Deaf Smith County Appointment of Substitute Trustee for Deed of Trust Form

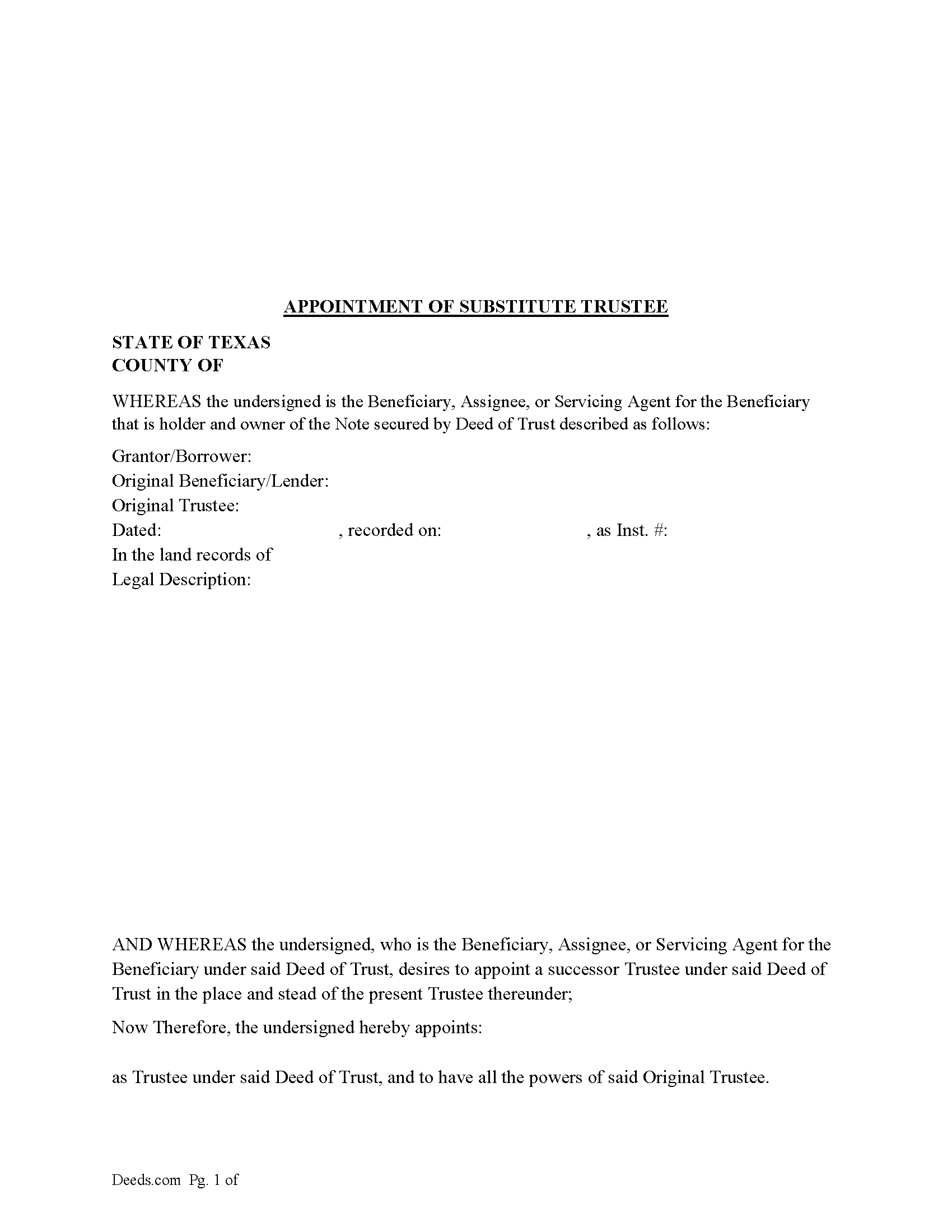

Deaf Smith County Appointment of Substitute Trustee Form

Fill in the blank form formatted to comply with all recording and content requirements.

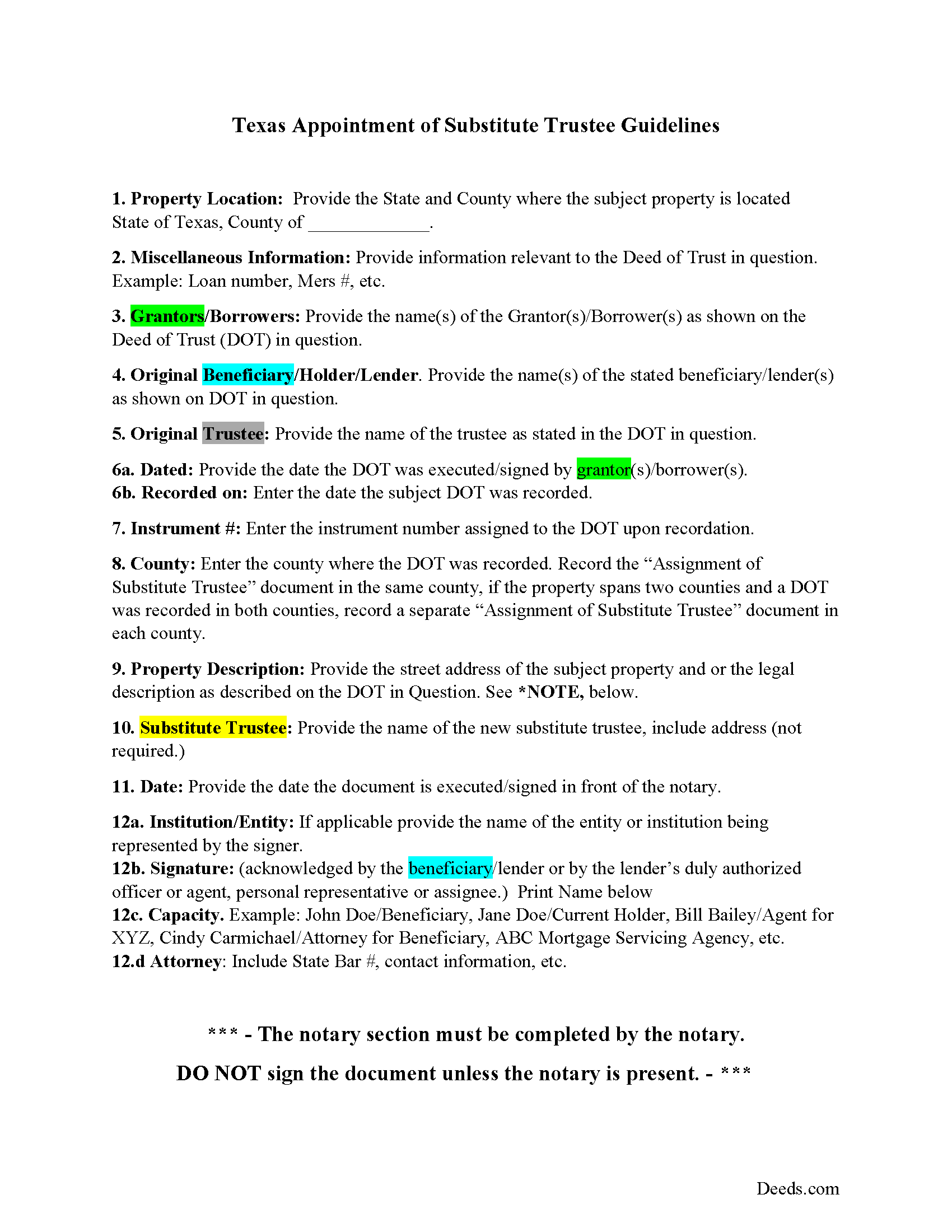

Deaf Smith County Appointment of Substitute Trustee Guidelines

Line by line guide explaining every blank on the form.

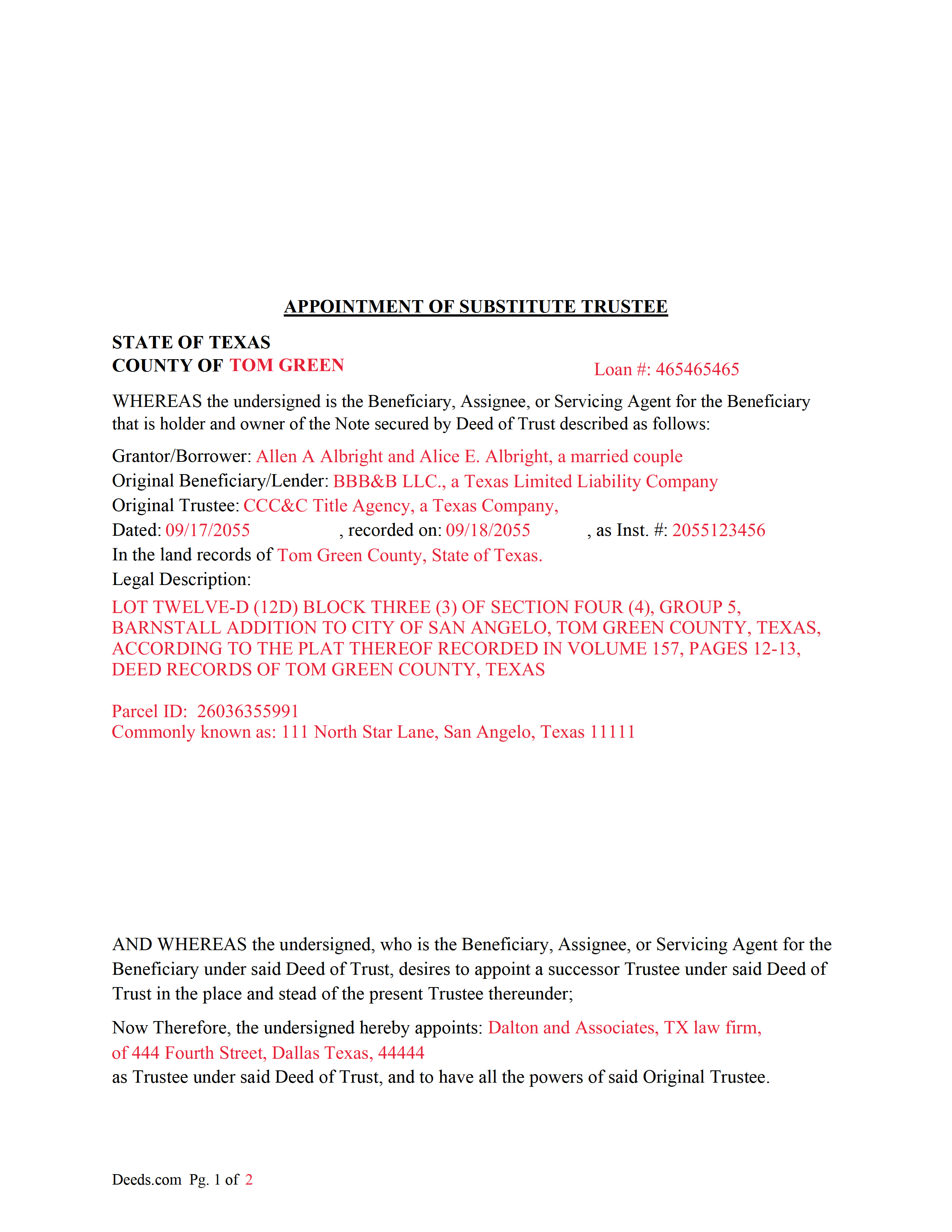

Deaf Smith County Completed Example of the Appointment of Substitute Trustee Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Deaf Smith County documents included at no extra charge:

Where to Record Your Documents

Deaf Smith County Clerk's Office

Hereford, Texas 79045-5542

Hours: Monday - Friday 8:00am - 12:00 & 1:00 - 5:00pm

Phone: (806) 363-7077

Recording Tips for Deaf Smith County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Deaf Smith County

Properties in any of these areas use Deaf Smith County forms:

- Dawn

- Hereford

Hours, fees, requirements, and more for Deaf Smith County

How do I get my forms?

Forms are available for immediate download after payment. The Deaf Smith County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Deaf Smith County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Deaf Smith County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Deaf Smith County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Deaf Smith County?

Recording fees in Deaf Smith County vary. Contact the recorder's office at (806) 363-7077 for current fees.

Questions answered? Let's get started!

This form is used to substitute a trustee in a Deed of Trust Document. This is frequently done when the Deed of Trust is in default and the current trustee can't or won't act. This document is executed by the Beneficiary/lender, assignee, representative, attorney or mortgage servicer.

"Substitute trustee" means a person appointed by the current mortgagee or mortgage servicer under the terms of the security instrument to exercise the power of sale. Sec. 51.0001.(7)

Sec. 51.0075. AUTHORITY OF TRUSTEE OR SUBSTITUTE TRUSTEE.

(a) A trustee or substitute trustee may set reasonable conditions for conducting the public sale if the conditions are announced before bidding is opened for the first sale of the day held by the trustee or substitute trustee.

(b) A trustee or substitute trustee is not a debt collector.

(c) Notwithstanding any agreement to the contrary, a mortgagee may appoint or may authorize a mortgage servicer to appoint a substitute trustee or substitute trustees to succeed to all title, powers, and duties of the original trustee. A mortgagee or mortgage servicer may make an appointment or authorization under this subsection by power of attorney, corporate resolution, or other written instrument.

(d) A mortgage servicer may authorize an attorney to appoint a substitute trustee or substitute trustees on behalf of a mortgagee under Subsection (c).

(e) The name and a street address for a trustee or substitute trustees shall be disclosed on the notice required by Section 51.002(b).

(f) The purchase price in a sale held by a trustee or substitute trustee under this section is due and payable without delay on acceptance of the bid or within such reasonable time as may be agreed upon by the purchaser and the trustee or substitute trustee if the purchaser makes such request for additional time to deliver the purchase price. The trustee or substitute trustee shall disburse the proceeds of the sale as provided by law.

(Texas Appointment of Substitute Trustee Package includes form, guidelines, and completed example) For use in Texas only.

Important: Your property must be located in Deaf Smith County to use these forms. Documents should be recorded at the office below.

This Appointment of Substitute Trustee for Deed of Trust meets all recording requirements specific to Deaf Smith County.

Our Promise

The documents you receive here will meet, or exceed, the Deaf Smith County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Deaf Smith County Appointment of Substitute Trustee for Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Dennis M.

November 26th, 2020

Very quick and easy to use. Deeds.com saved me a lot of money!

Thank you!

Earle T.

January 23rd, 2021

This is an excellent service. And very easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark R.

September 30th, 2022

All documents were site specific and up-to-date. Not recorded yet but have high hopes.

Thank you for your feedback. We really appreciate it. Have a great day!

Rechantell A.

August 1st, 2020

It was quick and easy. Trust worthy. Very satisfied and would recommend. Thank you for your services.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lynne Z.

April 22nd, 2022

not enough room for legal description. Wouldn't allow me to enter widow status in owner box. Not clear who to send it to so I printed it out and will ask the notary who I use for recording it.

Thank you!

Susan J.

June 29th, 2020

very fast service. immediate response and kept me informed along the way. the county was not cooperating and this was communicated to me and my fee was refunded, just like that. will definitely use this company again

Thank you!

Lorrisa L.

December 28th, 2018

No review provided.

Thank you for your rating. Have a great day!

Daniel D.

June 3rd, 2019

Easier than I expected. I followed the downloaded examples step by step, and before I knew it, the form was completed correctly and good to go. Thank you, Daniel D.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Allan y.

July 13th, 2019

I liked the guide and example to follow to fill out the form. Very helpful!!

Thank you!

Deborah D.

January 12th, 2021

Very easy to use, got everything I needed. Reasonable price.

Thank you!

Christine R.

February 8th, 2019

Ordering and directions were easy. The only thing missing in the instructions was how to record by mail. Thanks!

Thank you Christine. We'll work on making it more clear that one can find mailing information in our recording section. Have a great day!

ALYSSA J.

August 26th, 2020

I was unable to end up going through with the deed process on my own as it was out of my realm. I suspect if I knew what I was actually doing when completing a deed, it would of been sufficient. I ended up having to go through an attorney to complete the deed.

Glad to hear you sought the assistance of a legal professional familiar with your specific situation, we always recommend that to anyone who is not completely sure of what they are doing. Have a wonderful day.

TOM S.

July 21st, 2019

Itwas easy to locate the necessary forms I needed and download worked great.

Thank you!

Carol W.

March 14th, 2021

The only reason for the low review was I could not find the form that I needed.

Sorry to hear that we did not have what you needed. We hope you found it somewhere. Have a wonderful day.

Amie S.

January 8th, 2019

The forms that I downloaded from Deeds were perfect for what I needed. I even checked with a lawyer to see if the papers would work and she said yes.

Thanks Amie, have a great day!