Shelby County Disclaimer of Interest Form

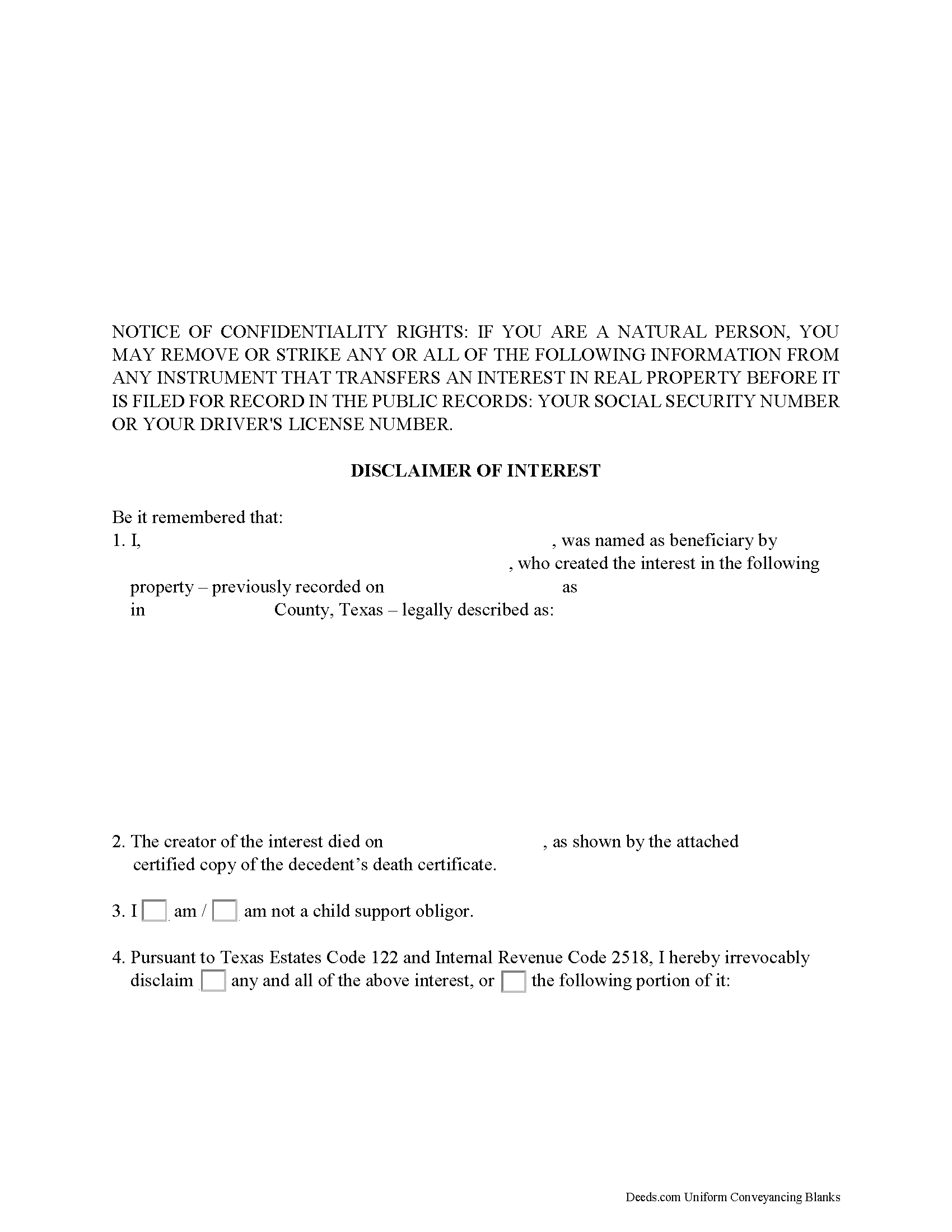

Shelby County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

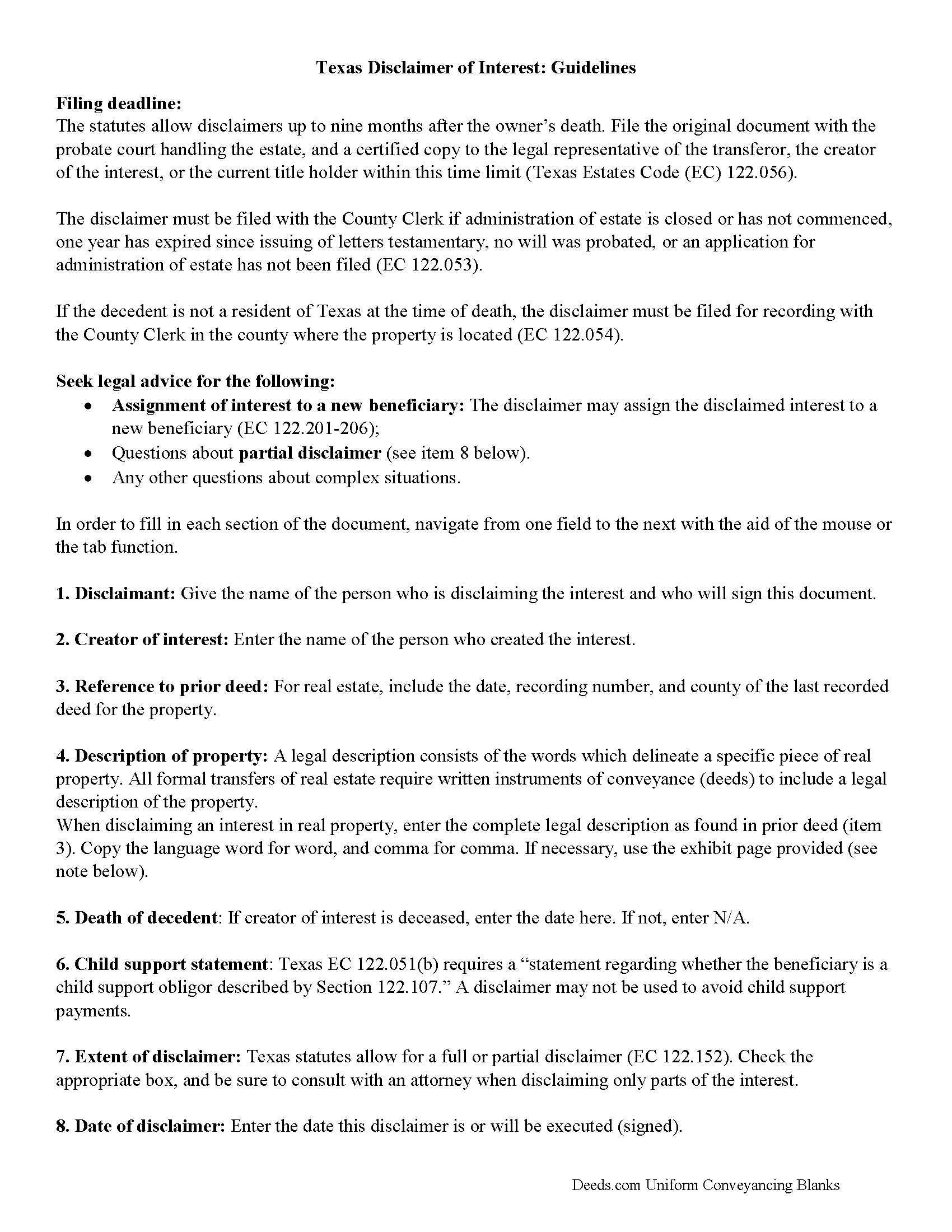

Shelby County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

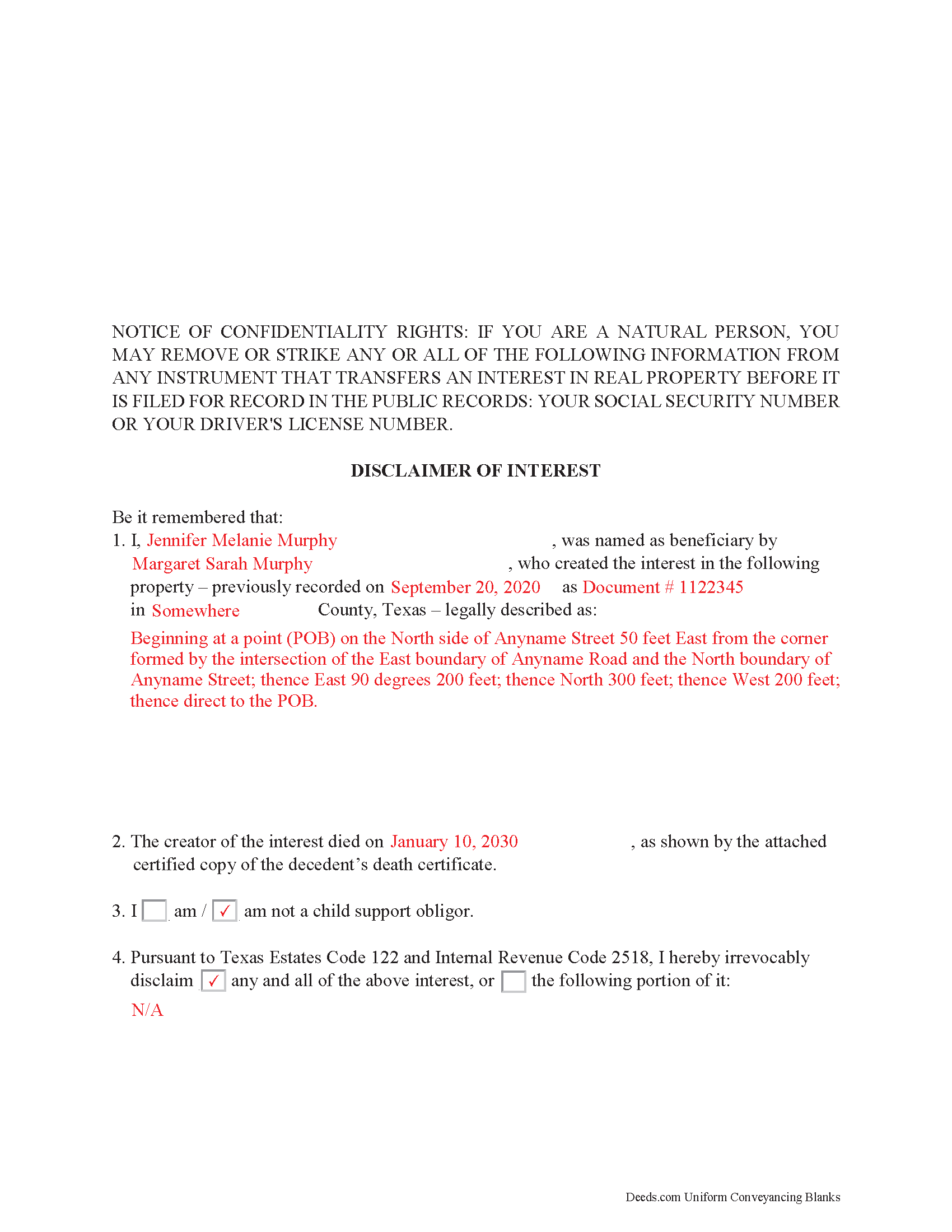

Shelby County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Shelby County documents included at no extra charge:

Where to Record Your Documents

Shelby County Clerk

Center, Texas 75935

Hours: 8:00 to 4:30 Monday through Friday

Phone: (936) 598-6361

Recording Tips for Shelby County:

- Recorded documents become public record - avoid including SSNs

- Bring extra funds - fees can vary by document type and page count

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Shelby County

Properties in any of these areas use Shelby County forms:

- Center

- Joaquin

- Shelbyville

- Tenaha

- Timpson

Hours, fees, requirements, and more for Shelby County

How do I get my forms?

Forms are available for immediate download after payment. The Shelby County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Shelby County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Shelby County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Shelby County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Shelby County?

Recording fees in Shelby County vary. Contact the recorder's office at (936) 598-6361 for current fees.

Questions answered? Let's get started!

Use the disclaimer to renounce an interest in real property in Texas.

A beneficiary in Texas can disclaim a bequeathed asset or power (Texas Estates Code, Chapter 122). Such a disclaimer, which must be in writing and signed by the beneficiary or a legally authorized representative, allows that beneficiary to renounce his or her interest in the property, either in full or partially (122.151-153). A beneficiary who is a child support obligor, however, must fulfill his obligations prior to any renunciation of an interest (122.107).

A disclaimer is irrevocable and binding for anyone who makes a claim against the beneficiary, for example, potential creditors (122.003-004). Unless the beneficiary is a charitable organization or governmental agency of the state, the document must be received within nine months after the decedent's death, or other qualifying event (122.055), and it is only valid if no actions have indicated prior acceptance of the property (122.104).

The document must be filed with the probate court in the county where the will or estate is being administered, or the county clerk if estate proceedings are closed (122.052-053). If the decedent is not a resident of the state, it must be filed with the county clerk for recording (122.054). It further must be delivered to the representative of the deceased or executor of the estate or the holder of legal title (122.056). When in doubt as to the drawbacks and benefits of renouncing the property, as well as assigning it to a subsequent beneficiary (122.201-206), consult with an attorney.

(Texas Disclaimer of Interest Package includes form, guidelines, and completed example)

Important: Your property must be located in Shelby County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Shelby County.

Our Promise

The documents you receive here will meet, or exceed, the Shelby County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Shelby County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

KATHLEEN S.

January 21st, 2021

Excellent service, great feedback and recommendations by the deed preparer, and I really appreciate the personalized service. The website is amazing, everything is well thought out, and all messages are saved, clear and easy to read. I wish my website was so easy to navigate! Seriously, the person who worked on my account is awesome. They made recommendations about what to include and what not to include. They didn't make me feel dumb for asking questions about out-of-state service and filing procedures, and I will be using Deeds.com exclusively on my cases. Five stars !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jacqueline B.

August 23rd, 2021

The service was very clear and direct. I was able to get everything I need right now. Your website is set up well. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Bradley F.

May 31st, 2021

WOW!!! Deeds.com came through with shinning colors. when I needed something recorded in a hurry and the county still shut down because of COVID, Deeds.com got the job done with very little trouble on my part and very quickly. I couldn't be happier. Will definitely recommend to anyone and everyone! Thank you to the staff for the quick work!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

YU LI K.

December 27th, 2023

Very easy to find the document I need and easy to download

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Pat K.

December 31st, 2018

It has been very easy. Like that the recording is so fast.

Thank you for your feedback. We really appreciate it. Have a great day!

Samantha S.

April 29th, 2021

I really appreciated Deeds.com. It was quick and easy to use. Saved me substantial time completing my deed recording.

Thank you for your feedback. We really appreciate it. Have a great day!

randy j.

December 15th, 2018

the deed format and fill-in language are very specific to one type of easement and are not generally applicable to any other type; in other words it is not useful in a majority of situations and i would recommend against purchase unless you are creating an easement for an appurtenant landowner ONLY

Thank you for your feedback. We really appreciate it. Have a great day!

Lori W.

July 28th, 2023

Timely, efficient and easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janice L.

April 27th, 2021

The forms were easy to request. I'm assuming that the download will be as well. Im so glad that I can upload the information without having to leave my home.

Thank you for your feedback. We really appreciate it. Have a great day!

Patrick A.

April 13th, 2019

Real value. Excellent forms, guidance & samples. Included Homestead Exemption form & info are also valuable & greatly appreciated.

Thank you for your feedback. We really appreciate it. Have a great day!

Hanne R.

November 17th, 2020

excellent

Thank you!

Andrew D.

August 12th, 2019

I was very pleased with the entire package we received. It will certainly make my job easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Kim C.

October 5th, 2020

Very user-friendly and easy to obtain exactly what I needed. I am impressed by the sample forms as well. I will definitely be using Deeds.com again!!

Thank you for your feedback. We really appreciate it. Have a great day!

Kathryn C.

February 14th, 2022

The transfer deed documents are laid out the way county offices need, but I don't like the requirements so I'm going to leave a bad review.

Well, thanks we guess.

Franklin W.

February 5th, 2019

I am not so happy. I did find and purchase the document I needed. But there is one problem. It is in Adobe PDF format only. I cannot enter information into the form.

Sorry to hear that. Sounds like you may have been trying to complete the document in your browser instead of downloading the PDF and completing it on your computer. The PDF forms are fill in the blank, that's one of the reasons we use that format.