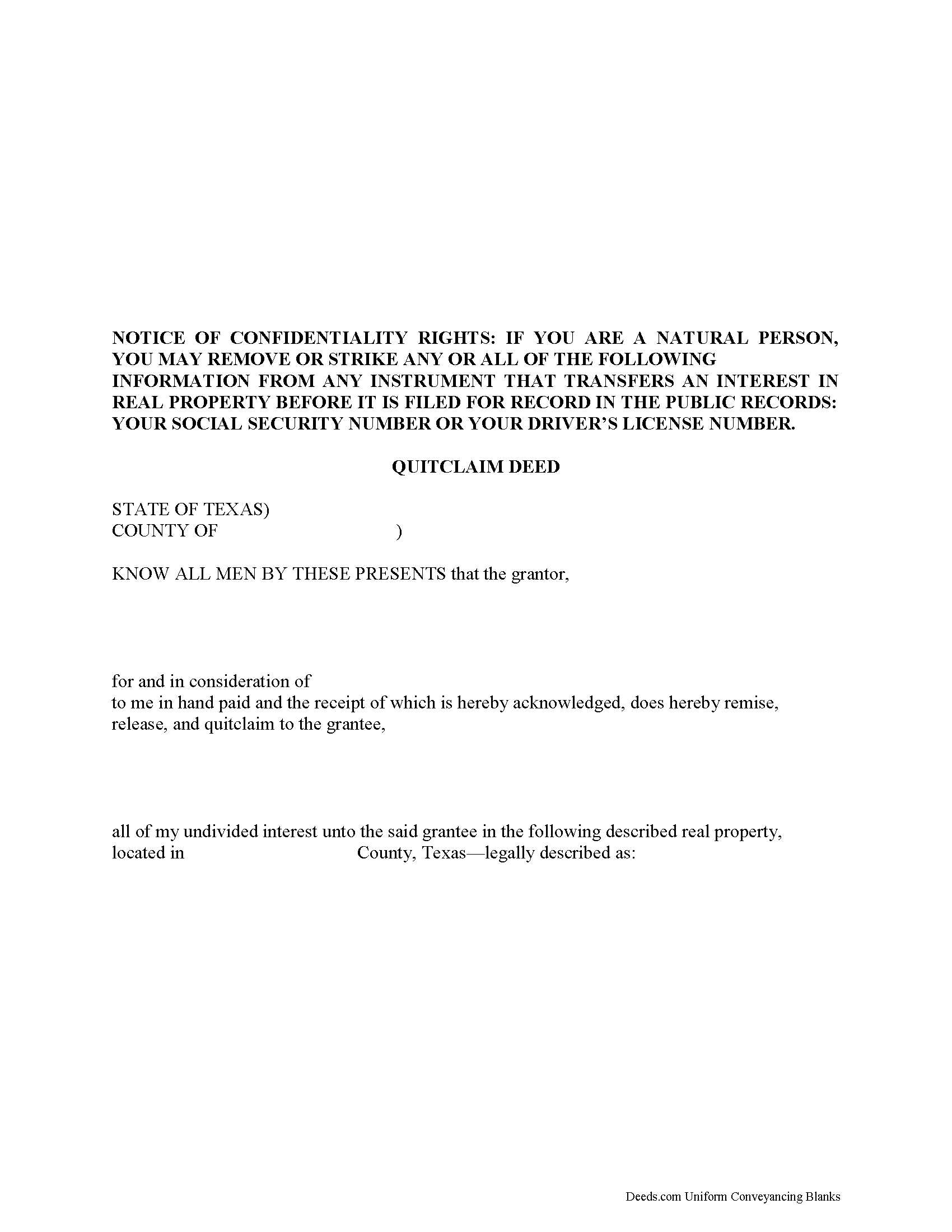

Johnson County Quitclaim Deed Form

Johnson County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Texas recording and content requirements.

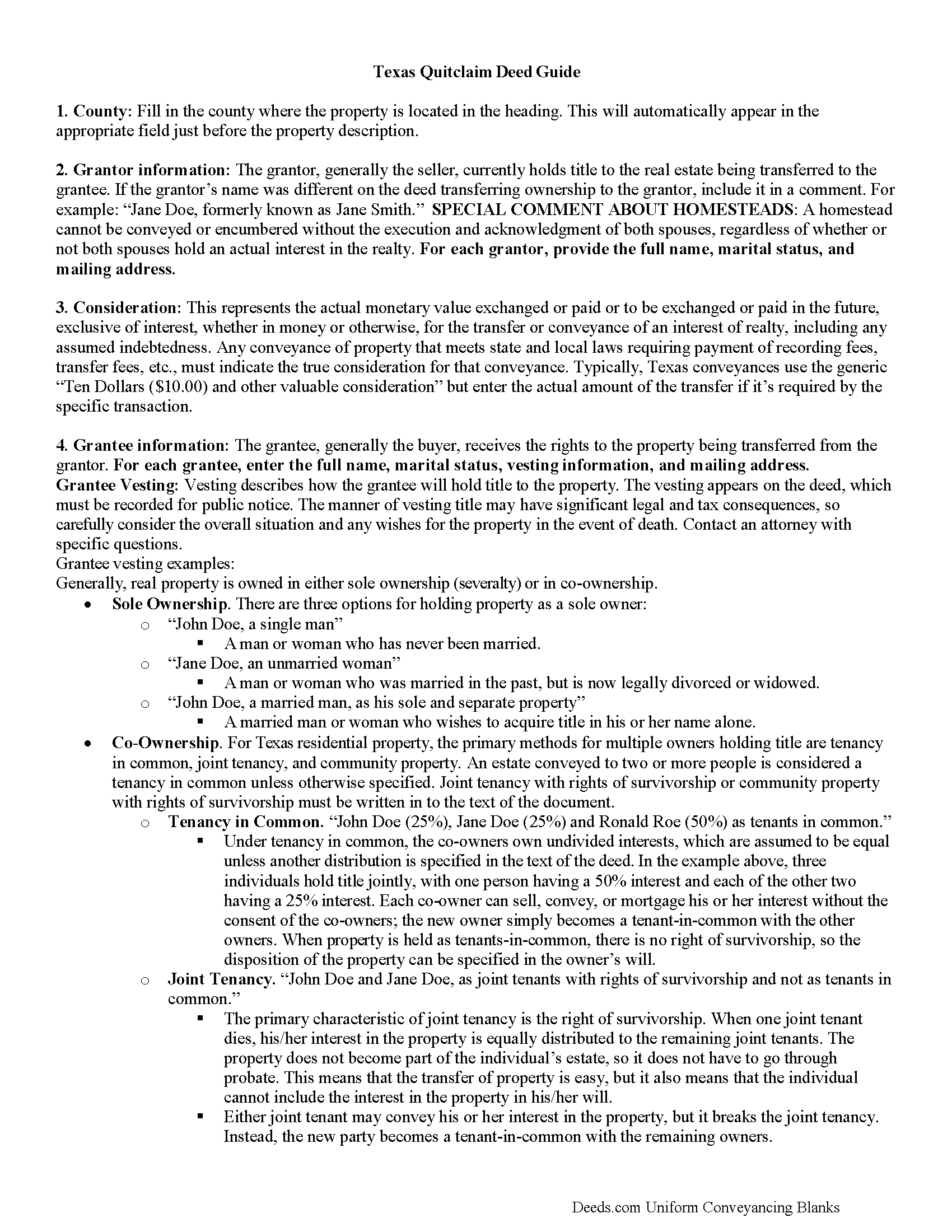

Johnson County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

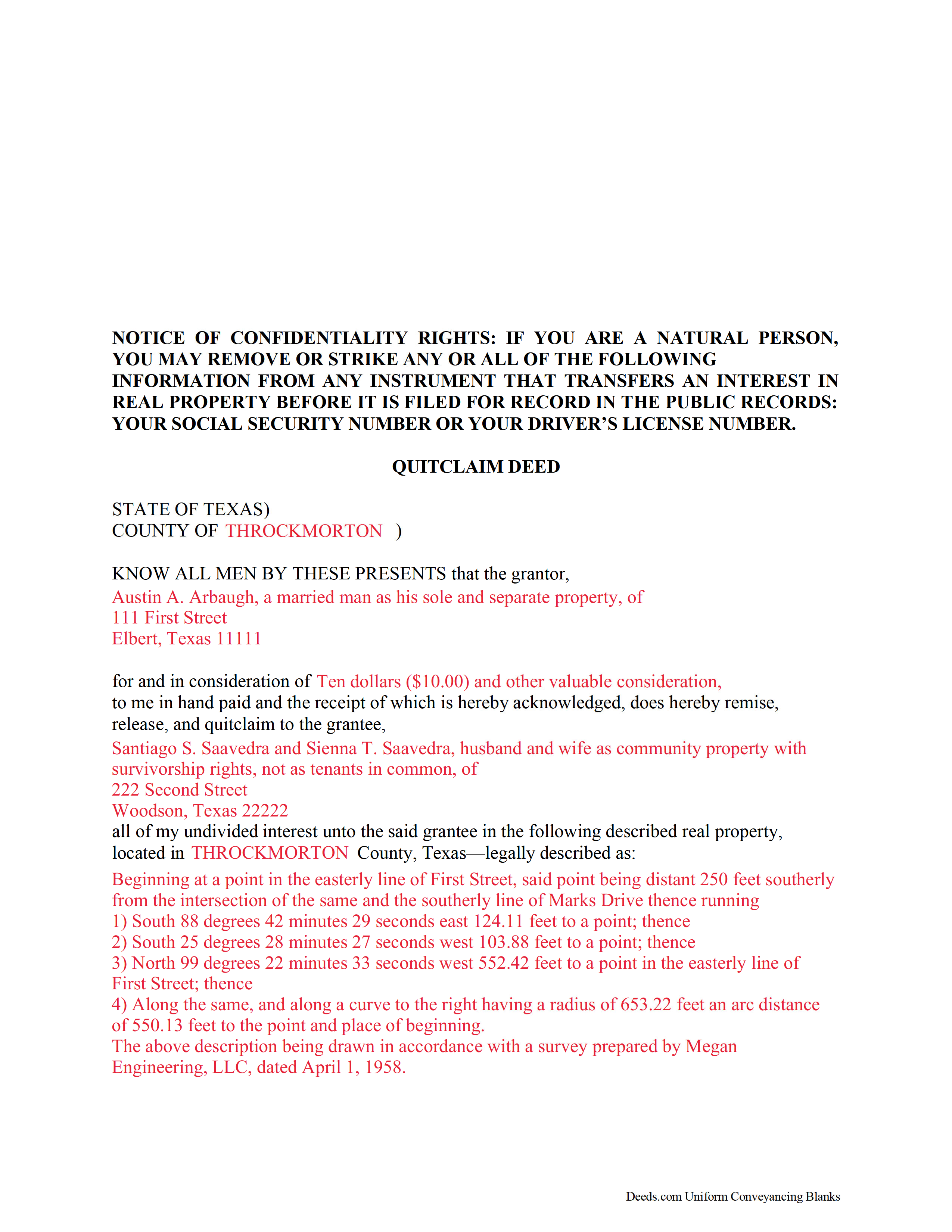

Johnson County Completed Example of the Quitclaim Deed Document

Example of a properly completed Texas Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Johnson County documents included at no extra charge:

Where to Record Your Documents

Johnson County Clerk

Cleburne, Texas 76033

Hours: 8:00am to 4:30pm M-F

Phone: (817) 202-4000 x1625 or 556-6310

Recording Tips for Johnson County:

- Documents must be on 8.5 x 11 inch white paper

- Check margin requirements - usually 1-2 inches at top

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Johnson County

Properties in any of these areas use Johnson County forms:

- Alvarado

- Burleson

- Cleburne

- Godley

- Grandview

- Joshua

- Keene

- Lillian

- Rio Vista

- Venus

Hours, fees, requirements, and more for Johnson County

How do I get my forms?

Forms are available for immediate download after payment. The Johnson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Johnson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Johnson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Johnson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Johnson County?

Recording fees in Johnson County vary. Contact the recorder's office at (817) 202-4000 x1625 or 556-6310 for current fees.

Questions answered? Let's get started!

A quitclaim deed in Texas is recordable once it has been acknowledged, sworn to with a proper jurat, or proved according to law. The grantor to the quitclaim deed must sign and acknowledge the instrument. If the grantee's address is not included in the deed, the recording party may face penalty fees. There may also be formatting standards and specific guidelines as to the type of information that should be included in a quitclaim deed presented for recording in Texas.

An unrecorded quitclaim deed is binding only to the parties involved, the party's heirs, and a subsequent purchaser who does not pay a valuable consideration or who has notice of the instrument (Tex. Prop. Code Ann. 13.001 b). The recording act in Texas states that any conveyance or interest in real property (i.e. a quitclaim deed) is void against creditors and subsequent purchasers for valuable consideration without notice unless the instrument has been acknowledged, sworn to, or proved and filed for record according to law. A quitclaim deed that is properly recorded in the proper county in Texas will provide notice to the public of the existence of the instrument and will also be subject to public inspection (Tex. Prop. Code Ann. 13.002).

(Texas Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Johnson County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Johnson County.

Our Promise

The documents you receive here will meet, or exceed, the Johnson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Johnson County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Roger G.

October 25th, 2019

Straight to the point and easy to use site.

Thank you!

Audrey T.

August 18th, 2020

The info was good for the money, but not all that I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin V.

January 5th, 2022

Quick and trouble free experience!

Thank you for your feedback. We really appreciate it. Have a great day!

Kenneth-Wayne L.

August 20th, 2020

1) I was very pleased when the staff mentioned your service since the three referenced on the Recorder's website all wanted HUGE Account set-up and maintenance fees AND BIG fees per recording, and yours has no set-up fee AND nominal per-recording fee; 2) My (few) recordings will be NON-LAND Related, summary or entire record(s) of Administrative (Procedures Act) records, Other than the Border width and Cover Sheet, do you anticipate any other special requirements for such recording(s)? NOTE: I just sent one by Snail Mail, and they just informed me that due to the GERMIPHOBIA 'Pandemic' the ONLY open and record Snail Mail ONCE A MONTH On the first of each chmonth!

Thank you!

Pamela S.

January 6th, 2021

Great experience! Instructions are very clear and thorough. The completeness of the instructions really inspired confidence. Within minutes of uploading my document, I received a message that it had been prepared and submitted to the county for recording. Makes it so simple! Well worth it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cynthia D.

May 22nd, 2021

It turned out I didn't need the information was taken care of by my husband. Thank you.

Thank you!

Stephen B.

May 9th, 2020

They have been fabulous not only for getting me the Title and Property info I needed quickly, but also for determining which Deed (of many) that I actually needed. They are an outstanding resource for any real estate investor, property owner, Realtor, or attorney.

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel L.

February 11th, 2022

You could make instructions clearer on the download process and when download is complete. You could also group things together for 1 or 2 "big" downloads.

Thank you for your feedback. We really appreciate it. Have a great day!

Todd B.

October 9th, 2020

very quick and easy

Thank you!

Janice T.

September 14th, 2020

The downloads were a great help in understanding of both what a Warranty Deed was and how to follow the steps as well as filling out the forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Dan M.

November 8th, 2024

Quick ... Easy ... Great Instructions ... Easy Peasy ...

We are grateful for your feedback and looking forward to serving you again. Thank you!

ROBERT L.

April 1st, 2019

I got a blank, a sample and detailed instructions, I'm happy. If the recorder's office had a form as they like to see, with your name as they like to see, and the property name as they like to see, no one would ever pay a lawyer for this but a little time to look up the exact names and this package you're all set. I recommend this because, while it isn't difficult, making a mistake could be very bad so getting the details right for a particular county is well worth the cost.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Beatrice V.

August 27th, 2020

I was in despair as I needed to file two (2) very important documents with the County. Due to Covid the office was closed and my only recourse was to E-Fie with a service provider. I was fortunate enough to hear about Deeds.com. They were specific, courteous, patient and most of all productive. My documents will take awhile for the final filing but that is because the County happens to have a slow turn around time. Otherwise, I am now relieved that this part is over. Thank you Deeds.com. You are awesome.

Thank you for the kinds words Beatrice.

Biinah B.

December 24th, 2020

Wished I had known about this site earlier. Just what we needed. Get tool to get lip to date legal help.

Thank you for your feedback. We really appreciate it. Have a great day!

Kathleen M.

July 21st, 2021

Wow, this was a breeze!! Best experience and fast. Great way to record documents in a matter of minutes. I recommend Deeds.com for anyone who needs to record documents quickly and conveniently.

Thank you for your feedback. We really appreciate it. Have a great day!