Northampton County Grant Deed Form

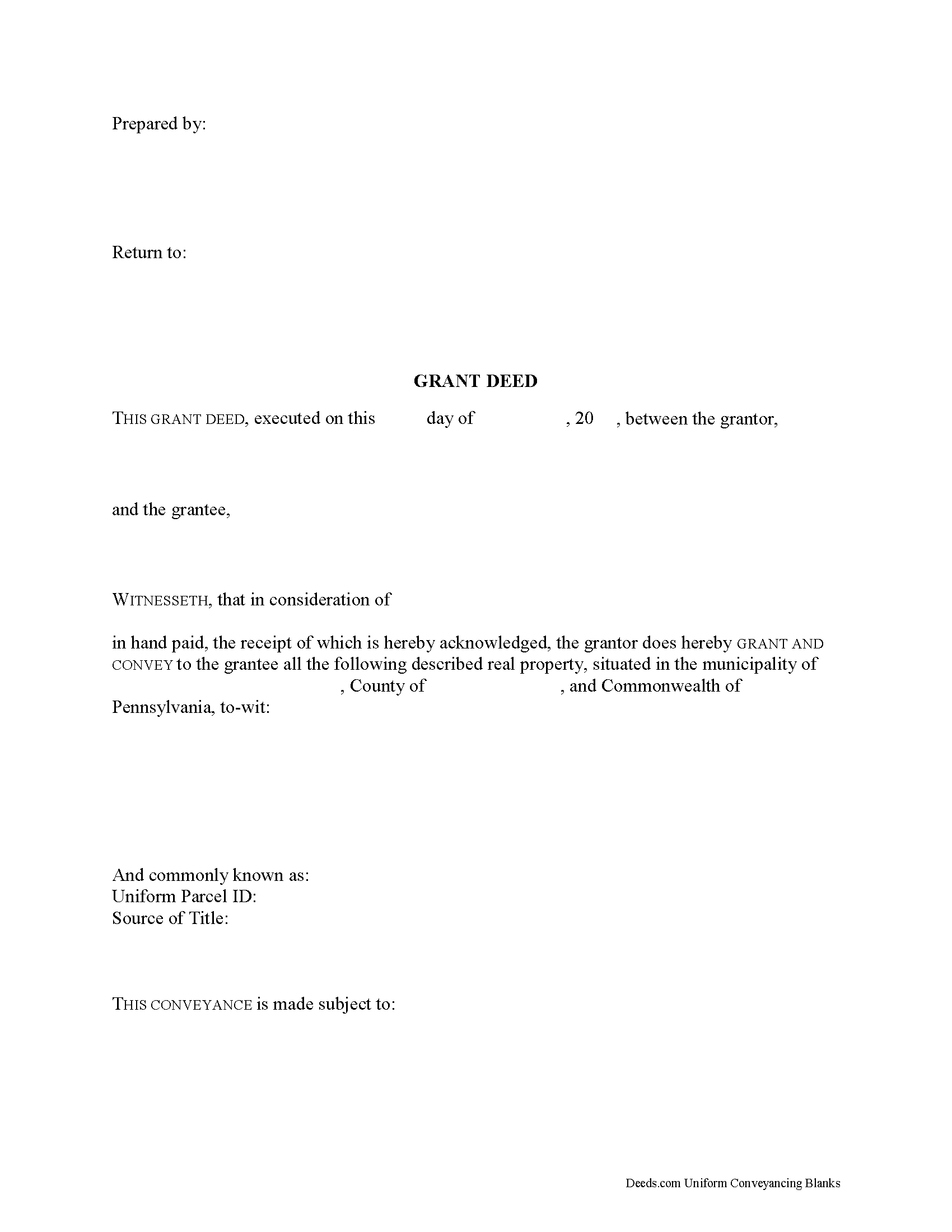

Northampton County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

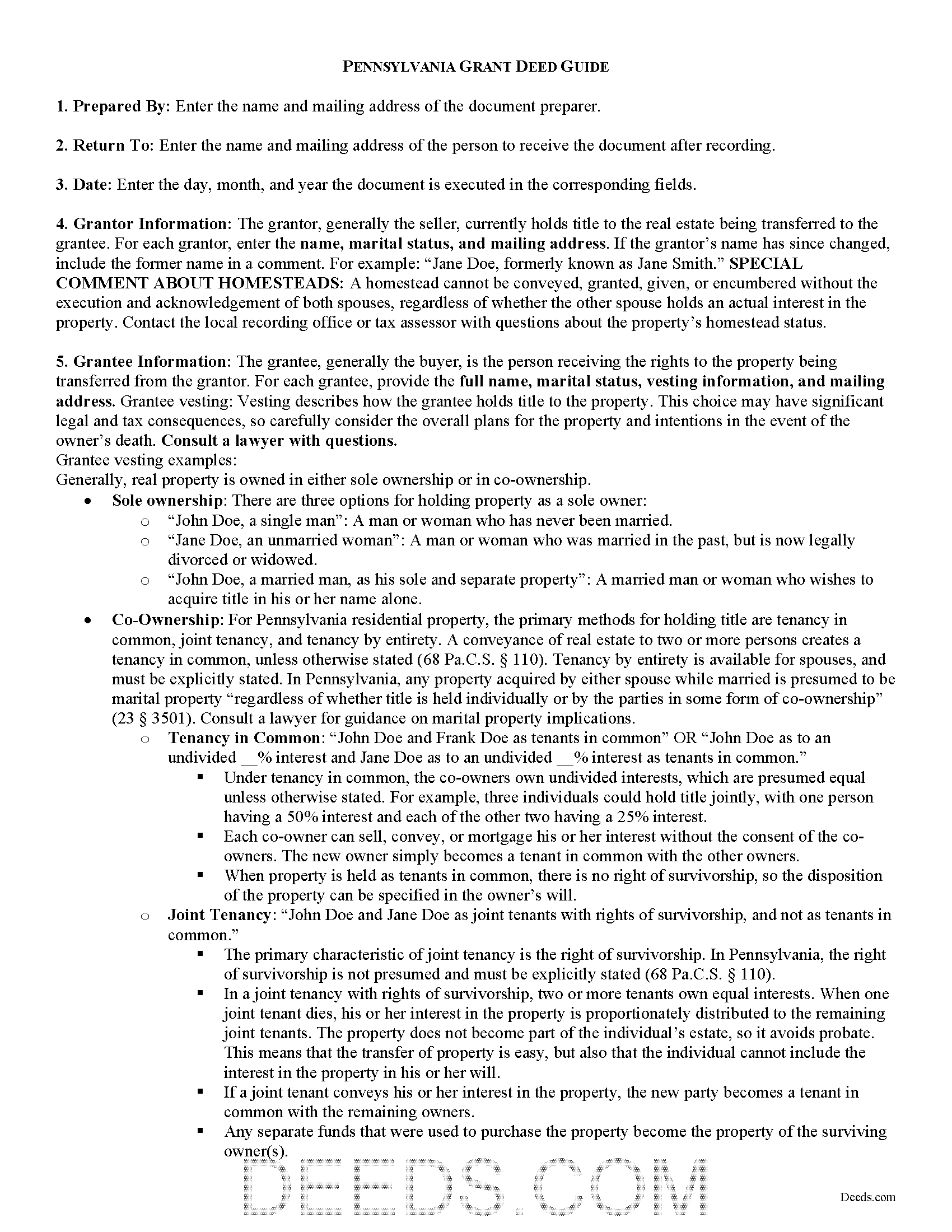

Northampton County Grant Deed Guide

Line by line guide explaining every blank on the form.

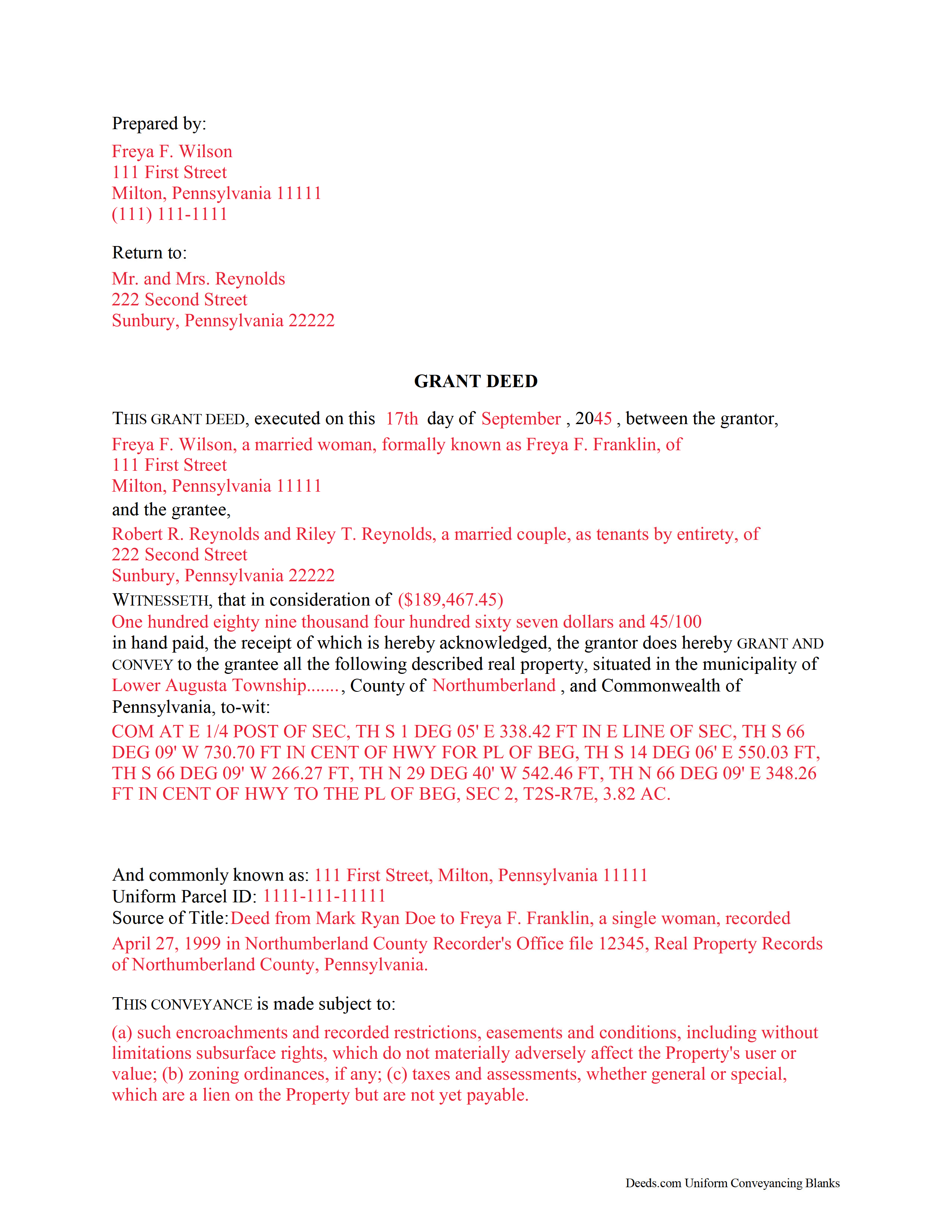

Northampton County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Pennsylvania and Northampton County documents included at no extra charge:

Where to Record Your Documents

Recorder of Deeds Division - County Courthouse

Easton, Pennsylvania 18042

Hours: 8:30am to 4:30pm M-F / until 4:00pm for PIN certification

Phone: (610) 829-6210

Recording Tips for Northampton County:

- Documents must be on 8.5 x 11 inch white paper

- Check that your notary's commission hasn't expired

- Bring extra funds - fees can vary by document type and page count

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Northampton County

Properties in any of these areas use Northampton County forms:

- Ackermanville

- Bangor

- Bath

- Bethlehem

- Cherryville

- Danielsville

- Easton

- Flicksville

- Hellertown

- Lehigh Valley

- Martins Creek

- Mount Bethel

- Nazareth

- Northampton

- Pen Argyl

- Portland

- Stockertown

- Tatamy

- Treichlers

- Walnutport

- Wind Gap

Hours, fees, requirements, and more for Northampton County

How do I get my forms?

Forms are available for immediate download after payment. The Northampton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Northampton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Northampton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Northampton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Northampton County?

Recording fees in Northampton County vary. Contact the recorder's office at (610) 829-6210 for current fees.

Questions answered? Let's get started!

In Pennsylvania, title to real property can be transferred from one party to another by executing a grant deed, but the state does not include an official form in the statutes. Use a grant deed to transfer a fee simple interest with covenants that the title is free of any encumbrances (except for those stated in the deed) and that the grantor holds an interest in the property and is free to convey it. The word "grant" in the conveyancing clause typically signifies a grant deed.

A lawful grant deed includes the grantor's full name, mailing address, and marital status; the consideration given for the transfer; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Pennsylvania residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by entirety. A conveyance of real estate to two or more persons creates a tenancy in common, unless otherwise stated (68 Pa.C.S. Section 110). A tenancy by entirety is available for spouses, and must be explicitly stated. In Pennsylvania, any property acquired by either spouse while married is presumed to be marital property "regardless of whether title is held individually or by the parties in some form of co-ownership" (23 Pa.C.S. Section 3501). Consult a lawyer for guidance on marital property implications.

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. Finally, the form must meet all state and local standards for recorded documents. The completed deed must be signed by the grantor (and his or her spouse, if applicable) in the presence of a notary.

All deeds in Pennsylvania require a certificate of residence. This certificate ensures the accuracy of the information used for updating the billing address for property tax bills and assessment notices, and should contain addresses recognized by the USPS. Enter the full name and mailing addresses of both the grantee and the tax bill recipient. The certificate must be signed by the grantee or the grantee's agent.

Any deed pertaining to an interest in real property for which a coal severance applies requires a notice pursuant to 52 Pa.C.S. 1551 (as part of the Conveyance Document Notice of Coal or Surface Support Severance Law). Any deed pertaining to an interest in real property situated in a Pennsylvania county in which bituminous coal has been found and separately assessed for taxation requires an additional notice signed by the grantee pursuant to 52 Pa.C.S. 1406.14 (as part of the Bituminous Mine Subsidence and Land Conservation Act). Note on the face of the deed whether the instrument requires either notice. Contact a lawyer to review the specific situation and ensure the deed contains all required notices.

Pennsylvania levies a Realty Transfer Tax based on the consideration paid, which is due upon recording. If the transfer is exempt from the tax, state the reason for the exemption on the face of the deed. See 61 Pa.C.S. 91.193(6) for a list of exemptions.

All deeds require a Statement of Value Form. Some counties require multiple copies. Contact the recorder for more information. Deeds falling under the jurisdiction of more than one municipality must stipulate the division of transfer taxes.

Some Pennsylvania counties require that deeds be submitted to the assessor prior to recording. Contact the local recording office to verify correct recording procedure. Record the original completed deed, along with any additional materials, at the Recorder of Deeds' office in the county where the property is located. (The City of Philadelphia handles recording for property in city limits.)

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a lawyer with questions about grant deeds, or for any other issues related to the transfer of real property in Pennsylvania.

(Pennsylvania GD Package includes form, guidelines, and completed example)

Important: Your property must be located in Northampton County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Northampton County.

Our Promise

The documents you receive here will meet, or exceed, the Northampton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Northampton County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Nicole M.

June 3rd, 2020

This is my very first use with your company. I submitted my package and within the hour you had responded with an Invoice for me to pay so you could proceed with my recording. So far I am very impressed! Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert S.

July 22nd, 2020

Process was easy to follow and worked as advertised. Thought the price was a little high.

Thank you!

Jennifer S.

December 11th, 2019

Fabulous

Thank you!

Donald S.

July 7th, 2020

Good

Thank you!

Kimberly S.

November 19th, 2019

It's so easy to use. Well worth the price. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Tyrone L.

April 24th, 2025

Great time saver fast service

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Janet R.

January 7th, 2019

Disappointed. Description of Lien discharge form does not indicate it is specific to Mechanic liens. I'm inexperienced with liens & should have contacted someone before I ordered.

Sorry to hear that, it does look like our product description was lacking clarity. We have updated the description to better reflect the documents. We have also canceled your order and refunded the payment. Hope you have a great day.

Jennifer C.

January 8th, 2021

Fast turnaround. Very much appreciated!

Thank you!

Alexandra M.

April 28th, 2021

Needed a Limited Power of Attorney form for a real estate transaction in another state. Proper form came up immediately and was fairly easy to complete. I think the sample completed form should have been more completely explained in layman's language instead of legalese (such as person granting permission instead of grantor or something like your name and address and the person who will be signing on your behalf) but since the form was one price no matter how many ways it was printed out, it was fine. I just filled it out several ways and had it notarized and sent it to my sister. Whichever combination is appropriate she and the lawyer will have. I found the site easy to navigate

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JoAnn S.

July 31st, 2021

Easy to process orders.

Thank you!

Roberta H.

September 15th, 2020

Awesome service, amazing speed Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Biinah B.

December 24th, 2020

Wished I had known about this site earlier. Just what we needed. Get tool to get lip to date legal help.

Thank you for your feedback. We really appreciate it. Have a great day!

Lorna D.

September 12th, 2020

Haven't used the form yet. But hopefully it's the correct one.

Thank you!

Michael P.

February 4th, 2024

WOW!! Thank you for making the availability and access to these forms an unpainful experience at a competitive price. Well done!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Renee H.

July 9th, 2021

First time to use this service, was easy and quick return.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!