Download South Carolina Correction Deed Legal Forms

South Carolina Correction Deed Overview

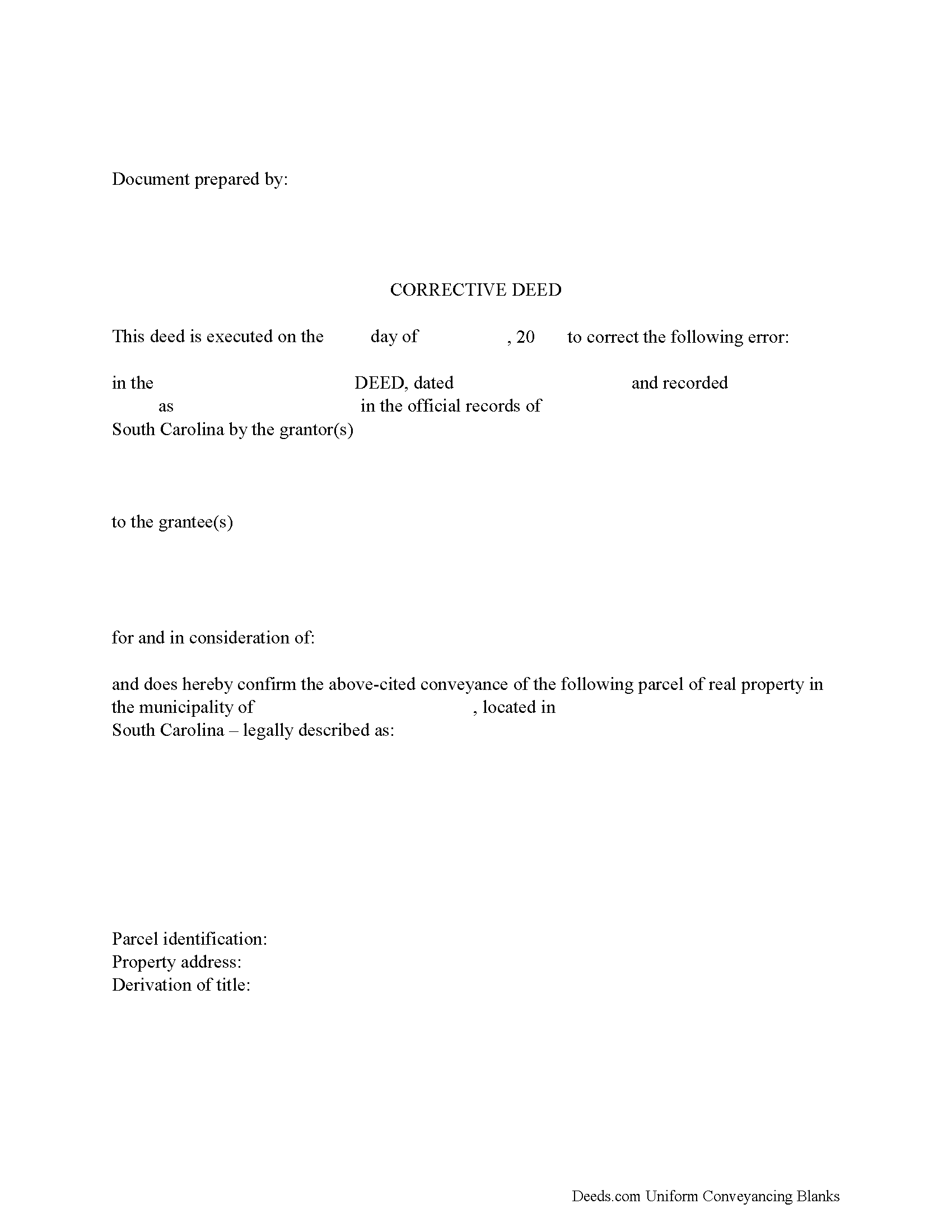

In South Carolina, use a correction deed to amend a previously recorded deed that contains a minor error.

A corrective deed is in effect an explanation and correction of an error in a prior instrument. As such, it passes no title, but only reiterates and confirms the prior conveyance. It should be executed from the original grantor to the original grantee, and it needs to be recorded in order to be legally valid.

The correction deed must reference the original conveyance it is correcting by type of error, date of execution and recording, as well as by recording number and location. Beyond that, it restates the information given in the prior deed, thus serving as its de facto reiteration. The prior deed, however, which constitutes the actual conveyance of title, remains on record.

Deeds of correction are most appropriate for minor errors and omissions in the original deed, such as misspelled names, omission of marital status, or typos in the legal description. More substantial changes, such as adding a name to the title, changing vesting information or legal description of the property, require a new deed of conveyance instead of a correction deed.

Correction deeds are exempt from deed recording fee, often referred to as documentary or deed stamps, pursuant to South Carolina Statutes 12-24-40 (12), which exempts deeds "that constitute a corrective deed or a quitclaim deed used to confirm title already vested in the grantee, as long as no consideration is paid or is to be paid under the corrective or quitclaim deed." However, an affidavit of exemption must be filed with the correction deed indicating the specific exemption.

(South Carolina CD Package includes form, guidelines, and completed example)