Walker County Demand for Payment Form

Walker County Demand for Payment Form

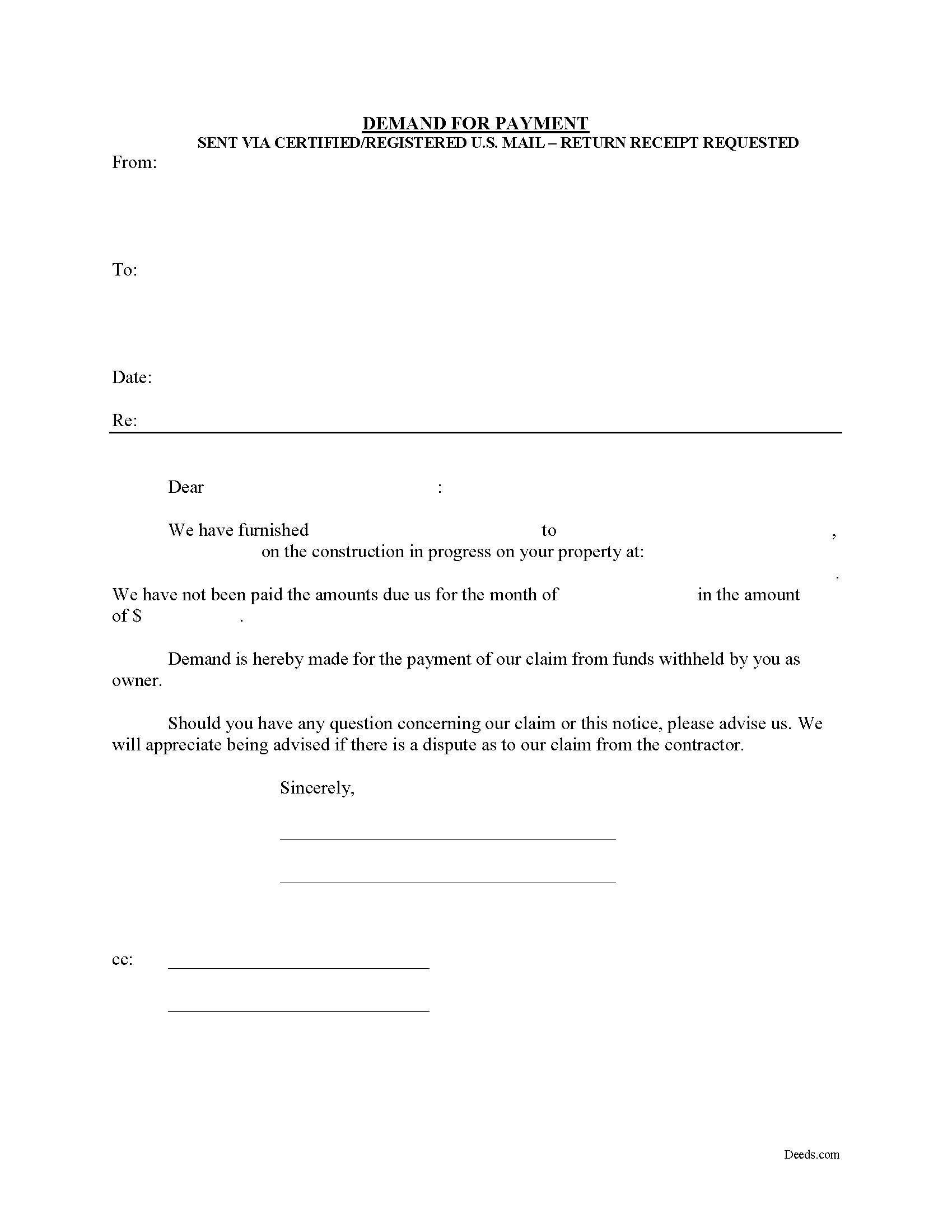

Fill in the blank Demand for Payment form formatted to comply with all Texas recording and content requirements.

Walker County Demand for Payment Guide

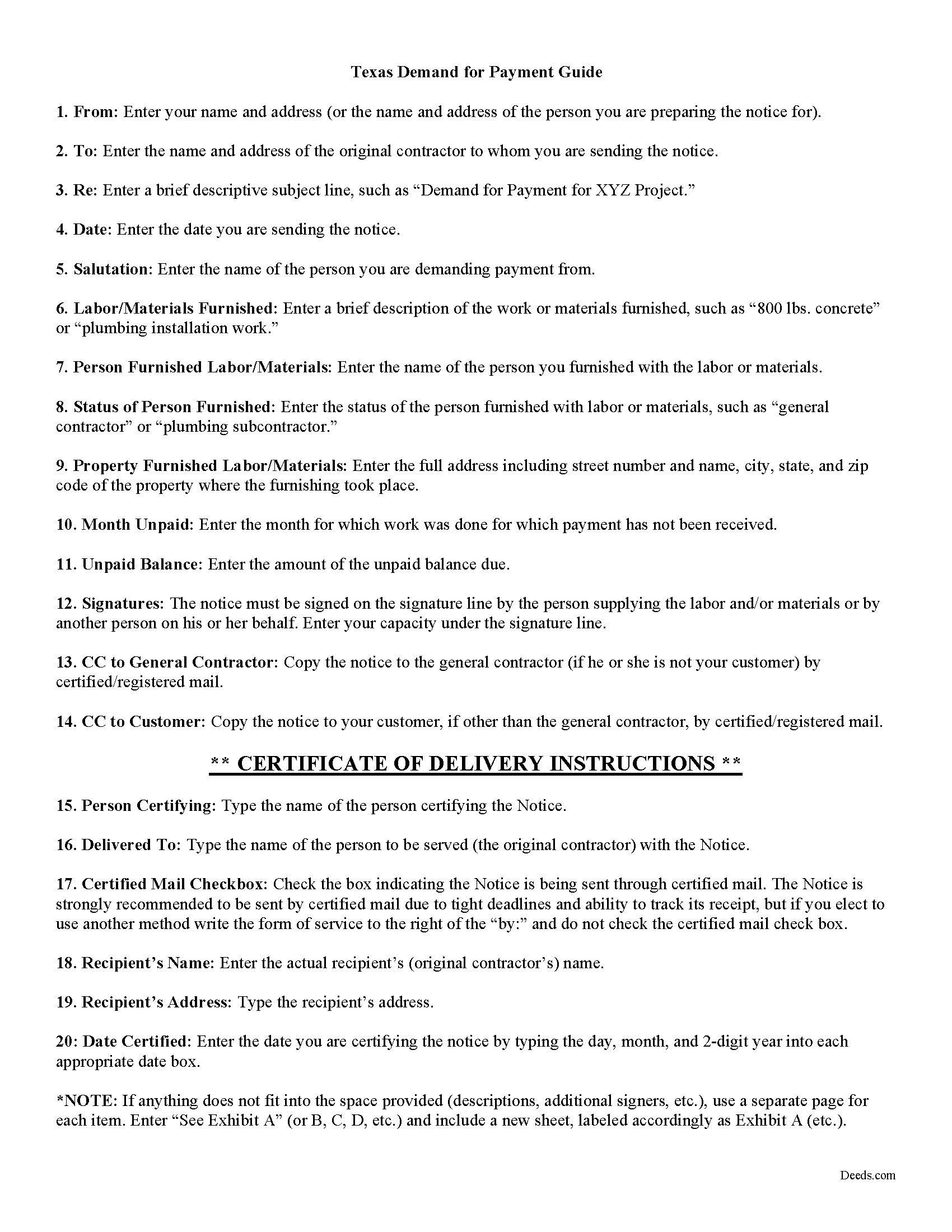

Line by line guide explaining every blank on the form.

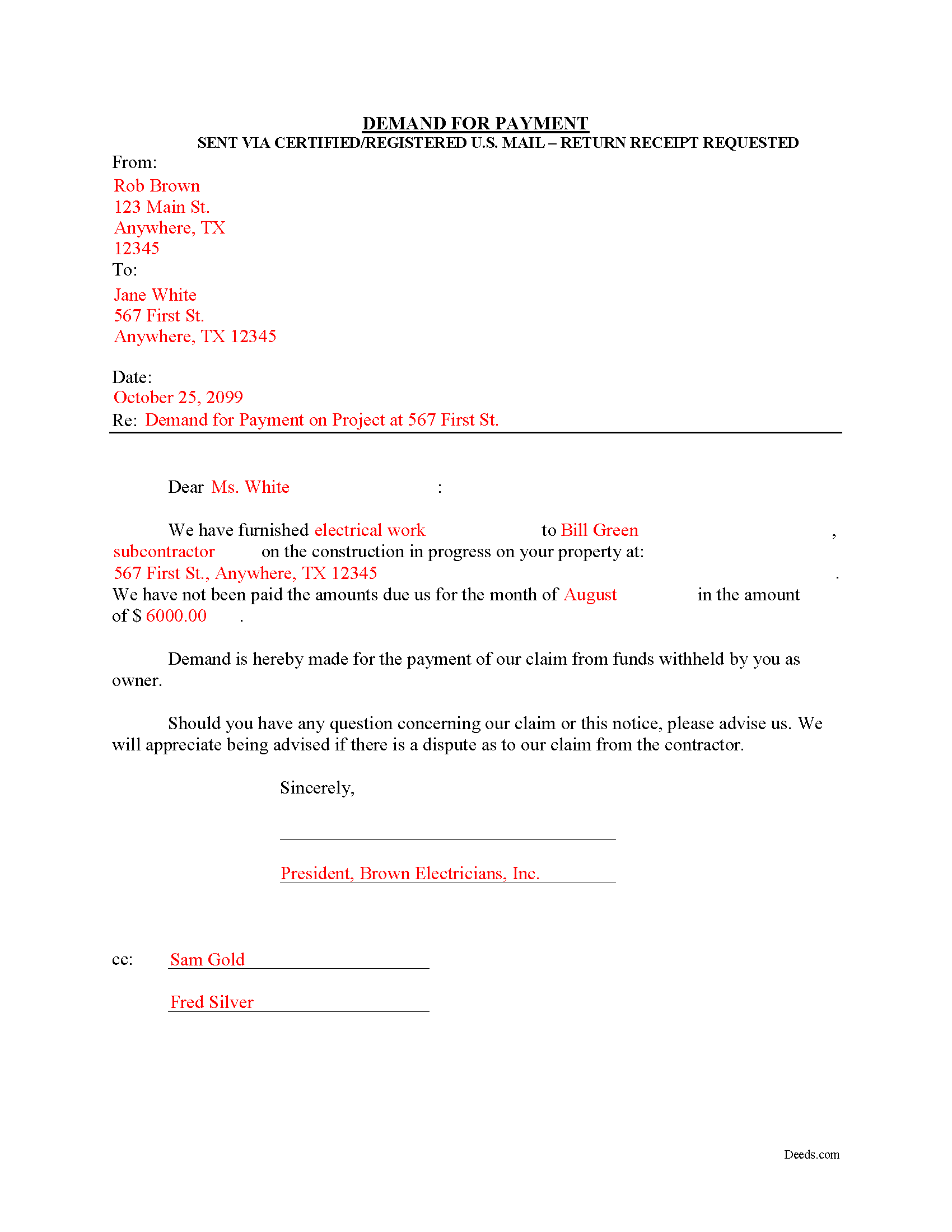

Walker County Completed Example of the Demand for Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Walker County documents included at no extra charge:

Where to Record Your Documents

County Clerk: Recording Division

Huntsville, Texas 77320

Hours: Monday - Friday 8:00am - 12:00 & 1:00 - 4:30pm

Phone: (936) 436-4903

Recording Tips for Walker County:

- Double-check legal descriptions match your existing deed

- Ask if they accept credit cards - many offices are cash/check only

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Walker County

Properties in any of these areas use Walker County forms:

- Dodge

- Huntsville

- New Waverly

- Riverside

Hours, fees, requirements, and more for Walker County

How do I get my forms?

Forms are available for immediate download after payment. The Walker County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Walker County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Walker County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Walker County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Walker County?

Recording fees in Walker County vary. Contact the recorder's office at (936) 436-4903 for current fees.

Questions answered? Let's get started!

The Demand for Payment form is used by unpaid individual claimants to demand payment of their claim on an owner who is authorized to withhold funds under 53.083(a) of the Texas Property Code. The demand form also provides notice to the owner that all or part of the claim has accrued under Texas Code 53.053 or is past due under the agreement between the parties.

The claimant must also send a copy of the demand to the original contractor. If the original contractor intends to dispute the claim, he must give the owner written notice no later than the 30th day after the day he receives the copy of the demand. Failure to respond in a timely fashion implies approval of the demand and the owner must then pay the claim.

The Demand for Payment identifies the parties, the project, and relevant dates, services/materials, and fees. It is a required step in securing an eventual mechanic's lien on the owner's property if the claim remains unpaid after demand is sent.

The form does not require a notary seal or other verification, nor is it filed in the local land records. Instead, deliver the demand for payment via certified or registered mail, with a return receipt requested.

Each case is unique, and the mechanic's lien law in Texas can be complicated. Contact an attorney for complex situations, with specific questions about sending a demand for payment, or any other issue related to mechanic's liens.

Important: Your property must be located in Walker County to use these forms. Documents should be recorded at the office below.

This Demand for Payment meets all recording requirements specific to Walker County.

Our Promise

The documents you receive here will meet, or exceed, the Walker County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Walker County Demand for Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Keli A.

June 3rd, 2021

Excellent site, super fast responses to messages, and great patience with a newbie user. Couldn't be more pleased. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Shannon D.

November 4th, 2020

Extremely easy site to use. We had our document e-recorded the same day and we didn't have to make a trip downtow!

Thank you!

Joyce M.

July 28th, 2019

Great website, but not helpful in locating my deed dated 1747.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeffey V.

April 4th, 2019

Easiest way I've found to get Warranty Deeds in different parts of the country. Highly recommend.

Thank you Jeffey.

Richard N.

November 27th, 2020

It went well. The proof will be when I complete the forms and submit to the County Clerk.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

CHRISTIN P.

September 27th, 2019

Did not use site; too expensive.

Thank you for your feedback. We really appreciate it. Have a great day!

Mark S.

September 14th, 2023

The forms were easy and convenient to use

Thank you Mark. We appreciate your feedback.

Janette K.

May 17th, 2019

I ordered a Transfer of Deed on Death document. It was easy to fill in, came with a useful guide and was customized to my county/state. It got the job done and was well worth the money!

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia R.

March 2nd, 2025

Very helpful. Worth the cost. Hopefully we will be able to proceed without expense of an attorney.

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

leila m.

January 30th, 2021

Very good service, friendly customer service I absolutely will use the service again

Thank you!

Dakota H.

December 19th, 2021

Brilliant idea. Beats working with an attorney who charges $250+ per hour. Thanks.

Thank you!

Frank B.

March 16th, 2023

Great website, super easy to use, user friendly to navigate. Will definitely use for future needs, and will definitely refer to other customers. F. Betancourt Texas

Thank you!

Joseph R.

August 22nd, 2025

The form and instructions were easy enough to follow if you had all the information.rnThe only drawback to the form was the length of text allowed for the name of the document (#4). The form self populates in multiple locations but when printed truncated the name if too many characters were used. I kept having to update the name of the document to allow for proper printing.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Karen M.

July 19th, 2020

Excellent and easy process to use the online fill in the blank sections, especially when you provided a example of what each topic/section should look like. Highly recommend!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sara S.

January 8th, 2021

Deed.com was very user friendly, made recording convenient and fast responses. I do recommend.

Thank you for your feedback. We really appreciate it. Have a great day!