Callahan County Deed of Trust and Promissory Note Form

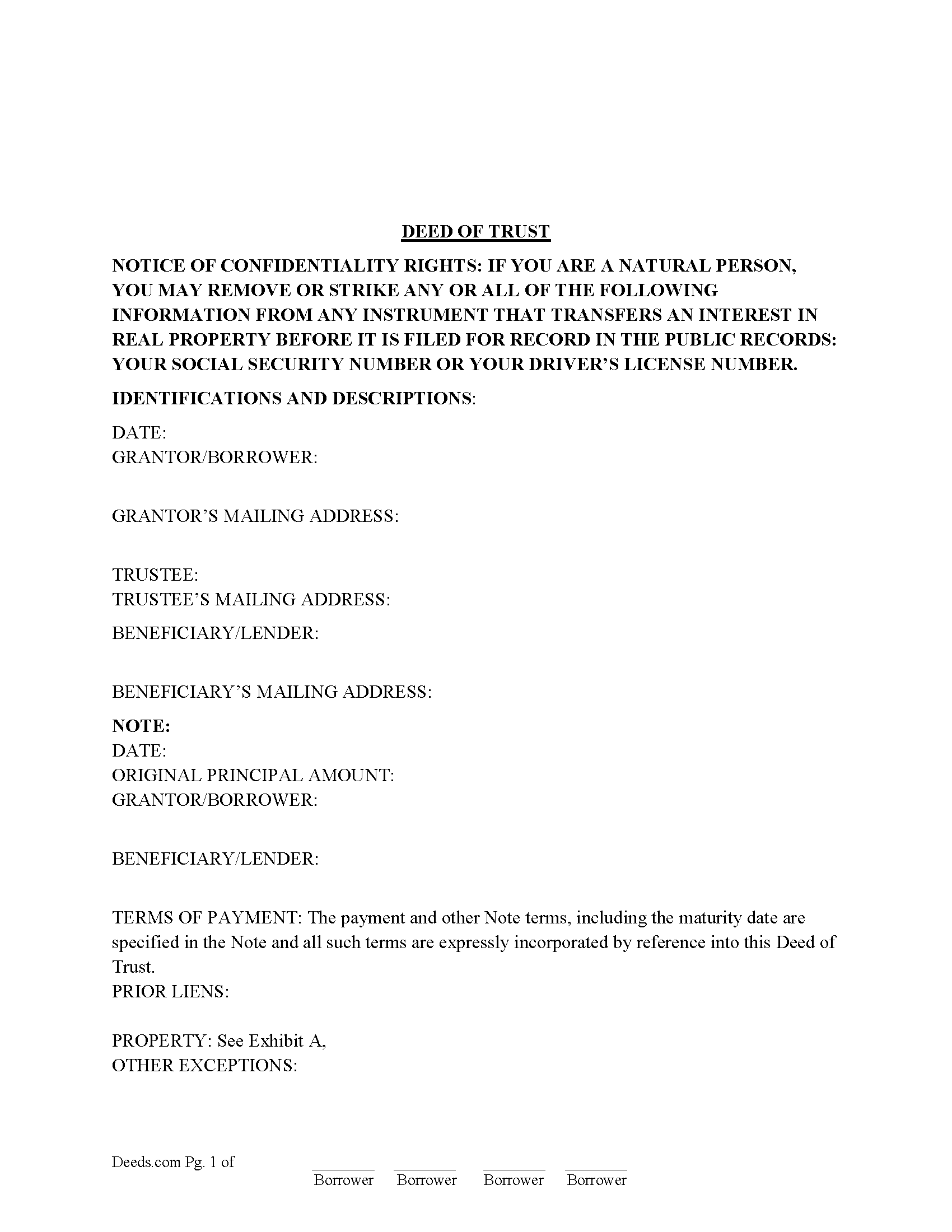

Callahan County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

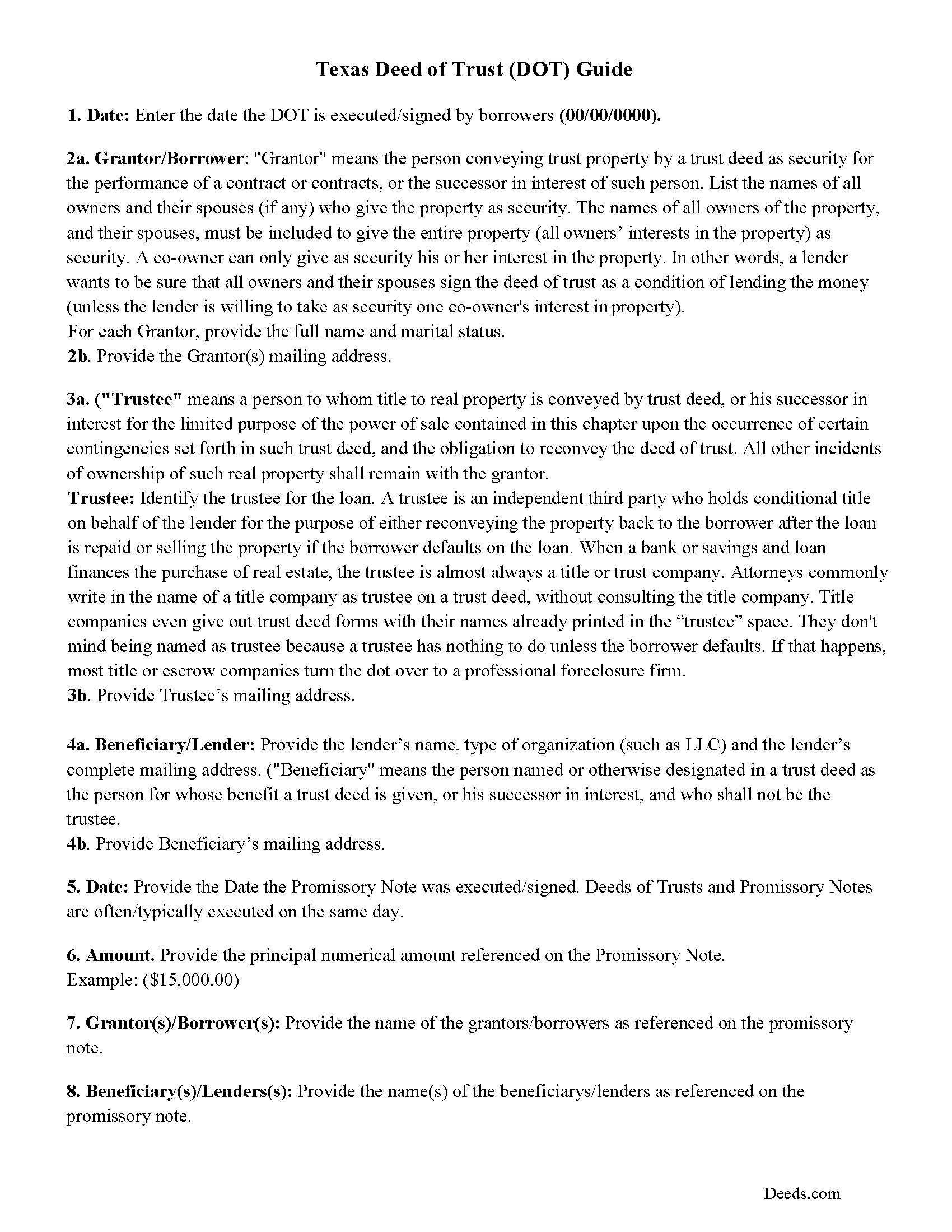

Callahan County Texas Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

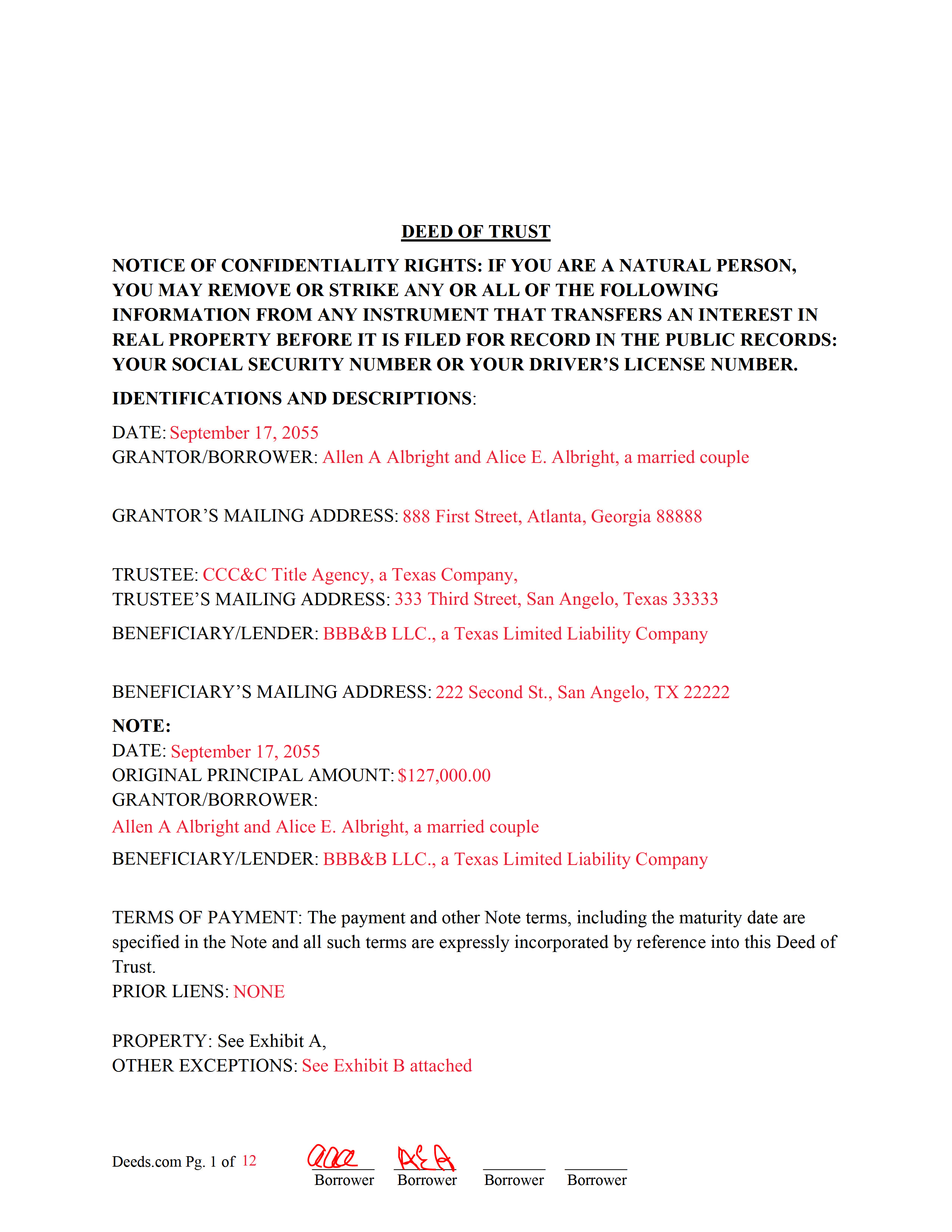

Callahan County Completed Example of the Deed of Trust Document

Example of a properly completed form for reference.

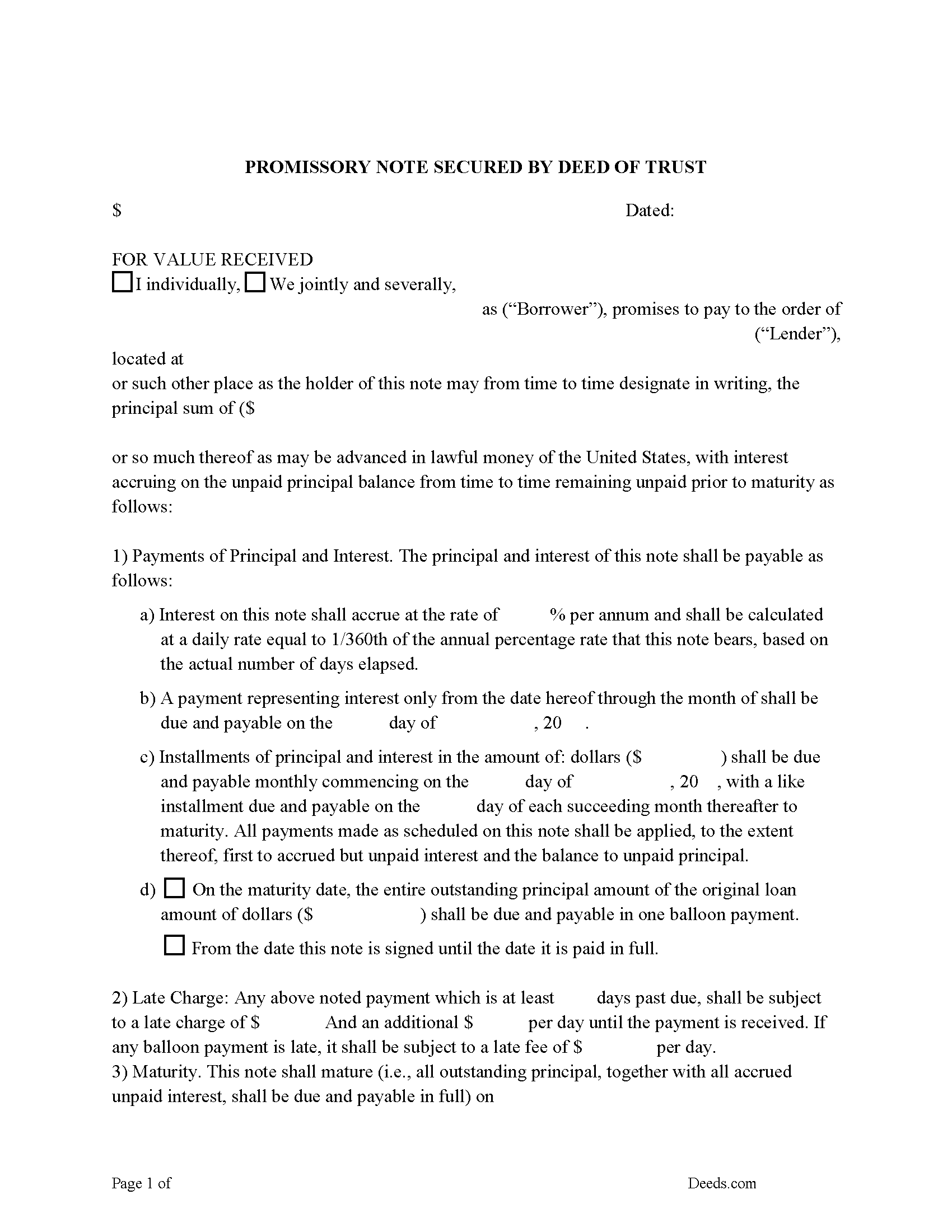

Callahan County Promissory Note Form

Note secured by Deed of Trust, fill in the blank.

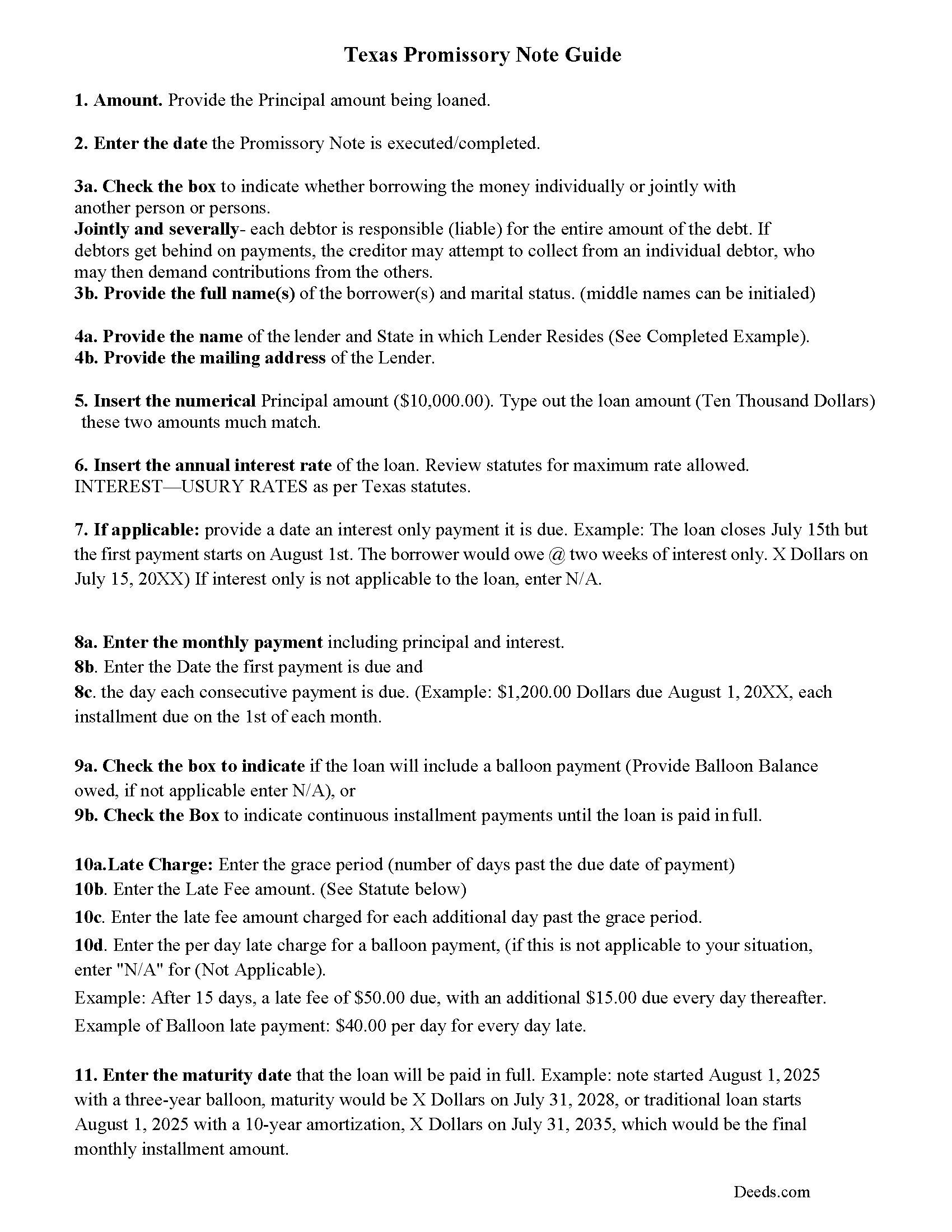

Callahan County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

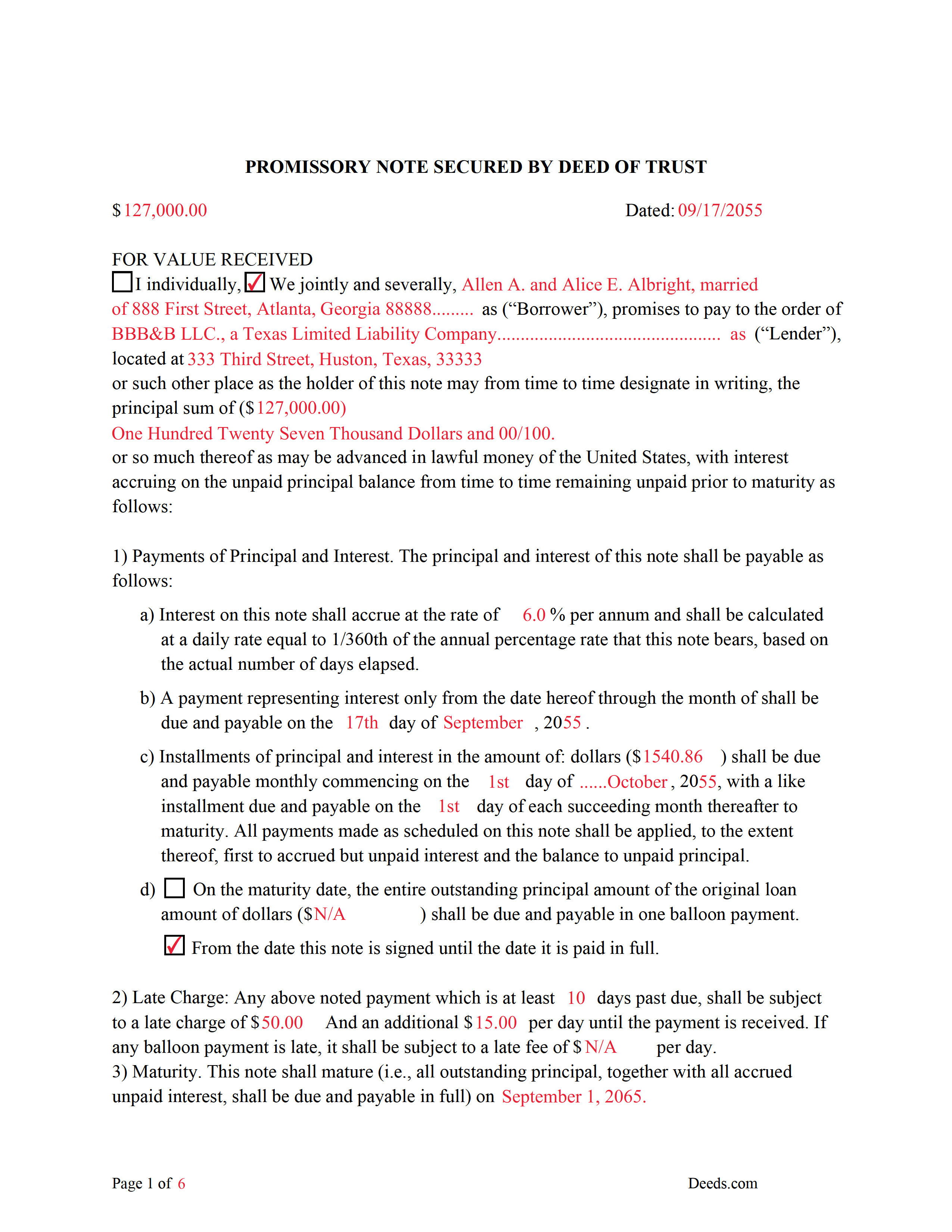

Callahan County Completed Example of the Promissory Note Document

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

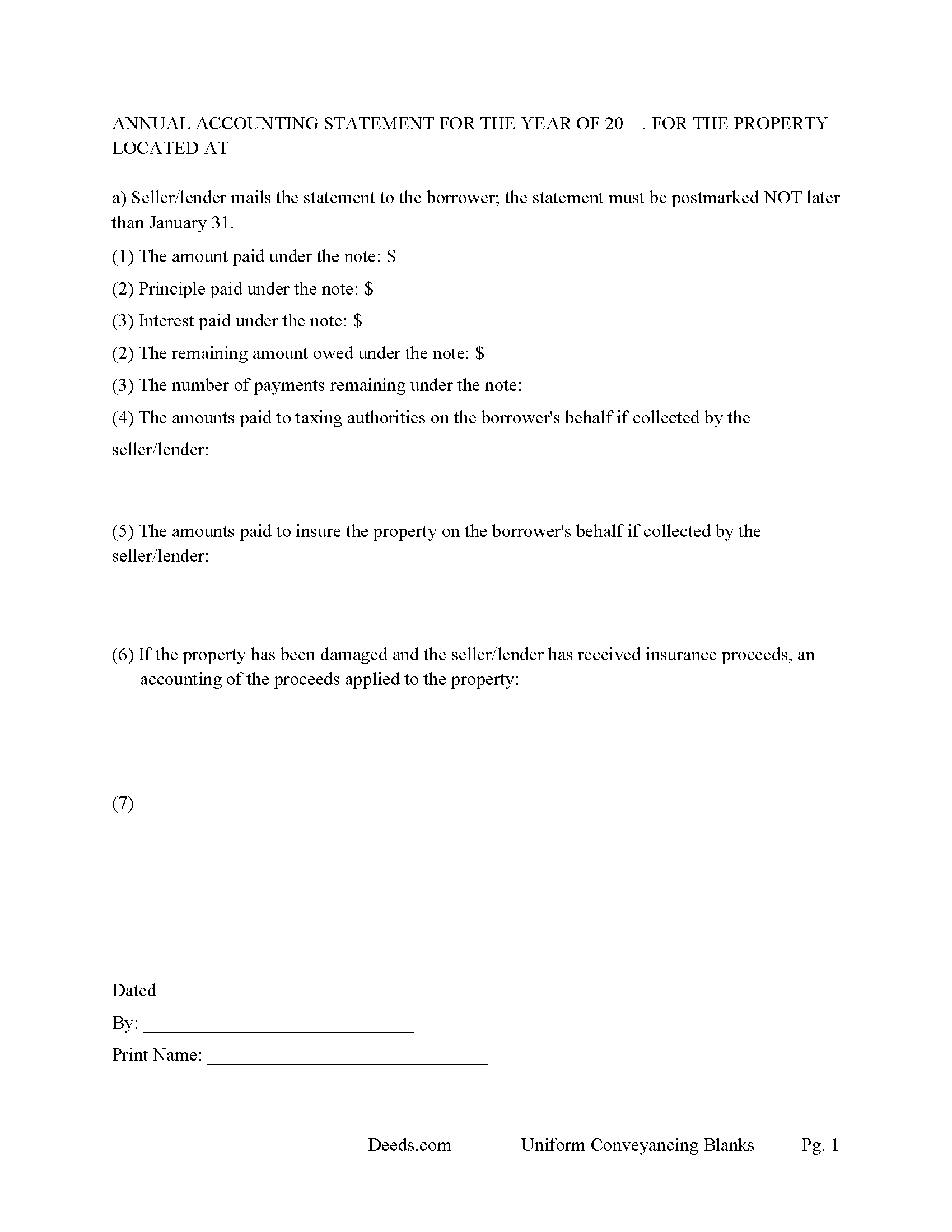

Callahan County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Callahan County documents included at no extra charge:

Where to Record Your Documents

Callahan County Clerk

Baird, Texas 79504

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (325) 854-5815

Recording Tips for Callahan County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Check that your notary's commission hasn't expired

- Bring extra funds - fees can vary by document type and page count

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Callahan County

Properties in any of these areas use Callahan County forms:

- Baird

- Clyde

- Cross Plains

- Putnam

Hours, fees, requirements, and more for Callahan County

How do I get my forms?

Forms are available for immediate download after payment. The Callahan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Callahan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Callahan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Callahan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Callahan County?

Recording fees in Callahan County vary. Contact the recorder's office at (325) 854-5815 for current fees.

Questions answered? Let's get started!

A deed of trust (DOT) is a document that conveys title to real property to a trustee as security for a loan until the grantor (borrower) repays the lender according to terms defined in a promissory note. It's similar to a mortgage but differs - mortgages only include two parties (borrower and lender). In Texas a Deed of Trust is the preferred lending instrument.

There are three parties to a deed of trust: the borrower (grantor), the lender (beneficiary), and the trustee. The trustee, typically a title agency or other disinterested party, serves two purposes: to initiate the foreclosure process for the lender if the borrower defaults on the loan, and to transfer (reconvey) the property back to the borrower after the debt is paid in full.

This DOT includes a power of sale clause, this can be beneficial to the lender, saving time and expense in the case of a foreclosure. Sec.51.0074. DUTIES OF TRUSTEE.

(a) One or more persons may be authorized to exercise the power of sale under a security instrument.

(b) A trustee may not be:

(1) assigned a duty under a security instrument other than to exercise the power of sale in accordance with the terms of the security instrument; or

(2) held to the obligations of a fiduciary of the mortgagor or mortgagee.

Use these forms to finance real property; residential, rental, condominiums, vacant land, and planned unit developments. A promissory note secured by a deed of trust, that include stringent default terms can be beneficial to the lender, typical of owner financing, investor financing, etc.

(Texas Deed of Trust Package includes forms, guidelines, and completed example)

For use in Texas only.

Important: Your property must be located in Callahan County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Callahan County.

Our Promise

The documents you receive here will meet, or exceed, the Callahan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Callahan County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Sarah N.

July 3rd, 2019

This is not at all the form that I needed. I am trying to disclaim my interest in a property, but this form is much too rigid to work for my case. It would have been nice to know some of the more specific details before purchasing the document.

Thank you for your feedback. Sorry hear of your confusion. We have canceled your order and payment. We do hope that you are able to find something more suitable to your needs. Have a wonderful day.

Saul N.

June 13th, 2023

Great and fast service. Would have been grate to have seen a little more detail or a pre-filled sample in the fields. Had a little confussion in some of the lines to fill out since the guide only explains a few of the lines not all of them. Otherwise, is really great to have this service with low cost. Thank you.

Thank you for taking the time to provide us with your feedback Saul, we appreciate you.

Theresa T.

October 31st, 2020

Great source easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARILEE S.

June 24th, 2019

A very easy website....consumer friendly, which is what is so important to me. I will be using your service again. Thank you

Thank you!

Larry T.

May 19th, 2023

Excellent service!!!!! A 5STAR

Thanks Larry! We appreciate you.

wendy w.

October 19th, 2022

Excellent

Thank you!

Janis H.

February 13th, 2020

Amazing! Great forms - created the quitclaim fairly easy, recorded with no issues. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Keith R.

October 11th, 2021

Great! Love the platform. Very helpful!!

Thank you!

Tammy C.

September 24th, 2020

Was very easy to use and i would recommend it

Thank you!

GLENN A M.

November 26th, 2019

I loved the easy to understand and use system, very user friendly.

Thank you!

David S.

October 20th, 2020

I downloaded the quit claim deed form and saved it on my computer. I opened it with Adobe and filled it out. The space for the legal description was too small (2 lines only) which did not allow enough room for the long property description that I had.

Thank you for your feedback. We really appreciate it. Have a great day!

Kenneth J.

May 5th, 2022

I thought the forms were good but expensive, Spending almost 30 dollars for a 3 page form was a stiff price to pay. I won't be getting any more

Thank you for your feedback. We really appreciate it. Have a great day!

Donna T.

April 23rd, 2020

Very clear instructions. All documents were easy to download and print.

Thank you for your feedback. We really appreciate it. Have a great day!

Coralis M.

September 2nd, 2021

Fast, efficient and professional service! Thanks

Thank you!

Shawn B.

November 17th, 2021

Deeds.com support is very quick and responsive. Would use again and recommend to others in need of e-recording.

Thank you for your feedback. We really appreciate it. Have a great day!