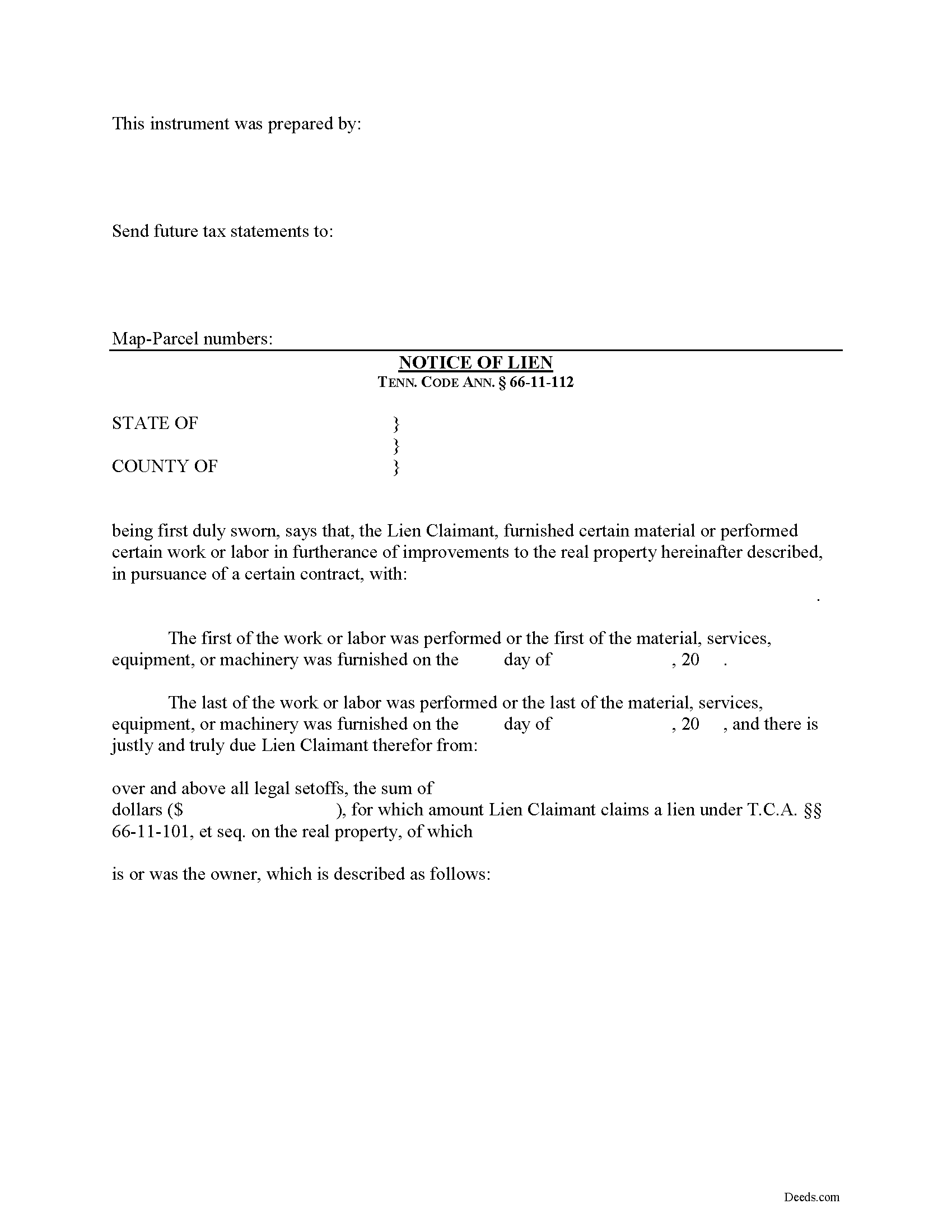

Pickett County Notice of Mechanics Lien Form

Pickett County Notice of Mechanics Lien Form

Fill in the blank Notice of Mechanics Lien form formatted to comply with all Tennessee recording and content requirements.

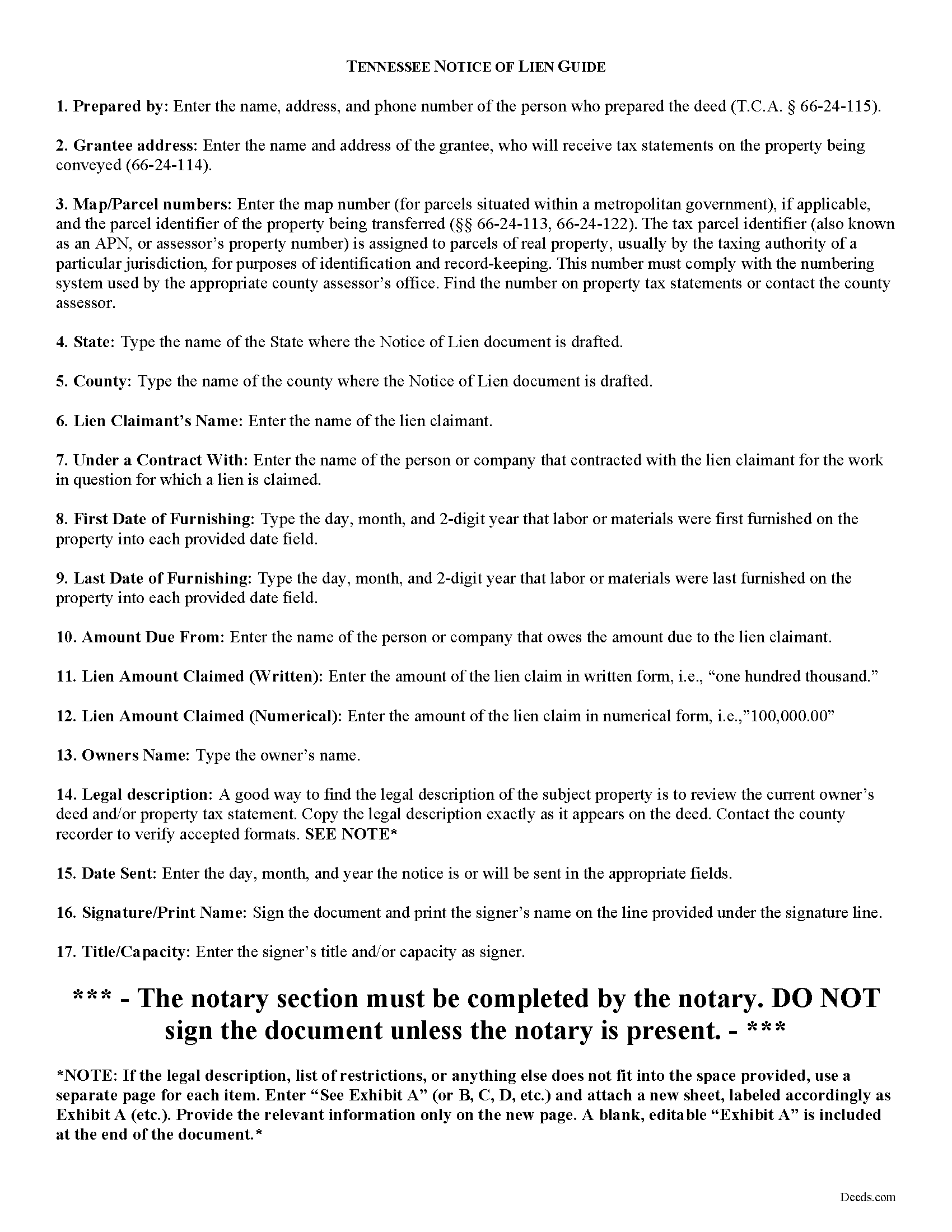

Pickett County Notice of Mechanics Lien Guide

Line by line guide explaining every blank on the form.

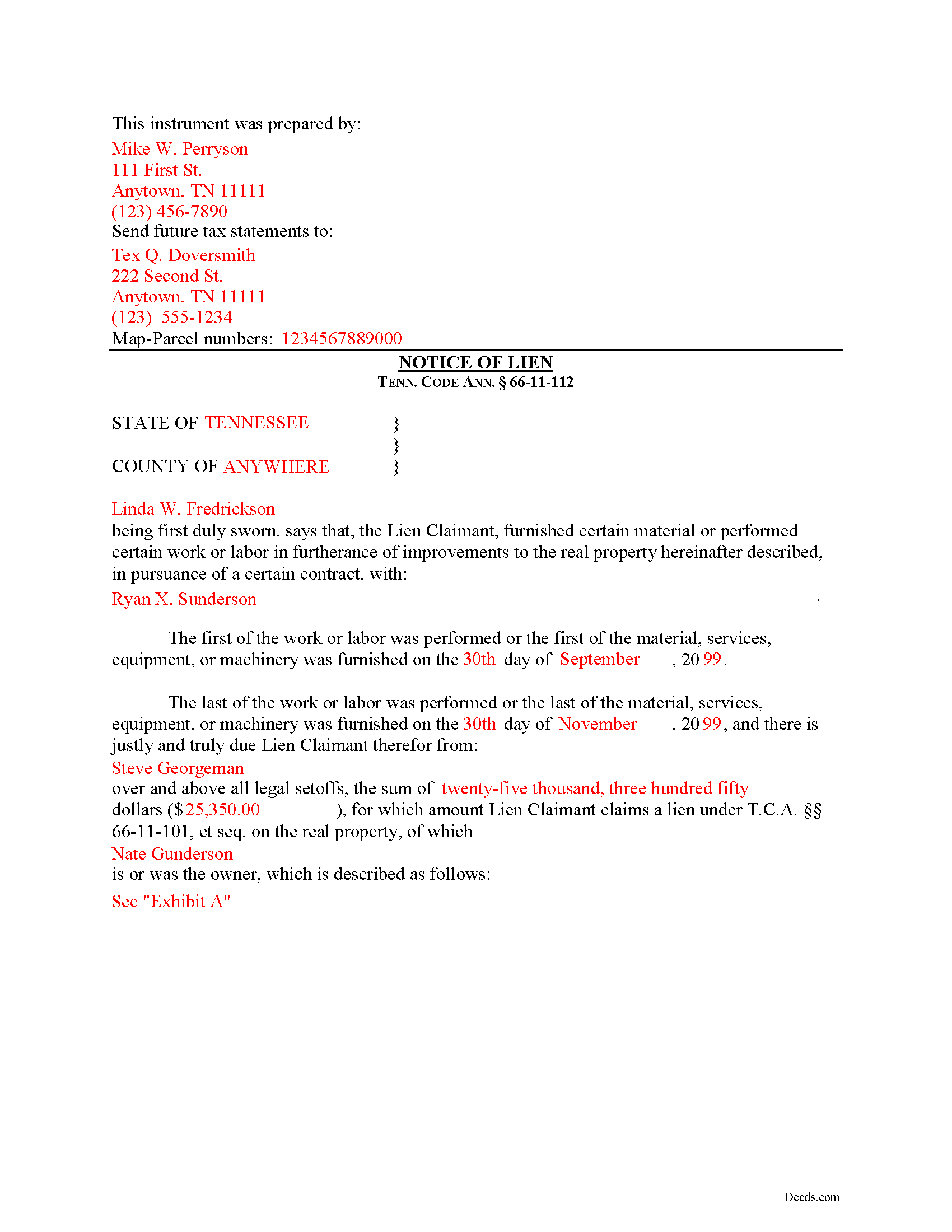

Pickett County Completed Example of the Notice of Mechanics Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Pickett County documents included at no extra charge:

Where to Record Your Documents

Pickett County Register of Deeds

Byrdstown, Tennessee 38549

Hours: 8:00am to 4:30pm.M-F

Phone: (931) 864-3316

Recording Tips for Pickett County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Leave recording info boxes blank - the office fills these

- Bring extra funds - fees can vary by document type and page count

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Pickett County

Properties in any of these areas use Pickett County forms:

- Byrdstown

Hours, fees, requirements, and more for Pickett County

How do I get my forms?

Forms are available for immediate download after payment. The Pickett County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pickett County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pickett County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pickett County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pickett County?

Recording fees in Pickett County vary. Contact the recorder's office at (931) 864-3316 for current fees.

Questions answered? Let's get started!

Filing a Mechanic's Lien Claim in Tennessee

Mechanic's Liens are used to place a block or burden on a property owner's title when a claimant (such as a contractor or materials supplier) has not been paid for labor, materials, or equipment provided. In Tennessee, mechanic's liens are governed under Chapter 11 of the Tennessee Property Code.

In order to preserve the priority of the lien, as it concerns subsequent purchasers or encumbrancers for a valuable consideration without notice of the lien, the lienor, is required to record in the office of the register of deeds of the county where the real property, or any part affected, lies, a sworn statement of the amount for, and a reasonably certain description of the real property on, which the lien is claimed. Tenn. Prop. Code 66-11-112(a).

The recording party shall pay filing fees, and shall be provided a receipt for the filing fees, which amount shall be part of the lien amount. Id. The recordation must be done no later than ninety (90) days after the date the improvement is complete or is abandoned, prior to which time the lien shall be effective as against the purchasers or encumbrancers without the recordation. Id.

The owner must serve thirty (30) days' notice on prime contractors and on all of those lienors who have served notice in accordance with Tenn. Prop. Code 66-11-145 (the notice of non-payment) prior to the owner's transfer of any interest to a subsequent purchaser or encumbrancer for a valuable consideration. Id.

If the sworn statement is not recorded within that time, the lien's priority as to subsequent purchasers or encumbrancers shall be determined as if it attached as of the time the sworn statement is recorded. Id. Therefore, timely recording is of the utmost importance to protect full lien rights.

According to Tennessee Prop. Code 66-11-112(b), a building, structure or improvement is deemed to have been abandoned for purposes of the lien law when there is a cessation of operation for a period of ninety (90) days and an intent on the part of the owner or prime contractor to cease operations permanently, or at least for an indefinite period. If either of these occur, it is time to file your lien.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any issues regarding mechanic's liens.

Important: Your property must be located in Pickett County to use these forms. Documents should be recorded at the office below.

This Notice of Mechanics Lien meets all recording requirements specific to Pickett County.

Our Promise

The documents you receive here will meet, or exceed, the Pickett County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pickett County Notice of Mechanics Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

LORIN C.

April 24th, 2019

This site and service is the best and most easily navigated that I've seen; I'm 80.....and I need...EASY!

Thank you for your feedback. We really appreciate it. Have a great day!

Janet R.

January 7th, 2019

Disappointed. Description of Lien discharge form does not indicate it is specific to Mechanic liens. I'm inexperienced with liens & should have contacted someone before I ordered.

Sorry to hear that, it does look like our product description was lacking clarity. We have updated the description to better reflect the documents. We have also canceled your order and refunded the payment. Hope you have a great day.

Nancy B.

August 23rd, 2020

Deeds.com is a godsend! Being able to download the pertinent state and county specific forms reassured me of having the correct t forms in which to proceed. The cost was most reasonable. Thanks for this service.

Thank you!

Tim T.

August 24th, 2020

Fast and efficient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Forrest D.

September 16th, 2022

Requires you work in Adobe Acrobat. Too difficult to edit, add and erase for an attorney.

Sorry to hear of your struggle. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Margaret T.

May 6th, 2022

Had a difficult time finding my download after purchase. Thankfully I had printed the form and had. However it was read only and I'm not experienced enough to be able to change that. So I went into my word program and typed in the form. I should be able to use it for my purpose. Just glad I was finally able to find it after hours of searching online. I'm in my 70's and not real computer intelligent which may have been part of the problem

Sorry to hear of your struggle Margaret, we will try harder to make our forms easier for everyone.

Hanna M.

June 10th, 2019

Very helpful information! Thank you for your service!

Thank you!

Jimmy P.

November 7th, 2021

Works well. Very satisfied.

Thank you!

Florentes P.

January 20th, 2019

The form is so limited in space that I can not fit the vesting information as well as the real property information. The property information, I could put it as Exhibit A. which is not the usual way. Not happy.

Sorry to hear that you are not happy with the available space on the document you received. Per your request we have canceled your order. We do hope you are able to find a solution that meets your needs and the recording/statutory requirements of the document. Have a great day!

Joseph M.

January 4th, 2021

Very easy to use the service and responses came very quickly.

Thank you!

Evaristo R.

October 6th, 2020

I was very excited to use the website but unfortunately they had a problem retrieving my Deed but thank you for the opportunity.

Thank you for your feedback. We really appreciate it. Have a great day!

Lou H.

April 27th, 2019

5 stars.

Thank you!

James B.

July 31st, 2019

Your website is very easy to use. No problem downloading the forms.

Thank you!

THOMAS P.

September 11th, 2020

This site is excellent and makes everything so much easier. 5 star platform.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Heather F.

January 13th, 2019

Quality forms and information. Everything went smoothly.

Great to hear Heather. Have a fantastic day!