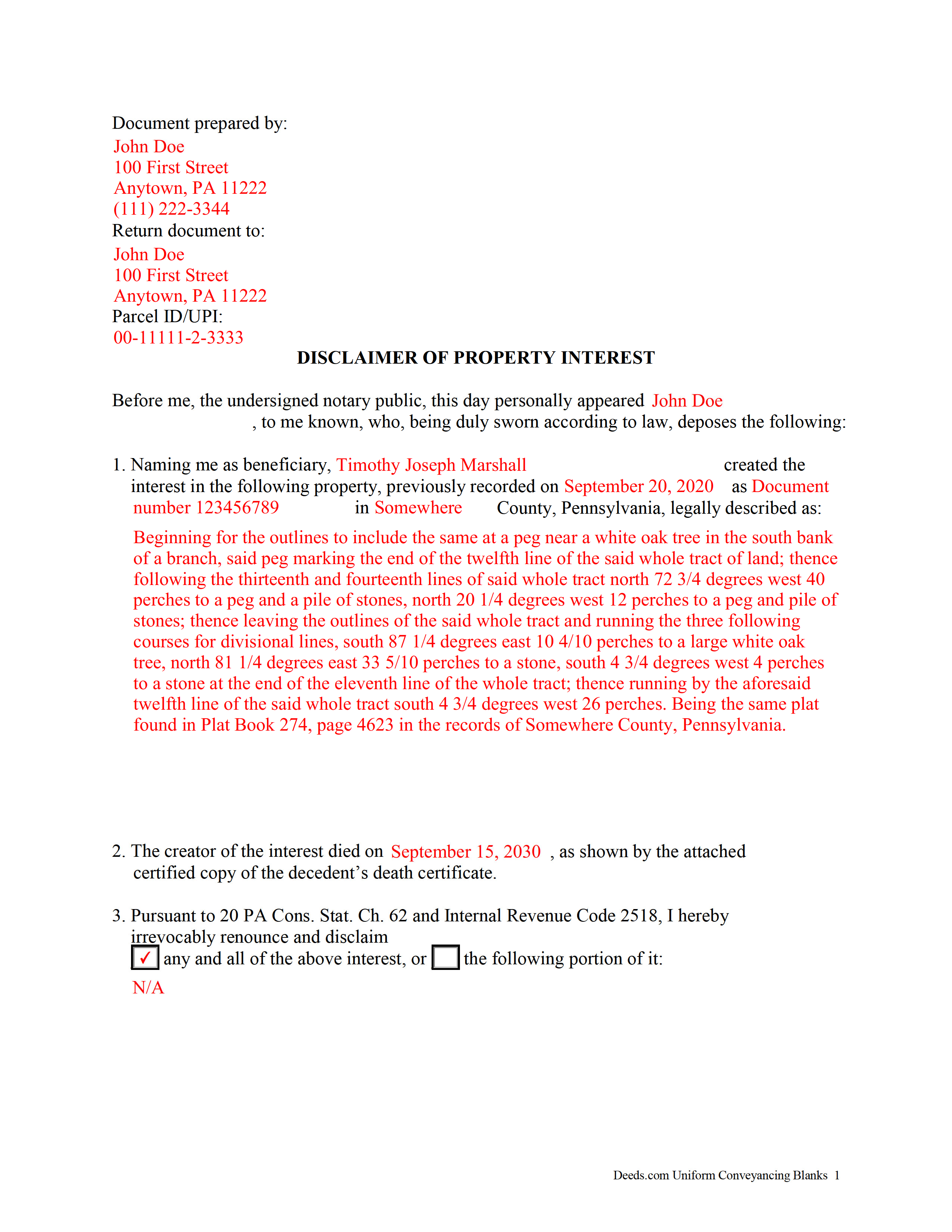

Bradford County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Pennsylvania and Bradford County documents included at no extra charge:

Where to Record Your Documents

Recorder of Deeds - County Courthouse

Towanda, Pennsylvania 18848

Hours: 8:00 a.m. - 4:30 p.m. Monday - Friday (Except Holidays)

Phone: (570) 265-1702

Recording Tips for Bradford County:

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- Check that your notary's commission hasn't expired

Cities and Jurisdictions in Bradford County

Properties in any of these areas use Bradford County forms:

- Alba

- Athens

- Burlington

- Camptown

- Canton

- Columbia Cross Roads

- East Smithfield

- Gillett

- Granville Summit

- Grover

- Le Raysville

- Milan

- Monroeton

- New Albany

- Rome

- Sayre

- Stevensville

- Sugar Run

- Sylvania

- Towanda

- Troy

- Ulster

- Warren Center

- Wyalusing

- Wysox

Hours, fees, requirements, and more for Bradford County

How do I get my forms?

Forms are available for immediate download after payment. The Bradford County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Bradford County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Bradford County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Bradford County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Bradford County?

Recording fees in Bradford County vary. Contact the recorder's office at (570) 265-1702 for current fees.

Questions answered? Let's get started!

A beneficiary of an interest in property in Pennsylvania can disclaim all or part of a bequeathed interest in, or power over, that property under 20 PA Stat. Cons. Ch. 62. This document must be in writing, declared a disclaimer, signed by the disclaimant or a legally authorized representative, and describe the disclaimed property or portion of it ( 6201).

The disclaimer must be delivered to the transferor, donor or representative, trustee or person who has legal title. In the case of an interest passing by death, an executed counterpart may be filed with the clerk of the court in the county where the estate is or will be administered. If it pertains to real property, it may also be recorded with office of the recorder in the county where the property is situated ( 6204).

Even though the Pennsylvania statutes stipulate no time limit to the delivery, the disclaimer must be received no later than 9 months after the transfer is made (e.g. date of death) in order to comply with IRS regulations. In addition, the disclaimer is invalid if the disclaimant has accepted the property, i.e., performed any affirmative act that is consistent with ownership of property, such as acceptance, transfer, or sale of it ( 6206 (a)). A partial acceptance within six months does not preclude a disclaimer ( 6206 (b)).

Once effective, the disclaimer is irrevocable and binding to the disclaimant and all who claim under him or her (( 6205). Be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property.

(Pennsylvania DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Bradford County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Bradford County.

Our Promise

The documents you receive here will meet, or exceed, the Bradford County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Bradford County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Mark S.

June 28th, 2022

The forms were easy to fill in and file. I've never filed anything like this before and the forms made it extremely easy. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Leslie C.

September 13th, 2023

I recently purchased online DIY legal forms, and I must say I was thoroughly impressed. The documents provided were accurate, comprehensive, and precisely what I needed. The accompanying guide was clear, instructive, and really bridged the gap for someone like me who isn't well-versed in legal jargon. What stood out the most, however, was the inclusion of the example. It served as a practical reference and made the entire process so much more approachable. Being able to see a filled-out sample made all the difference. Overall, this product has been invaluable in helping me navigate legal processes on my own.

Thank you for your feedback. We really appreciate it. Have a great day!

Bertha V. G.

May 17th, 2019

Great information and very easy to understand.

Thank you for your feedback. We really appreciate it. Have a great day!

Earnestine C.

September 4th, 2019

Informative and instruction clear and concise, which made it easy for a person without real estate knowledge to acquire needed information. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

JoAnn L.

September 10th, 2020

The process was easy, and efficient. There was a person available to help if needed. Very pleased, would use this again.

Thank you!

Susan S.

April 4th, 2019

Very quick, easy and readily available forms. No wait, no advertisements, no pressure to purchase MORE. I expected to only get part of the information I needed, and for there to be a hidden cost to get the complete package, but surprisingly, I got immediate access to all the forms I ordered, AND THERE WERE NO ADDITIONAL HIDDEN COSTS! How refreshing!

Thank you Susan, we really appreciate your feedback.

Kimberly W.

May 11th, 2022

Thank you for making this process so convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael W.

February 8th, 2025

Wonderful service.

Thank you!

BROOKE W.

February 16th, 2021

Great fillable form! And the separate instruction sheet was detailed and very clear. I particularly appreciate you including a sample of a completed form. I've filled in real estate forms before but never this one, and there were some things I didn't know.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deneene C.

April 17th, 2020

Was a great help to me. I'm very pleased .

Thank you!

Dan L.

May 31st, 2024

The only suggestion I have is to include sample of putting quitclaim into a revocable trust.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Ryan B.

January 13th, 2021

This was a very quick and convenient way to complete one of the tasks for my divorce that I imagined would be extremely difficult. Thank you deeds.com for making a difficult situation bearable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sylvia H.

July 21st, 2022

Thank you so much for making it easy and professionally trustworthy. You are the best!!!

Thank you!

Christy Z.

July 18th, 2019

Very thorough forms received and very quick service. Thank You!

Thank you for your feedback. We really appreciate it. Have a great day!

Wayne T.

November 11th, 2022

I found that it was easy-to-use and complete.

Thank you!