Maverick County Executor Deed Form

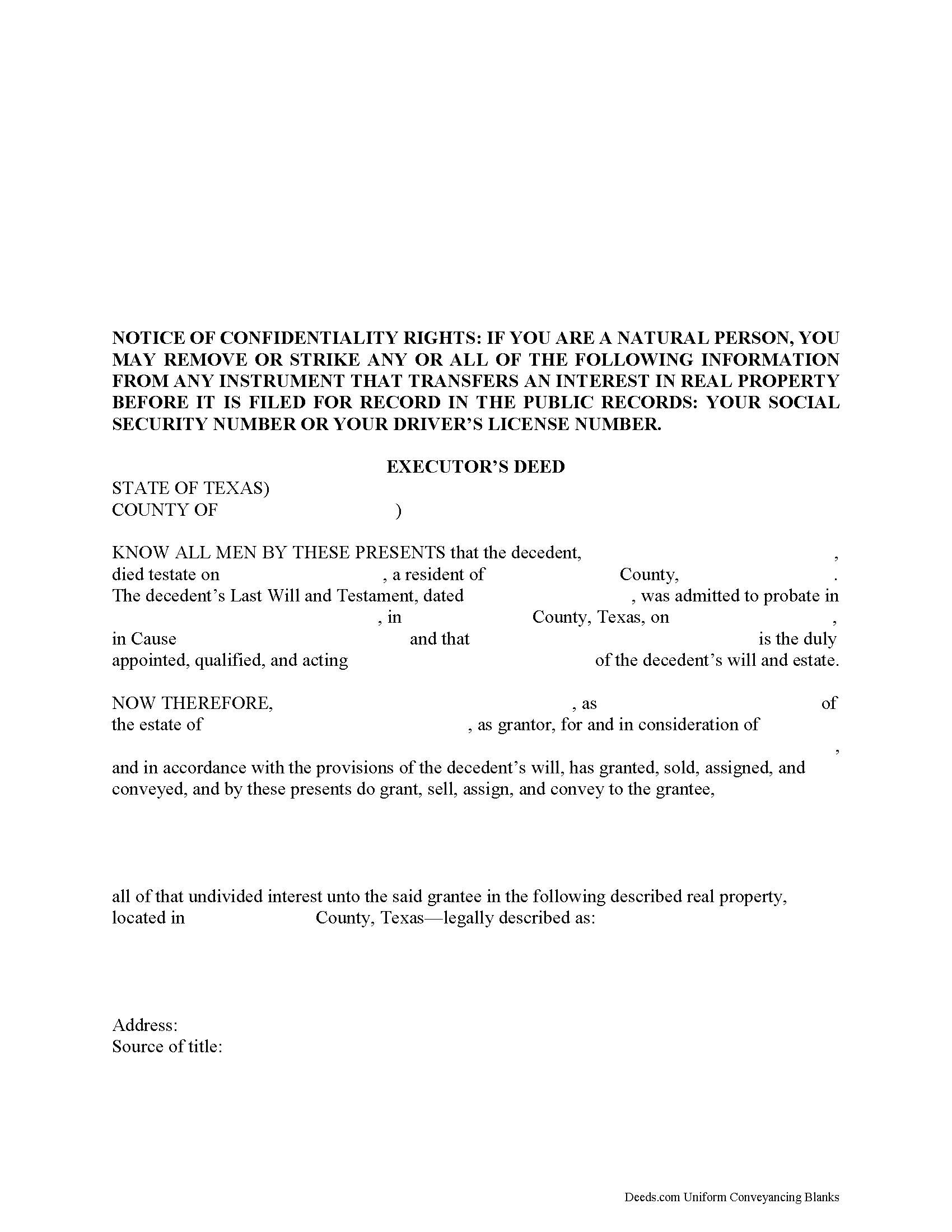

Maverick County Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

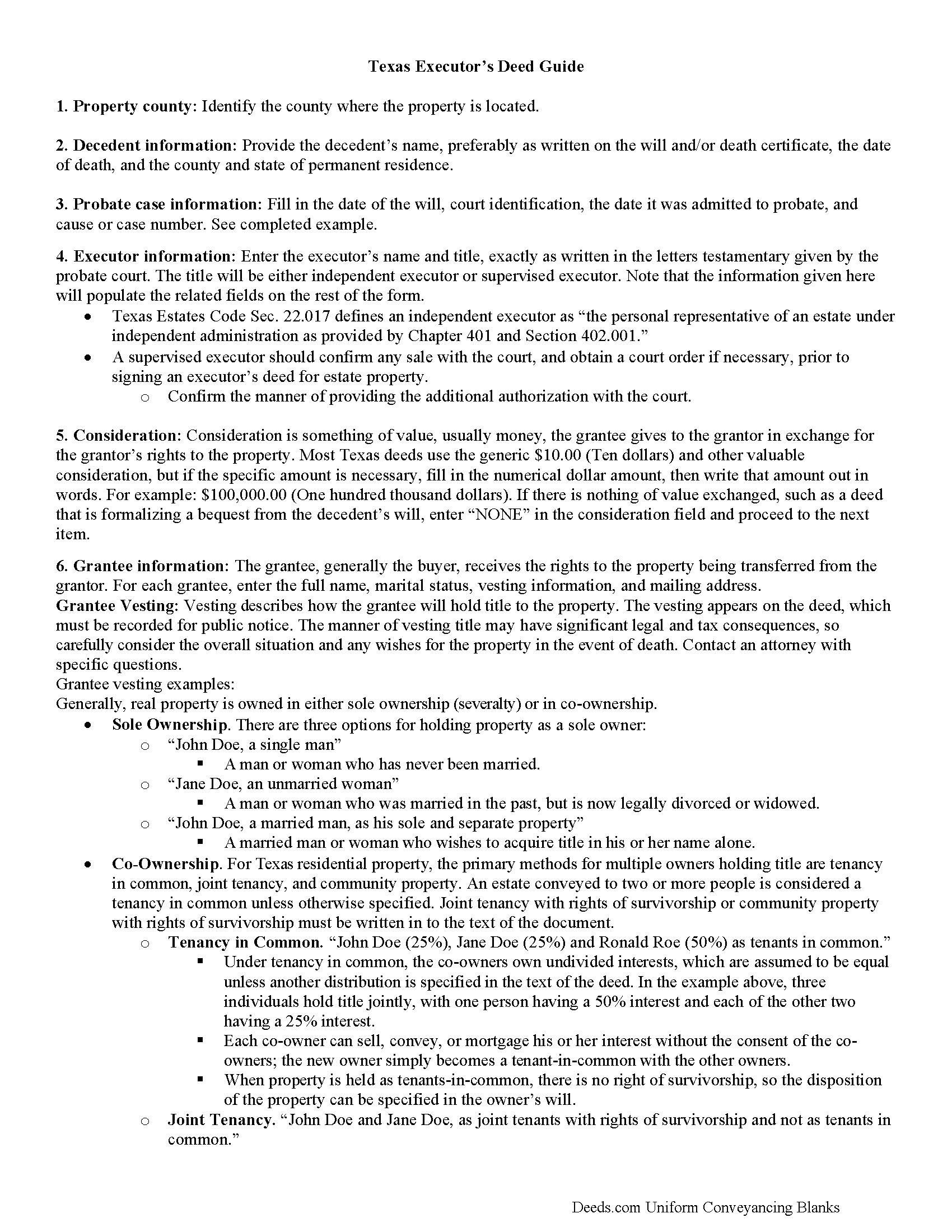

Maverick County Executor Deed Guide

Line by line guide explaining every blank on the form.

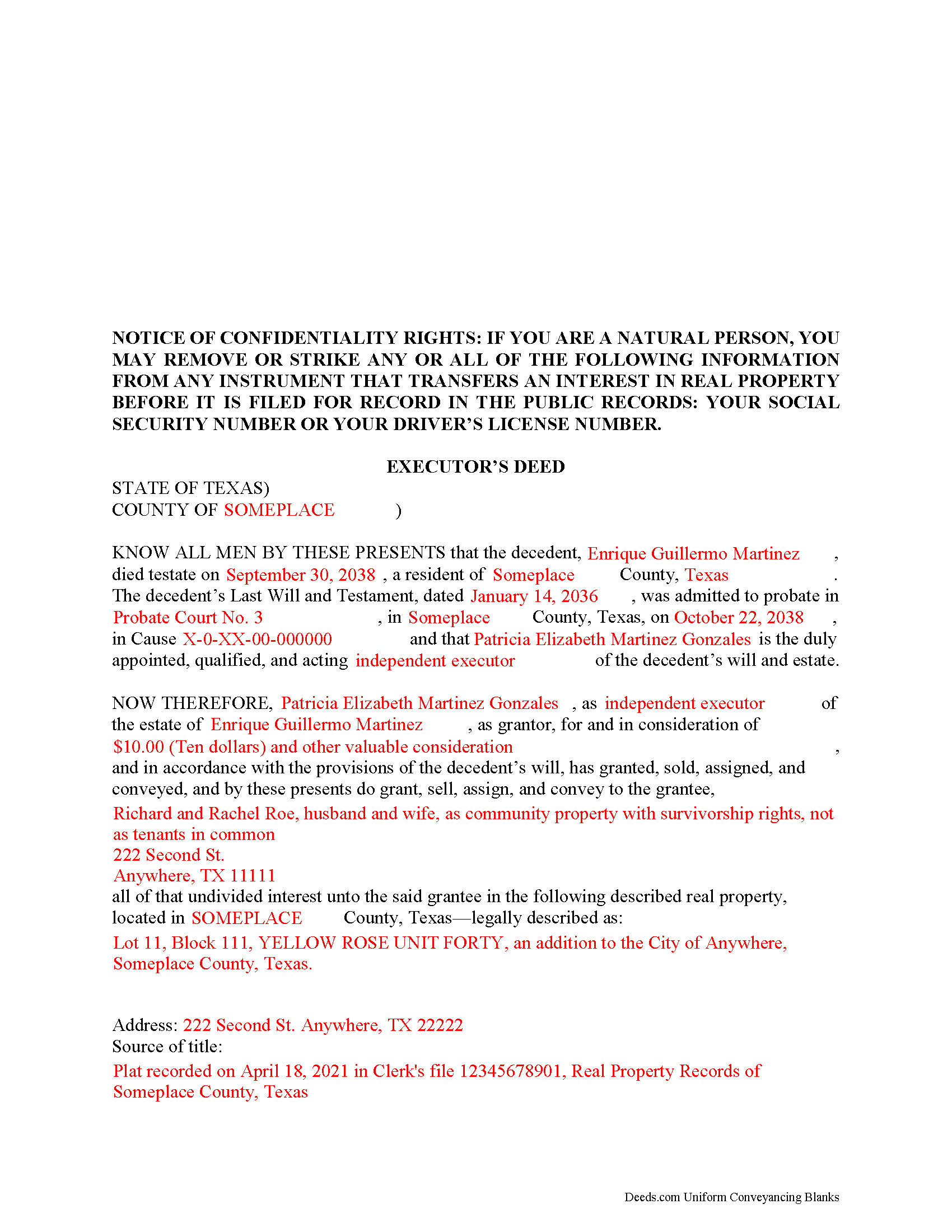

Maverick County Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Maverick County documents included at no extra charge:

Where to Record Your Documents

Maverick County Clerk Office

Eagle Pass, Texas 78852

Hours: Monday - Friday 8:00am - 4:30pm

Phone: (830) 773-2829

Recording Tips for Maverick County:

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

- Make copies of your documents before recording - keep originals safe

- Ask about their eRecording option for future transactions

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Maverick County

Properties in any of these areas use Maverick County forms:

- Eagle Pass

- El Indio

- Quemado

Hours, fees, requirements, and more for Maverick County

How do I get my forms?

Forms are available for immediate download after payment. The Maverick County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Maverick County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Maverick County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Maverick County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Maverick County?

Recording fees in Maverick County vary. Contact the recorder's office at (830) 773-2829 for current fees.

Questions answered? Let's get started!

The Texas Statutes cover the rules for selling a decedent's property from a probate estate in Chapter 356 of the Estates Code.

When a will is admitted to probate, the court officer authorizes an executor to manage, and eventually close, the estate. Among other duties, this involves identifying the assets and liabilities, paying the bills, and distributing property according to the terms specified in the will.

Many estates contain real property. Depending on the circumstances, the executor might transfer the title to heirs as directed in the decedent's will or sell the property outright. In any case, the executor must issue a deed for the transfer. Note that executor's deeds do NOT typically include a general warranty on the title. The executor may offer a special warranty, meaning that he has the right to sell the property, and will only defend the title against claims on his actions.

An executor's deed is used by executors who are authorized by the Probate Court to transfer real property out of an estate. These instruments must meet the same requirements as a warranty deed or quitclaim deed, plus include additional information about the probate case. Sometimes, the executor must also include supporting documentation such as copies of the letters testamentary, the will, signatures from heirs or beneficiaries, etc.

Settling probate estates can be complicated, so take the time to understand the issues. Before buying or selling real property from an estate, review all the risks and benefits, and contact an attorney with questions.

(Texas Executor Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Maverick County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Maverick County.

Our Promise

The documents you receive here will meet, or exceed, the Maverick County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Maverick County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Larry B.

September 30th, 2020

Clear Directions; worked well.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Hamed T.

January 12th, 2022

Easy Process! Realy recommend them for E-Recording!

Thank you for your feedback. We really appreciate it. Have a great day!

Alex Q.

July 26th, 2023

The best people to work with! Thank you for all you do. We send documents from all states to Deeds.com to record for us. They are professional, keep us updated and always notify us if there is an issue with one of our documents prior to sending to recording and that saves us money and time! Thank you!!

Thanks for the kind words Alex. We appreciate you!

David C.

July 21st, 2021

I was very impressed. Your program makes it very user friendly which is a must for most of the public . I have recommended this site to various clients for estate planning documents with simple estates.

Thank you!

Chuck M.

May 30th, 2019

Easy to use service. However, the product that I purchased did not meet my needs. No fault of the company.

Thank you for your feedback Chuck. We certainly don't want you to purchase something you can not use. We have canceled your order and payment. Have a wonderful day.

Kyle K.

June 10th, 2020

Very quick and simple process! Will be using this service much more.

Thank you!

Melody P.

May 13th, 2021

Thank you for getting our docs recorded so quickly and efficiently! Great and dependable service, as always!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RAYMOND W.

March 20th, 2019

Thank you for the comprehensive forms - very much appreciated!

Thank you Raymond.

David B.

May 16th, 2024

Prompt review and submission of documents could be an appropriate tagline for this business. The attention to detail and rapid response makes the company a great go to for servicing needs related to deeds.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Pamela G.

November 18th, 2020

I have an apple phone. I could not fill in the form to pay because apple phones do not have a dash that can be used when the field requires a phone number with a dash. I had to borrow an android phone in which the telephone keypad had a dash that could be used. It was easy to pay using an android phone but impossible to pay using an apple phone. Remove the requirement for dashes to allow apple phones to use this service.

Thank you!

Alan G.

October 28th, 2021

Using www.deeds.com was super ez even for a non-technical person like me, it saved me lots of time and the instructions and communications were great,I was able to file my deed online in half a day with most of that time taken up by the jurisdiction I filed with processing my submittal. I will use it again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tracey H.

November 10th, 2020

The transaction was easy and the download was immediately, What a great service to provide for a reasonable price. I highly recommend this service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandra G.

January 3rd, 2019

We were referred to the site by banking friend. It does take time to read through and figure out what a person needs, form-wise, to accomplish the goal. Once that was decided, check out and the download was very easy. What a great savings in cost and time.

Thank you Sandra, glad we could help. Also, please thank your friend for us. Have a wonderful day.

Frazer W.

December 19th, 2024

Deeds.com does a great job getting our legal documents filed with the D.C. Recorder of Deeds. Frazer Walton, Jr. Law Office of Frazer Walton, Jr.

Your appreciative words mean the world to us. Thank you.

Gerald G.

September 16th, 2020

I am researching forms required to change deed from joint owners to individual. Subsequently, forms required when/after a trust is established for real property.

Thank you!