Collin County Quitclaim Deed Form

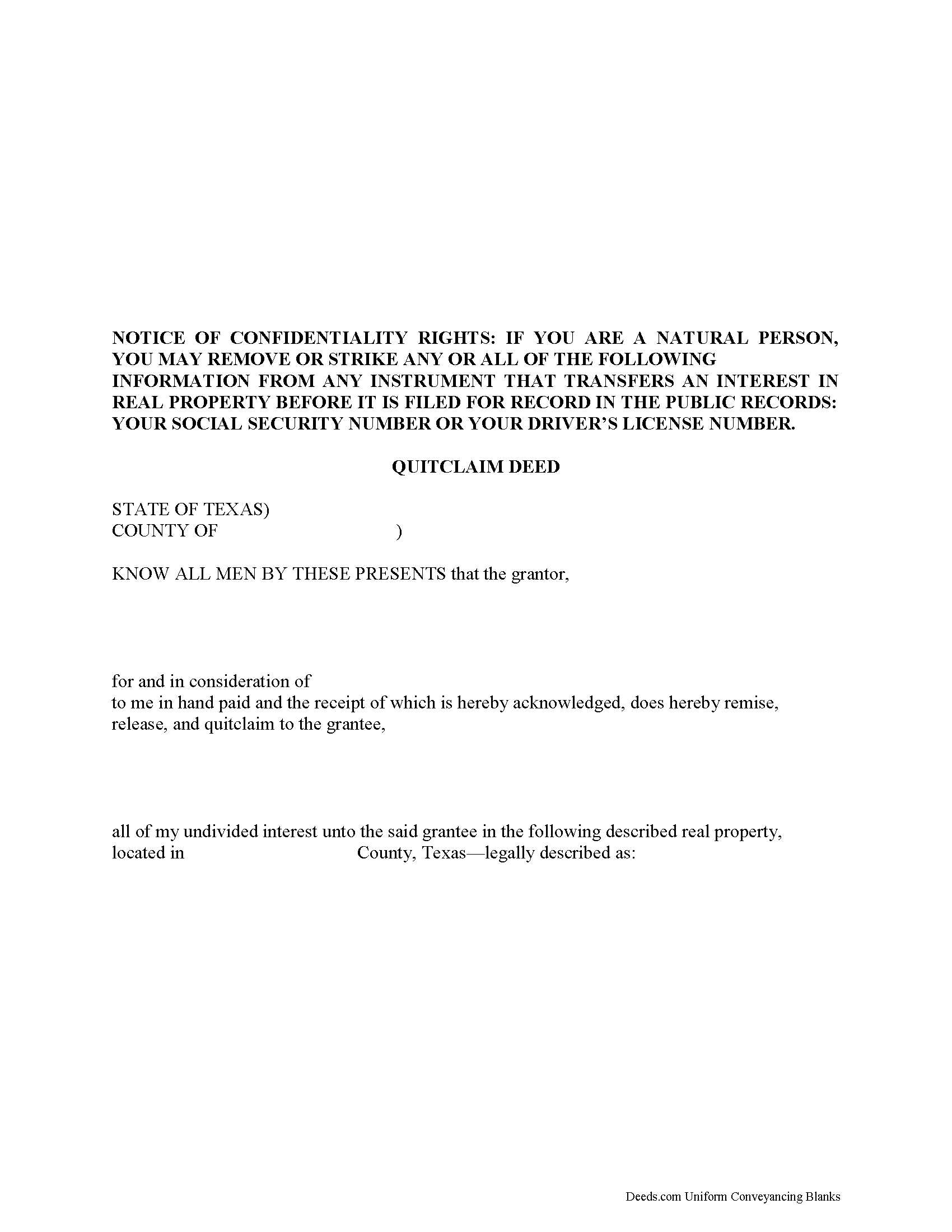

Collin County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Texas recording and content requirements.

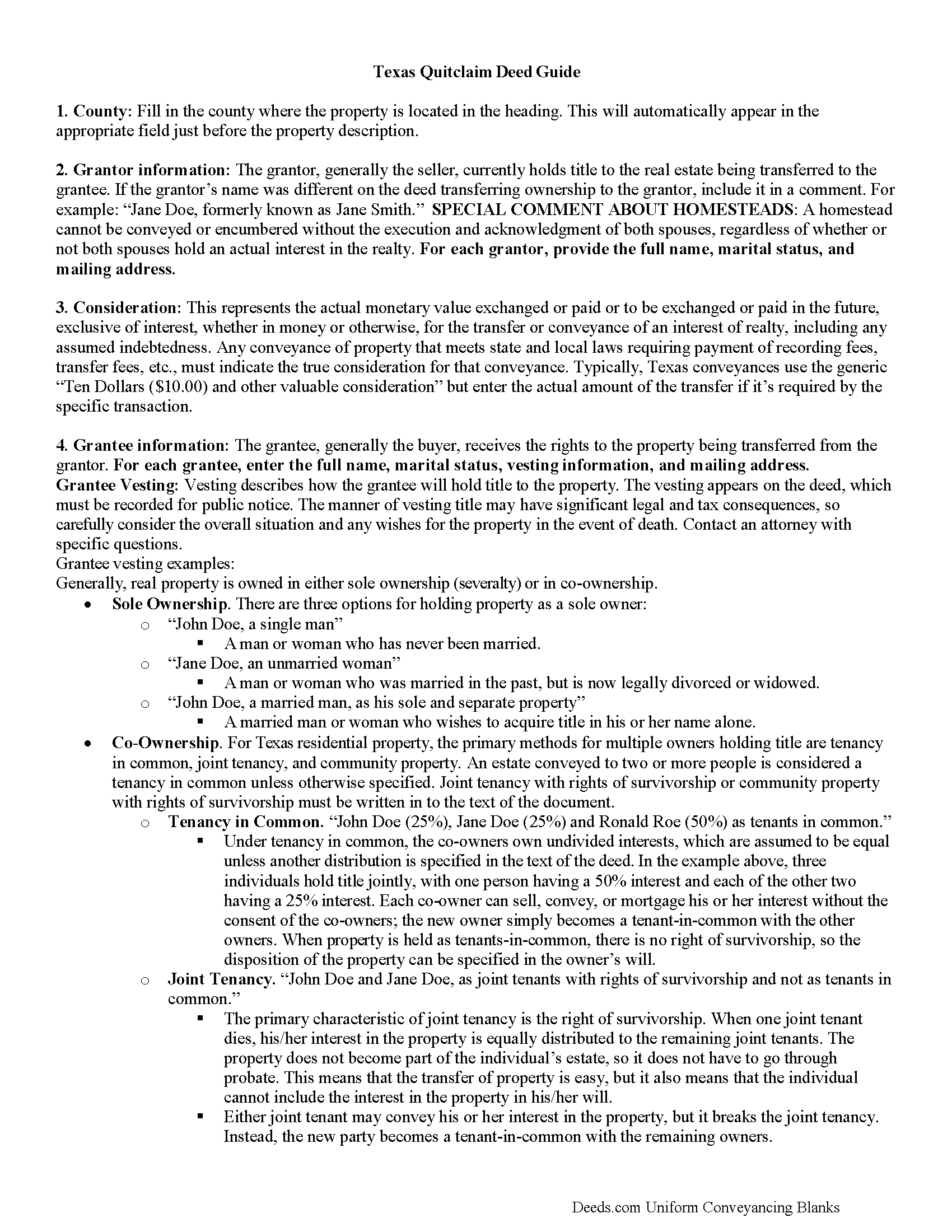

Collin County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

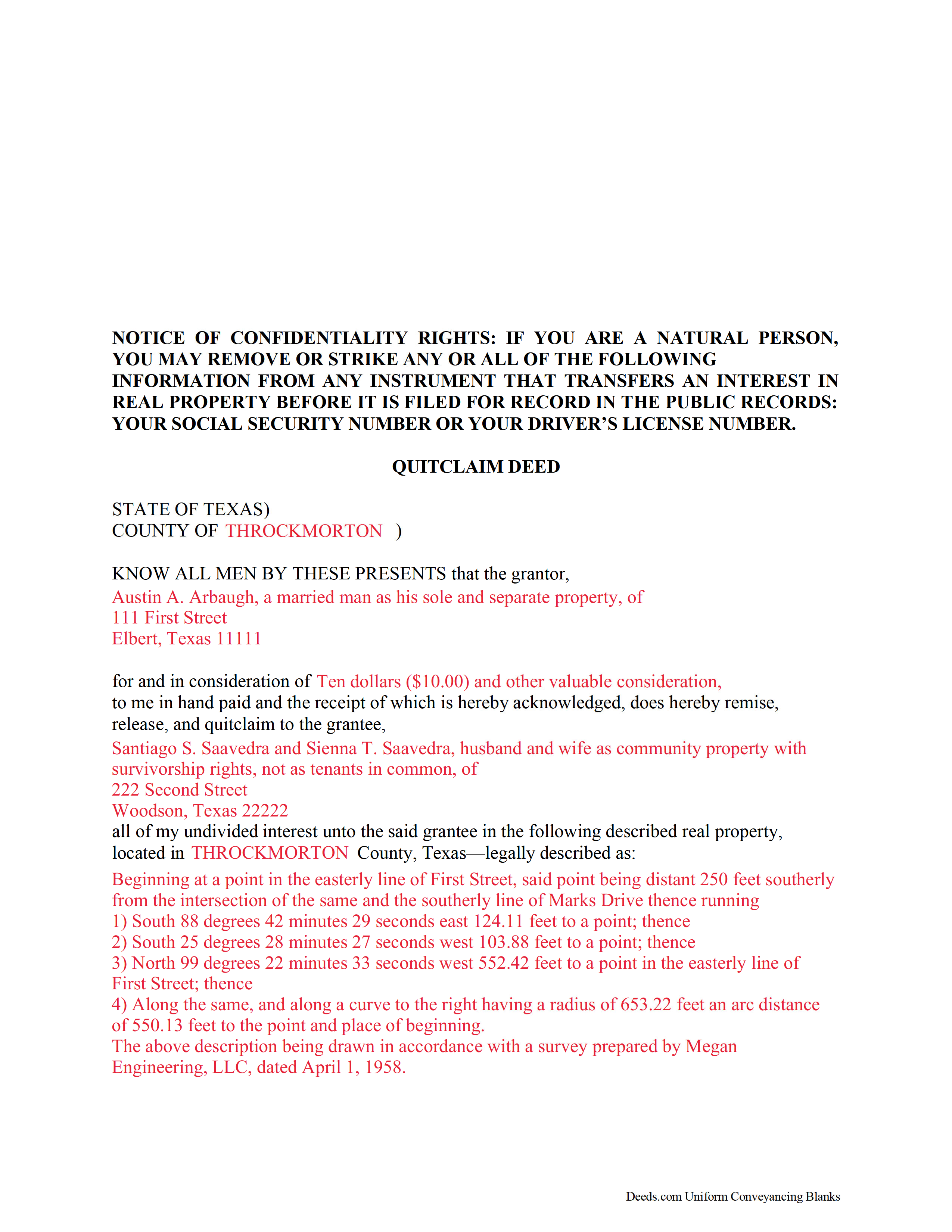

Collin County Completed Example of the Quitclaim Deed Document

Example of a properly completed Texas Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Collin County documents included at no extra charge:

Where to Record Your Documents

Collin County Clerk

McKinney, Texas 75071

Hours: 8:00 to 4:30 M-F

Phone: 972-548-4185 (McKinney) 972-424-1460 ext. 4185 (Metro)

Recording Tips for Collin County:

- Verify all names are spelled correctly before recording

- Both spouses typically need to sign if property is jointly owned

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Collin County

Properties in any of these areas use Collin County forms:

- Allen

- Anna

- Blue Ridge

- Celina

- Copeville

- Dallas

- Farmersville

- Frisco

- Josephine

- Lavon

- Mckinney

- Melissa

- Nevada

- Plano

- Princeton

- Prosper

- Westminster

- Weston

- Wylie

Hours, fees, requirements, and more for Collin County

How do I get my forms?

Forms are available for immediate download after payment. The Collin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Collin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Collin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Collin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Collin County?

Recording fees in Collin County vary. Contact the recorder's office at 972-548-4185 (McKinney) 972-424-1460 ext. 4185 (Metro) for current fees.

Questions answered? Let's get started!

A quitclaim deed in Texas is recordable once it has been acknowledged, sworn to with a proper jurat, or proved according to law. The grantor to the quitclaim deed must sign and acknowledge the instrument. If the grantee's address is not included in the deed, the recording party may face penalty fees. There may also be formatting standards and specific guidelines as to the type of information that should be included in a quitclaim deed presented for recording in Texas.

An unrecorded quitclaim deed is binding only to the parties involved, the party's heirs, and a subsequent purchaser who does not pay a valuable consideration or who has notice of the instrument (Tex. Prop. Code Ann. 13.001 b). The recording act in Texas states that any conveyance or interest in real property (i.e. a quitclaim deed) is void against creditors and subsequent purchasers for valuable consideration without notice unless the instrument has been acknowledged, sworn to, or proved and filed for record according to law. A quitclaim deed that is properly recorded in the proper county in Texas will provide notice to the public of the existence of the instrument and will also be subject to public inspection (Tex. Prop. Code Ann. 13.002).

(Texas Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Collin County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Collin County.

Our Promise

The documents you receive here will meet, or exceed, the Collin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Collin County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Nancy C.

July 14th, 2019

Amazing every that you need right at your fingertips. Extremely easy to navigate and very informative. I would highly recommend this site!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shelton S.

April 9th, 2025

This site provided everything I needed to get the job done. Next step is a trip to the County Clerk!

We deeply appreciate the trust you have placed in our services. Thank you for your valuable feedback and for choosing us.

Melissa S.

March 24th, 2024

Simple & easy to navigate. At time of writing this, guide & example of purchased deed is included. Plus lots of extra information to help secure your property. Would recommend to anyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bradley B.

December 20th, 2020

This was a good way to find the owners of land located in the middle of some that I owned. The experience was fairly easy and the cost reasonable.

Thank you!

Roy T.

April 3rd, 2020

Thank you for an easy to use system. I was able to find all the information I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David K.

August 9th, 2021

My 1st trip to your site. I give it a full 5-star rating! Thank you. I'll be back.

Thank you for your feedback. We really appreciate it. Have a great day!

Cindy A.

August 28th, 2025

Needed a deed and the form provided with example and guide were of the most help. Thank you

Thank you, Cindy! We’re so glad the form, example, and guide were helpful in getting your deed taken care of. We appreciate your feedback!

Jenni R.

April 19th, 2023

Dry convenient and had just the form I needed and included directions, filled out sample form and other resources. Will recommend and use again if needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael C.

January 16th, 2019

I would appreciate being able to increase the size of the blocks such as the Grantor block and the legal description block where information is enter on the form and to adjust the font. Otherwise great product,

Thank you for your feedback Michael. We do wish we could make that an option. Unfortunately, adhering to formatting requirements (specifically margin requirements) leaves a finite amount of space available on the page.

Walton A.

February 3rd, 2022

Thanks ..this was very helpful and easy!

Thank you!

TIFFANY C.

May 20th, 2020

It would be nice if the notary State was fillable, we are having to notarize in another State. Also, need more room to add 2 beneficiaries with two different addresses.

Thank you for your feedback. We really appreciate it. Have a great day!

ROBERT L.

April 1st, 2019

I got a blank, a sample and detailed instructions, I'm happy. If the recorder's office had a form as they like to see, with your name as they like to see, and the property name as they like to see, no one would ever pay a lawyer for this but a little time to look up the exact names and this package you're all set. I recommend this because, while it isn't difficult, making a mistake could be very bad so getting the details right for a particular county is well worth the cost.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jeffery W.

August 25th, 2020

Great service!

Thank you!

Ronnie W T.

September 16th, 2022

Very fast and efficient as soon as we paid for the document, it was downloaded to us immediately.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Corinne S.

December 3rd, 2019

Did not need power to "serve" contractor. All work done well, paid for, nothing more. Worth noting when things could go awry!

Thank you!