Northampton County Trustee Deed Form

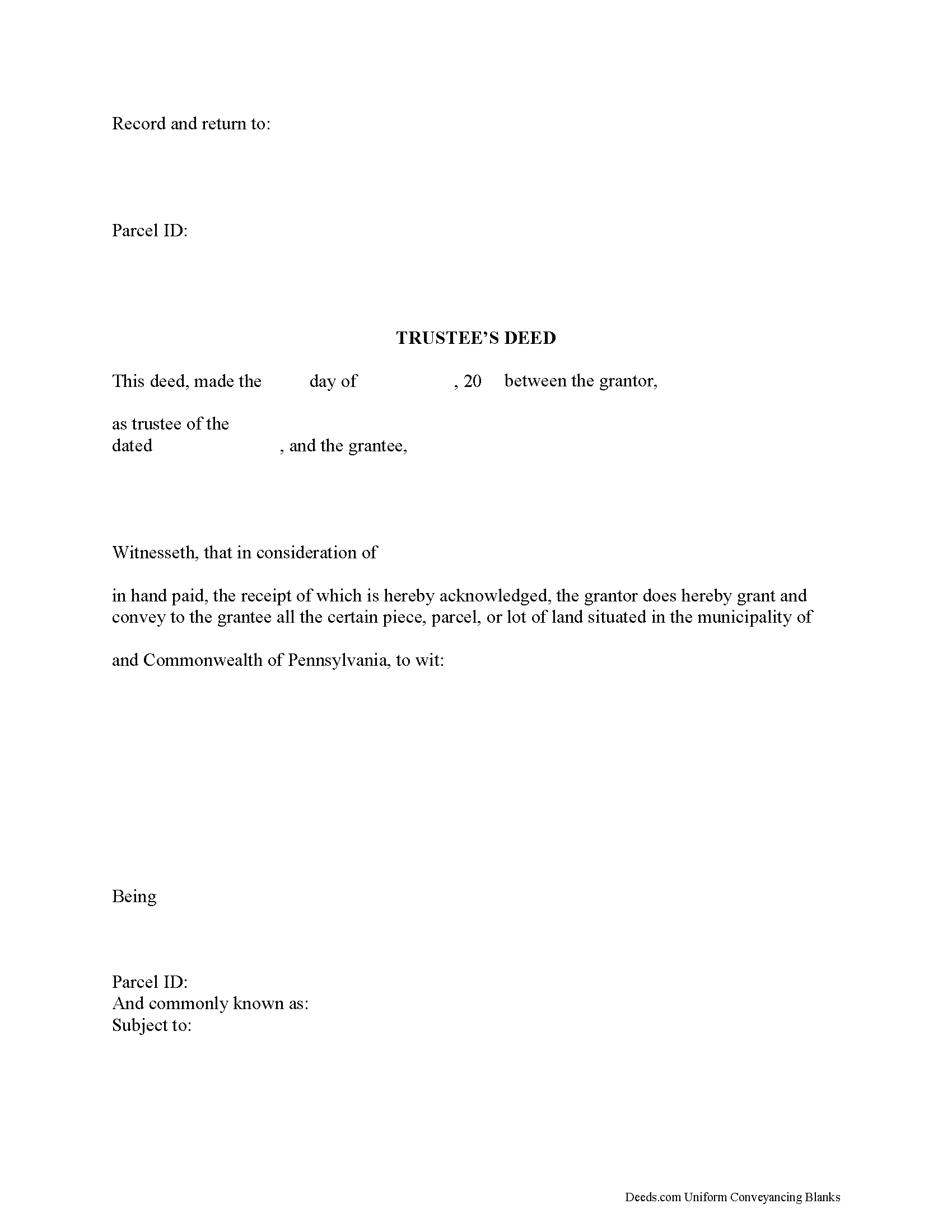

Northampton County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

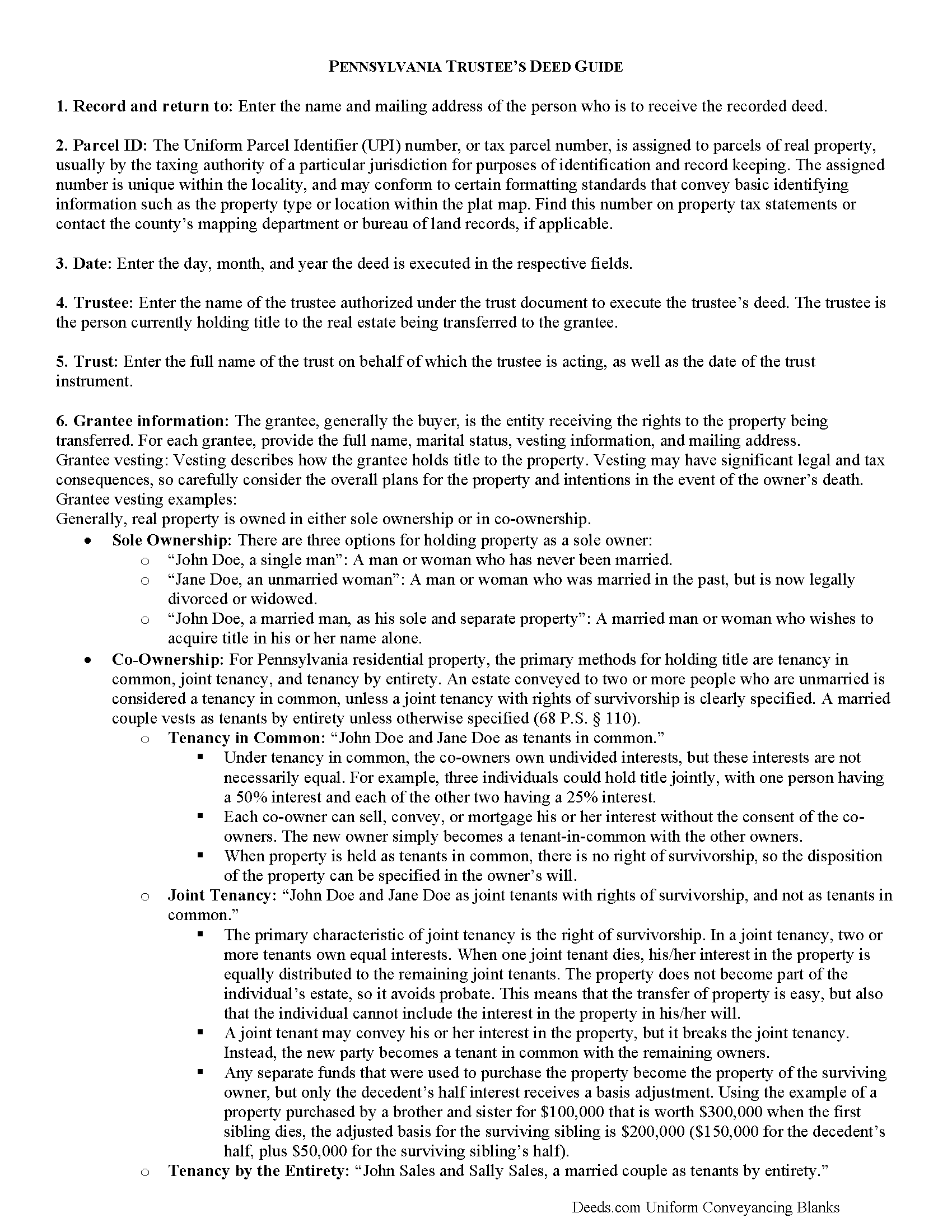

Northampton County Trustee Deed Guide

Line by line guide explaining every blank on the form.

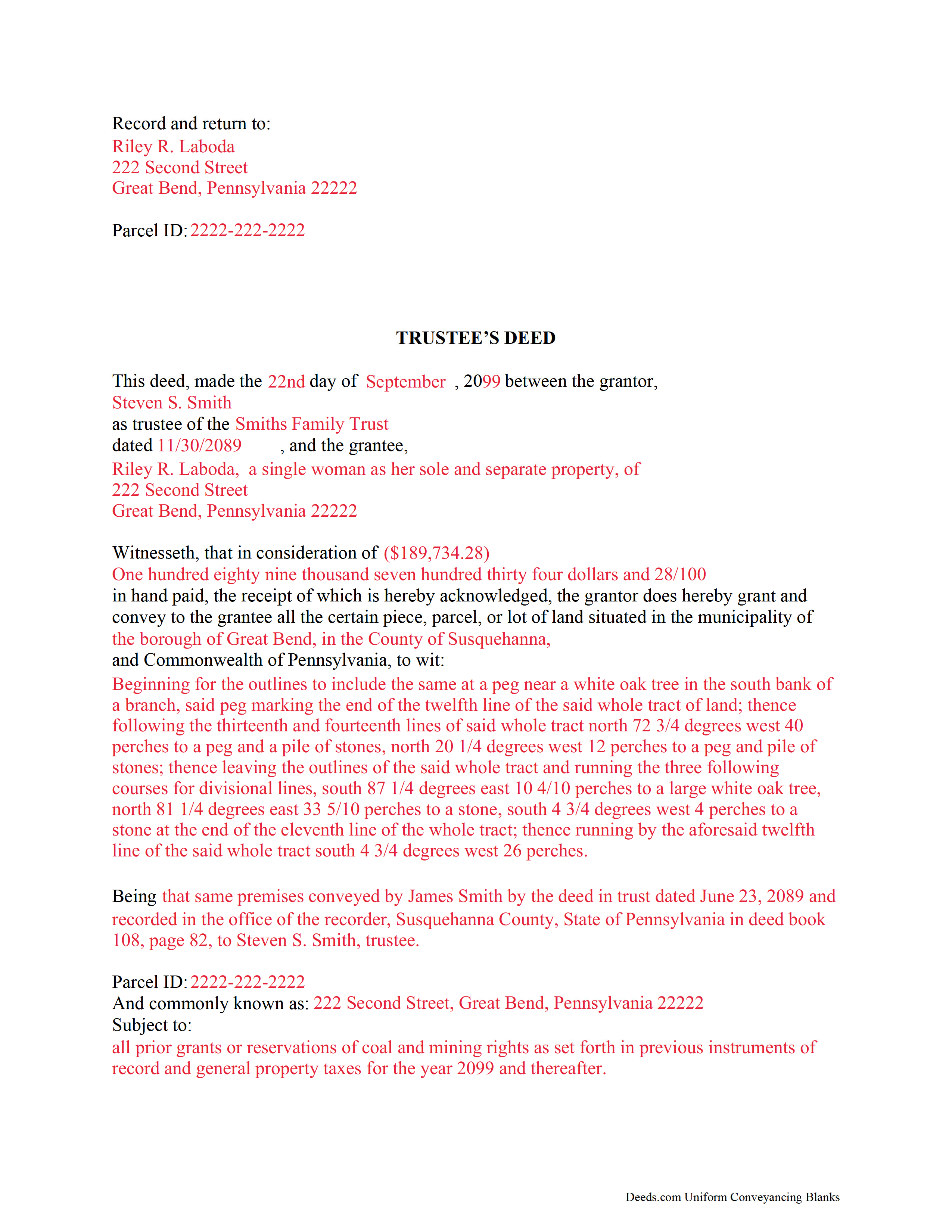

Northampton County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Pennsylvania and Northampton County documents included at no extra charge:

Where to Record Your Documents

Recorder of Deeds Division - County Courthouse

Easton, Pennsylvania 18042

Hours: 8:30am to 4:30pm M-F / until 4:00pm for PIN certification

Phone: (610) 829-6210

Recording Tips for Northampton County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Documents must be on 8.5 x 11 inch white paper

- Avoid the last business day of the month when possible

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Northampton County

Properties in any of these areas use Northampton County forms:

- Ackermanville

- Bangor

- Bath

- Bethlehem

- Cherryville

- Danielsville

- Easton

- Flicksville

- Hellertown

- Lehigh Valley

- Martins Creek

- Mount Bethel

- Nazareth

- Northampton

- Pen Argyl

- Portland

- Stockertown

- Tatamy

- Treichlers

- Walnutport

- Wind Gap

Hours, fees, requirements, and more for Northampton County

How do I get my forms?

Forms are available for immediate download after payment. The Northampton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Northampton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Northampton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Northampton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Northampton County?

Recording fees in Northampton County vary. Contact the recorder's office at (610) 829-6210 for current fees.

Questions answered? Let's get started!

Title 20, Chapter 77 of the Pennsylvania Statutes governs trusts in the State of Pennsylvania.

A trust is a wealth management tool commonly used in estate planning. There are three main parties to a trust: the settlor, who funds the trust by conveying assets into it; the trustee, who administers the trust and controls its assets; and the beneficiary, who has a present or future interest in the trust (P.S. 7703). Note that a sole trustee cannot also be the sole beneficiary (P.S. 7732(a)(5)).

Under a trust, the acting trustee manages the trust as directed by the settlor. This arrangement works, in part, because the trustee holds what amounts to a proxy title to the trust's assets. If the trust contains real property that the settlor wishes to sell, the trustee executes and records a document called a trustee's deed to transfer the title to the grantee/buyer -- the settlor is not identified in the transaction.

In most cases, trustee's deeds are modified quitclaim or special warranty deeds. Quitclaim deeds contain no warranties of title, and special warranty deeds only offer the grantee protection against title claims originating while grantor controlled the property. Generally, a trustee uses a quitclaim deed if the settlor and grantee are close relatives (spouses, parent to child, etc.). A trustee of a living trust might also use a quitclaim deed to transfer property out of the trust and to himself as an individual. Third-party purchasers might require a special warranty deed in order to obtain a mortgage or title insurance.

Besides fulfilling the requirements for all instruments affecting real property in the State of Pennsylvania (tax parcel number, legal description, prior deed information, certificate of residence, and so on), the trustee's deed names the trustee as the grantor and gives the date and the name of the trust under which the trustee is acting. A certificate of trust is sometimes included to verify the trust's existence and the trustee's authority to act on behalf of the trust. As with other instruments, the deed must be signed and acknowledged in the presence of a notary, then recorded in the county where the property is situated.

Trust law can be thorny, and each situation is unique. Consult an attorney with specific questions or for complicated circumstances.

(Pennsylvania TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Northampton County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Northampton County.

Our Promise

The documents you receive here will meet, or exceed, the Northampton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Northampton County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Jeffry C.

October 19th, 2020

Deeds.com has been a lifesaver for my house buying business. Excellent support!

Thank you Jeffry, glad we could help.

Kevin M.

April 1st, 2020

Easy to navigate. Comprehensive

Thank you!

Jack S.

March 5th, 2019

Excellent and timely responses. Do you offer an annual rate? Thank you.

Thanks again Jack. Unfortunately we do not offer any annual rates or subscriptions, sorry.

Robert W.

February 22nd, 2020

With the guide everything went great

Thank you!

Michael F.

May 15th, 2020

VERY EFFICIENT AND PLEASANT.

Thank you for your feedback. We really appreciate it. Have a great day!

Timothy G.

May 16th, 2023

Very happy with the cost and with the speed in which the deed was recorded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Isabel M.

December 20th, 2018

Easy and quick...I highly recommend this site:)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cecelia C.

December 16th, 2021

Service was fantastic. So helpful and they promptly get back with you. No reason to drive if you are out of state and need to get a deed filed. Safe way to file if you don't want to go to public office or can't physically get there.

Thank you for your feedback. We really appreciate it. Have a great day!

Eppie G.

October 19th, 2021

Perfect

Thank you!

Patricia P.

July 14th, 2021

Easy to use and super convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

Djala C.

November 18th, 2019

my experience was excellent.

Thank you!

Troy D.

October 9th, 2020

Excellent Service. Great time savings over having to send someone to the recording office. Am planning on utilizing this service for our recording needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody P.

May 4th, 2021

Great service as always, thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Max P.

February 26th, 2021

Excellent. Timely. Efficient. Smooth. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tamica D.

April 22nd, 2020

Exceptional service. Thank you for your assistance.

Thank you!