Venango County Personal Representative Deed Form

Venango County Personal Representative Deed Form

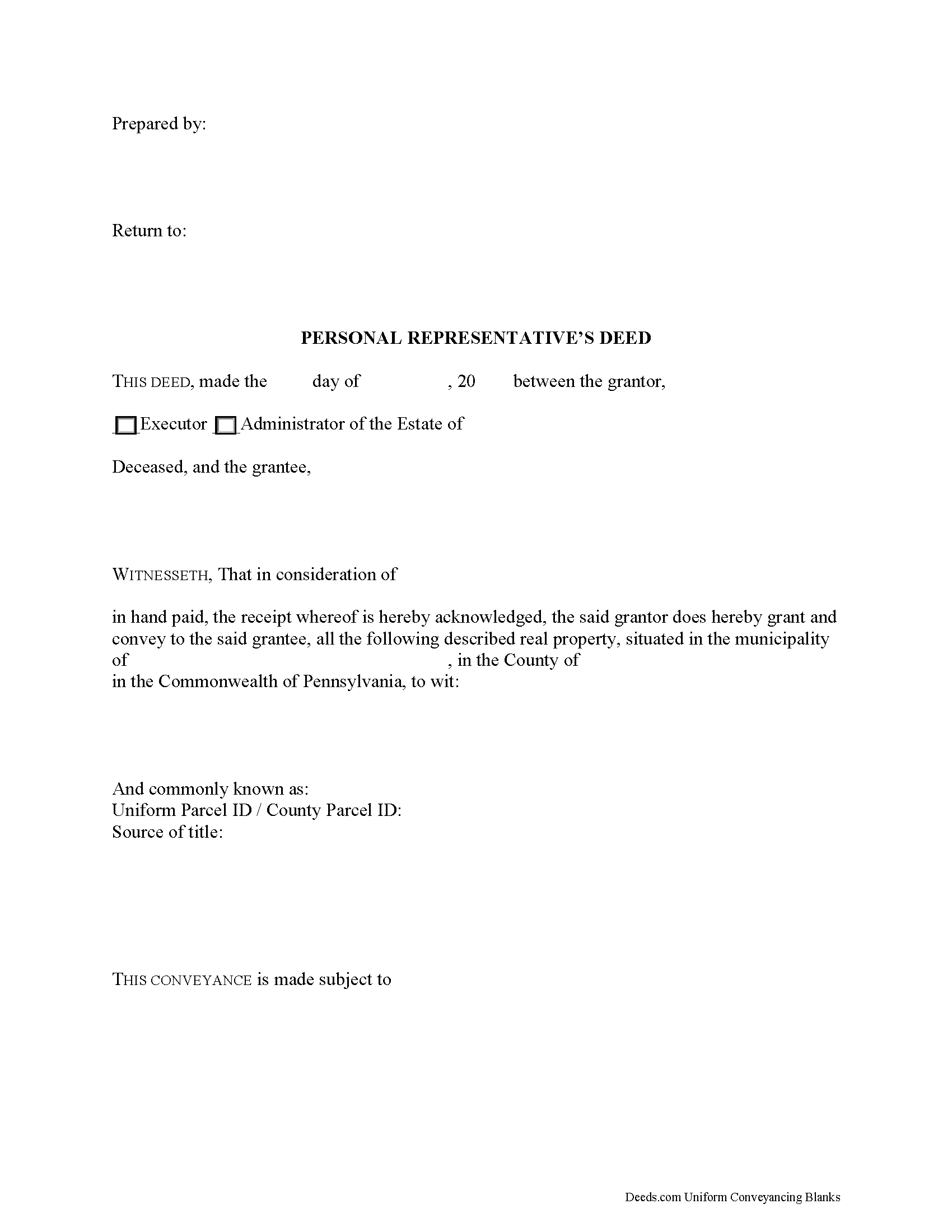

Fill in the blank form formatted to comply with all recording and content requirements.

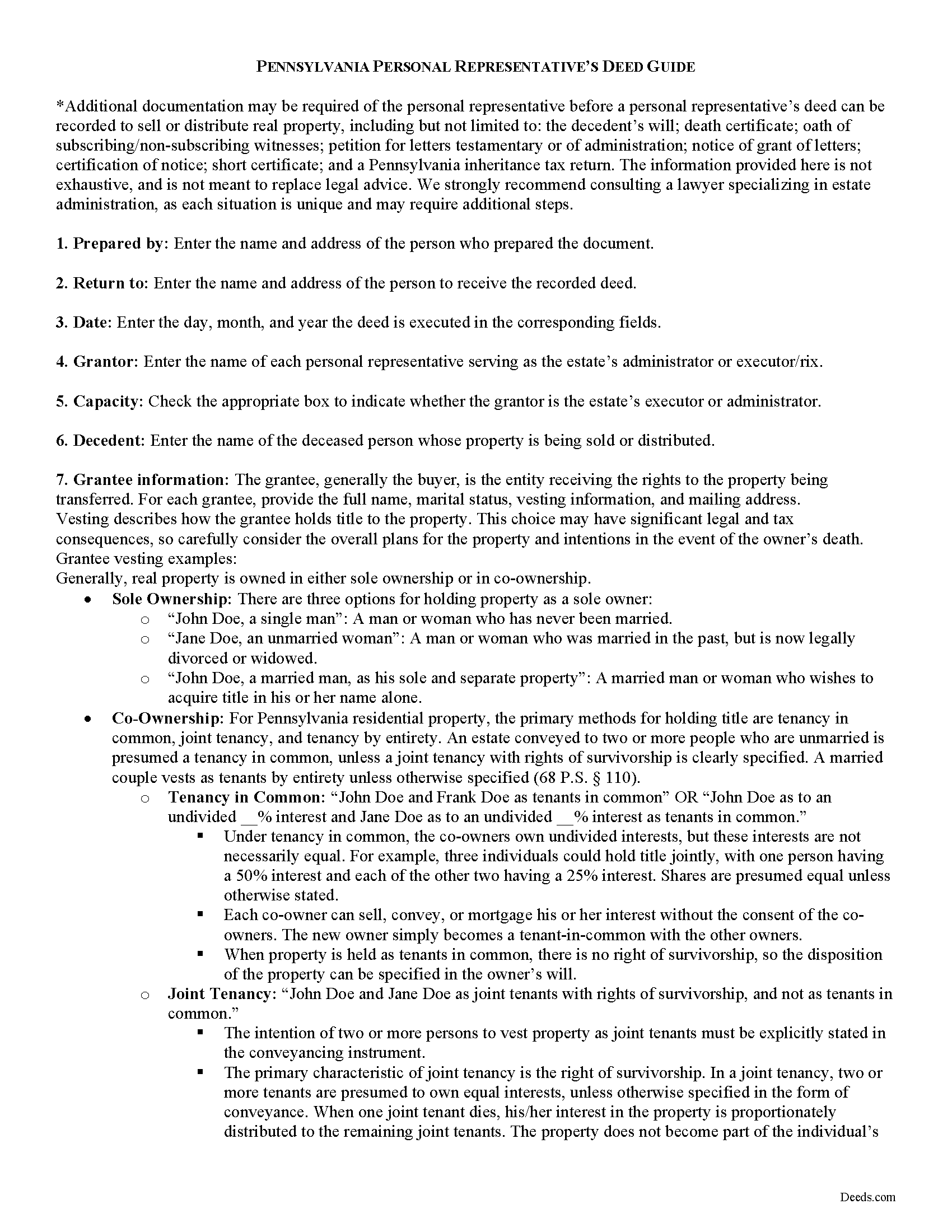

Venango County Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

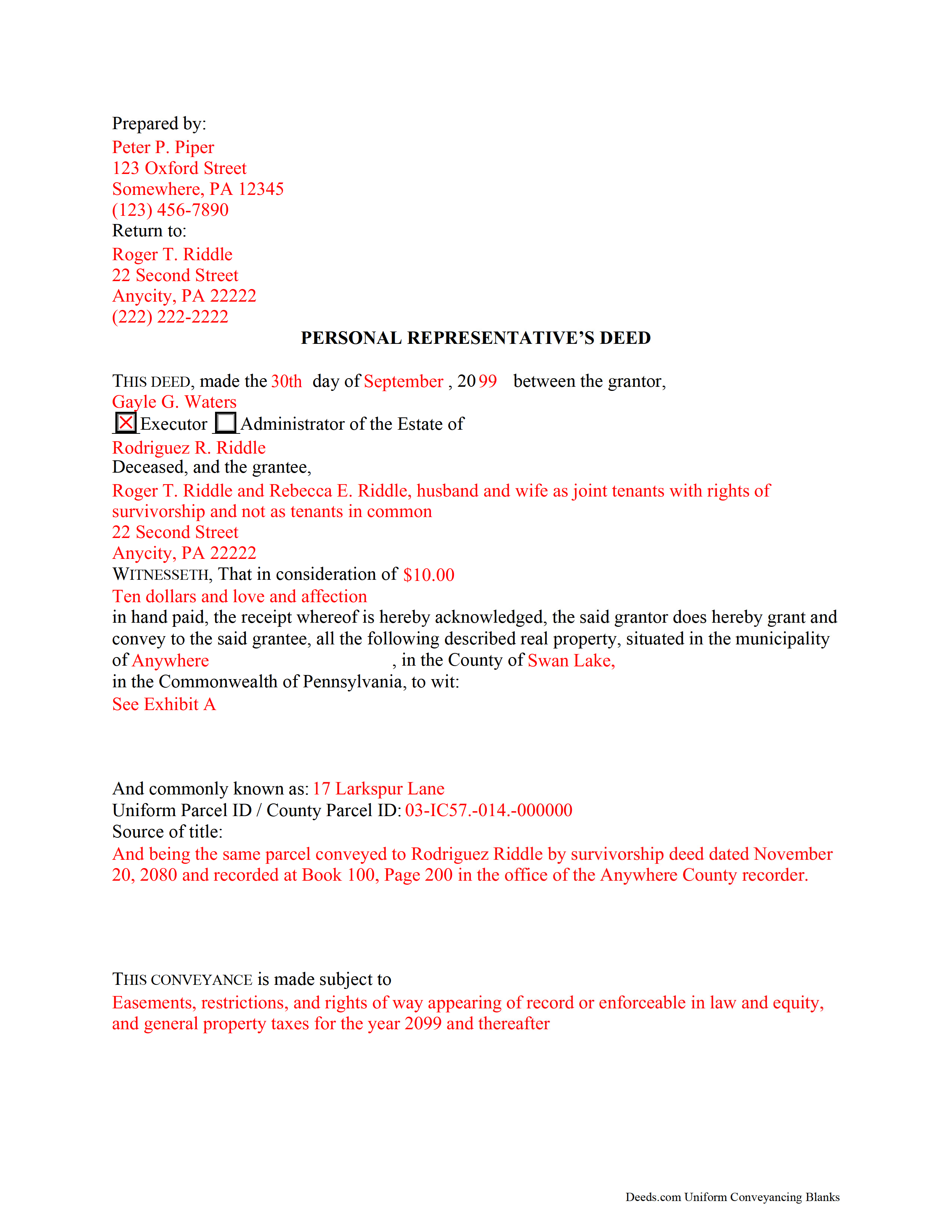

Venango County Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Pennsylvania and Venango County documents included at no extra charge:

Where to Record Your Documents

Register & Recorder - County Courthouse

Franklin, Pennsylvania 16323

Hours: 8:30 to 4:30 Monday through Friday

Phone: (814) 432-9539

Recording Tips for Venango County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- Check margin requirements - usually 1-2 inches at top

- Both spouses typically need to sign if property is jointly owned

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Venango County

Properties in any of these areas use Venango County forms:

- Clintonville

- Cooperstown

- Cranberry

- Emlenton

- Franklin

- Kennerdell

- Oil City

- Pleasantville

- Polk

- Reno

- Rouseville

- Seneca

- Utica

- Venus

Hours, fees, requirements, and more for Venango County

How do I get my forms?

Forms are available for immediate download after payment. The Venango County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Venango County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Venango County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Venango County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Venango County?

Recording fees in Venango County vary. Contact the recorder's office at (814) 432-9539 for current fees.

Questions answered? Let's get started!

Using a Personal Representative's Deed in Pennsylvania

--

The information provided in this article is not meant to be exhaustive, and should not take the place of legal advice. We strongly recommend consulting a lawyer when administering an estate, as each situation is unique. Personal representatives have a fiduciary duty to serve in the estate's best interests, and are "personally liable for undue mistakes made in the administration of the decedent's estate" [1].

--

When Pennsylvania residents die, their estate is admitted to probate, regardless of whether they left a will. A will is a legal document whereby a person (testator) gives directions for the distribution of personal assets upon death, and identifies who will administer the estate. Probate is the legal process of distributing assets. In the Commonwealth of Pennsylvania, this process, also referred to as estate administration, is governed by Title 20 et seq. of the Pennsylvania Code (Decedents, Estates, and Fiduciaries).

A probate case begins with the Register of Wills for the county where the deceased claimed permanent residence. Those with property situated in two or more counties also require ancillary probate proceedings. The decedent's will, if one exists, is recorded at this time, along with supporting documents (ex. death certificate, affidavit of subscribing or non-subscribing witness, petition for grant of letters). Pennsylvania implements an expedited probate for estates valued under $50,000.

Upon petition for grant of letters, the Register of Wills issues letters of administration or letters testamentary, depending on whether the decedent died testate (with a will) or intestate (without a will). The letters are a document granting formal authority to the fiduciary who will administer the estate, and are filed as part of the probate case. Fiduciaries may also obtain a short certificate from the Register certifying their capacity to administer the decedent's estate.

This fiduciary is known generally as a "personal representative," or more specifically as either an executor (or executrix, if female) or an administrator. The term "executor" is used when the decedent died with a will and named an executor. The term "administrator" is used when (1) the decedent died without a will (2) the decedent died testate but failed to name an executor in the will, or (3) the decedent died with a will and named an executor, but the executor failed or ceased service. In short, an executor is someone designated by will as the personal representative, whereas an administrator is someone appointed by the Register.

All assets owned solely by the decedent must go through probate. Concerning real property, when the decedent vests title as a sole owner or as a tenant in common, the real property will need to go through probate before it can be distributed by the personal representative. Real property vested with rights of survivorship between or among joint tenants or between husband and wife as tenants by the entirety automatically vests in the surviving joint tenant(s) or spouse. Property held in trust may also avoid probate.

The personal representative has several responsibilities as fiduciary, including submitting a comprehensive inventory of the estate, filing a Pennsylvania Inheritance Tax Return, giving notice to beneficiaries, and paying any debts, before any distribution of assets can occur. Depending on the situation, this process may take several months, so seek legal advice to ensure that all requisite steps are met.

When the decedent leaves instructions for the succession of real property, the named beneficiaries in the will are called devisees. When there is no will, Pennsylvania laws of intestacy determine the succession of the decedent's real property, with title flowing to the decedent's heirs at law. Depending on the situation, the personal representative may sell the decedent's real property [2].

In Pennsylvania, both executors and administrators use the personal representative's deed to distribute or sell real property. As with other types of deeds executed by grantors in a representative capacity (such as trustee's deeds), the personal representative's deed in Pennsylvania typically carries a special warranty, covenanting that the grantor will warrant and defend the property against the lawful claims and demands of the grantor or grantors, and all persons claiming or to claim by, through, or under him or them (21 P.S. 6). The special warranty is fitting for grantors who are transferring property indirectly, or on behalf of, an estate, as they may not have comprehensive knowledge of the title's history prior to the decedent's death.

The deed identifies the acting personal representative as either an executor or administrator, as well as the decedent and date of death. In addition to the grantee and vesting information, legal description of the subject property, and title derivation required for documents pertaining to interests in real property, the personal representative's deed cites the date of the testator's will, if any; the date of probate; the county of probate; the file or case number; and the name of the personal representative.

The deed is signed by the acting representative in the presence of a notary public and recorded in the county Register of Deeds in which the subject real property is situated. Additional notices may be required in Pennsylvania concerning coal and mine subsidence, and supporting documents such as a death certificate and a short certificate may be required to verify the personal representative's authority to convey real property.

To formally close probate, the personal representative must file a report of completion with the register of wills.

If administration of estate not complete within two years of the decedent's date of death, the personal representative may have to file a status report with Register of Wills.

See more forms relating to estate administration at http://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/Pages/Inheritance-Tax.aspx#.WFABK-YrLIU.

Contact a lawyer with questions regarding estate administration and probate in Pennsylvania.

[1] http://www.whiteandwilliams.com/resources-alerts-Personal-Representatives-and-Fiduciaries-Executors-Administrators-and-Trustees-and-Their-Duties.html

[2] http://www.stallardlawoffice.com/single-post/2015/09/19/Posts-on-Pennsylvania-Real-Property-Title-Death-Wills-and-Joint-Ownership

(Pennsylvania PRD Package includes form, guidelines, and completed example)

Important: Your property must be located in Venango County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed meets all recording requirements specific to Venango County.

Our Promise

The documents you receive here will meet, or exceed, the Venango County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Venango County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Adriana V.

July 2nd, 2020

Excellent and a very fast way to release important documents. Thank you very much.

Thank you!

Julie R.

December 16th, 2020

Seamless and prompt service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debbie M.

August 21st, 2019

Everything that I needed was included. I appreciate that there was a sample as well as the step-by-step directions included in the download. I would definitely recommend this site to anyone that needs it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Erica W.

July 21st, 2020

Very easy and convenient. I will use this service again!

Thank you!

Michael M.

January 11th, 2019

I downloaded the gift deed and I can not type my info onto it what am I doing wrong. Please advise

Sounds like you may be trying to complete the form in your browser. The document needs to be downloaded and saved to you computer, then opened in Adobe.

Gary F.

October 6th, 2021

5 star review. Was able to order and download what I wanted in just a few minutes without any glitches.

Thank you for your feedback. We really appreciate it. Have a great day!

Cynthia N.

February 25th, 2021

great service, quick and easy!

Thank you!

Theresa M.

June 5th, 2020

Deeds.com was simple to use and had a quick turnaround. Saved me so much time hunting around on the internet and recorder's office website to try and figure out the process. would definitely use again!

Thank you!

Tammie S.

February 8th, 2019

No review provided.

Thank you for your feedback. We really appreciate it. Have a great day!

Katherine M.

June 26th, 2019

Very helpful!

Thank you!

Magdy G.

July 13th, 2020

Very fast and efficient service. Everything was done online. Did not need any help.

Thank you!

Shirley P.

June 14th, 2019

Very easy to use, download and print. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laura H.

August 25th, 2020

I was very impressed with how quickly I was provided the data.

Thank you!

Tim G.

April 23rd, 2020

Pretty good all in all. I do wish I could download forms to a word doc instead of a .pdf. Word is more 'accessable'.

Thank you!

Jaime H.

October 20th, 2020

quick and easy

Thank you!