Union County Affidavit of Deceased Joint Tenant Form

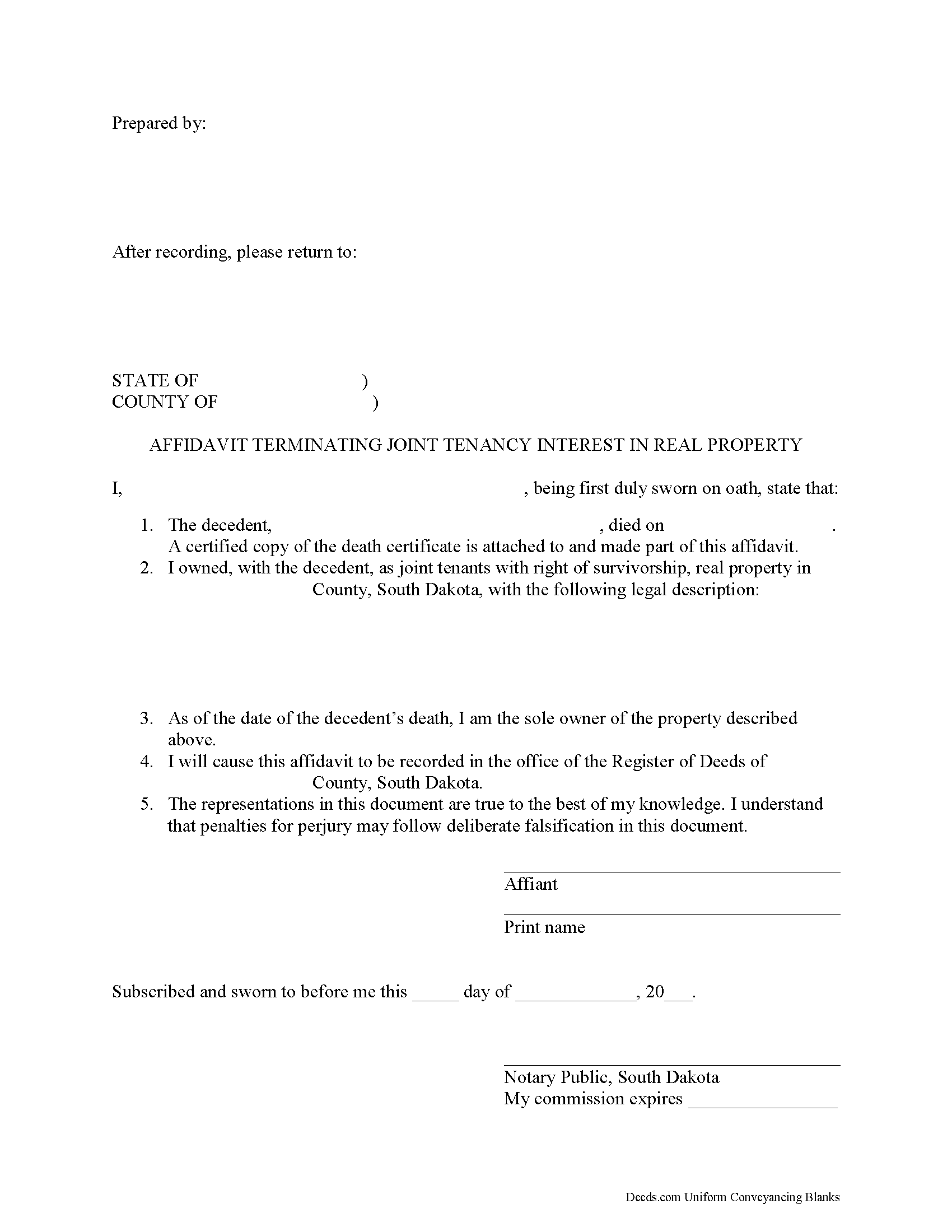

Union County Affidavit of Deceased Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

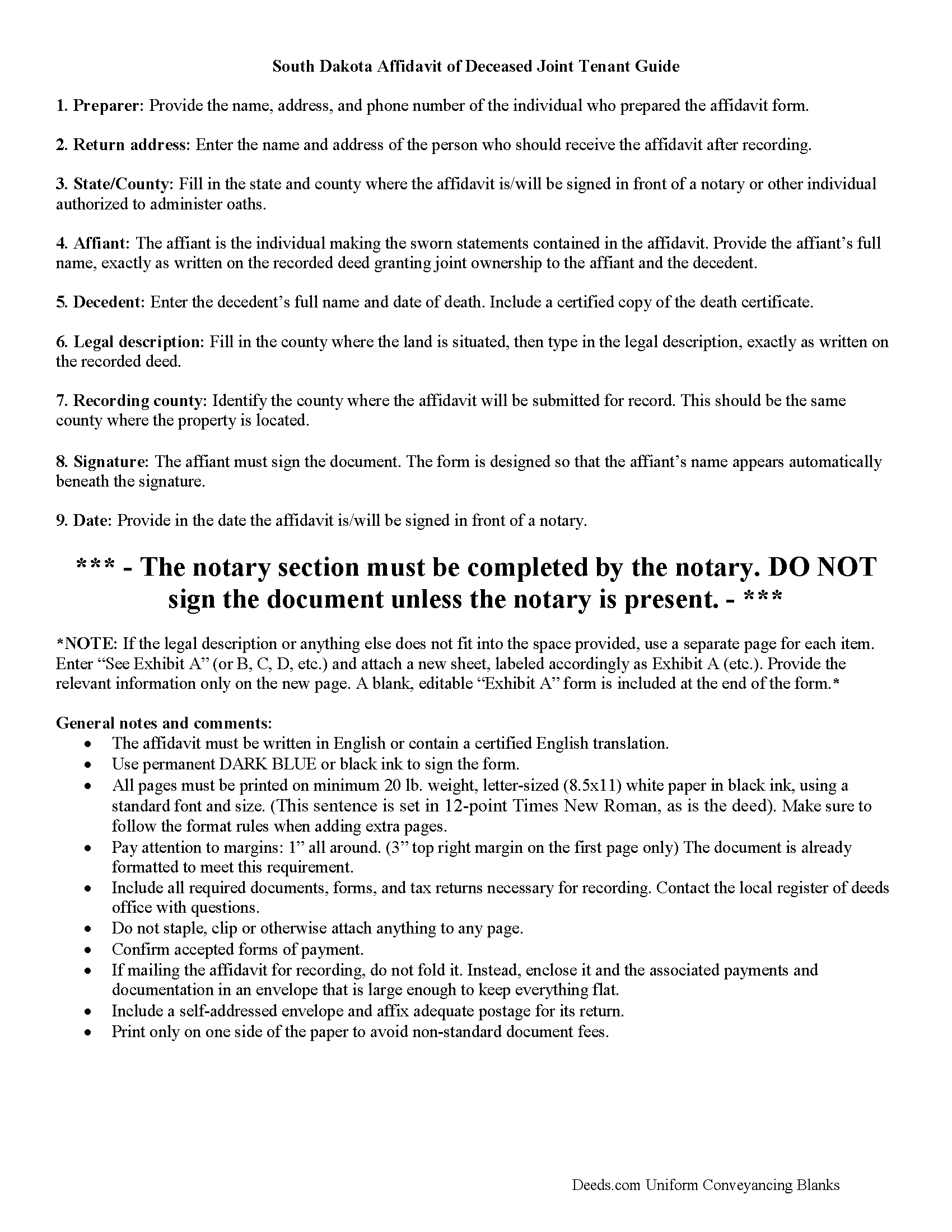

Union County Affidavit of Deceased Joint Tenant Guide

Line by line guide explaining every blank on the form.

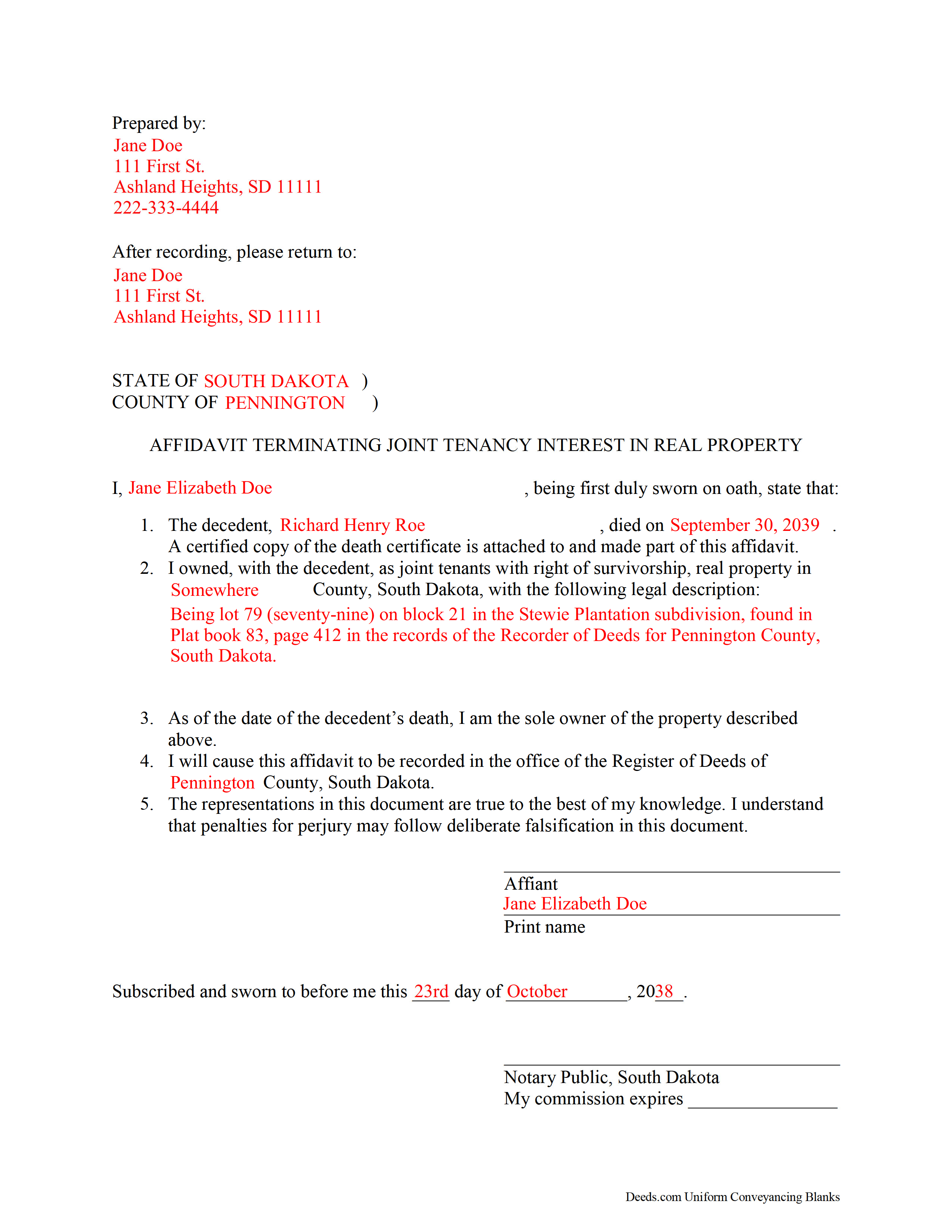

Union County Completed Example of the Affidavit of Deceased Joint Tenant Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Union County documents included at no extra charge:

Where to Record Your Documents

Union County Register of Deeds

Elk Point, South Dakota 57025

Hours: 8:30 to 5:00 M-F

Phone: (605) 356-2191

Recording Tips for Union County:

- Make copies of your documents before recording - keep originals safe

- Bring extra funds - fees can vary by document type and page count

- Recorded documents become public record - avoid including SSNs

- Ask about their eRecording option for future transactions

- Have the property address and parcel number ready

Cities and Jurisdictions in Union County

Properties in any of these areas use Union County forms:

- Alcester

- Beresford

- Elk Point

- Jefferson

- North Sioux City

Hours, fees, requirements, and more for Union County

How do I get my forms?

Forms are available for immediate download after payment. The Union County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Union County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Union County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Union County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Union County?

Recording fees in Union County vary. Contact the recorder's office at (605) 356-2191 for current fees.

Questions answered? Let's get started!

Clearing the Title on South Dakota Real Estate after a Joint Tenant Dies

In South Dakota, land owned by two or more people can be held as a tenancy in common, a partnership, or a joint tenancy (SDCL 43-2-11).

Joint tenancy, as defined at 43-2-12, is a property interest "owned by several persons in equal shares, by a title created by a single will or transfer, when expressly declared in the will or transfer to be a joint tenancy, or when granted or devised to personal representatives or trustees as joint tenants." South Dakota's joint tenancy includes the right of survivorship, meaning that if one of the co-owners dies, that person's share is distributed equally among the remaining owners. This distribution is identified as a nonprobate transfer under 29A-2-205(ii).

Nonprobate transfers are not included in the deceased owner's estate; instead, they cause the property to descend to the survivors as a function of law. Still, it makes sense, especially with real estate titles, to formalize and update the changed status. One way to accomplish this is by executing and recording an affidavit stating the relevant facts, attach a certified copy of the decedent's death certificate, and file it with the register of deeds for the county where the property is located.

Each circumstance is unique. Contact an attorney with specific questions or for complex situations.

(South Dakota AODJT Package includes form, guidelines, and completed example)

Important: Your property must be located in Union County to use these forms. Documents should be recorded at the office below.

This Affidavit of Deceased Joint Tenant meets all recording requirements specific to Union County.

Our Promise

The documents you receive here will meet, or exceed, the Union County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Union County Affidavit of Deceased Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Steve V.

June 6th, 2025

Quick and easy. Quite the time saver.

Thanks, Steve! We're glad to hear the process was quick and easy—and that it saved you time. That’s exactly what we aim for!

Charles W.

December 26th, 2022

in one of the reviews, the person said they wished that there was more room allowed for use in the grantor section. the reply was that they were sorry but there was only enough room for what was there considering margins, etc. that is not true. on the forms i downloaded there was plenty of extra room at the top of the page (about 2 inches) that was not being used.

Thank you!

Linda D.

July 17th, 2019

It was easy to download the form I wanted BUT there were 2 other options listed for "open/download." I didn't want to risk more charges for something I couldn't determine I needed so I passed them up. There were a few others listed with the option to "view" so I did that, without down-loading, and there were no additional charges. I would've liked that opportunity for 2 others that didn't offer "view" so maybe deeds.com missed a sale?

Thank you for your feedback Linda. All the documents available for download in your account are included with your payment, no additional charges.

Richard T.

July 15th, 2021

Amazing service from competent individuals that really go above and beyond to get you documents processed.

Thank you!

Michael A.

July 5th, 2021

Pleasant experiences. Look forward to future contacts

Thank you!

Ralph O.

September 16th, 2024

The experience has been excellent. The site gave me exactly what I was looking for. The documentation we easy to understand.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Matthew T.

September 9th, 2020

I am a litigator based in Lee County that rarely needs to record deeds or mortgages. However, at times, the settlement or resolution of a dispute results in the conveyance of real property. I ended up in a situation where a deed to real property in Bradford County needed to be recorded on behalf of a client. My usual e-recording vendor does not include that County. Registering with Bradford County's regular e-recording vendor would have required an expensive and unnecessary annual fee. Deeds.com was easy to use, inexpensive and fast. I highly encourage its use, especially for lawyers that occasionally need to record instruments but do not do so regularly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lynn S.

February 3rd, 2021

Awesome service! I was a first time user recording a document online. I received alerts and updates throughout the process to completion of recording. I highly recommend deeds.com. They made this process stress free. Thank you

Thank you Lynn, we appreciate the kind words. Have an amazing day!

Donna R.

February 10th, 2021

Great service. Just started using Deeds.com yesterday. So far, so good.

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin B.

May 28th, 2023

Easy to use and very helpful

Thank you for taking the time to give us your feedback Kevin. Hope you have an amazing day.

SHEDDRICK H.

June 17th, 2023

I got exactly what I paid for. No fraudulent transaction on my card. I like that. This is an excellent service. Straight and to the point help. That e-recording process looks like a winner. When I get my forms filled out I might use that.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Timothy K.

February 23rd, 2019

Great company to work with, quick responses.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elexis C.

November 14th, 2019

Easy, fast & amazing descriptions of all forms needed.

Thank you!

Kristina M.

February 2nd, 2021

deeds.com has been an easy and efficient way for my organization to file deeds on behalf of older DC residents. KVH especially has been wonderfully helpful in providing guidance about the submission process. Appreciate the professionalism and patience

Thank you for the kind words Kristina.

Cheryl C.

September 1st, 2021

Very pleased. I spent a fair amount of time chasing a blank form only to be told it couldn't be given to me - I had to go through my attorney. Going thru the deeds.com was a breeze; the blank form looked exactly like one I had filed before :-)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!