Macon County Correction Deed Form

Macon County Correction Deed Form

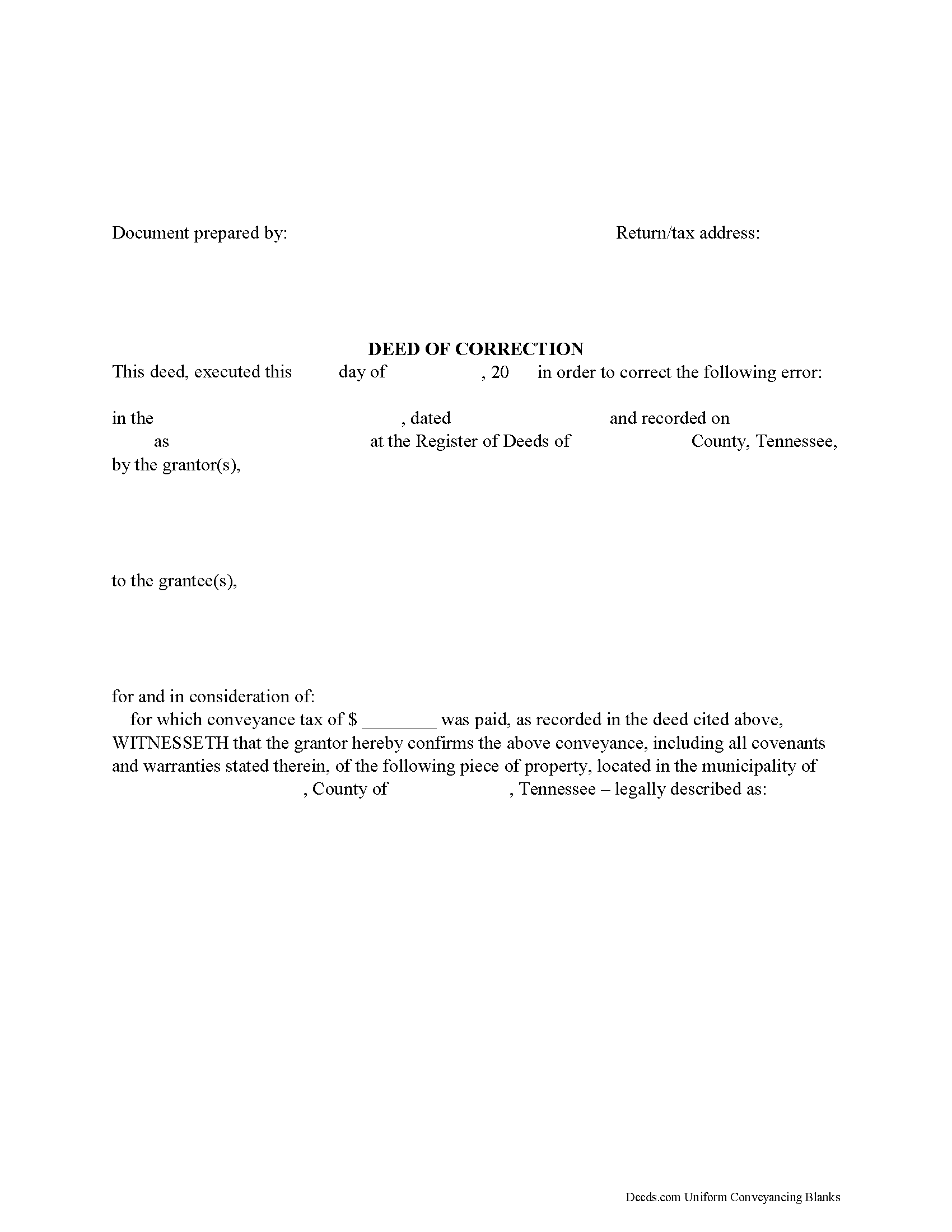

Fill in the blank form formatted to comply with all recording and content requirements.

Macon County Correction Deed Guide

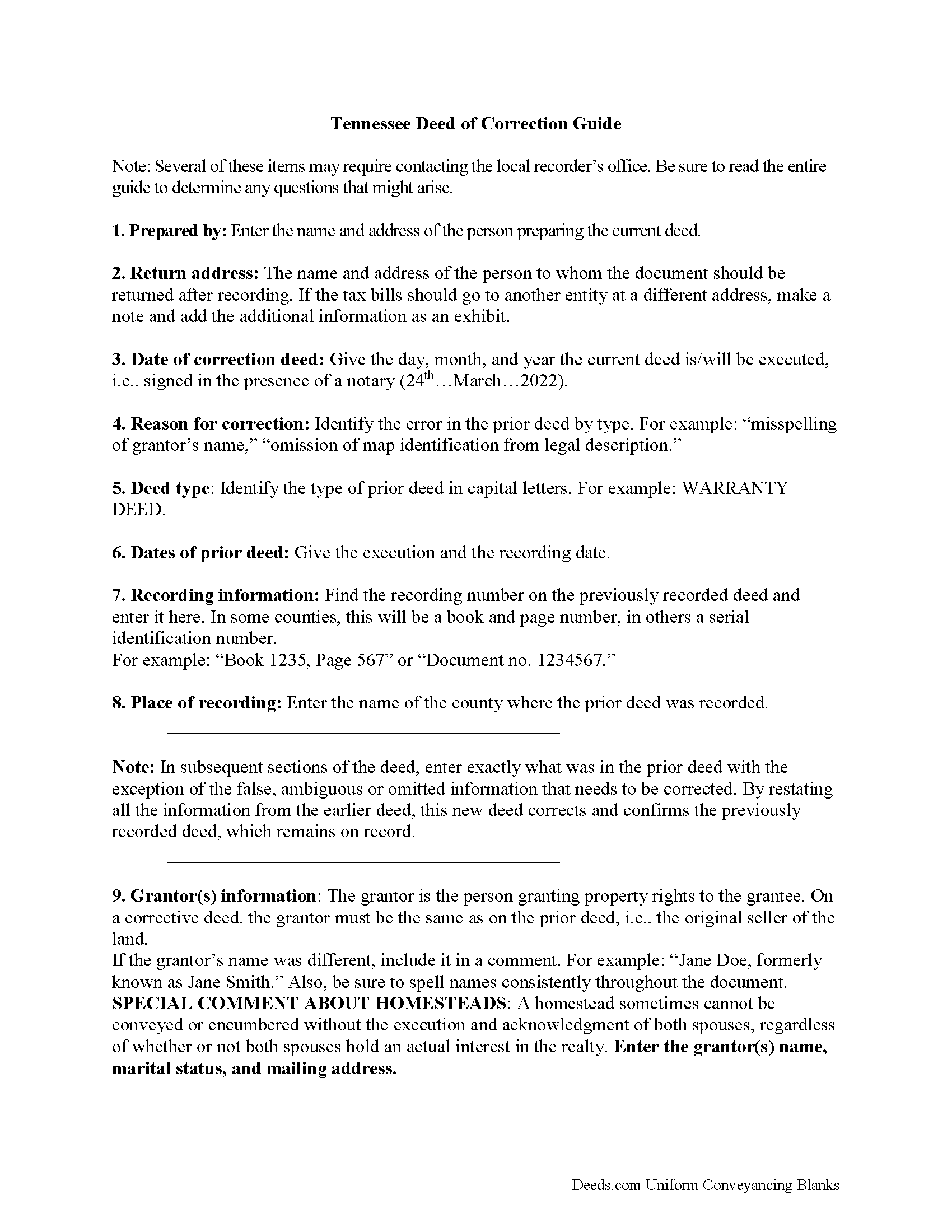

Line by line guide explaining every blank on the form.

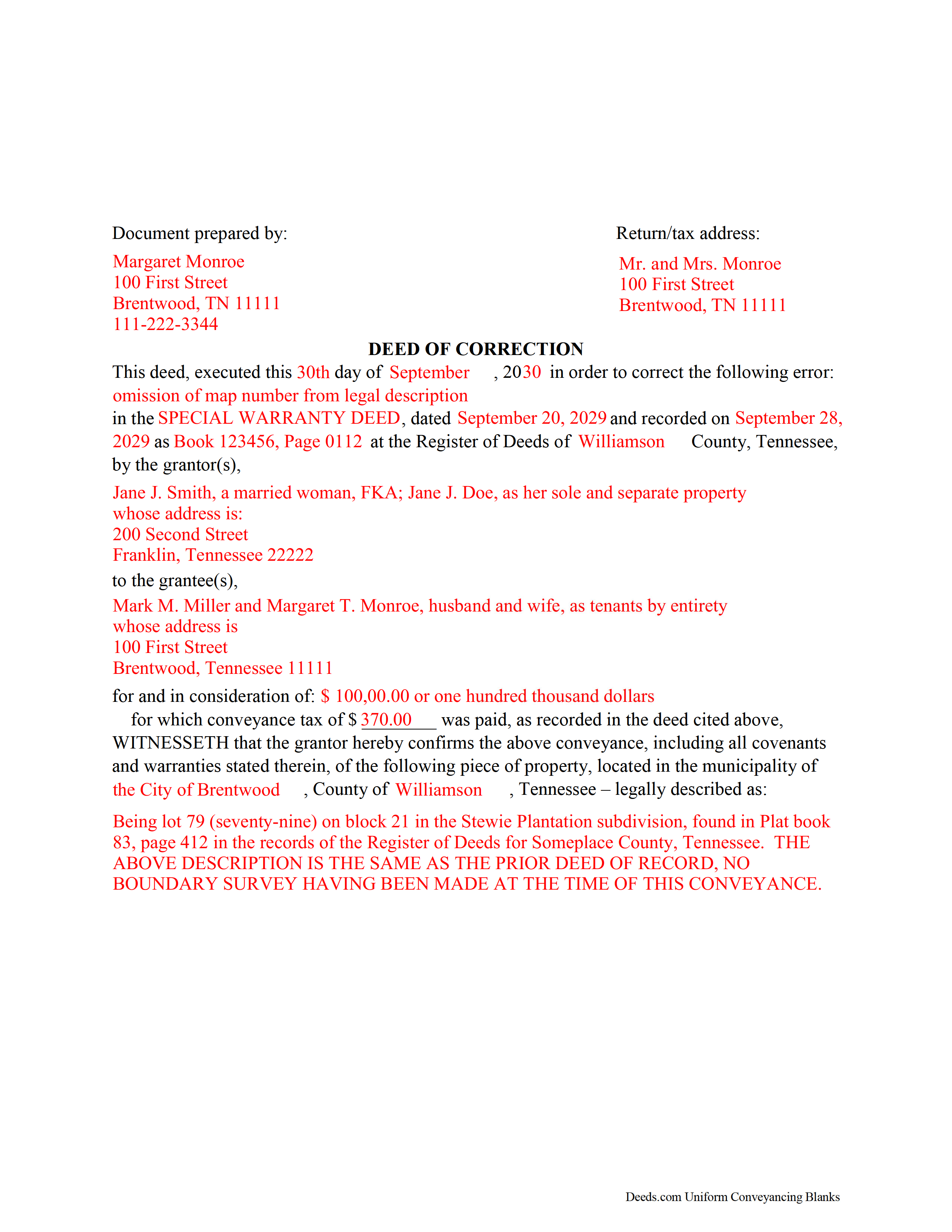

Macon County Completed Example of a Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Macon County documents included at no extra charge:

Where to Record Your Documents

Macon County Register of Deeds

Lafayette, Tennessee 37083

Hours: 8:00 to 4:00 M-F

Phone: (615) 666-2353

Recording Tips for Macon County:

- Check that your notary's commission hasn't expired

- Ask if they accept credit cards - many offices are cash/check only

- Ask about their eRecording option for future transactions

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Macon County

Properties in any of these areas use Macon County forms:

- Lafayette

- Red Boiling Springs

Hours, fees, requirements, and more for Macon County

How do I get my forms?

Forms are available for immediate download after payment. The Macon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Macon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Macon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Macon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Macon County?

Recording fees in Macon County vary. Contact the recorder's office at (615) 666-2353 for current fees.

Questions answered? Let's get started!

Use the correction deed to correct errors in a warranty, special warranty, or quitclaim deed in Tennessee.

The best option for correcting a deed in Tennessee is to record a correction deed. Other options, such as a scrivener's affidavit and re-recording the original deed, both have some drawbacks. The scrivener's affidavit can serve as a valid alternative when the original grantor is not available. Tennessee law provides that a corrected copy of the original document may be attached to the affidavit as an exhibit (T.C.A. 66-24-101(a)(27)). Such a copy, however, only carries the weight of an exhibit to an affidavit and not that of a recorded document.

Re-recording the original deed with corrections requires a new execution/signing and notary acknowledgement. The reason for correcting, the actual correction and cross-reference to the prior recording must be made on the existing copy or, depending on county requirements, on a title page. This will not only require fees for the additional page(s) when re-recording, but also creates potential problems during the recording if the added information does not stay within the required document margins.

The easiest and cleanest option for correcting a deed is to record a new correction deed, which makes reference to the original document by date and recording number and gives the reason for the correction by indicating the type of error. Except for the corrected or omitted information, it duplicates the text of the prior deed. The original parties must sign in the presence of a notary, who then acknowledges this new instrument prior to recording. In some Tennessee counties, a corrective deed must have a new oath of value, if the original deed is more than 6 months old.

(Tennessee CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Macon County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Macon County.

Our Promise

The documents you receive here will meet, or exceed, the Macon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Macon County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Fred B.

February 8th, 2019

Great service and all seems to be what I was looking for

Thank you Fred, have a great day!

Brenda E.

April 24th, 2020

This is a great tool to use. It makes recording documents so easy and convenient. The website is very user-friendly. The only suggestion I would have is if the website could email me directly when I have a message so I don't have to keep checking back to see if my document is ready.

Thank you for your feedback. We really appreciate it. Have a great day!

Helen M.

May 19th, 2020

The forms are very confusing when there is so much to download! Trying to keep track and make sure you have everything needed is terrible! I think I have everything but I was under the impression I would be filling it out online and with instructions... I am very disappointed to say the least!

Sorry to hear of your disappointment Helen. We have gone ahead and canceled your order and payment. We do hope that you are able to find something more suitable to your needs elsewhere. Have a wonderful day.

Chelsie F.

April 3rd, 2020

Super customer service and communication! Fast service and more informative than expected! Can't say thanks enough.

Thank you!

Trace A.

June 3rd, 2023

Deeds.com had much better and fuller information than any other help i found (90% complete vs 60 % complete); they tout how up-to-date they are on all the counties in the country and the idiosyncrasies of each county's forms and procedures; but some minor points of the info i needed were missing or confusing. Including that they sold me on e-Recording my deed through them, only to find out after i had done all the prep for that, that they had failed to tell me upfront (or i missed it somehow) that the county i was dealing with did not yet accept online recording. So, they were by far the best i found, but not 100%.

Thank you for your honest and thorough feedback Trace. We will review your concerns carefully in an effort to improve our services. Hope you have an amazing day.

NATALIE A.

January 6th, 2021

The form was very easy to use and the sample tool you had was very helpful. the only problem i had was saving the document and then trying to find it later. I finally was able to figure out how to save it. but i still cannot find the saved document on my computer. Luckily i printed it before i closed it and did not need to make any changes.

Thank you for your feedback. We really appreciate it. Have a great day!

Anne J.

September 25th, 2023

I could not be happier with the service. Shortly after I uploaded my documents, my package was prepared and invoiced. It was only minutes before the document was recorded with the County I selected and returned to me with their seal for download.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert B.

August 14th, 2021

The forms were easy to download and fill.

Thank you!

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Bette B.

November 2nd, 2021

Got Form I needed with detailed instructions and it was inexpensive

Thank you for your feedback. We really appreciate it. Have a great day!

Reida S.

September 29th, 2020

Have used two times. Smooth transaction both times. Fast, simple and easy to use system. Would use them again in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

DARLA L.

September 8th, 2022

I was happy with the quick response to obtain the requested forms. Effective and easy website to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David K.

March 25th, 2019

Worked Great! First time go at the courthouse

Thank you!

Don M.

February 8th, 2023

ONCE A PERSON STARTS THE PROCESS, IT IS QUITE EASY, THE PROCESS THAT IS.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kristen H.

August 29th, 2019

This was such a money saver. I was told by someone at the courthouse that I had to have a lawyer prepare the paper work for my mom. They stated that family members couldn't prepare the papers. I was hopeful when I found that I could prepare the survivorship affidavit on Deeds. I was able to prepare everything myself and had no issues today when at the courthouse for all the changes. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!