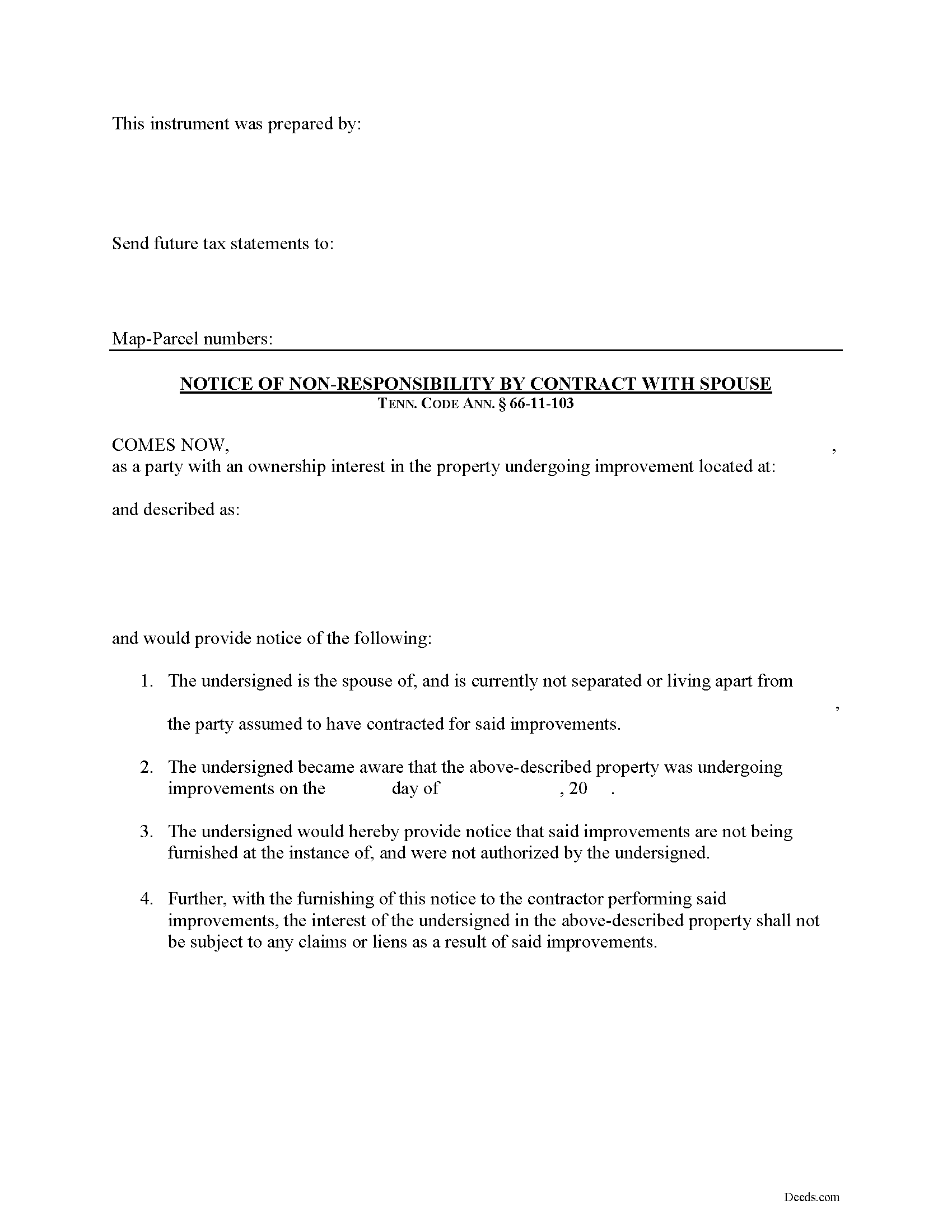

Warren County Notice of Spousal Non-Responsibility Form

Warren County Notice of Spousal Non-Responsibility Form

Fill in the blank Notice of Spousal Non-Responsibility form formatted to comply with all Tennessee recording and content requirements.

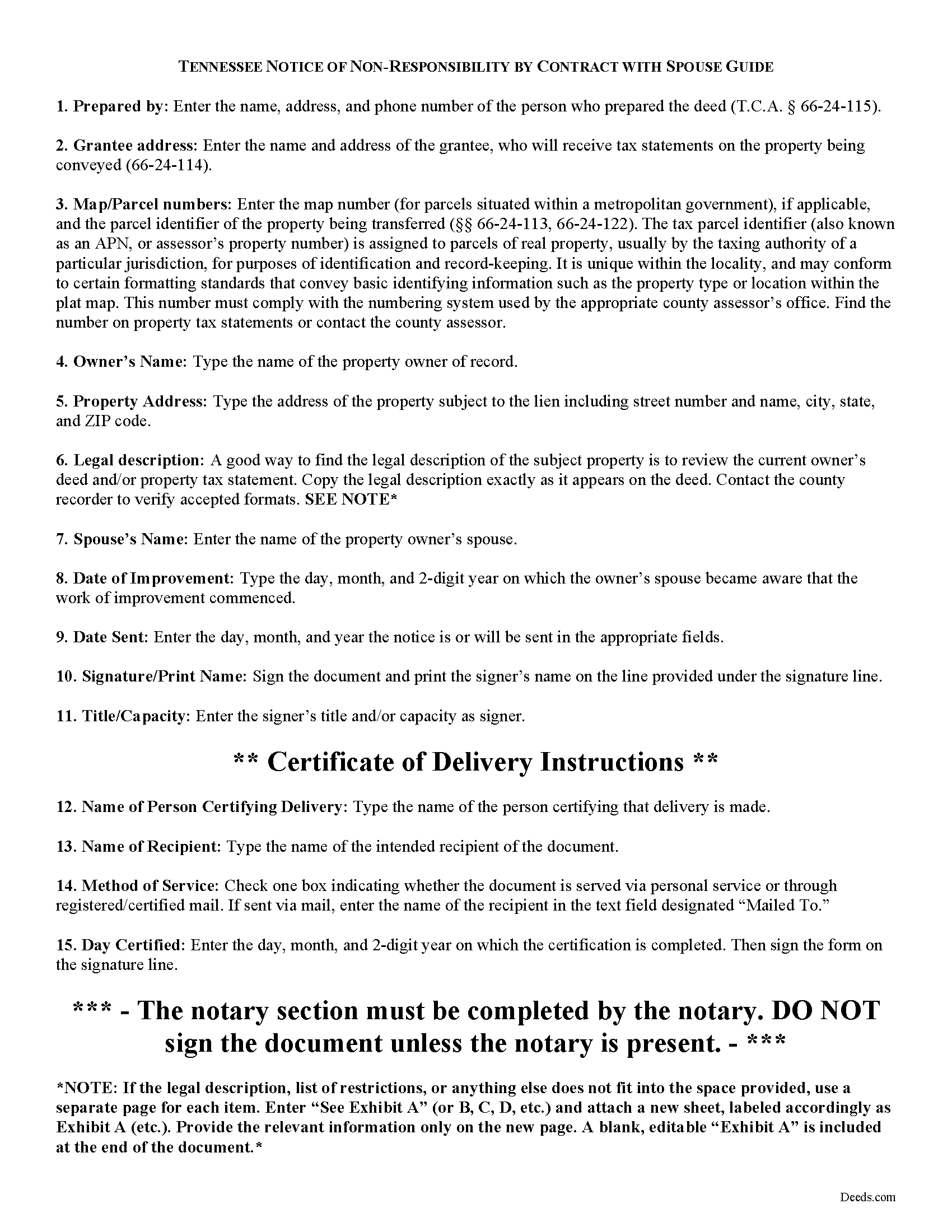

Warren County Notice of Non-Responsibility Guide

Line by line guide explaining every blank on the form.

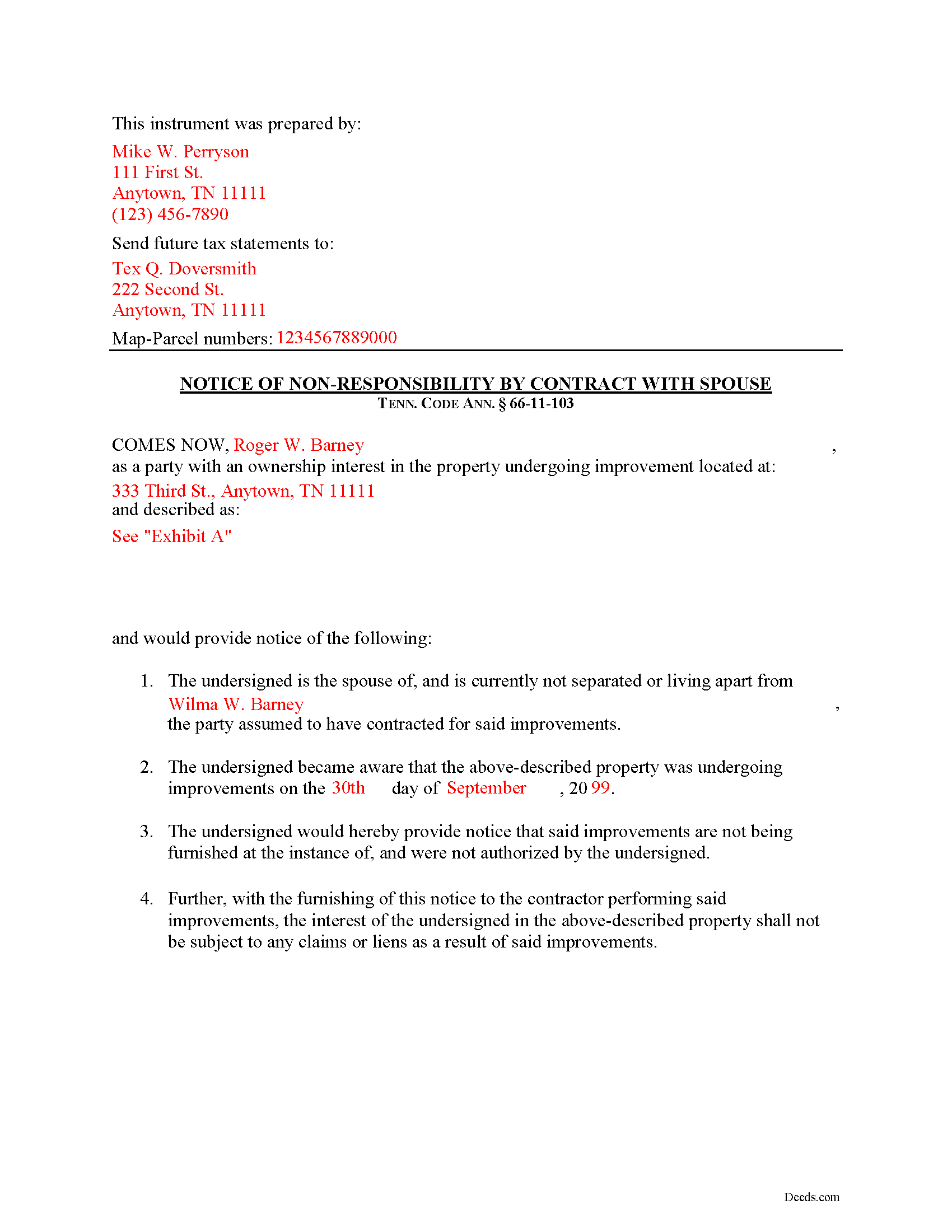

Warren County Completed Example of the Notice of Non-Responsibility Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Warren County documents included at no extra charge:

Where to Record Your Documents

Warren County Register Of Deeds

McMinnville, Tennessee 37110

Hours: Monday - Thursday 8 AM to 4:30 PM; Friday 8 AM to 5 PM

Phone: (931) 473-2926

Recording Tips for Warren County:

- Check that your notary's commission hasn't expired

- Ask if they accept credit cards - many offices are cash/check only

- Leave recording info boxes blank - the office fills these

- Request a receipt showing your recording numbers

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Warren County

Properties in any of these areas use Warren County forms:

- Campaign

- Mc Minnville

- Morrison

- Rock Island

- Smartt

- Viola

Hours, fees, requirements, and more for Warren County

How do I get my forms?

Forms are available for immediate download after payment. The Warren County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Warren County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Warren County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Warren County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Warren County?

Recording fees in Warren County vary. Contact the recorder's office at (931) 473-2926 for current fees.

Questions answered? Let's get started!

Tennessee Notice of Non-Responsibility by Contract with Spouse

Under Tennessee Property Code section 66-11-103, spouses are awarded certain protections from mechanic's lien if a notice of objection to the contract is timely filed. The form of the notice is called a "Notice of Non-Responsibility by Contract with Spouse."

When the contract for improving real property is made with a husband or a wife who is not separated and living apart from that person's spouse, and the property is owned by the other spouse or by both spouses, the spouse who is the contracting party shall be deemed to be the agent of the other spouse unless the other spouse serves the prime contractor with written notice of that spouse's objection to the contract within ten (10) days after learning of the contract. Tenn. Prop. Code 66-11-103.

This document identifies the parties, the location and starting date of the project, and specifically states that the filing spouse accepts no obligations related to the improvement. If the notice is filed within the required ten-day period after learning of the contract, it can be a powerful tool to avoid any lien being placed on the spouse's property interest.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any questions about the Notice of Non-Responsibility or for any other issues regarding mechanic's liens.

Important: Your property must be located in Warren County to use these forms. Documents should be recorded at the office below.

This Notice of Spousal Non-Responsibility meets all recording requirements specific to Warren County.

Our Promise

The documents you receive here will meet, or exceed, the Warren County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Warren County Notice of Spousal Non-Responsibility form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Michael S.

December 22nd, 2020

I was very impressed. I needed a Grant Deed that would comply with Calif. law. I haven't tried to record it yet, but I think it's spot-on. References to statutes very helpful. I'm a retired Idaho attorney, and my first attempt was politely rejected by the recorder. (documentary transfer fee exemption, etc.)

Thank you!

Billy R.

May 18th, 2021

Thank you...........easy process........Billy C

Thank you!

Sharon L H.

December 30th, 2018

The forms were good enough, hard to get excited about legal forms... The information was very thorough and helpful.

Thank you!

Charles S.

July 2nd, 2021

Easy to set up and fast service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William U.

December 1st, 2020

Prompt service, reasonable price.

Thank you!

Dorien C.

March 25th, 2023

Easy to use, thank you.

Thank you!

Mark S.

September 14th, 2023

The forms were easy and convenient to use

Thank you Mark. We appreciate your feedback.

Linda C.

February 23rd, 2019

If I hadn't spent my career as an escrow officer (albeit in another state), I may have had a hard time figuring out exactly which deed I needed and how to prepare them, even with the back-up informational, how-to pdf documents, without an attorney. My experience speaks to how much the general public doesn't understand and how confusing it can be. Nonetheless, the access to so many documents at a fairly reasonable cost, the basic how-to docs made available along with the purchased doc makes all the difference. I appreciate having such things available to the public. Many thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan N.

July 29th, 2020

Very easy to use and I received the information in a timely manner. I will use this service again.

Thank you!

Samuel T.

June 26th, 2021

So far, so good. explanations provided for the forms and instructions on how I should proceed were clear as a bell, and it was nice to get immediate delivery of the forms. I'll be looking for other ways to take advantage of this site, for sure.

Thank you!

Mary R.

February 19th, 2024

Love to use DEEDS>COM

Thank you Mary.

Melody P.

December 15th, 2021

Thanks for such great service!

Thank you for your feedback. We really appreciate it. Have a great day!

Jo Ann M.

August 18th, 2022

Easy from the download to just fill out and print. Good instructions to follow. A cover letter form would be a extra plus

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna r.

September 18th, 2020

Downloads were easy but I am pretty lost in filling out. Thought be more instructions

Thank you for your feedback Donna. If you are not completely sure of what you are doing we highly recommend seeking the assistance of a legal professional familiar with your specific situation.

Robert K.

August 1st, 2020

I used your TOD document to deed my home to my daughter. Your sample document was very helpful. I had to do it a few times but finally got it right. I didn't check but It was surely cheaper than a lawyer fee.

Thank you for your feedback. We really appreciate it. Have a great day!