Shelby County Deed of Trust and Promissory Note Form

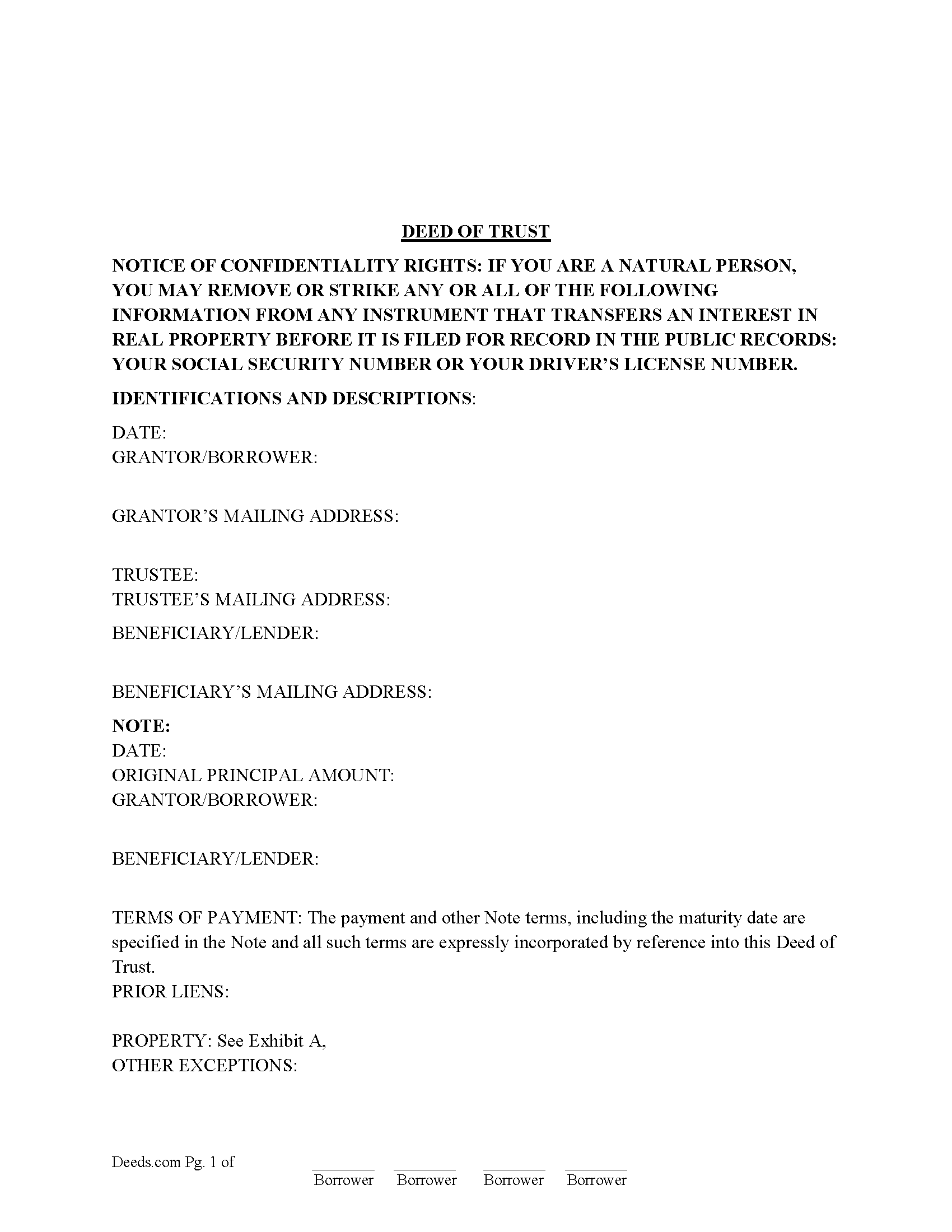

Shelby County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

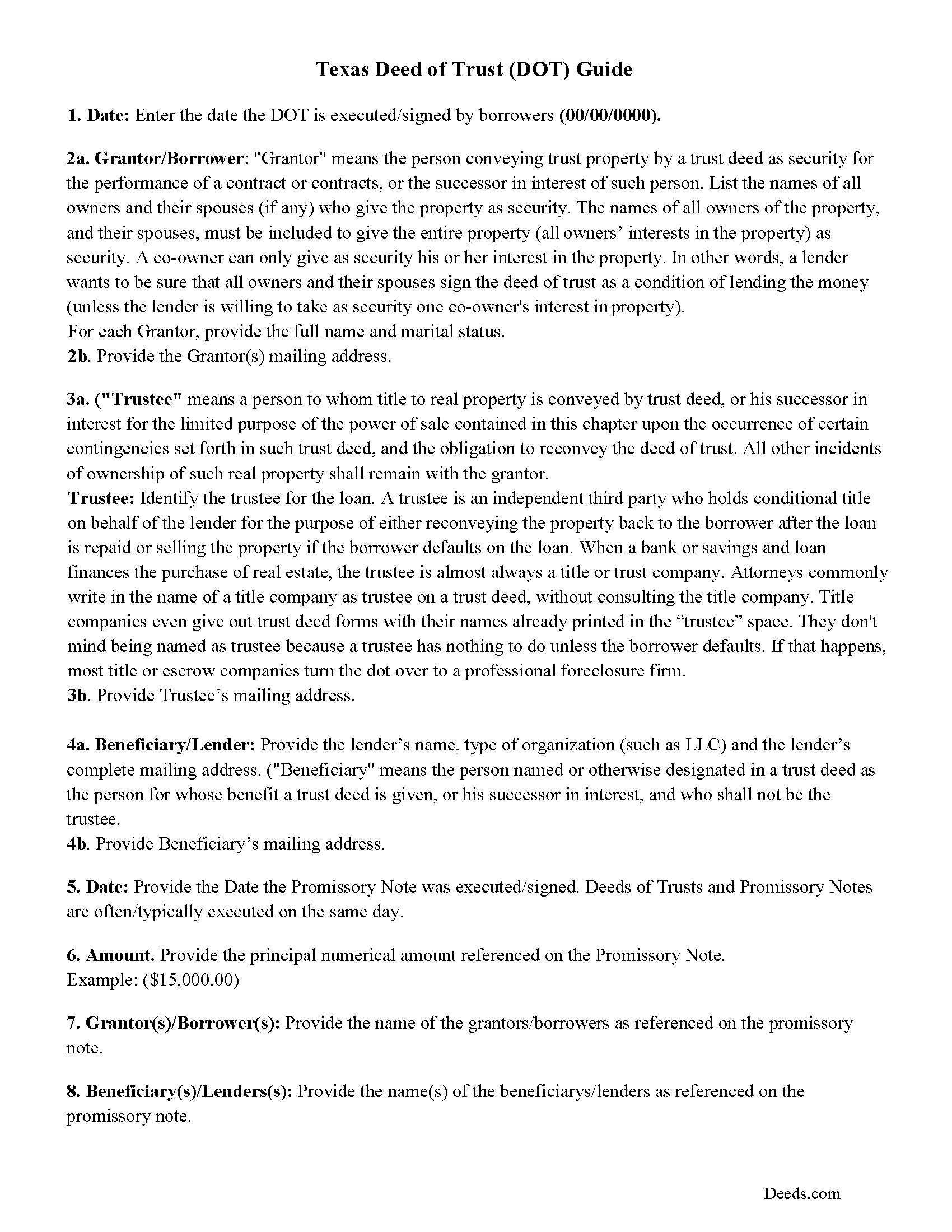

Shelby County Texas Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

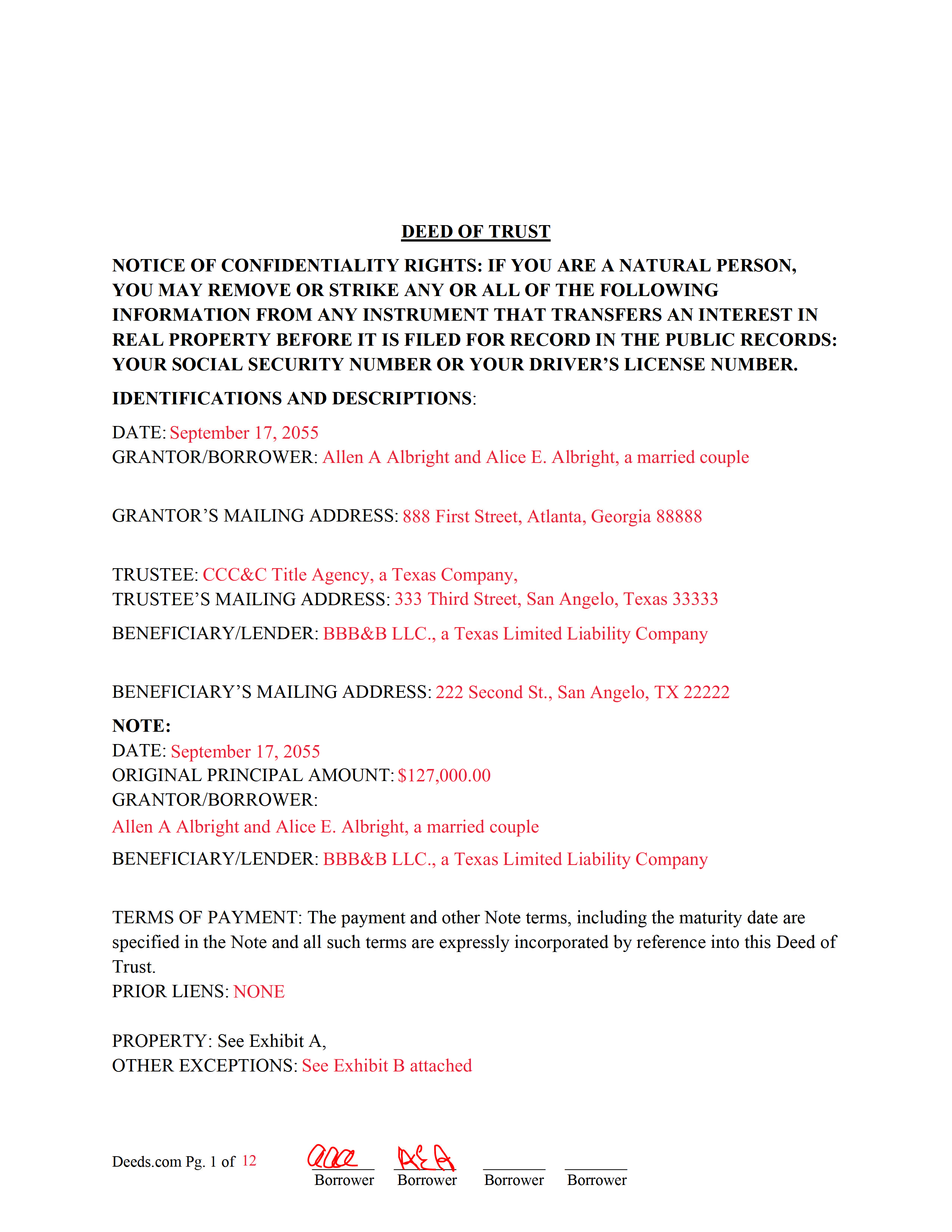

Shelby County Completed Example of the Deed of Trust Document

Example of a properly completed form for reference.

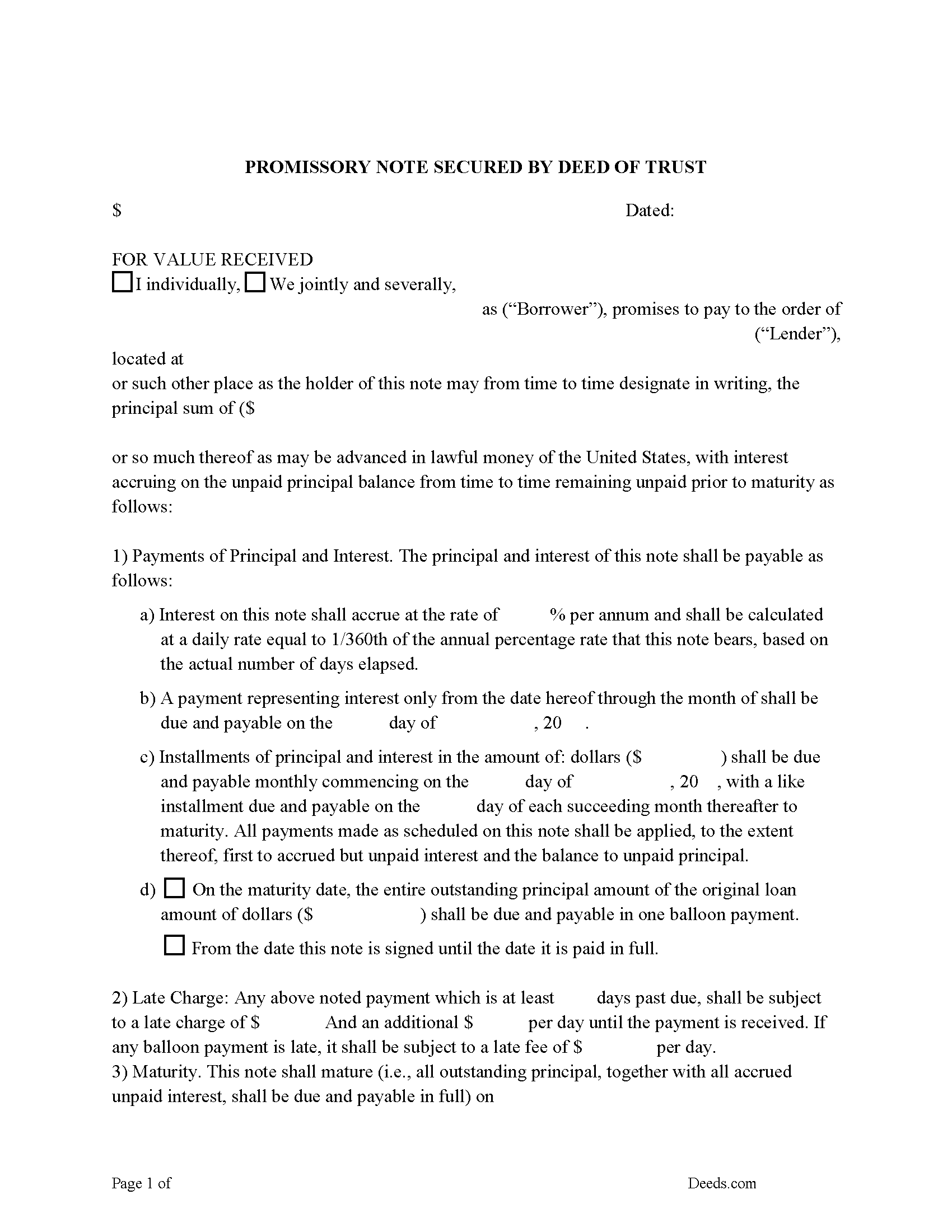

Shelby County Promissory Note Form

Note secured by Deed of Trust, fill in the blank.

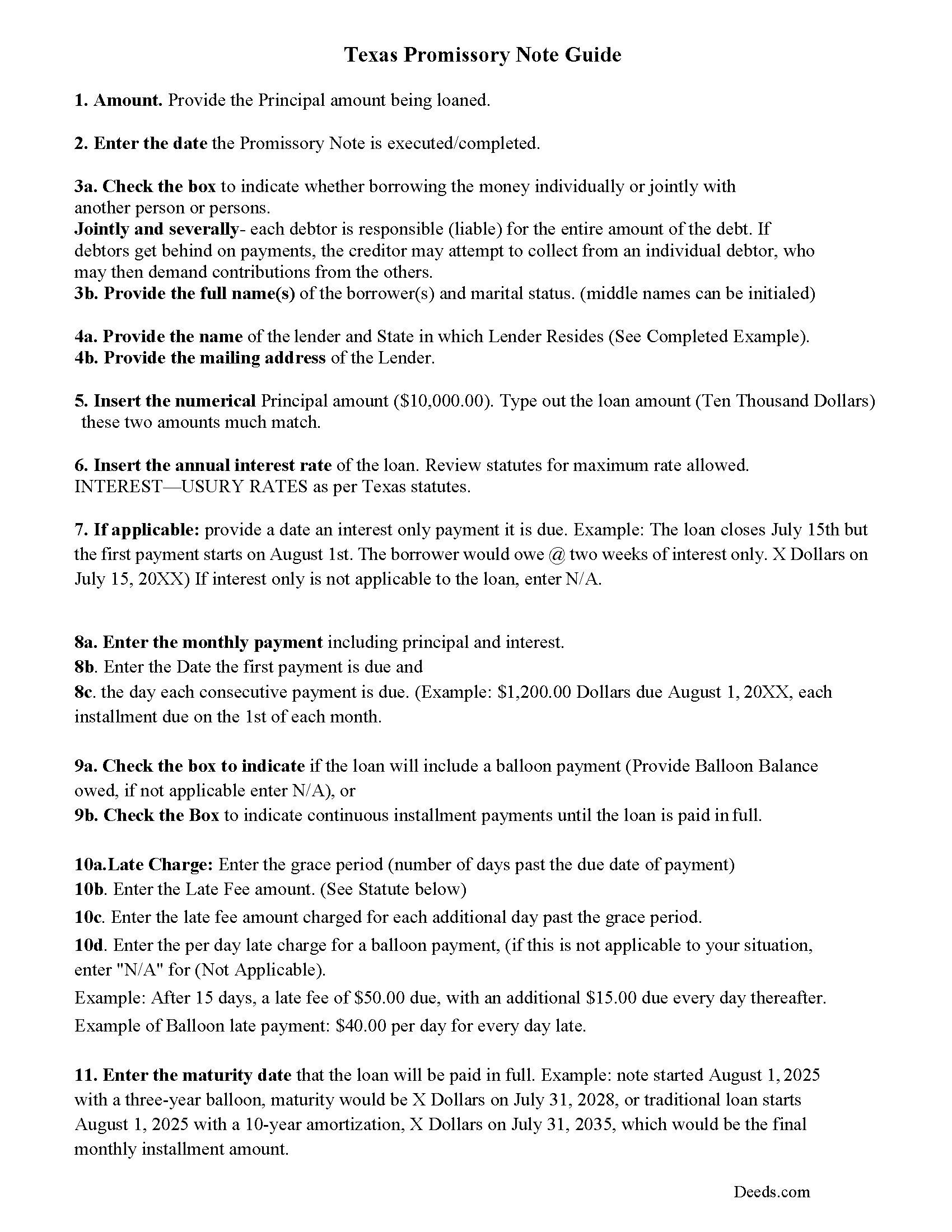

Shelby County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

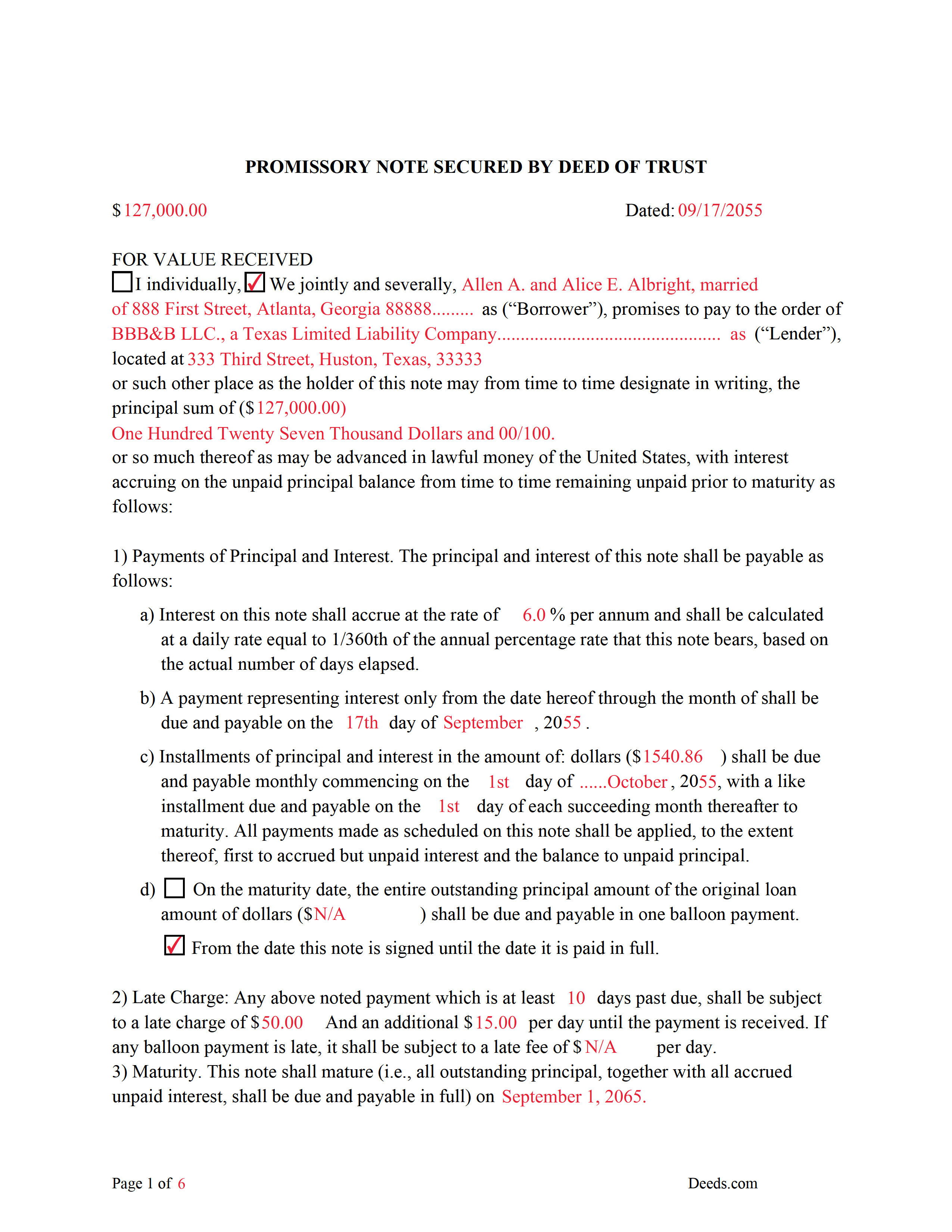

Shelby County Completed Example of the Promissory Note Document

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

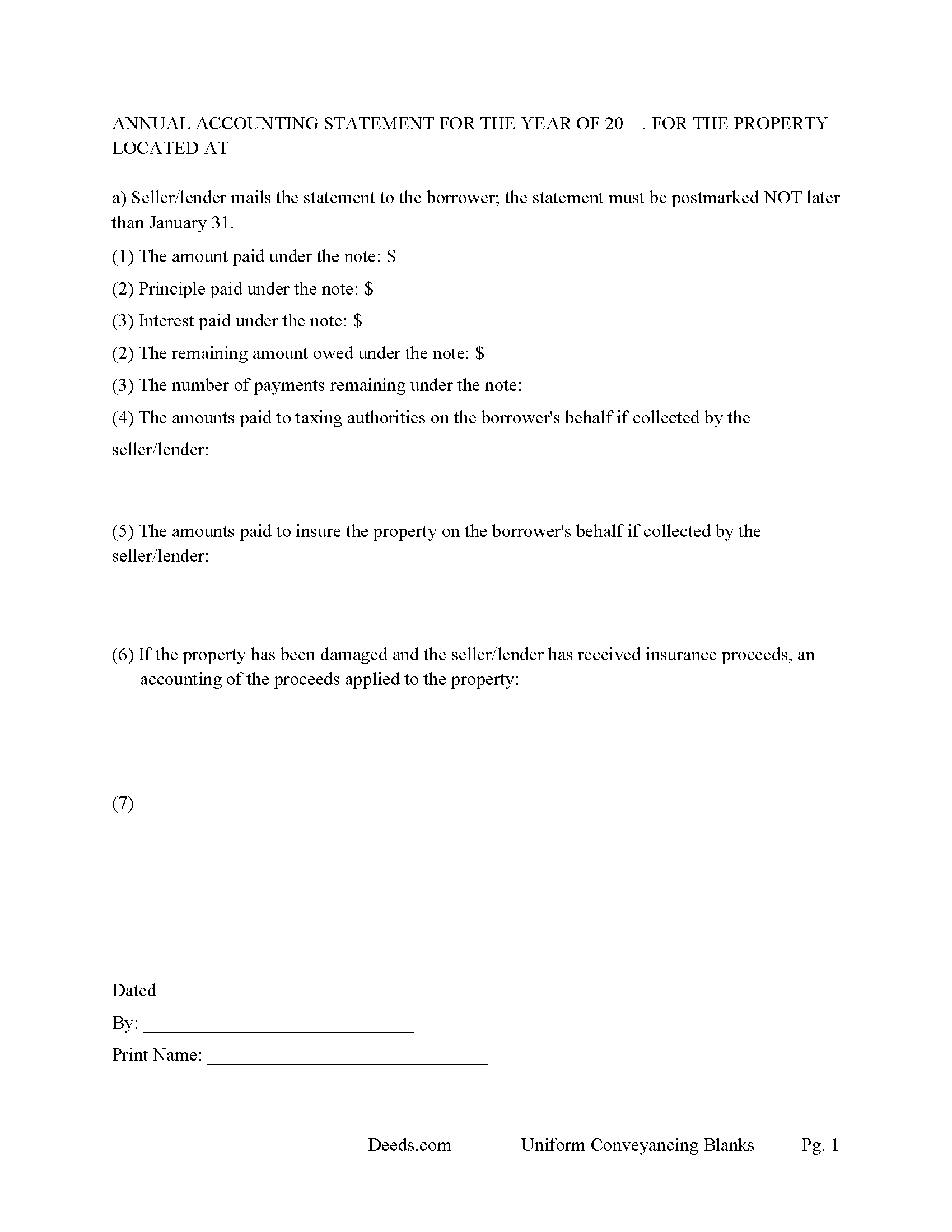

Shelby County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Shelby County documents included at no extra charge:

Where to Record Your Documents

Shelby County Clerk

Center, Texas 75935

Hours: 8:00 to 4:30 Monday through Friday

Phone: (936) 598-6361

Recording Tips for Shelby County:

- Bring your driver's license or state-issued photo ID

- Leave recording info boxes blank - the office fills these

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Shelby County

Properties in any of these areas use Shelby County forms:

- Center

- Joaquin

- Shelbyville

- Tenaha

- Timpson

Hours, fees, requirements, and more for Shelby County

How do I get my forms?

Forms are available for immediate download after payment. The Shelby County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Shelby County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Shelby County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Shelby County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Shelby County?

Recording fees in Shelby County vary. Contact the recorder's office at (936) 598-6361 for current fees.

Questions answered? Let's get started!

A deed of trust (DOT) is a document that conveys title to real property to a trustee as security for a loan until the grantor (borrower) repays the lender according to terms defined in a promissory note. It's similar to a mortgage but differs - mortgages only include two parties (borrower and lender). In Texas a Deed of Trust is the preferred lending instrument.

There are three parties to a deed of trust: the borrower (grantor), the lender (beneficiary), and the trustee. The trustee, typically a title agency or other disinterested party, serves two purposes: to initiate the foreclosure process for the lender if the borrower defaults on the loan, and to transfer (reconvey) the property back to the borrower after the debt is paid in full.

This DOT includes a power of sale clause, this can be beneficial to the lender, saving time and expense in the case of a foreclosure. Sec.51.0074. DUTIES OF TRUSTEE.

(a) One or more persons may be authorized to exercise the power of sale under a security instrument.

(b) A trustee may not be:

(1) assigned a duty under a security instrument other than to exercise the power of sale in accordance with the terms of the security instrument; or

(2) held to the obligations of a fiduciary of the mortgagor or mortgagee.

Use these forms to finance real property; residential, rental, condominiums, vacant land, and planned unit developments. A promissory note secured by a deed of trust, that include stringent default terms can be beneficial to the lender, typical of owner financing, investor financing, etc.

(Texas Deed of Trust Package includes forms, guidelines, and completed example)

For use in Texas only.

Important: Your property must be located in Shelby County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Shelby County.

Our Promise

The documents you receive here will meet, or exceed, the Shelby County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Shelby County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Roy W.

April 29th, 2020

It's fine

Thank you!

Debbra .S C.

June 1st, 2023

Very easy and nice website to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Flordeliza R.

February 6th, 2023

Once I was able to get my scanner working and provide good quality scans, the turnaround was quick and my documents were recorded and returned to me the same day with the Recorder's Stamp for download. Deeds.com staff was able to guide me to make sure my package was complete. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Delsina T.

October 9th, 2020

So helpful. Thank you so much for making this a smooth process.

Thank you!

Rhonda P.

February 23rd, 2021

Very quick and easy! Didn't even have to leave the house and I didn't have to send via USPS which is nice since we are in a pandemic. The convenience of this site is worth the extra money. Would definitely use this site again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lillian F.

September 13th, 2019

Very well satisfy with my results. I could not ask for better service d

Thank you for your feedback. We really appreciate it. Have a great day!

Mary C.

August 30th, 2022

The Deeds.com site made is relatively simple to download a Beneficiary Deed form specific to St Louis, which is great, because neither the city or state provide this. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Karen W.

October 18th, 2021

Great experience. Easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alan S.

April 28th, 2020

Great job! Fast and easy. Terrific communications.

Thank you!

Abigail Frances B.

December 28th, 2018

Thanks for the easy download, clear instructions, good price- I'm looking forward to filling them out.

Thank you for your feedback. We really appreciate it. Have a great day!

Andre H.

June 19th, 2025

World class forms, great for someone like me that has no clue what I'm doing! Always better to let the pros do it than think one knows it all and gets themselves in trouble!

Thank you for your feedback. We really appreciate it. Have a great day!

William C.

February 23rd, 2020

Excellent, easy to use. Technically accurate in all information offered.

Thank you!

Laureen M.

November 5th, 2020

This service was extremely helpful. I truly appreciated the way I was communicated with every step of the way in getting my Deed recorded.

Thank you!

A. S.

February 27th, 2019

First, I am glad that you gave a blank copy, an example copy, and a 'guide'. It made it much easier to do. Overall I was very happy with your products and organization... however, things got pretty confusing and I have a pretty 'serious' law background in Real Estate and Civil law. With that said, I spent about 10+ hours getting my work done, using the Deed of Trust and Promissory note from you and there were a few problems: First, it would be FANTASTIC if you actually aligned your guide to actually match the Deed or Promissory Note. What I mean is that if the Deed says 'section (E)' then your guide shouldn't be 'randomly' numbered as 1,2,3, for advice/instructions, but should EXACTLY match 'section (E)'. Some places you have to 'hunt' for what you are looking for, and if you did it based on my suggestion, you wouldn't need to 'hunt' and it would avoid confusion. 2nd: This one really 'hurt'... you had something called the 'Deed of Trust Master Form' yet you had basically no information on what it was or how to use it. The only information you had was a small section at the top of the 'Short Form Deed of Trust Guide'. Holy Cow, was that 'section' super confusing. I still don't know if I did it correctly, but your guide says only put a return address on it and leave the rest of the 16 or so page Deed of Trust beneath it blank... and then include your 'Deed of Trust' (I had to assume the short form deed that I had just created) as part of it. I had to assume that I had to print off the entire 17 page or so title page and blank deed. I also had to assume that the promissory note was supposed to be EXHIBIT A or B on the Short Form Deed. It would be great if someone would take a serious look at that short section in your 'Short Form Deed of Trust Guide' and realize that those of us using your products are seriously turning this into a county clerk to file and that most of us, probably already have a property that has an existing Deed... or at least can find one in the county records if necessary... and make sure that you make a distinction between the Deed for the property that already exists, versus the Deed of Trust and Promissory note that we are trying to file. Thanks.

Thank you for your feedback. We'll have staff review the document for clarity. Have a great day!

Pamela B.

May 29th, 2021

The process was not difficult but I don't think that it suited my needs. There were several fields that were not applicable to me but I had to enter something to proceed. I also filled out the other form and mailed it in with some documentation that the electronic service did not ask for. Questions of my attempt are still unanswered. I hope I didn't waste time with this process. We shall see. Thank you.

Thank you!