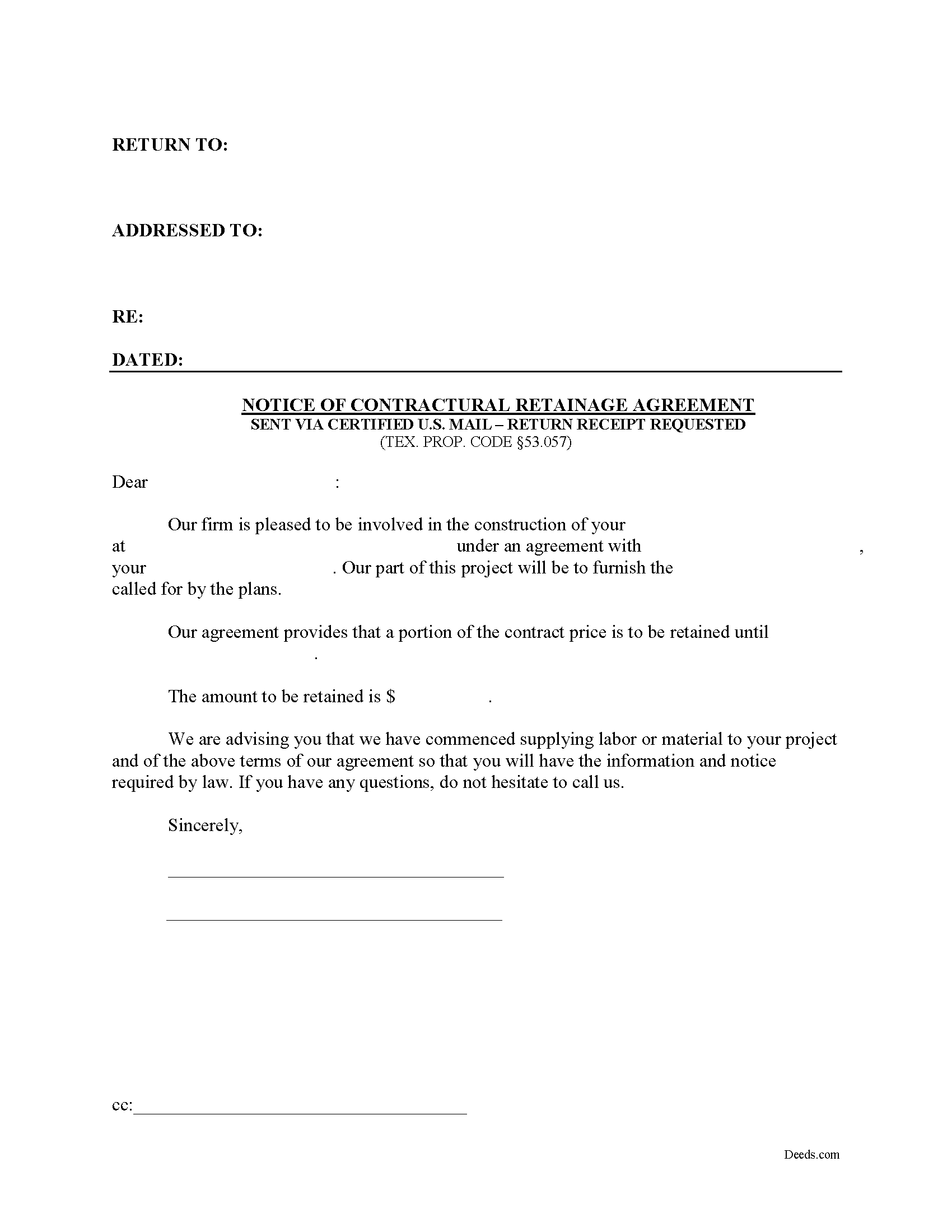

Erath County Notice of Contractual Retainage Form

Erath County Notice of Contractual Retainage Form

Fill in the blank Notice of Contractual Retainage form formatted to comply with all Texas recording and content requirements.

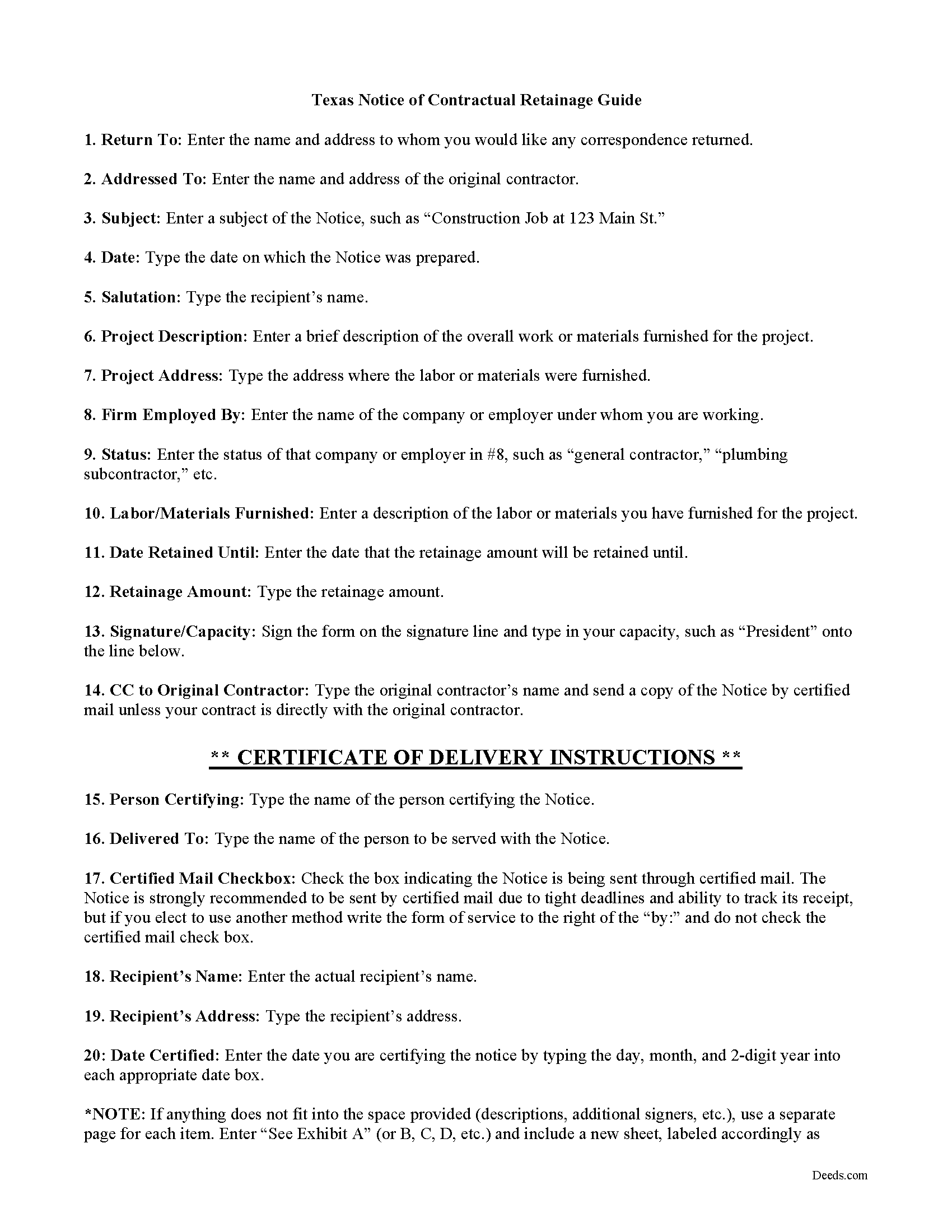

Erath County Notice of Contractual Retainage Guide

Line by line guide explaining every blank on the form.

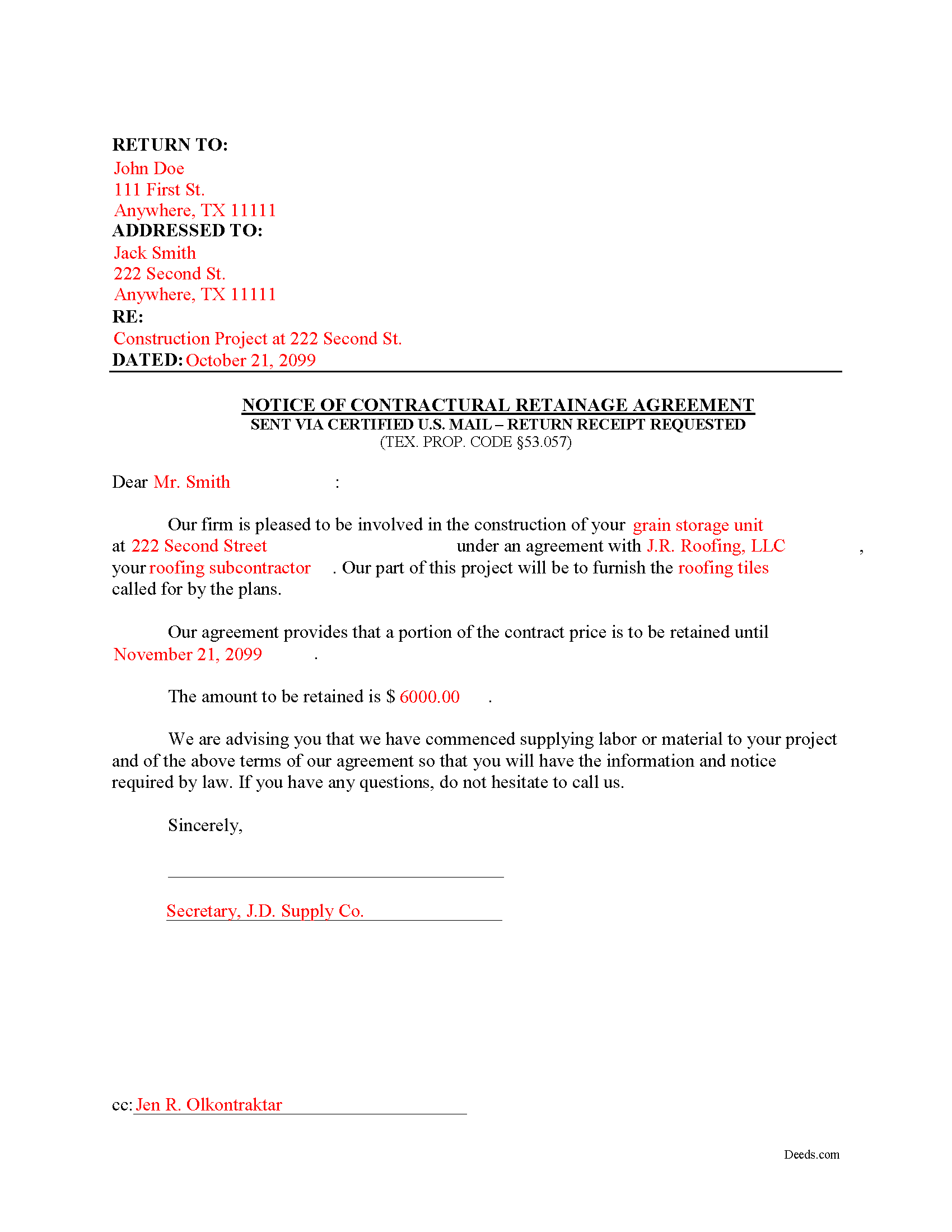

Erath County Completed Example of the Notice of Contractual Retainage Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Erath County documents included at no extra charge:

Where to Record Your Documents

Erath County Clerk

Stephenville, Texas 76401-4255

Hours: Monday-Friday 8:00am-4:00pm

Phone: (254) 965-1482

Recording Tips for Erath County:

- White-out or correction fluid may cause rejection

- Check margin requirements - usually 1-2 inches at top

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Erath County

Properties in any of these areas use Erath County forms:

- Bluff Dale

- Dublin

- Lingleville

- Morgan Mill

- Stephenville

Hours, fees, requirements, and more for Erath County

How do I get my forms?

Forms are available for immediate download after payment. The Erath County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Erath County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Erath County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Erath County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Erath County?

Recording fees in Erath County vary. Contact the recorder's office at (254) 965-1482 for current fees.

Questions answered? Let's get started!

As a contractor, it's important to send out early notice forms shortly after beginning work on a construction job. By putting all interested parties on notice, claimants can help protect their lien rights. One important early notice form is called a Notice of Contractual Retainage, as defined at Sec. 53.057 of the Texas Property Code.

Retainage means an amount representing part of a contract payment that is not required to be paid to the claimant within the month following the month in which labor is performed, material is furnished, or specially fabricated material is delivered. TEX. PROP. CODE 53.001(11). Simply put, it is a portion of the agreed upon contract price that is deliberately withheld until the work reaches substantial completion to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. If the job is not up to par, the retainage amount is used to make any changes or fixes.

Give this notice to all other interested parties to make them aware that the person who hired you is withholding a retainage amount from you under your contract. Therefore, once provided with the notice, the other parties above you can withhold a matching retainage amount. If you are an original contractor on the job, the notice is not required since the owner already has such notice of any retainage agreement.

Use this form if you do not have a direct contract with the owner or the original contractor. Thus, you need to provide this notice to these parties to make them aware of the existing retainage agreement. The claimant must give the owner or reputed owner the notice of contractual retainage no later than the earlier of: (a) the 30th day after the date the claimant's agreement providing for retainage is completed, terminated, or abandoned; or (b) the 30th day after the date the original contract is terminated or abandoned. TEX. PROP. CODE 53.057(b).

The Notice of Contractual Retainage does not need to be notarized or recorded. Instead, deliver it to relevant parties via certified or registered US mail, with return receipt requested.

Each case is unique, and the Texas lien law is complicated. Contact an attorney for complex situations, with specific questions about sending a notice of contractual retainage, or any other issue about mechanic's liens.

Important: Your property must be located in Erath County to use these forms. Documents should be recorded at the office below.

This Notice of Contractual Retainage meets all recording requirements specific to Erath County.

Our Promise

The documents you receive here will meet, or exceed, the Erath County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Erath County Notice of Contractual Retainage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Joanne H.

February 14th, 2022

easy to download and use. this document. thank you

Thank you!

william l H.

June 26th, 2021

Just downloaded package , fast and quick and all the info i will need to complete my deed. Thanks again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sherry F.

January 5th, 2019

Good product and service.

Thank you!

Mary Ann G.

April 16th, 2019

Couldn't find the deed form that I needed. Needs to have a short summary to determine the correct form.

Sorry to hear that Mary Ann, we appreciate your feedback.

Dawn L.

May 26th, 2022

Not totally satisfied as unable to edit as needed on signature page of the deed. I want to be able to date the document and don't want the verbage "signed, sealed and delivered in the presence of" to appear and cannot remove it. The notary will make his or her own statement below as to the date executed.

Thank you for your feedback. We really appreciate it. Have a great day!

Melissa L.

August 26th, 2022

Exactly what I was looking for and easy to fill out.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy D.

July 30th, 2019

Program works well. Saves a lot of time trying to find out what you need to do.

Thank you!

Melvin L.

June 8th, 2022

So easy, very simple to use. I was very pleased with the service Deeds provided. Would definely use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debbie C.

July 21st, 2020

Wonderful forms and service.

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah Anne C.

July 16th, 2024

Easy, Comprehensive and most importantly Easy!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandra H.

February 26th, 2019

I am a retired attorney. I chanced upon this website while looking for a Florida Lady Bird Deed Form. It conforms to Florida Law and was exactly what I needed. The forms are easy to obtain and even easier to use and print out.

Thank you so much Sandra, we really appreciate your feedback.

George T.

August 10th, 2019

Very good. Thanks.

Thank you!

Jennifer A M.

March 6th, 2021

Great service; very easy and simple, especially as an individual that needed only one (1) document recorded with my municipality.

Thank you!

Dee S.

July 18th, 2019

This was easy and much cheaper than getting a lawyer. Thanks! - From alabama

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jonathan F.

September 4th, 2020

An excellent service. Makes filing deeds so much easier than having to go to the courthouse or use FedEx. I will be a customer for the rest of my legal career.

Thank you!