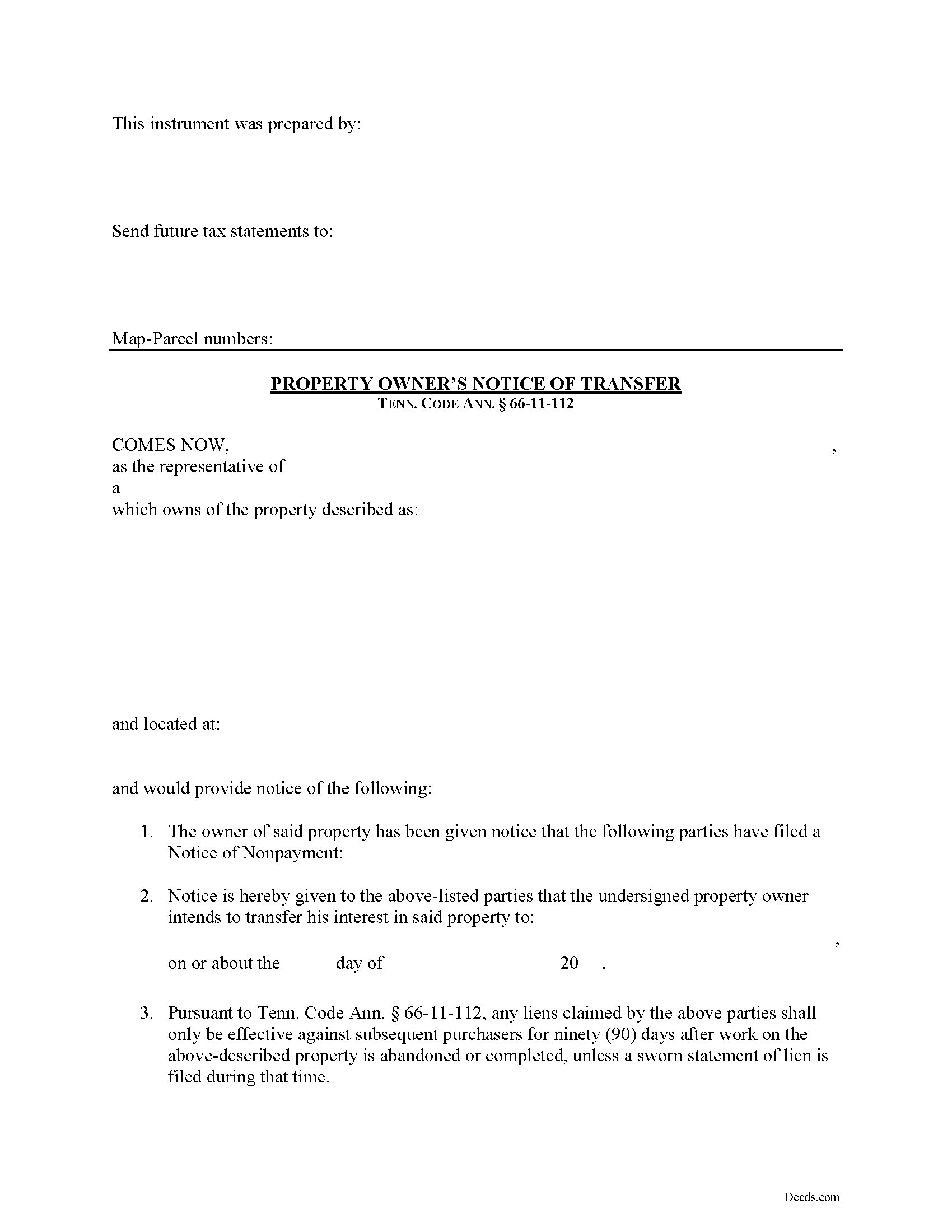

Jefferson County Notice of Transfer Form

Jefferson County Notice of Transfer Form

Fill in the blank Notice of Transfer form formatted to comply with all Tennessee recording and content requirements.

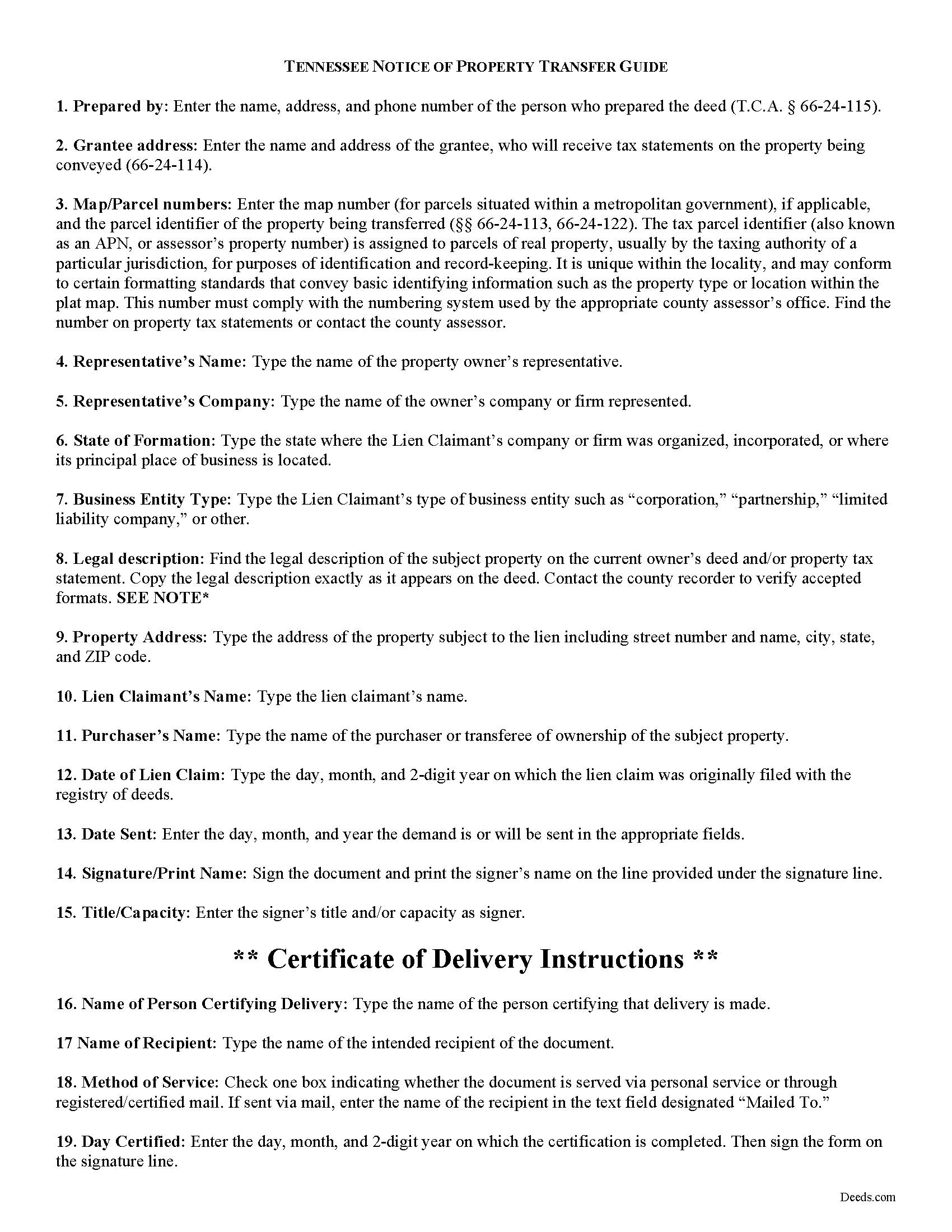

Jefferson County Notice of Transfer Guide

Line by line guide explaining every blank on the form.

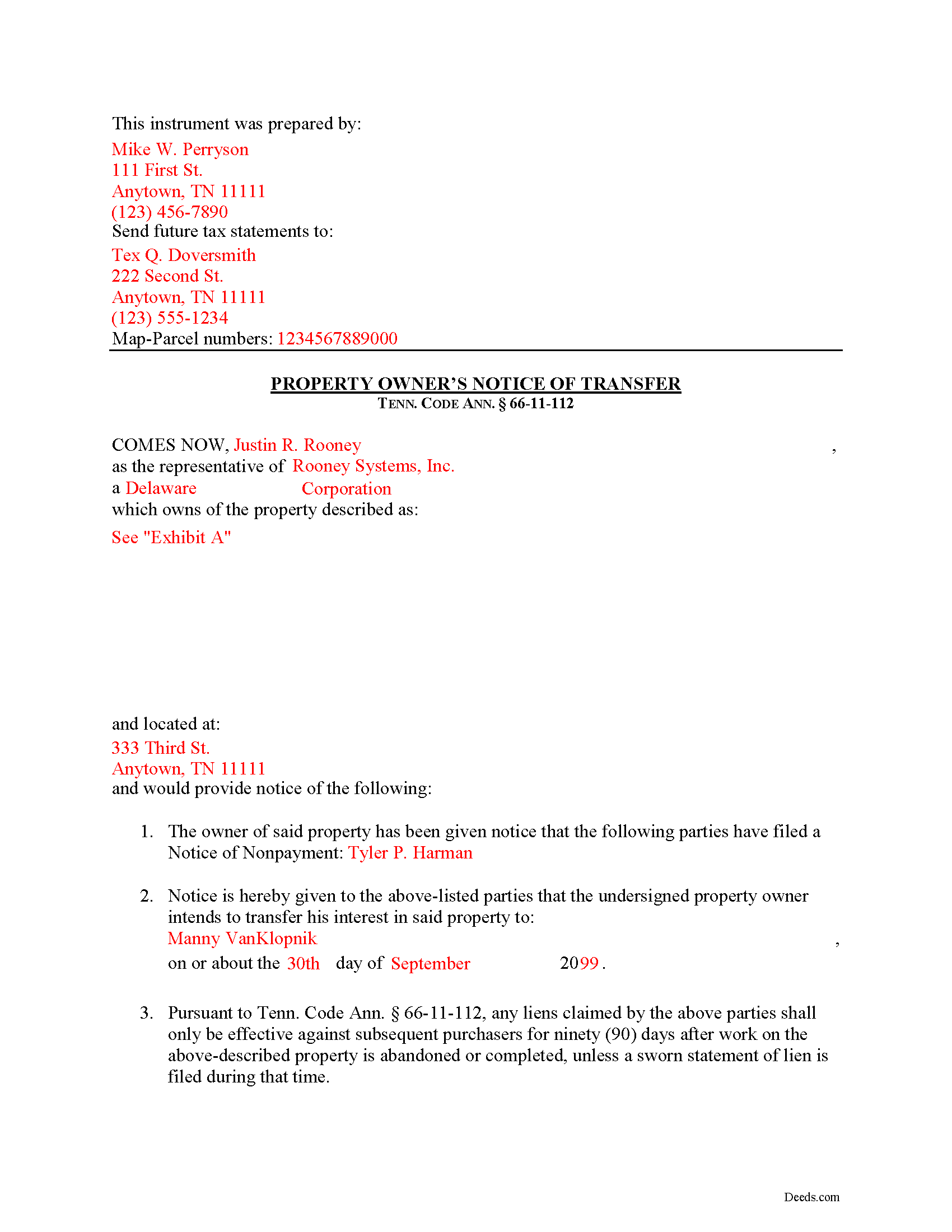

Jefferson County Completed Example of the Notice of Transfer Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Jefferson County documents included at no extra charge:

Where to Record Your Documents

Jefferson County Register of Deeds

Dandridge, Tennessee 37725

Hours: 8:00 to 4:00 M-F

Phone: (865) 397-2918

Recording Tips for Jefferson County:

- Verify all names are spelled correctly before recording

- Recorded documents become public record - avoid including SSNs

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Jefferson County

Properties in any of these areas use Jefferson County forms:

- Dandridge

- Jefferson City

- New Market

- Strawberry Plains

- White Pine

Hours, fees, requirements, and more for Jefferson County

How do I get my forms?

Forms are available for immediate download after payment. The Jefferson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jefferson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jefferson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jefferson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jefferson County?

Recording fees in Jefferson County vary. Contact the recorder's office at (865) 397-2918 for current fees.

Questions answered? Let's get started!

Transferring Property Subject to Lien Claims in Tennessee

Lots of things can happen with a property that can cause the owner to sell or otherwise transfer ownership while a lien is pending. Luckily, in Tennessee offers a procedure for accelerating the time to enforce a lien when transferring property to a purchaser. Drafting and recording a Notice of Transfer will effectively limit the time that the lien claimant can enforce any lien against a subsequent purchaser.

Under Tenn. Prop. Code 66-11-112(a), any liens claimed only remain effective against subsequent purchasers for ninety (90) days after work on the above-described property is abandoned or completed, unless a sworn statement of lien is filed during that time.

The notice identifies the parties, the location of the work or improvement, intended date of the transfer, and any other information relevant to the specific situation.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any questions about the Notice of Transfer or for any other issues regarding mechanic's liens.

Important: Your property must be located in Jefferson County to use these forms. Documents should be recorded at the office below.

This Notice of Transfer meets all recording requirements specific to Jefferson County.

Our Promise

The documents you receive here will meet, or exceed, the Jefferson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jefferson County Notice of Transfer form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Guadalupe G.

November 10th, 2022

Easy but why charge???

Thank you!

Lavonia L.

October 7th, 2024

Found exactly what I was looking for and it helped tremendously.

Thank you for your feedback. We really appreciate it. Have a great day!

Alex Q.

January 25th, 2022

10 STARS! Deeds.com never fails! Thank you so much!

Thank you!

Joseph K.

June 12th, 2020

Your responsiveness is outstanding. I appreciate the guidance and consistent support. Thank you.

Thank you!

Austin S.

August 13th, 2020

Everything is done in a timely manner which is very much appreciated.

Thank you for your feedback. We really appreciate it. Have a great day!

Logan S.

April 27th, 2020

Wonderful experience. Was preapred to wait days, recording was finished in less than an hour.

Thank you!

Chelsie F.

April 3rd, 2020

Super customer service and communication! Fast service and more informative than expected! Can't say thanks enough.

Thank you!

Carolyn N.

March 21st, 2023

It worked! It was exactly what I needed and was easily understood.

Thank you!

Mark G.

May 22nd, 2019

I would recommend this product for little effort needed to complete any action you might require.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rocio G.

December 8th, 2020

Better than in person service, I recommend this service 100%.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert F.

December 1st, 2021

Great, quick and easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Bernique C.

May 18th, 2022

Was very pleased to be referred by another user for needed documents. Add me to "satisfied customers"

Thank you for your feedback. We really appreciate it. Have a great day!

William C.

February 23rd, 2020

Excellent, easy to use. Technically accurate in all information offered.

Thank you!

Connie J L.

August 26th, 2020

Fast and easy to use. Easy to print.

Thank you!

Larry P.

June 27th, 2023

Easy to follow step by step in completing form. Filing successful on first try. Economical cost. Would highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!