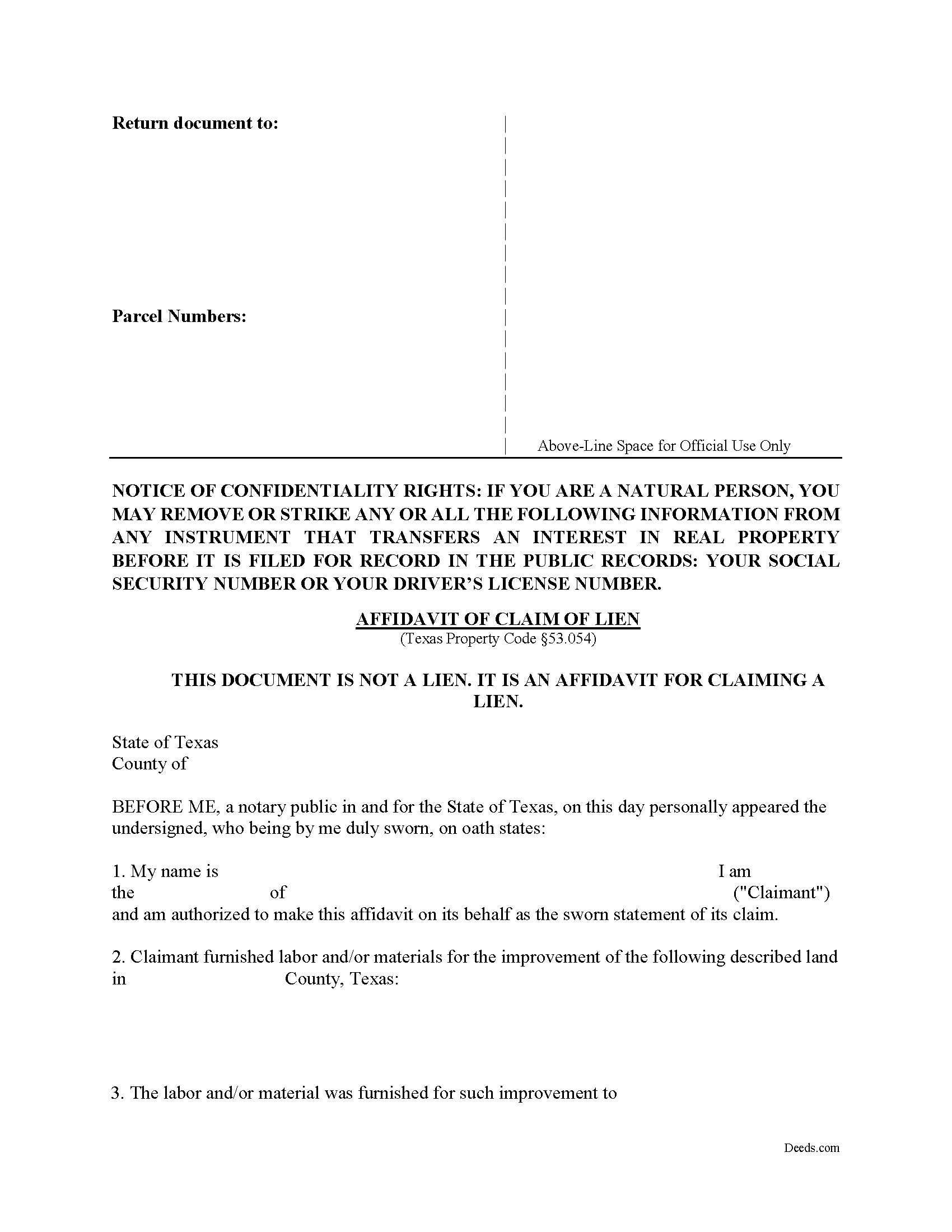

Dimmit County Affidavit of Lien Form

Dimmit County Affidavit of Lien Form

Fill in the blank Affidavit of Lien form formatted to comply with all Texas recording and content requirements.

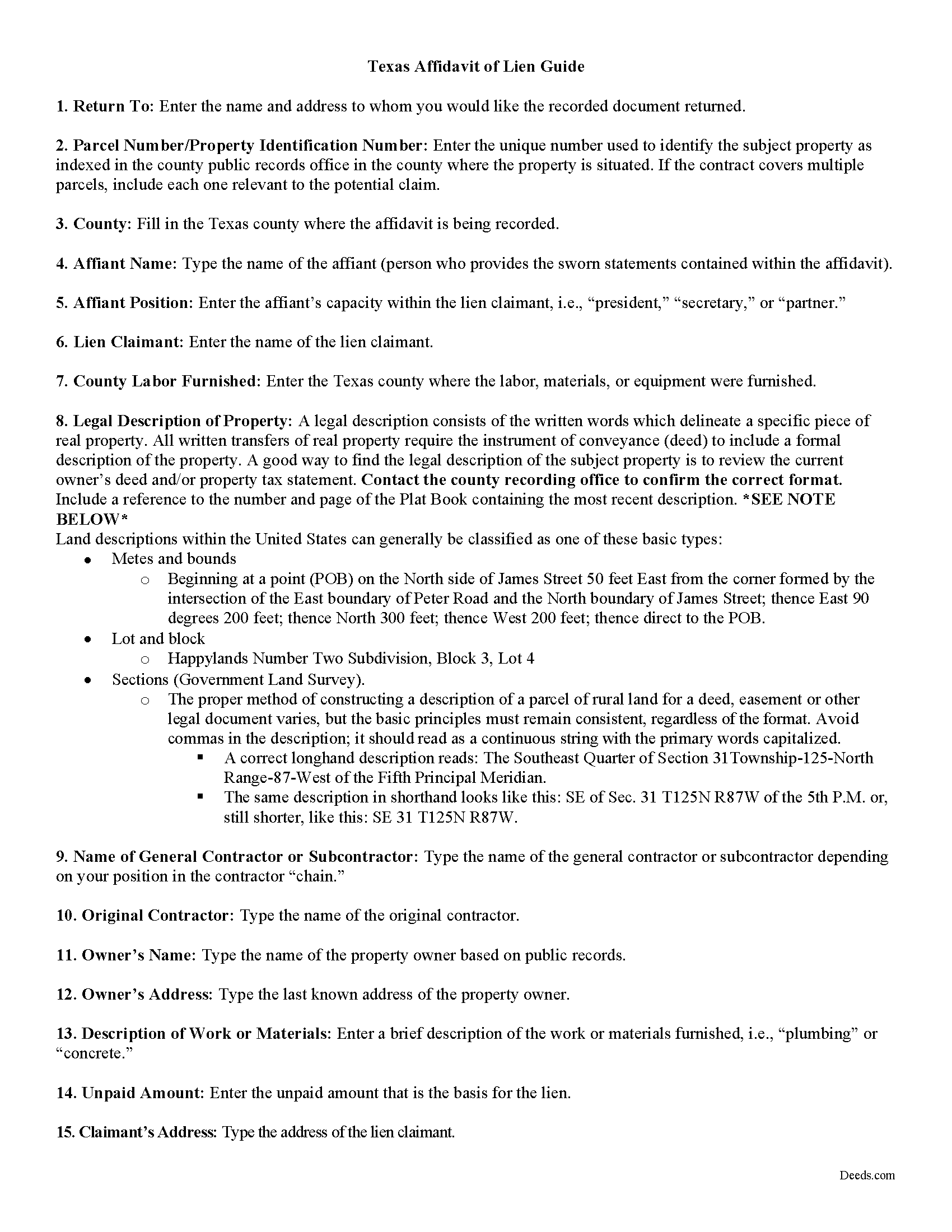

Dimmit County Affidavit of Lien Guide

Line by line guide explaining every blank on the form.

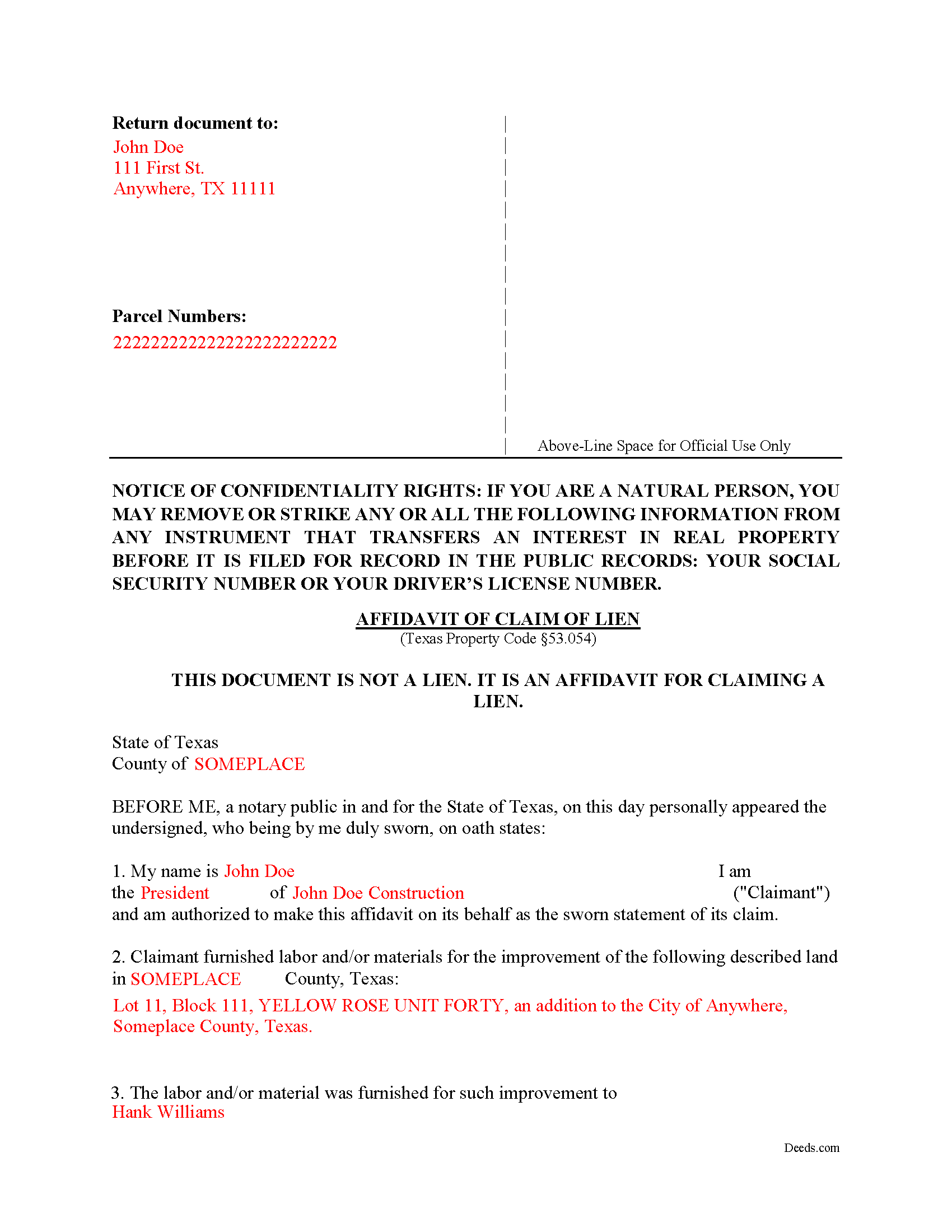

Dimmit County Completed Example of the Affidavit of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Dimmit County documents included at no extra charge:

Where to Record Your Documents

Dimmit County Clerk

Carrizo Springs, Texas 78834-3161

Hours: Monday - Friday 8:00am - 12:00 & 1:00 - 4:30pm

Phone: (830) 876-4238

Recording Tips for Dimmit County:

- Bring your driver's license or state-issued photo ID

- White-out or correction fluid may cause rejection

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Dimmit County

Properties in any of these areas use Dimmit County forms:

- Asherton

- Big Wells

- Carrizo Springs

- Catarina

Hours, fees, requirements, and more for Dimmit County

How do I get my forms?

Forms are available for immediate download after payment. The Dimmit County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Dimmit County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Dimmit County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Dimmit County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Dimmit County?

Recording fees in Dimmit County vary. Contact the recorder's office at (830) 876-4238 for current fees.

Questions answered? Let's get started!

An affidavit is a sworn statement of fact, in writing, made by an affiant under oath or affirmation, administered by a person lawfully authorized (such as a notary public). In this case, the affiant states that labor or equipment was furnished by the lien claimant and the balance owed remains unpaid. The affidavit is not a lien, but sets out sworn facts based on personal knowledge, that when recorded, will later become the lien. It is a necessary step to perfect (make effective against third parties) the lien.

To claim a lien for a commercial job, the affiant must file an affidavit with the county clerk of the county in which the property is located, not later than the 15th day of the fourth calendar month after the day on which the indebtedness accrues. TEX. PROP. CODE 53.052(a).

Note that for residential construction projects, the claimant must file the affidavit with the county clerk no later than the 15th day of the THIRD (3rd) calendar month after non-payment of the invoice. TEX. PROP. CODE 53.052(b).

The affidavit must substantially comply with the Texas Property Code. Therefore, the it must contain: 1) a signature by the person claiming the lien or by another person on the claimant's behalf; 2) a sworn statement of the amount of the claim; 3) the name and last known address of the owner or reputed owner; 4) a general statement of the kind of work done and materials furnished by the claimant and, for a claimant other than an original contractor, a statement of each month in which the work was done and materials furnished for which payment is requested; 5) the name and last known address of the person by whom the claimant was employed or to whom the claimant furnished the materials or labor; 6) the name and last known address of the original contractor; 7) legally sufficient description of the property to be charged with the lien; 8) the claimant's name, mailing address, physical address (if different); and 9) for a claimant other than an original contractor, a statement identifying the date each notice of the claim was sent to the owner and the method by which the notice was sent. TEX. PROP. CODE 53.054(a). Leave out amounts not related to the value of materials or labor furnished (such as attorney's fees), as these can void the entire lien claim.

When recording the affidavit, attach a copy of any applicable written agreement or contract and a copy of each notice sent to the owner. TEX. PROP. CODE 53.054(b). This is good practice and can help prove the claim by creating a paper trail. The affidavit is not required to set forth individual items of work done or material furnished or specially fabricated and the affiant may use any abbreviations or symbols that are customary in your trade. TEX. PROP. CODE 53.054(c).

After the affidavit is properly recorded it must be served. Send a copy of the affidavit by registered or certified mail to the owner (or reputed owner) at the owner's last known business or residence address not later than the fifth (5th) day after the date the affidavit is filed with the county clerk. TEX. PROP. CODE 53.055(a). If the claimant is not an original contractor, they must also send a copy of the affidavit to the original contractor at the original contractor's last known business or residence address within the same period. TEX. PROP. CODE 53.055(b).

Each case is unique, and the Texas lien law is complex, so contact an attorney with specific questions or for complex situations.

Important: Your property must be located in Dimmit County to use these forms. Documents should be recorded at the office below.

This Affidavit of Lien meets all recording requirements specific to Dimmit County.

Our Promise

The documents you receive here will meet, or exceed, the Dimmit County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Dimmit County Affidavit of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4584 Reviews )

Ken B.

August 9th, 2022

Instructions were easy to follow

Thank you!

samira m.

December 9th, 2022

I love whoever is behind this website. I bought the wrong form and I told them and they refunded me asap! I figured out which form I need days later and bought it just now. They didn't have to refund me for my own mistake. That was very kind. I'll be returning for any other forms I may need and will tell others too. Thank you so much!!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

gene h.

July 10th, 2020

Had used website while working as Land Rep for major oil company (retired 2.5 years ago). Recently had need to do some online research and went back to Deeds.com to find needed documents. Same as before, website provides a great service at a great price.

Thank you for your feedback. We really appreciate it. Have a great day!

Jonathan F.

September 4th, 2020

An excellent service. Makes filing deeds so much easier than having to go to the courthouse or use FedEx. I will be a customer for the rest of my legal career.

Thank you!

Claire W.

March 24th, 2022

The price is right, and very simple to follow

Thank you!

John P.

August 11th, 2020

very good. received what i ordered in a timely fashion despite my incompetence.

Thank you for your feedback. We really appreciate it. Have a great day!

Anita M W.

May 17th, 2023

This process is outstanding, and it saved the hassle of going downtown and dealing with traffic.

Thank you for the kinds words Anita. Glad we could be of assistance. Have an amazing day!

DENISE E.

February 25th, 2021

I just submitted a beneficiary deed and it was accepted immediate and then recorded the next day! I like that I receive email messages notifying me of the process. The process was super easy and seamless. It's saved me so much time that I did not have to drive to downtown Phoenix to have this document record it. I love Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Jenny E.

March 21st, 2021

I thought the website was good. But once I paid the money and downloaded the papers I needed for Grays Harbor. I had to end up calling a escrow company that we had worked with only to find out that they work with a slightly different version. The escrow company was kind enough to email me the version Grays Harbor recommends and uses. There is a chance I could use theses in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Nina L.

April 13th, 2023

I needed a specific form. I found it, printed it and saved myself $170 because I didn't need a lawyer. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret S.

March 16th, 2020

Great experience, quick and easy, thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Ronald S.

December 7th, 2020

fantastic forms, great service!

Thank you for your feedback. We really appreciate it. Have a great day!

ronnie y.

May 22nd, 2019

well worth the money thank you

Thank you!

Roger W H.

March 31st, 2022

So far GOOD, just can't locate legal description. Will sign in later when have correct info. Thanx!! Rog

Thank you!

Amy R.

January 8th, 2025

Forms I was looking for were easy to find, easy to download and accessible at any time in my account.

We are grateful for your feedback and looking forward to serving you again. Thank you!