Kleberg County Disclaimer of Interest Form

Kleberg County Disclaimer of Interest Form

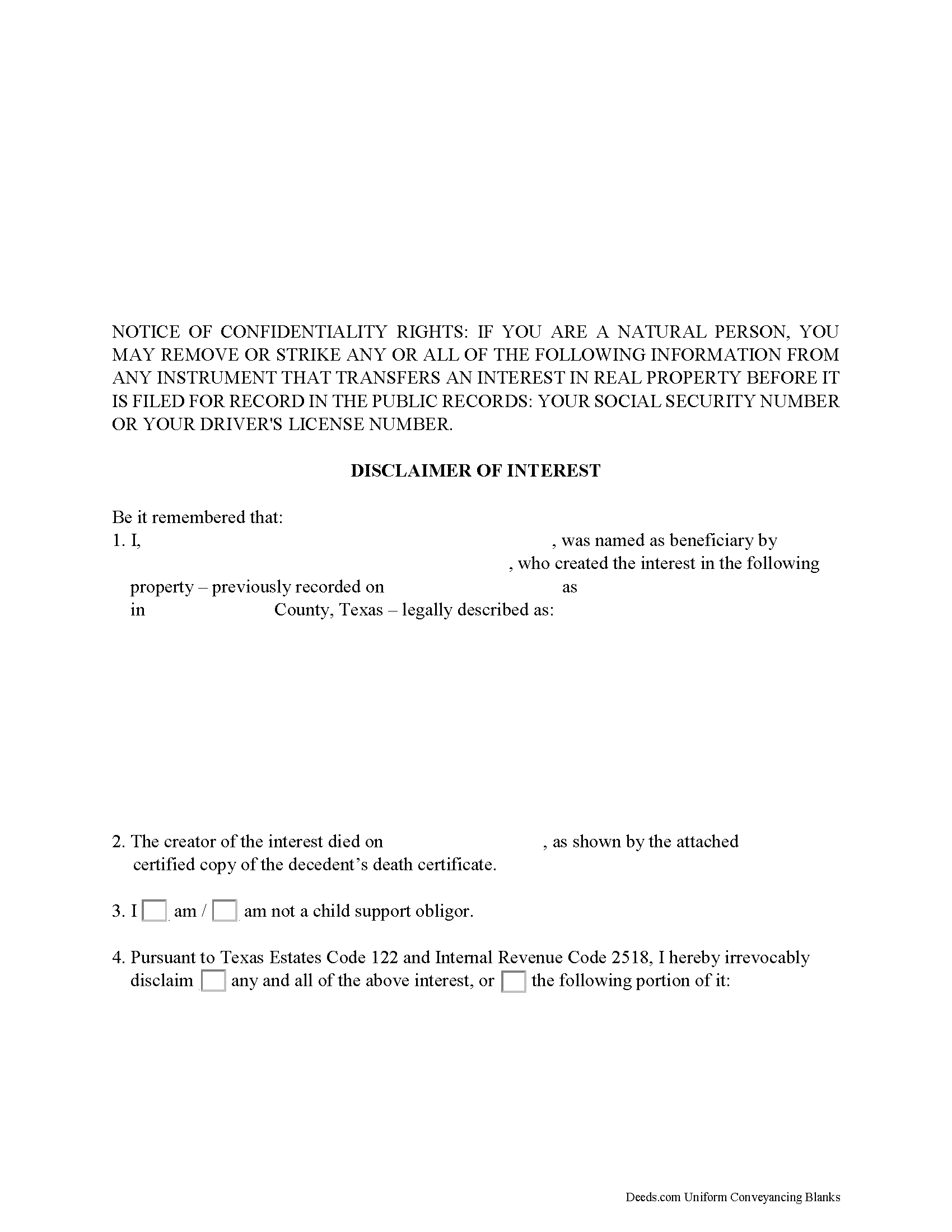

Fill in the blank form formatted to comply with all recording and content requirements.

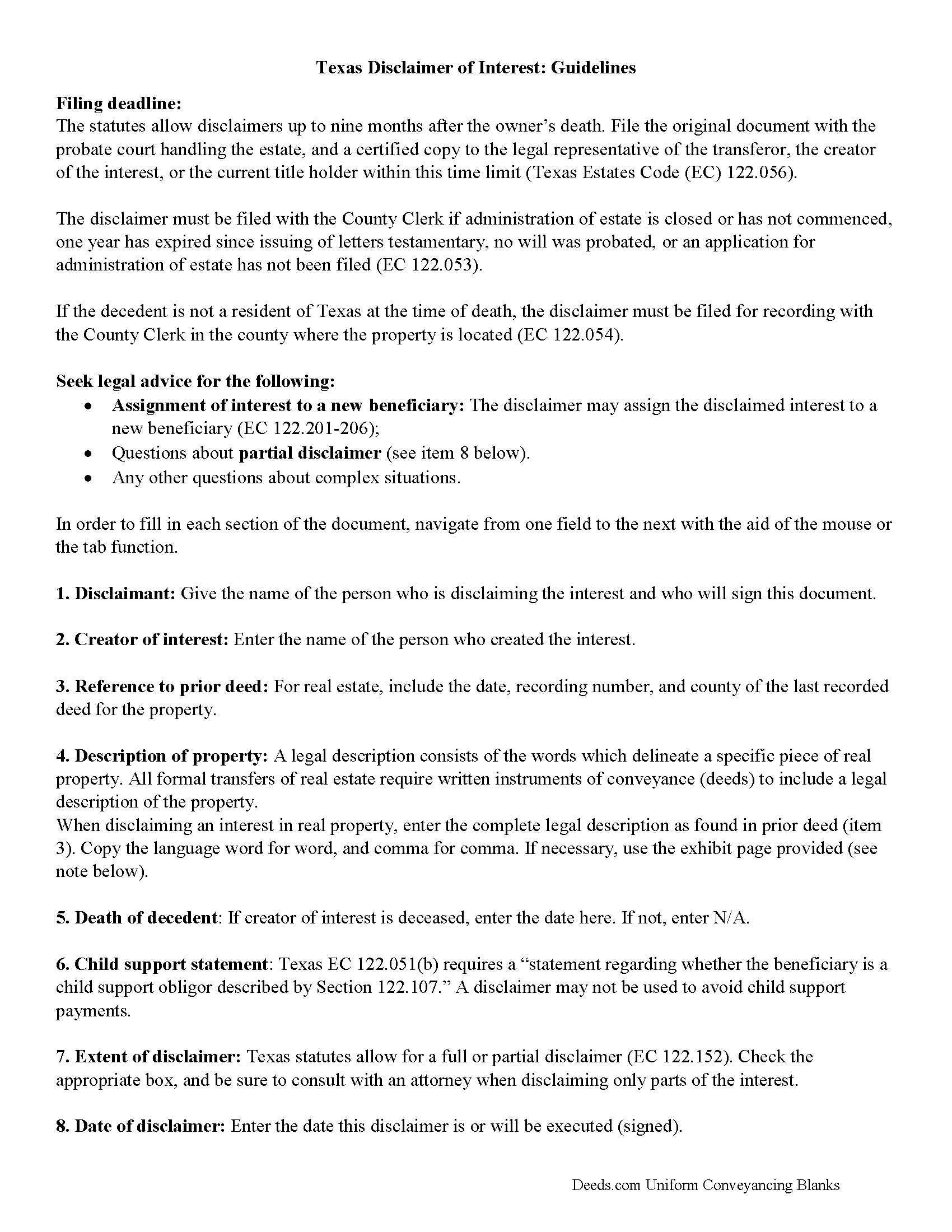

Kleberg County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

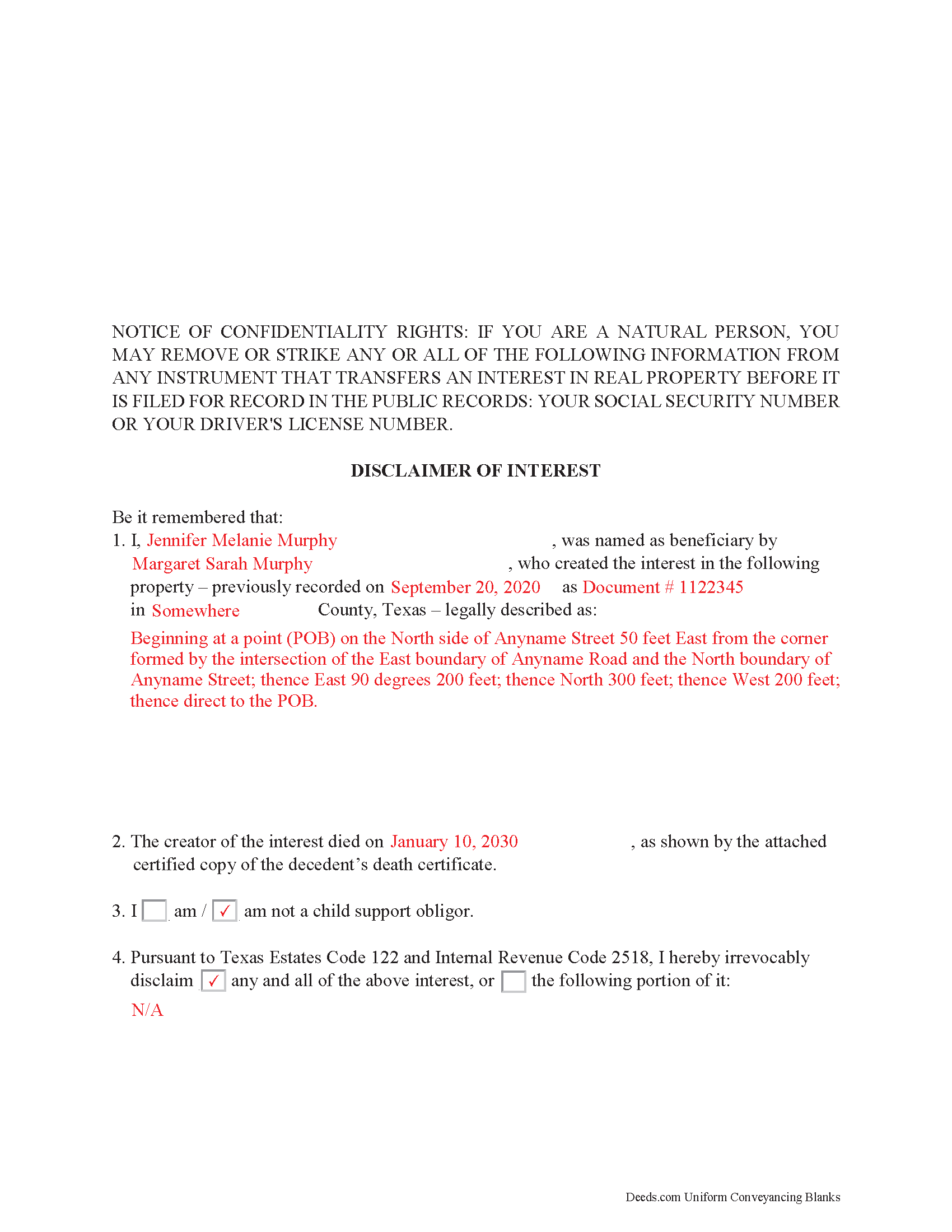

Kleberg County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Kleberg County documents included at no extra charge:

Where to Record Your Documents

Kleberg County Clerk

Kingsville, Texas 78364

Hours: Monday - Friday 8:00am - 5:00pm / some days closed from 12:00 to 1:00

Phone: (361) 595-8548

Recording Tips for Kleberg County:

- Verify all names are spelled correctly before recording

- Leave recording info boxes blank - the office fills these

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Kleberg County

Properties in any of these areas use Kleberg County forms:

- Kingsville

- Riviera

Hours, fees, requirements, and more for Kleberg County

How do I get my forms?

Forms are available for immediate download after payment. The Kleberg County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kleberg County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kleberg County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kleberg County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kleberg County?

Recording fees in Kleberg County vary. Contact the recorder's office at (361) 595-8548 for current fees.

Questions answered? Let's get started!

Use the disclaimer to renounce an interest in real property in Texas.

A beneficiary in Texas can disclaim a bequeathed asset or power (Texas Estates Code, Chapter 122). Such a disclaimer, which must be in writing and signed by the beneficiary or a legally authorized representative, allows that beneficiary to renounce his or her interest in the property, either in full or partially (122.151-153). A beneficiary who is a child support obligor, however, must fulfill his obligations prior to any renunciation of an interest (122.107).

A disclaimer is irrevocable and binding for anyone who makes a claim against the beneficiary, for example, potential creditors (122.003-004). Unless the beneficiary is a charitable organization or governmental agency of the state, the document must be received within nine months after the decedent's death, or other qualifying event (122.055), and it is only valid if no actions have indicated prior acceptance of the property (122.104).

The document must be filed with the probate court in the county where the will or estate is being administered, or the county clerk if estate proceedings are closed (122.052-053). If the decedent is not a resident of the state, it must be filed with the county clerk for recording (122.054). It further must be delivered to the representative of the deceased or executor of the estate or the holder of legal title (122.056). When in doubt as to the drawbacks and benefits of renouncing the property, as well as assigning it to a subsequent beneficiary (122.201-206), consult with an attorney.

(Texas Disclaimer of Interest Package includes form, guidelines, and completed example)

Important: Your property must be located in Kleberg County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Kleberg County.

Our Promise

The documents you receive here will meet, or exceed, the Kleberg County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kleberg County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Phyllis R Q.

January 26th, 2022

So far so good, I did not know the convenience I would have from my seat to file a legal document! Awesome Service!

Thank you!

Stacie L.

April 1st, 2020

The deed is great. However, I do not believe your Statement of Full Consideration is up to date as it does not give the reference for an exemption on the Transfer on Death Deed.

Thank you Stacie. We'll take a look at those supplemental forms. Have a great day!

Jaimie F.

February 2nd, 2024

Very easy process and the customer service representatives are very friendly and helpful.

It was a pleasure serving you. Thank you for the positive feedback!

BARBARA S.

November 22nd, 2020

Easy to use; great back-up documentation; reasonably priced.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jayne S.

August 24th, 2023

Very prompt and excellent service!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael M.

May 29th, 2019

My sale is a land contract and it is complicated. We were thinking we'd have to get an attorney. Your site is very thorough and helpful. We will still have an attorney look over our final papers --and we are still waiting on my deed from the bank to finalize our input. Had several questions, but they seemed to be answered as I went along. The actual process of downloading and saving and having a link went very smoothly. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Justin H.

June 10th, 2021

Couldn't pull a simple deed for a legal description.

Thank you for your feedback Justin. We do hope that you were able to find something more suitable to your needs elsewhere. Have a wonderful day.

Erik H.

July 16th, 2020

tl;dr - Bookmarked and anticipating using this site for years to come. My justification for rating 5/5 1. Provide intuitive method for requesting property records. 2. Cost for records *seems reasonable. 3. They clearly state that interested parties could gather these records at more affordable costs through the county (which was more confusing for an inexperienced person such as myself). I mean, I appreciate and respect this level of honesty. *I didn't shop around too much because it was difficult for me to find other services that could deliver CA property records.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Valerie S.

July 16th, 2020

The service was easy, fast, and cheap and we were able to close our sale 2 days after we downloaded the deed! Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Taylor M.

July 18th, 2020

Service is good. The website isn't very user friendly and could use some updating. Overall I'm happy with the service.

Thank you for your feedback. We really appreciate it. Have a great day!

heather i.

December 5th, 2022

I don't pay very close attention to what I'm doing all the time which leads to mistakes. Deeds.com was helpful in correcting my error and getting me on my way.

Thank you!

Viola J.

August 2nd, 2021

You made this so easy to process the Executor Deed. THANK YOU a thousand times. Appreciate that all forms are in one place and I did not have to search all over the internet to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathleen M.

December 29th, 2023

I am very happy with this service

Your kind words have brightened our teams day! Thank you for the positive feedback.

Jennie P.

June 25th, 2019

Thank you for the information you sent.

Thank you!

Regina W.

February 3rd, 2022

So glad I found this form. Very easy to download and looks like all the instructions are there to correctly fill out my paperwork. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!