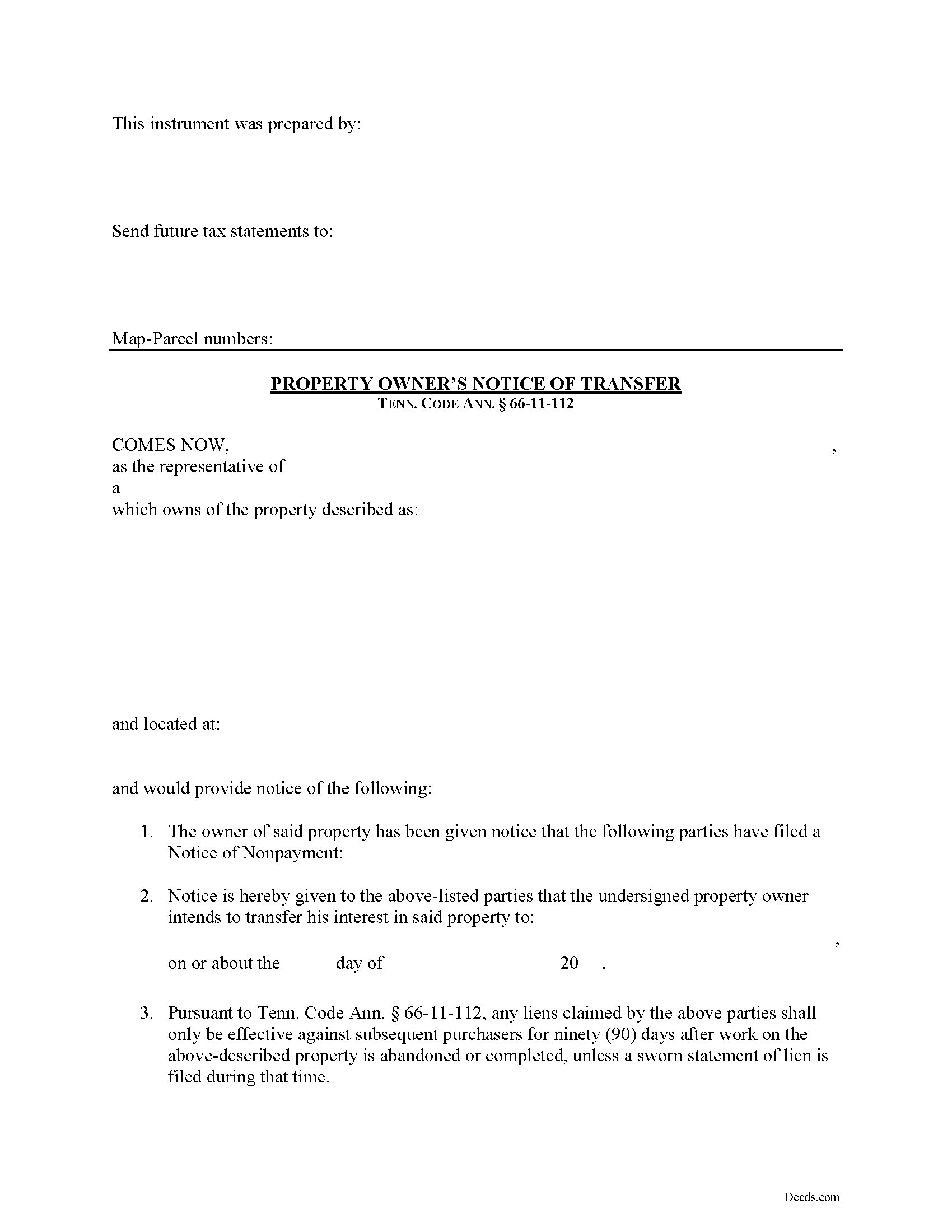

Hardin County Notice of Transfer Form

Hardin County Notice of Transfer Form

Fill in the blank Notice of Transfer form formatted to comply with all Tennessee recording and content requirements.

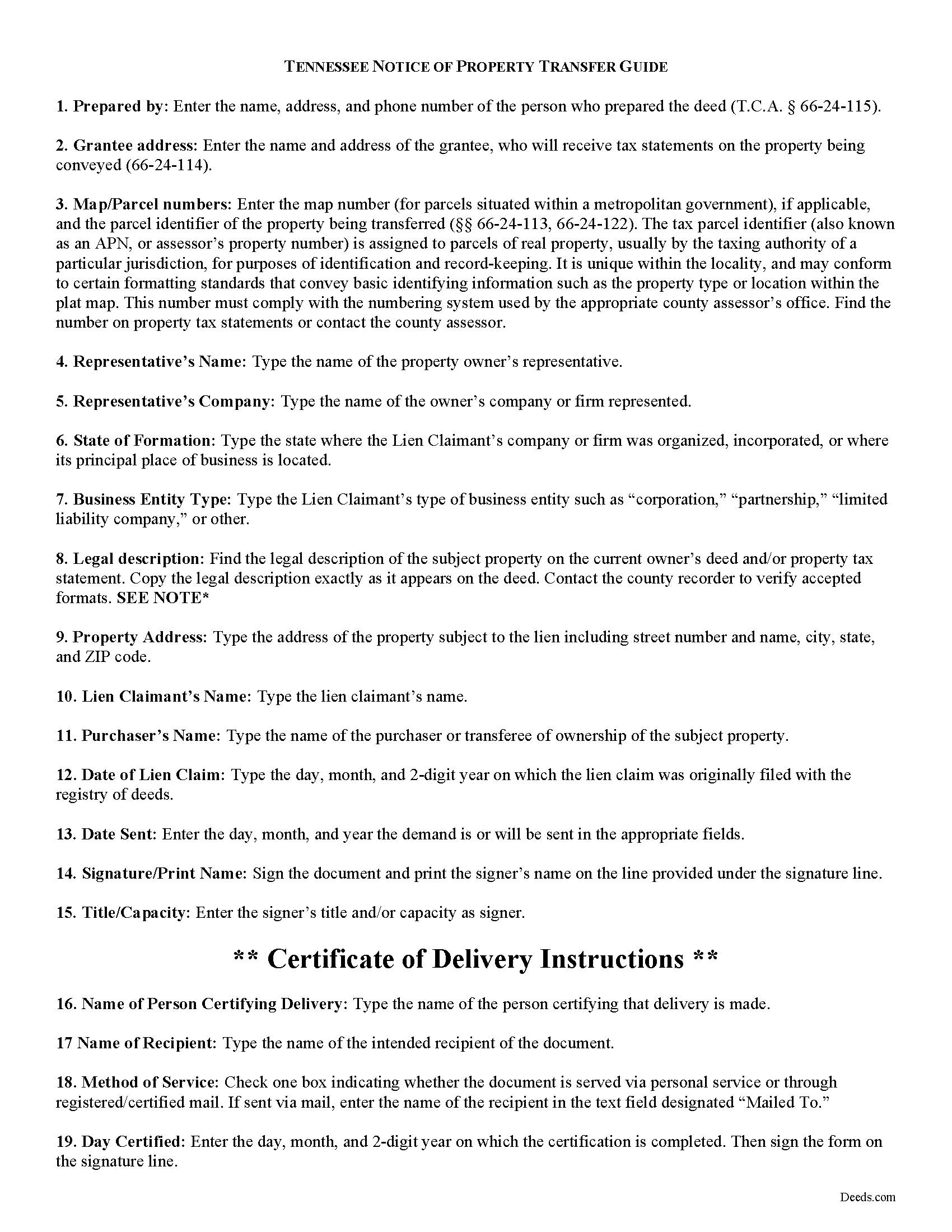

Hardin County Notice of Transfer Guide

Line by line guide explaining every blank on the form.

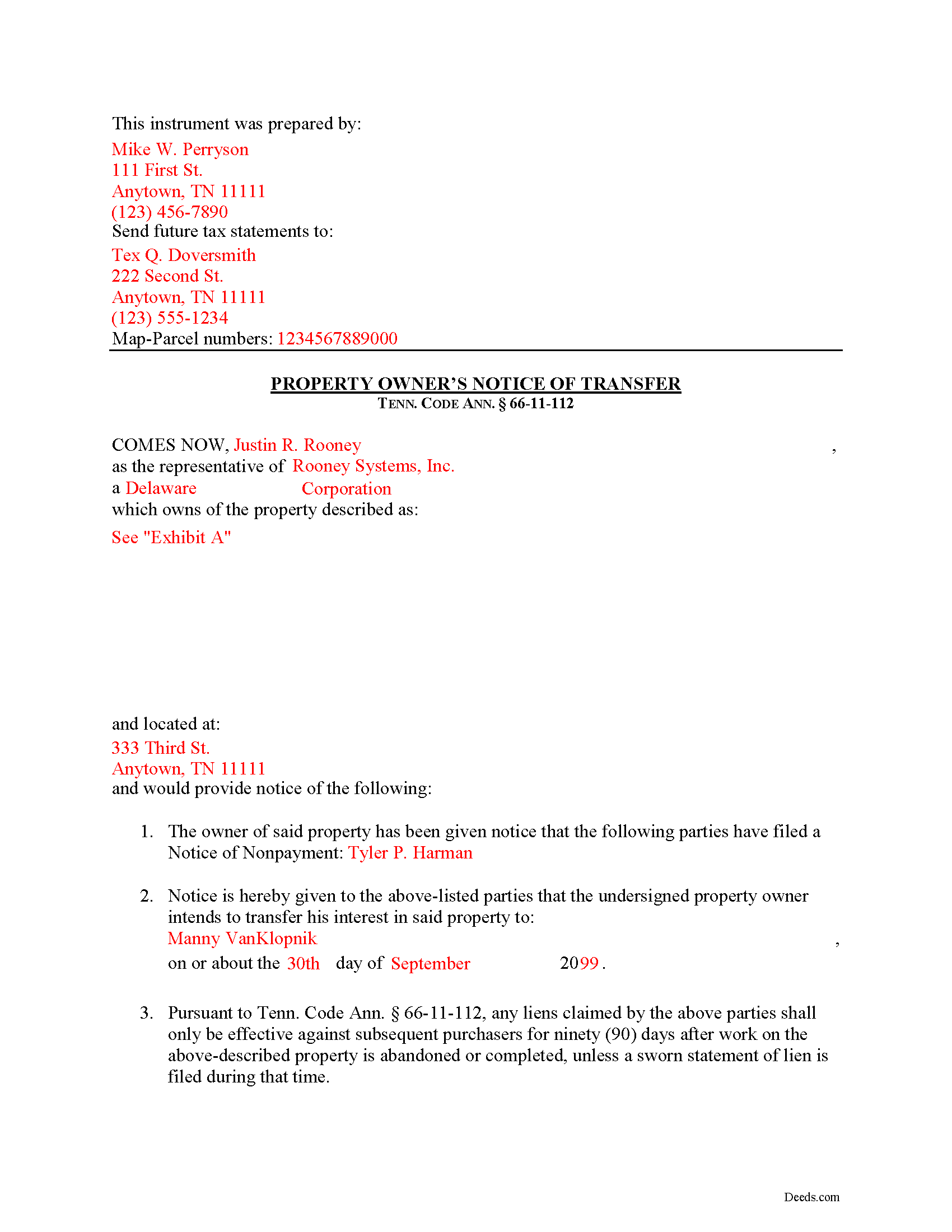

Hardin County Completed Example of the Notice of Transfer Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Hardin County documents included at no extra charge:

Where to Record Your Documents

Hardin County Register Of Deeds

Savannah, Tennessee 38372

Hours: 8:30 to 4:30 M-F

Phone: (731) 925-4936

Recording Tips for Hardin County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Verify all names are spelled correctly before recording

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Hardin County

Properties in any of these areas use Hardin County forms:

- Counce

- Crump

- Morris Chapel

- Olivehill

- Pickwick Dam

- Saltillo

- Savannah

- Shiloh

Hours, fees, requirements, and more for Hardin County

How do I get my forms?

Forms are available for immediate download after payment. The Hardin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hardin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hardin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hardin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hardin County?

Recording fees in Hardin County vary. Contact the recorder's office at (731) 925-4936 for current fees.

Questions answered? Let's get started!

Transferring Property Subject to Lien Claims in Tennessee

Lots of things can happen with a property that can cause the owner to sell or otherwise transfer ownership while a lien is pending. Luckily, in Tennessee offers a procedure for accelerating the time to enforce a lien when transferring property to a purchaser. Drafting and recording a Notice of Transfer will effectively limit the time that the lien claimant can enforce any lien against a subsequent purchaser.

Under Tenn. Prop. Code 66-11-112(a), any liens claimed only remain effective against subsequent purchasers for ninety (90) days after work on the above-described property is abandoned or completed, unless a sworn statement of lien is filed during that time.

The notice identifies the parties, the location of the work or improvement, intended date of the transfer, and any other information relevant to the specific situation.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any questions about the Notice of Transfer or for any other issues regarding mechanic's liens.

Important: Your property must be located in Hardin County to use these forms. Documents should be recorded at the office below.

This Notice of Transfer meets all recording requirements specific to Hardin County.

Our Promise

The documents you receive here will meet, or exceed, the Hardin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hardin County Notice of Transfer form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Raymond R C.

September 10th, 2019

Old document deeds were not available and my cost was returned. Was referred to another location and was able to get some help there.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard H.

October 5th, 2022

Excellent service, very user friendly

Thank you!

Michael K.

April 21st, 2020

Service seems smooth. I just wonder what the turn around time on recording is (I need proof of recordation).

Thank you!

Jacqueline H.

February 4th, 2021

Thank you for all your assistance and patience in doing the deed. I can honestly say that DEEDs.com will be permanently on my list as a go to company. I will use the company as a referral to friends and family.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brian J.

September 4th, 2025

make filing doc so simple and fast saves time and money

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Delba O.

January 4th, 2021

This was the easiest process ever. Thank you for making this so easy. No hassle, just upload your docs, pay the invoice and done. It didn't even take 2 business days to get my deed recorded. If I ever need to record anything I will definitely use your services again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janet M.

December 17th, 2020

This site is amazing! What a time saver from driving somewhere and standing around waiting.

Thank you!

Clay H.

July 11th, 2022

The provided docs and guide were very helpful. Well worth the price in my opinion.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan M.

September 3rd, 2020

Outstanding service. Docs delivered to recorder as expected without issue. Happy our recorder recommended Deeds.com.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathleen M.

July 21st, 2021

Wow, this was a breeze!! Best experience and fast. Great way to record documents in a matter of minutes. I recommend Deeds.com for anyone who needs to record documents quickly and conveniently.

Thank you for your feedback. We really appreciate it. Have a great day!

Nathan M.

April 6th, 2020

It had the info, but when I would type into the document the items I needed in adobe all that would print out was the info I typed and none of the document information.

Thank you!

Robert T.

June 10th, 2021

Thanks to Deeds.com, our law office was able to get the deed of trust filed without having to run around town wasting gas and they were very efficient and quick with getting it done in a timely manner.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Norman J.

October 3rd, 2023

I really enjoyed your service. It was great.

Thank you!

Nancy N.

February 12th, 2022

Very easy to use. Appreicate the sample filled out forms and the guide book. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Gerald C.

May 25th, 2019

Pros, quick purchase and document availability including instructions and examples. Cons, For the cert. of trust, the form would not accept the length of our trust name with no way to get around. The pdf file printing did not meet the requirements for 2.5" top margin and .5" other margins as well as the 10pt font size as the form information was shrunk down even when normal printing.

Thank you for your feedback. We really appreciate it. Have a great day!