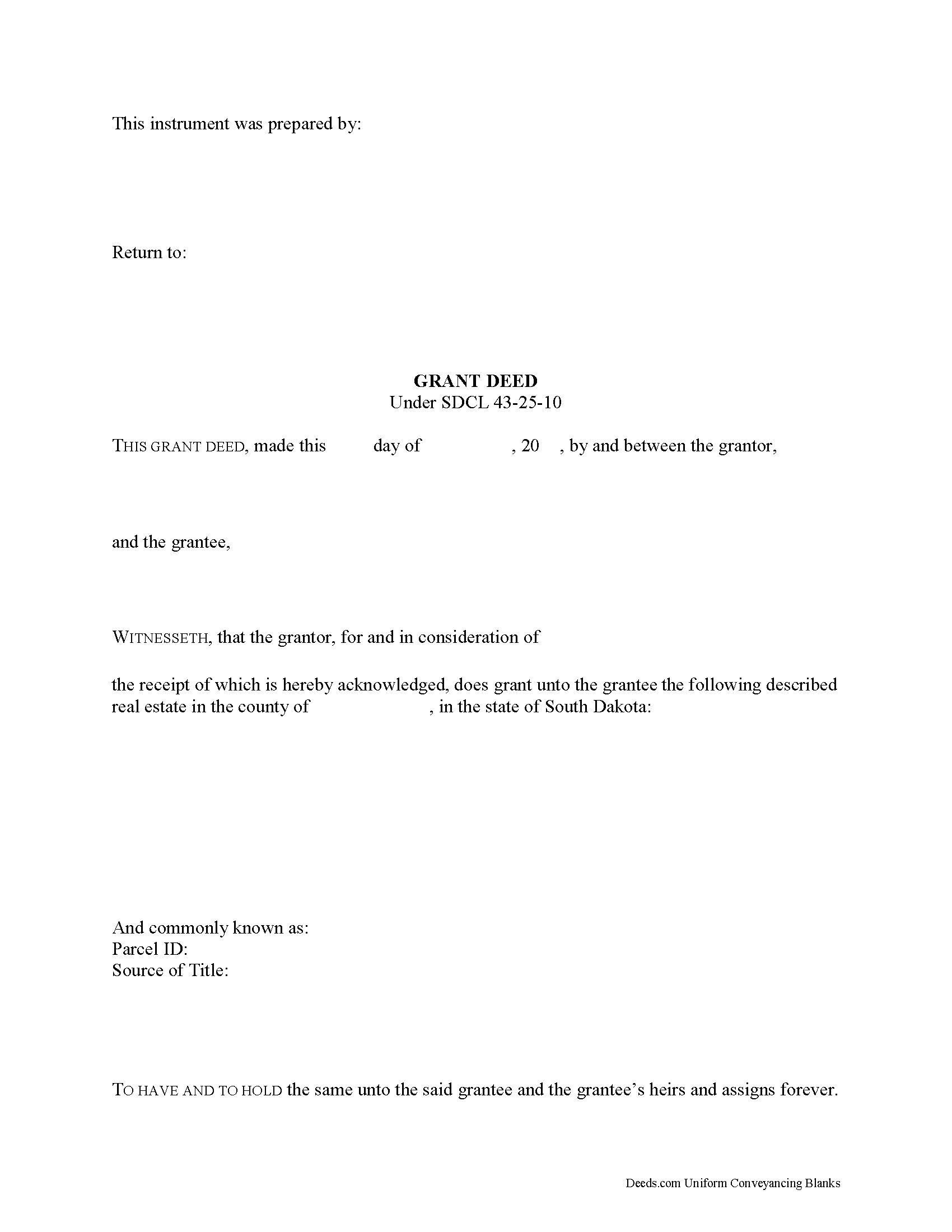

Stanley County Grant Deed Form

Stanley County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

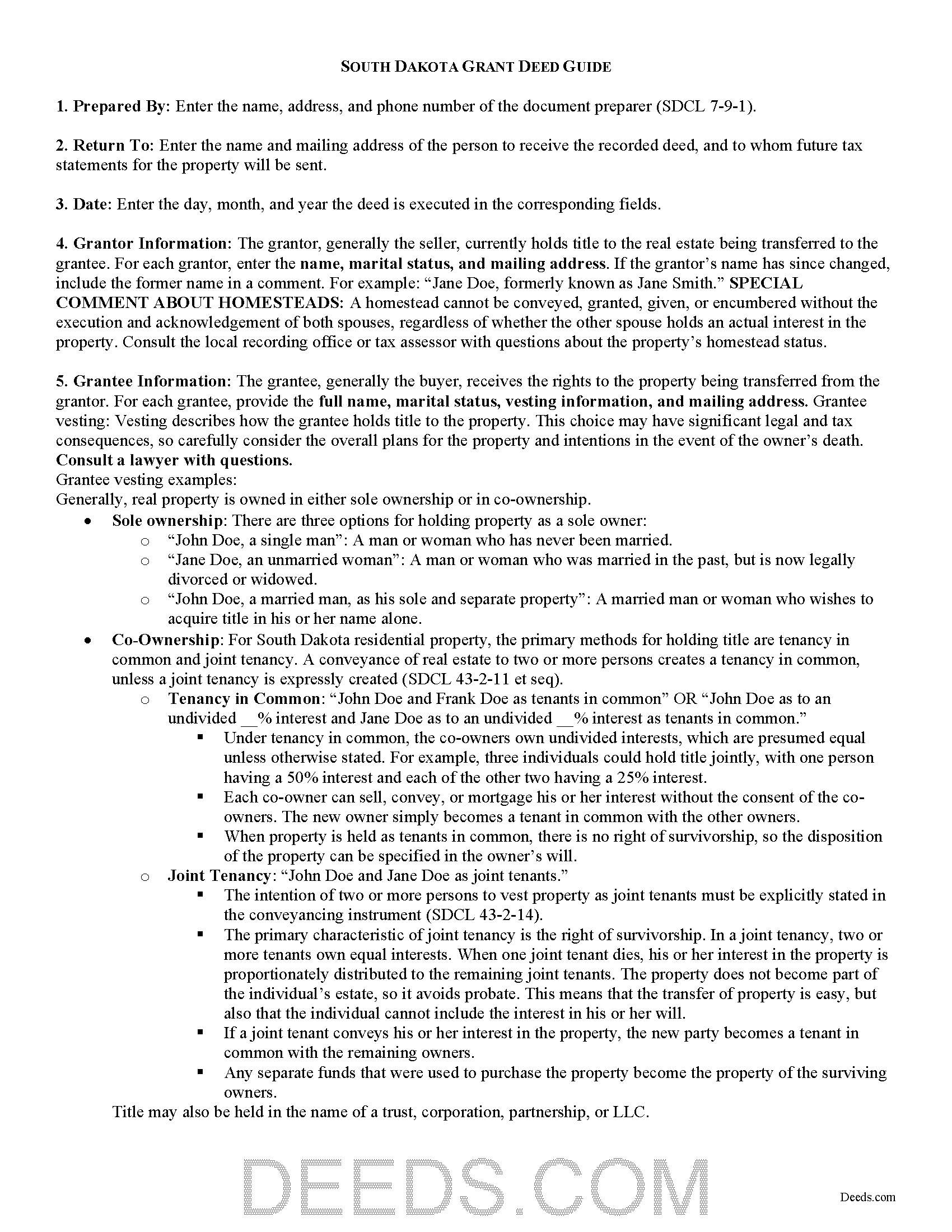

Stanley County Grant Deed Guide

Line by line guide explaining every blank on the form.

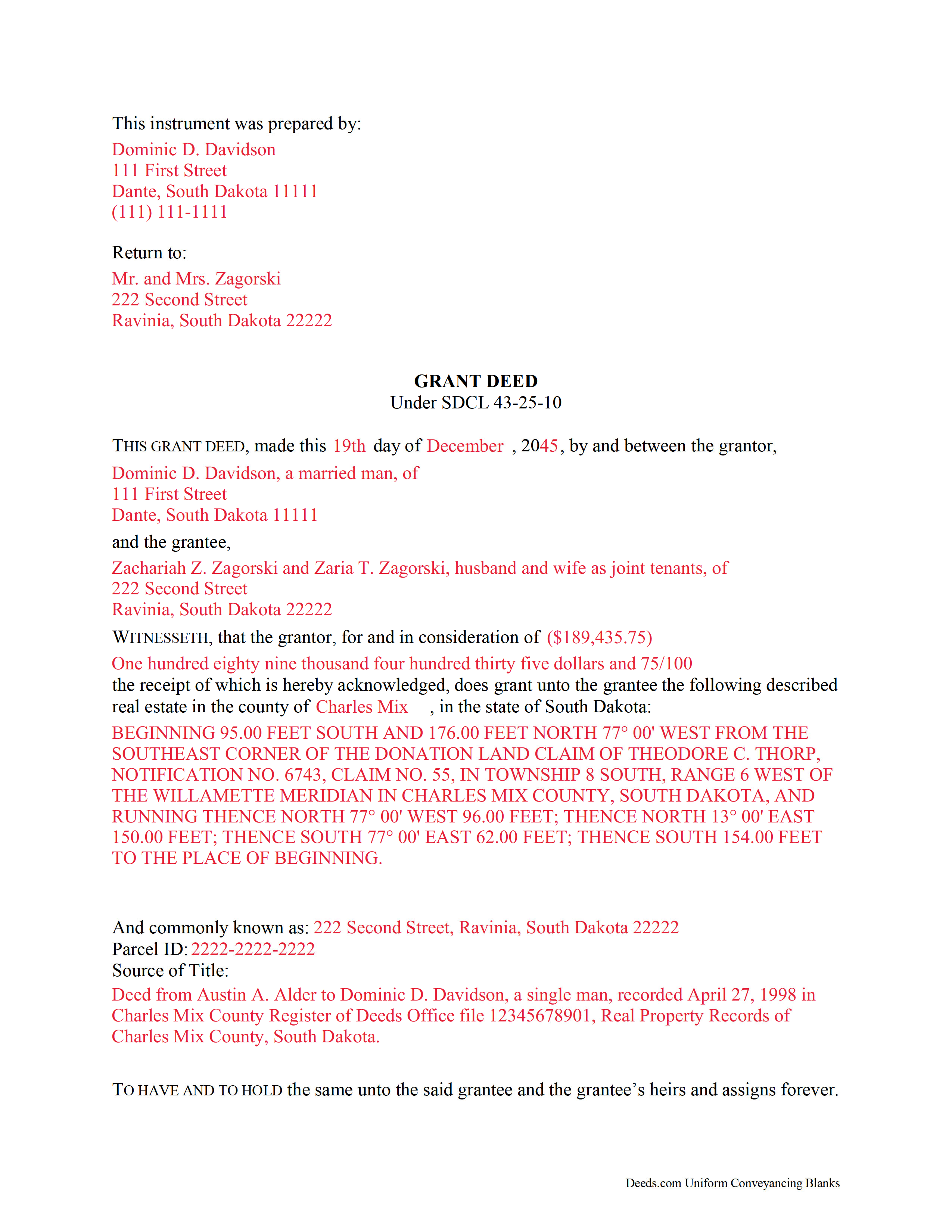

Stanley County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Stanley County documents included at no extra charge:

Where to Record Your Documents

Stanley County Register of Deeds

Fort Pierre , South Dakota 57532

Hours: 8:00 to 12:00 & 1:00 to 5:00 M-F

Phone: (605) 223-7786

Recording Tips for Stanley County:

- Bring your driver's license or state-issued photo ID

- Bring extra funds - fees can vary by document type and page count

- Recording fees may differ from what's posted online - verify current rates

- Make copies of your documents before recording - keep originals safe

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Stanley County

Properties in any of these areas use Stanley County forms:

- Fort Pierre

- Hayes

Hours, fees, requirements, and more for Stanley County

How do I get my forms?

Forms are available for immediate download after payment. The Stanley County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Stanley County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Stanley County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Stanley County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Stanley County?

Recording fees in Stanley County vary. Contact the recorder's office at (605) 223-7786 for current fees.

Questions answered? Let's get started!

In South Dakota, title to real property can be transferred from one party to another by executing a grant deed. Use a grant deed to transfer title with the implied covenants that guarantee that the title is free of any encumbrances (except for those stated in the deed) and that the grantor holds an interest in the property and is free to convey it (43-25-10). The word "grant" in the conveyancing clause transfers fee simple title (SDCL 43-25-10).

Grant deeds offer the grantee (buyer) more protection than quitclaim deeds, but less than warranty deeds. A grant deed differs from a quitclaim deed in that the latter offers no warranty of title, and only conveys any interest that the grantor may have in the subject estate. A warranty deed offers more surety than a grant deed because it requires the grantor to defend against claims to the title.

A lawful grant deed includes the grantor's full name, mailing address, and marital status; the consideration given for the transfer; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For South Dakota residential property, the primary methods for holding title are tenancy in common and joint tenancy. A conveyance of real estate to two or more persons creates a tenancy in common, unless a joint tenancy is expressly created (43-2-11 et seq).

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The completed deed must be acknowledged by the grantor (and his or her spouse, if applicable) in the presence of a notary. Finally, the document must meet all state and local standards of form and content for documents pertaining to real property in South Dakota. See SDCL 43-28-23.

A transfer fee is levied based on the consideration paid. Pursuant to SDCL 43-4-23, if the transfer is exempt from the transfer fee, the deed should cite any exemption claimed. A list of exemptions can be found at 43-4-22. Real estate transfer fees are due upon recording, unless an exemption is claimed. Contact the appropriate Register of Deeds office for up-to-date information on transfer fees. The deed must also be recorded with a Certificate of Real Estate Value (SDCL 7-9-7(4)).

Record the original completed deed, along with any additional materials, at the Register of Deeds office in the county where the property is located. Contact the appropriate Register of Deeds to verify accepted forms of payment.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a South Dakota lawyer with any questions related to grant deeds or the transfer of real property.

(South Dakota GD Package includes form, guidelines, and completed example)

Important: Your property must be located in Stanley County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Stanley County.

Our Promise

The documents you receive here will meet, or exceed, the Stanley County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Stanley County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

John H.

April 19th, 2021

I haven't begun yet, but this looks like what I need.

Thank you!

Benjamin B.

November 10th, 2022

Your software was beneficial; facilitating preparation of a legal document and cover page in a state where I had limited legal experience.

Thank you for your feedback. We really appreciate it. Have a great day!

Walter K.

November 24th, 2021

Works ok but could have more specific information. My wife and I both own the Quit Claim property, should we both sign as Grantors?

Thank you!

LORIN C.

April 24th, 2019

This site and service is the best and most easily navigated that I've seen; I'm 80.....and I need...EASY!

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy C.

July 14th, 2019

Amazing every that you need right at your fingertips. Extremely easy to navigate and very informative. I would highly recommend this site!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ginger L.

May 29th, 2022

Excellent full set of documents with example and guidelines on how to do it ourselves without paying a lawyer. Or, we save legal fees by completing it ourselves and having a lawyer review it. Love that I can save the pdf and fill it out whenever I want. Thank you for having this available!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard R.

November 14th, 2019

Very straightforward, and fair-enough pricing.

Thank you!

Don M.

February 17th, 2023

The process was easy going. The process is one thing, the results another. I have attempting to resolve this matter, of claiming sole ownership of the property for several YEARS. I lost my Bride of 65 years in 2015. A lawyer I hired failed in his attempt, so I'm waiting to see the actual results. I also have two parcels in New Mexico under the same situation, so if this is successful, I'll gladly be back. Thank You so very much. Don Martin

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Loren H.

December 11th, 2022

I really appreciate your forms according to South Dakota laws and statues. Your forms allow me to effectively do estate planning without extensive legal expenses. The "Revocable Transfer of Death Deed" is perfect to protect against extensive probate problems for seniors in retirement. Thank you and May God Bless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robin F.

November 9th, 2022

Very Convenient and easy to use

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Angela J M.

September 29th, 2023

Quick turnaround (about 24hrs) easy process.

Thank you for your feedback. We really appreciate it. Have a great day!

STACIA V.

July 19th, 2019

I filled out the forms that were somewhat easy. I was surprised that it was recorded by the county recording office. I just hope that it really worked. I think it did. I will find out later this year.

Thank you!

Viola J.

August 2nd, 2021

You made this so easy to process the Executor Deed. THANK YOU a thousand times. Appreciate that all forms are in one place and I did not have to search all over the internet to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan K.

July 13th, 2021

They were unable to complete the task and my money was immediately refunded.

Thank you for your feedback Susan, sorry we were unable to assist.

dean s.

July 23rd, 2019

Excellent work. Berry happy!

Thank you!