Hardin County Specific Power of Attorney for the Sale of Property Form

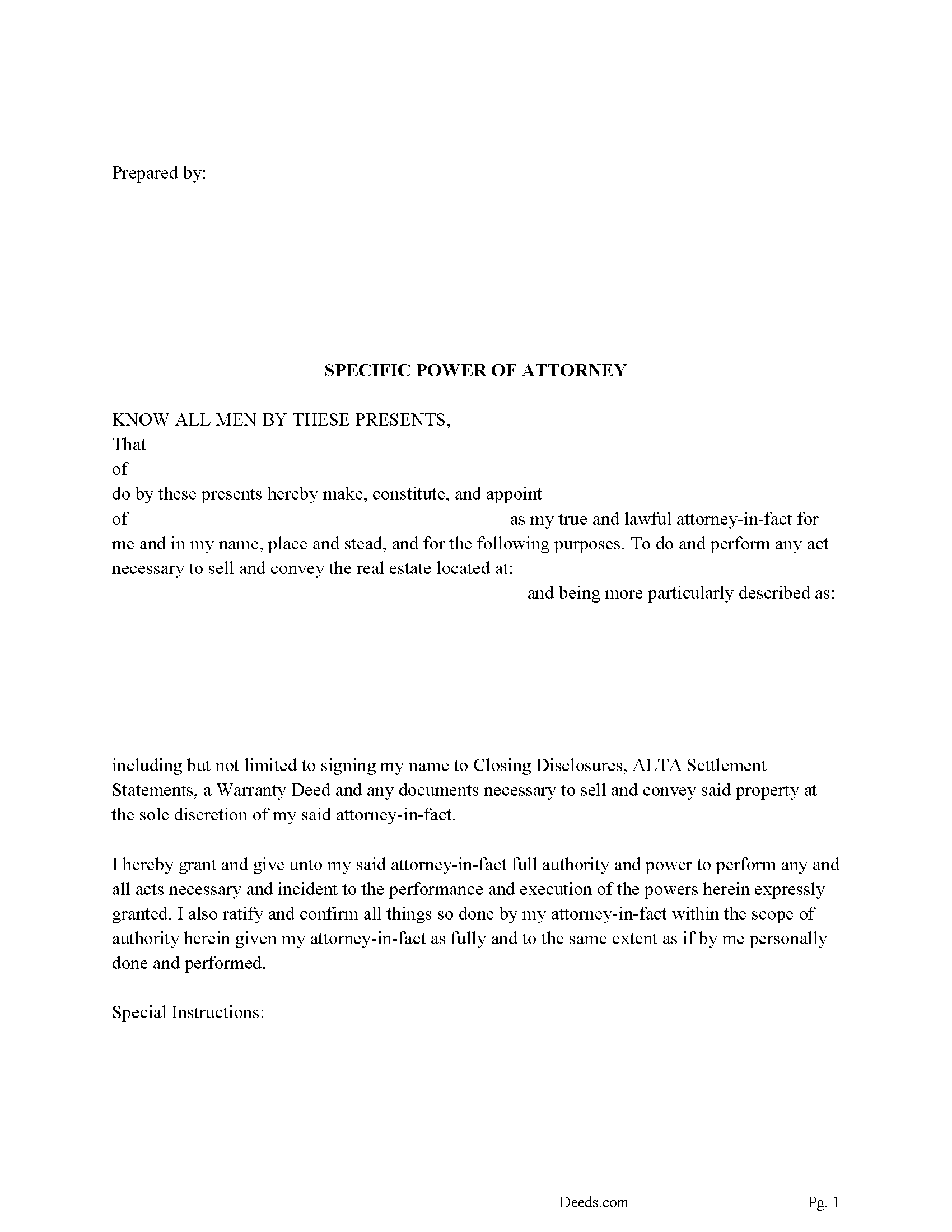

Hardin County Specific Power of Attorney Form / Sale of Property

Fill in the blank form formatted to comply with all recording and content requirements.

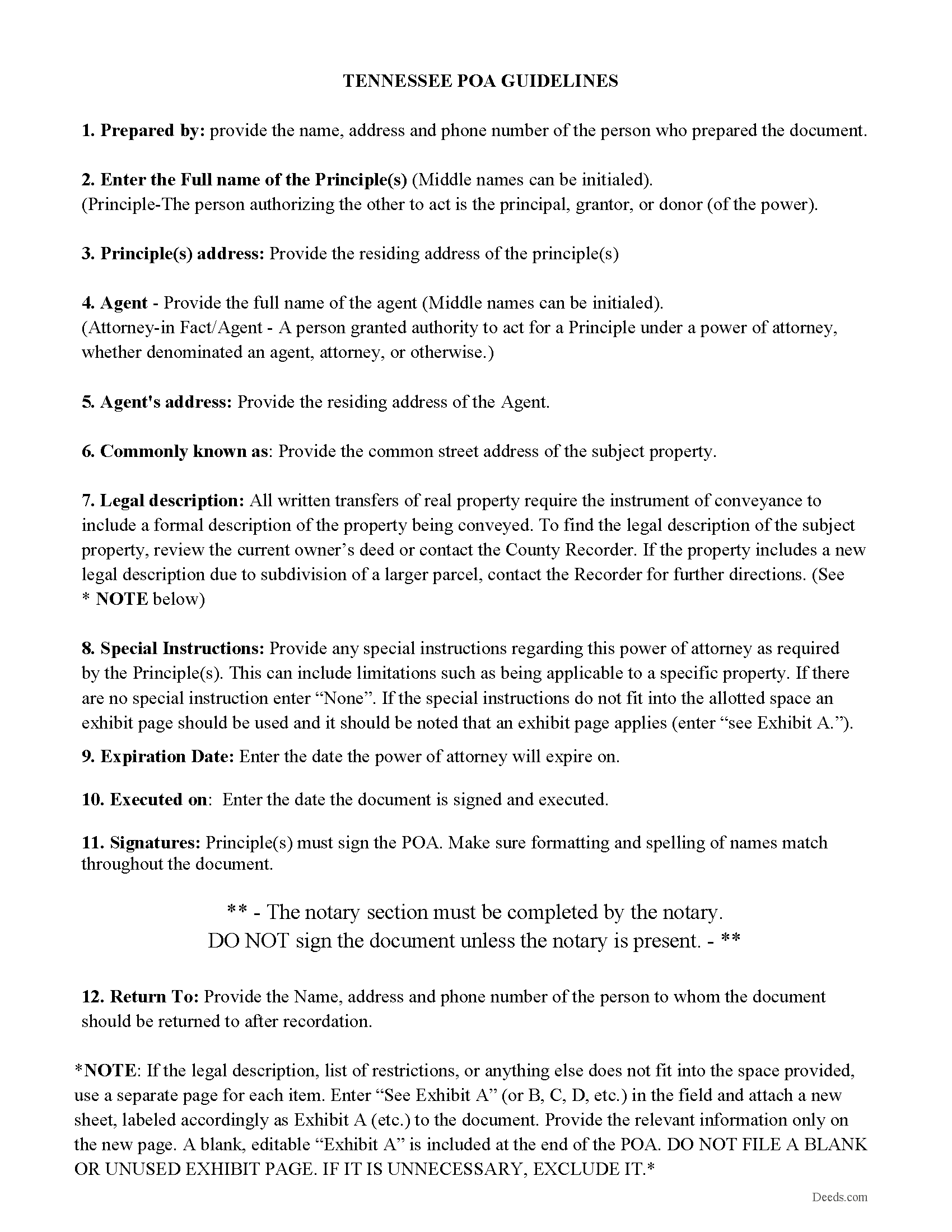

Hardin County Specific Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

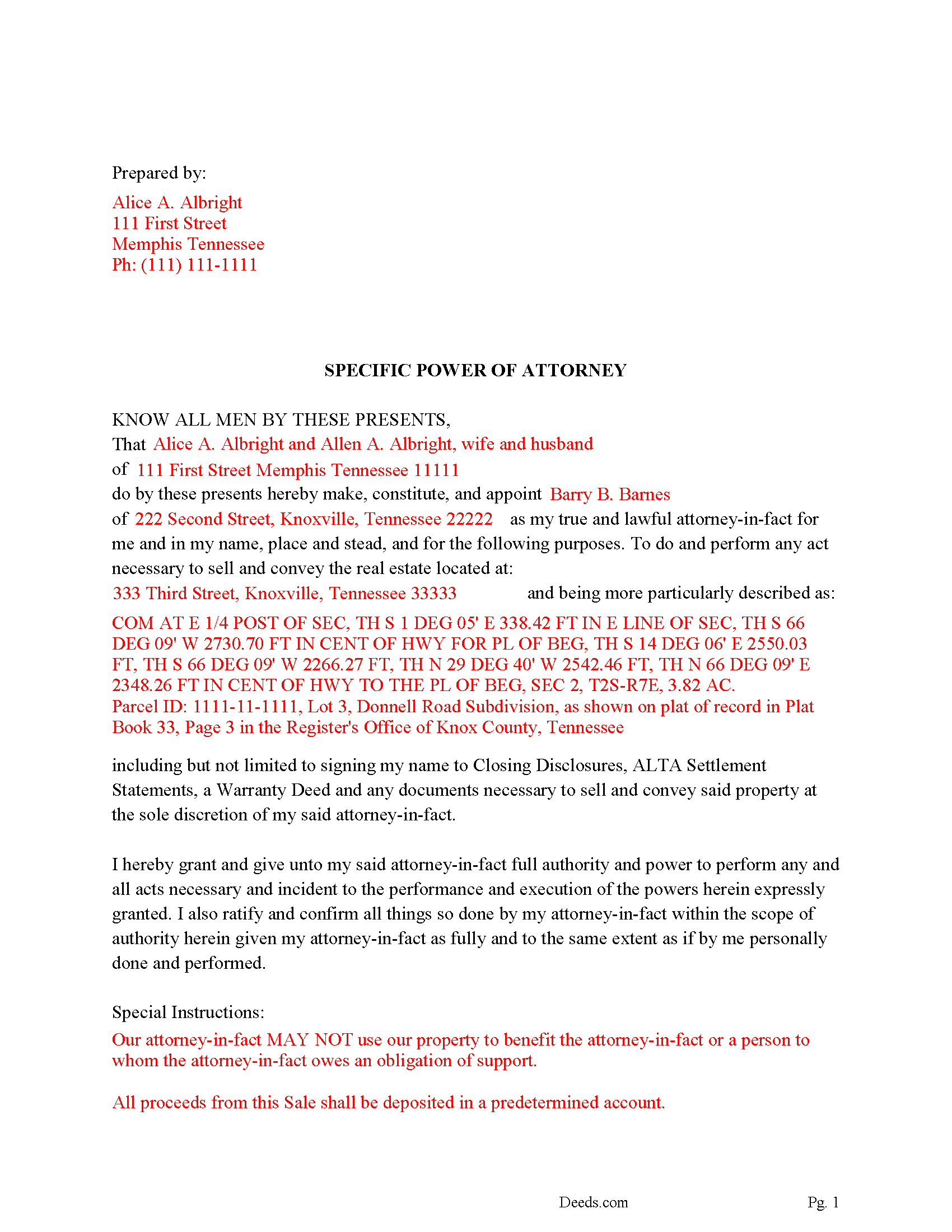

Hardin County Completed Example of the Specific POA

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Hardin County documents included at no extra charge:

Where to Record Your Documents

Hardin County Register Of Deeds

Savannah, Tennessee 38372

Hours: 8:30 to 4:30 M-F

Phone: (731) 925-4936

Recording Tips for Hardin County:

- White-out or correction fluid may cause rejection

- Ask if they accept credit cards - many offices are cash/check only

- Recording fees may differ from what's posted online - verify current rates

- Ask about their eRecording option for future transactions

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Hardin County

Properties in any of these areas use Hardin County forms:

- Counce

- Crump

- Morris Chapel

- Olivehill

- Pickwick Dam

- Saltillo

- Savannah

- Shiloh

Hours, fees, requirements, and more for Hardin County

How do I get my forms?

Forms are available for immediate download after payment. The Hardin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hardin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hardin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hardin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hardin County?

Recording fees in Hardin County vary. Contact the recorder's office at (731) 925-4936 for current fees.

Questions answered? Let's get started!

The Principal(s), owners of the property appoint a second party, attorney-in-fact to sell a specific property. In this form the principal is empowering the attorney-in-fact to do and perform any act necessary to sell and convey the real estate specified. Included is a "Special Instructions" section where the attorney-in-fact's powers can be further limited and/or defined.

This power of attorney shall become effective immediately upon the execution of same and pursuant to Tennessee Code Annotated Section 34-6-101 et seq. and shall be considered a "Durable Power of Attorney."

This power of attorney is formatted for recording in the Tennessee County, where the subject property is located and terminates upon a date provided by the principal. Therefore 60, 90, 120 days, etc. can be allotted for the sale.

(Tennessee SPOA-Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Hardin County to use these forms. Documents should be recorded at the office below.

This Specific Power of Attorney for the Sale of Property meets all recording requirements specific to Hardin County.

Our Promise

The documents you receive here will meet, or exceed, the Hardin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hardin County Specific Power of Attorney for the Sale of Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Ken W.

February 3rd, 2019

Everything perfect, good price. Completely satisfied

Thank you!

Lacee G.

November 25th, 2019

Great real estate deed forms.

Thank you!

Maribeth M.

June 25th, 2021

Usually I have trouble registering things online, even though people tell me it's easy. This time, it WAS easy and fast, and I'm grateful I didn't have to drive somewhere and stand in line. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terrell W.

January 27th, 2021

Was a little hard to find the form but once I did everything worked well

Thank you for your feedback. We really appreciate it. Have a great day!

Maricarol F.

March 6th, 2019

Found the site very easy to use. My fault I did not answer back right away. What was found is almost what I needed... Thanks.

Thank you for the feedback Maricarol, we really appreciate it.

Frank H.

September 22nd, 2022

Form and instructions were useful. But I suggest creating a form for transferring a deed pursuant to a trust. The existing form is based on a will going through probate so it doesn't fit the trust situation in some respects.

Thank you for your feedback. We really appreciate it. Have a great day!

Curtis G.

May 18th, 2020

Easy to use.

Thank you!

TAMMIE M.

November 20th, 2020

The site worked well for me.

Thank you!

Gene L S.

April 12th, 2019

Exactly what I needed, at a reasonable cost.

Thank you Gene.

Anthony C.

January 9th, 2021

Good information for solving my issue...

Thank you!

ALEX A.

June 30th, 2020

Yes I appreciate your services everything so far looking good this shows the facts the reasons most of all format I enjoy it I hopefully I can use it for some other legal forms also for Fry's Baker's fraud title fraud I'm interested in a lot of services that will provide me with a preferences of a fraud situations on mortgage security loans but other than that the services are awesome and I appreciate it appreciate your services and I'll keep on using it and thanks again thumbs up

Thank you!

Griselle M.

February 9th, 2021

This is my third time using Deeds.com and they don't disappoint. Their customer service is outstanding - absolutely excellent - via messages, I communicated with them immediately and 24/7 - on weekends and at night. I would not even try another service as they provide excellence which is so rare these days.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joan L. W.

June 9th, 2021

Excellent Service

Thank you!

Jamie F.

March 13th, 2020

Your service was very helpful as we were able to obtain a form for another state for our client.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patrick M.

November 1st, 2019

Very useful and easy to use. Great value too. Especially liked the example.

Thank you for your feedback. We really appreciate it. Have a great day!