Hardeman County Release of Lien - by Deed of Trust and Note Form

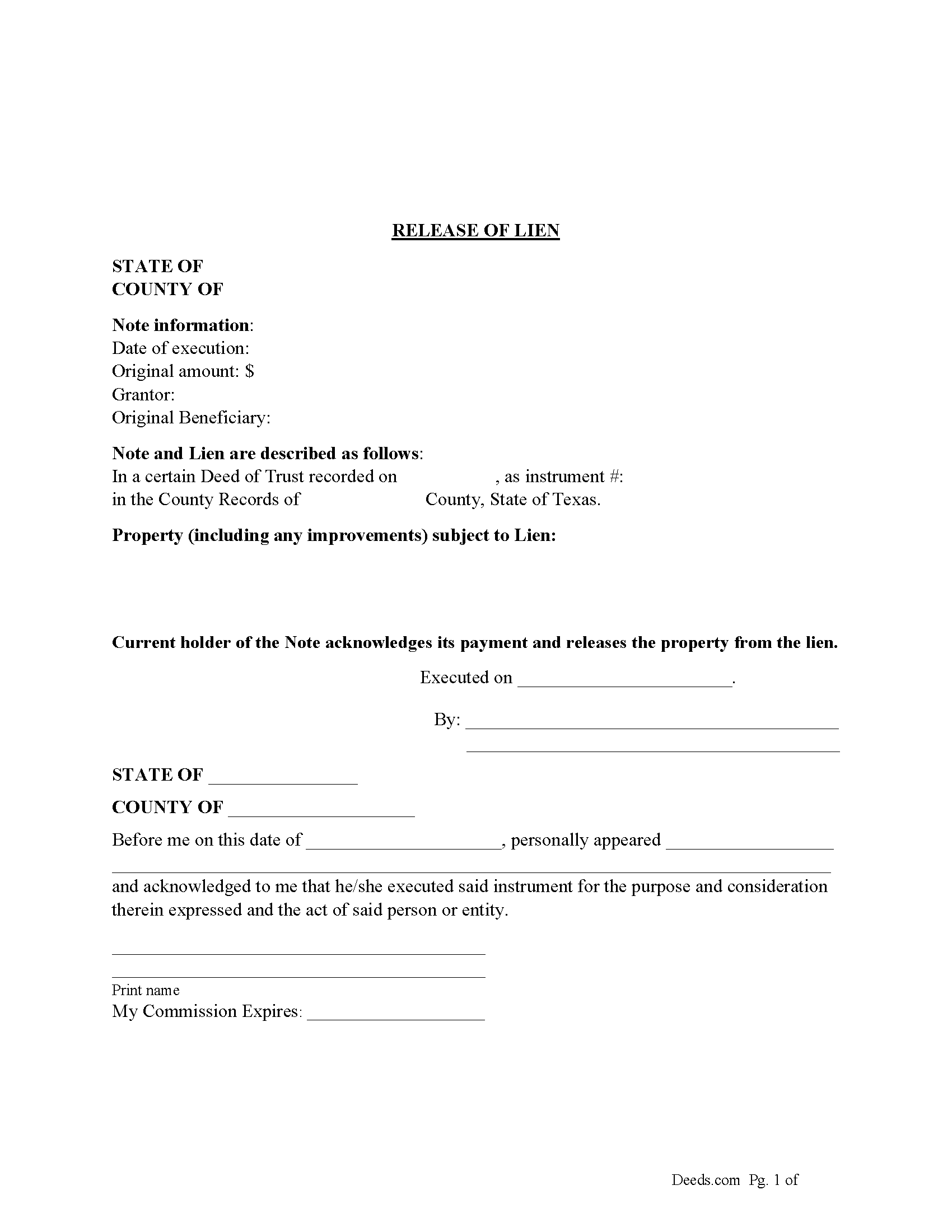

Hardeman County Release of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

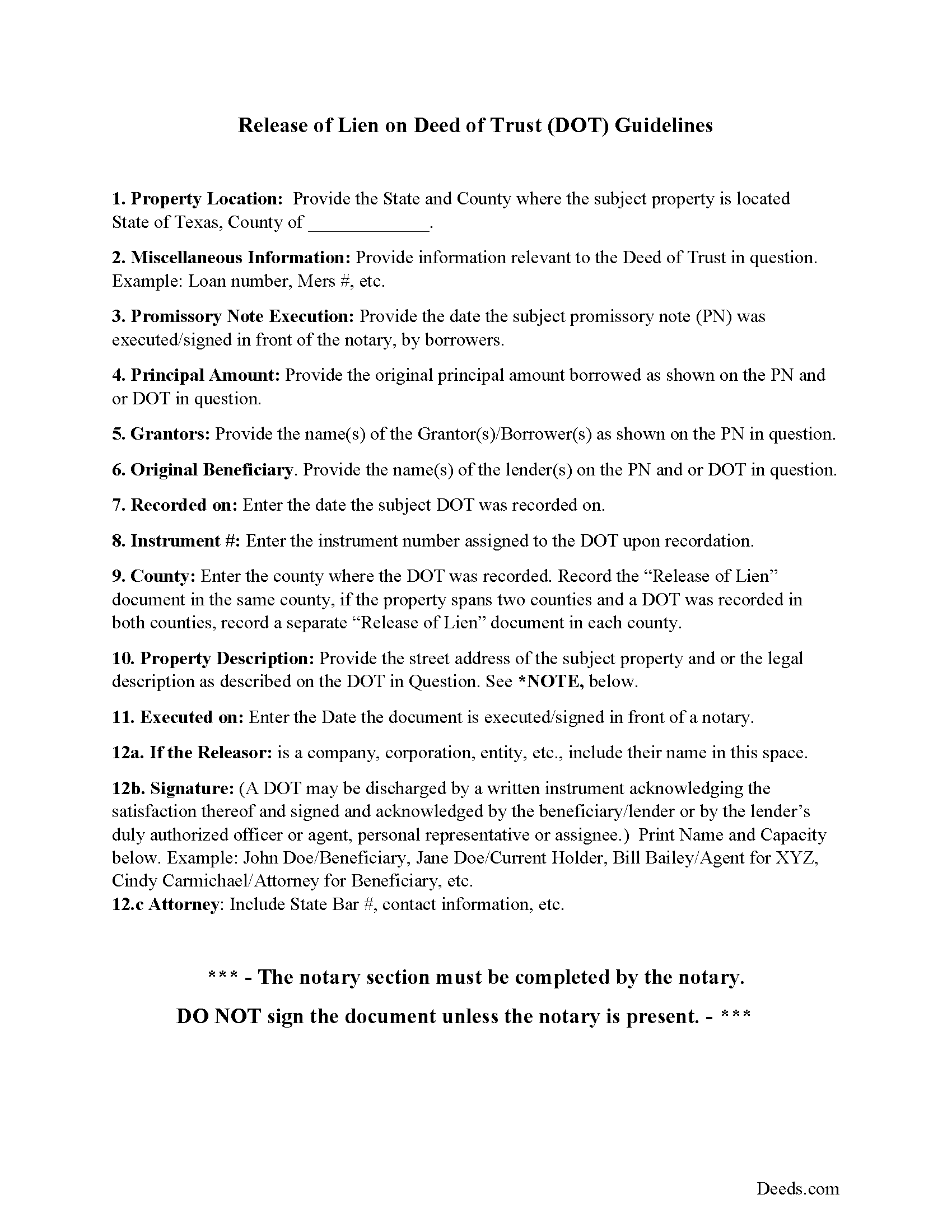

Hardeman County Guidelines for Release of Lien

Line by line guide explaining every blank on the form.

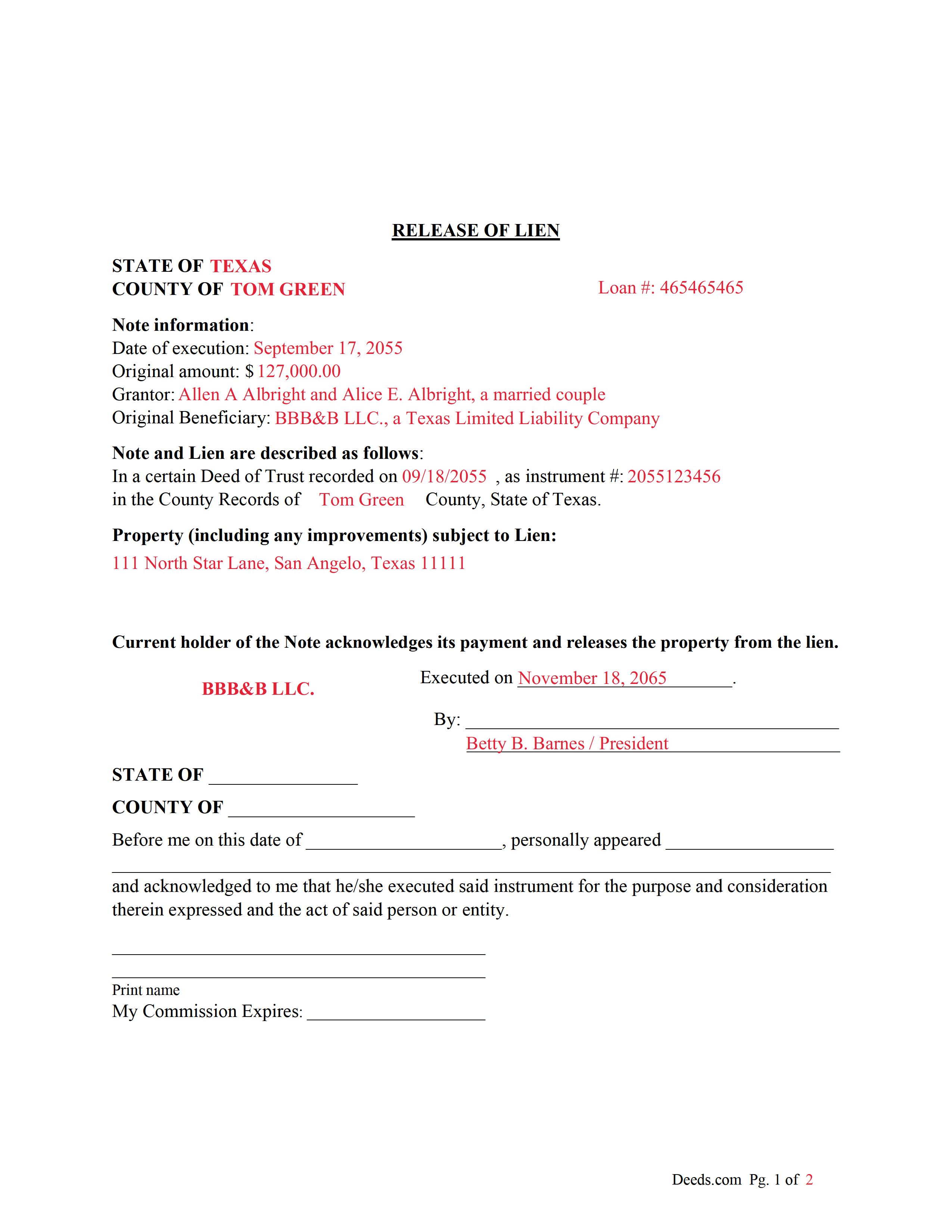

Hardeman County Completed Example of the Release of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Hardeman County documents included at no extra charge:

Where to Record Your Documents

County Clerk Office

Quanah, Texas 79252

Hours: Monday - Friday 8:30am - 12:00 & 1:00 - 5:00pm

Phone: (940) 663-2901

Recording Tips for Hardeman County:

- Double-check legal descriptions match your existing deed

- Check that your notary's commission hasn't expired

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Hardeman County

Properties in any of these areas use Hardeman County forms:

- Chillicothe

- Quanah

Hours, fees, requirements, and more for Hardeman County

How do I get my forms?

Forms are available for immediate download after payment. The Hardeman County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hardeman County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hardeman County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hardeman County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hardeman County?

Recording fees in Hardeman County vary. Contact the recorder's office at (940) 663-2901 for current fees.

Questions answered? Let's get started!

This form used to release a lien placed on real property by a previously recorded Deed of Trust. The current holder/lender or representative signs the Release of Lien document, acknowledging payment and release of the lien.

(Texas Release of Lien Package includes form, guidelines, and completed example) For use in Texas only.

Important: Your property must be located in Hardeman County to use these forms. Documents should be recorded at the office below.

This Release of Lien - by Deed of Trust and Note meets all recording requirements specific to Hardeman County.

Our Promise

The documents you receive here will meet, or exceed, the Hardeman County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hardeman County Release of Lien - by Deed of Trust and Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Cynthia W.

September 4th, 2019

Fantastic forms, thanks for making them available.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rebecca F.

November 4th, 2021

Forms were great. I wasn't able to find them anywhere. Even the county recorder didn't have them

Thank you for your feedback. We really appreciate it. Have a great day!

Chuck M.

May 30th, 2019

Easy to use service. However, the product that I purchased did not meet my needs. No fault of the company.

Thank you for your feedback Chuck. We certainly don't want you to purchase something you can not use. We have canceled your order and payment. Have a wonderful day.

Maricarol F.

March 6th, 2019

Found the site very easy to use. My fault I did not answer back right away. What was found is almost what I needed... Thanks.

Thank you for the feedback Maricarol, we really appreciate it.

Shelby D.

May 1st, 2021

Not very helpful since I am married and the example provided is for single person. Nevada homestead requires spouse to sign off on quit claim deed but no guidance provided as to where this acknowledgment is placed on template form. There should be example for married person as well. Had to use another service. Waste of $21.

Thank you for your feedback. We really appreciate it. Have a great day!

Melanie W.

October 23rd, 2022

I used deeds.com to complete a gift deed for transferring a house to our son. Finding the correct form and completing it correctly was extremely easy due to wonderful explanations and examples provided with the purchase of the form. The registrar filing the deed told me she was impressed with the work we did. An attorney would have charged $150 so the $28.00 was well worth the money.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy A.

June 23rd, 2021

First time user and I was pleasantly surprised how quick and easy it was to get my Deed recorded. And the fee was not outrageous.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William G.

January 11th, 2021

I am very pleased with Deeds.com. They responded back very quickly, checked my forms, gave an example for a correction, and submitted the forms over the weekend. What more could you ask?

Thank you!

franklin m.

October 14th, 2020

good format, helpful instructions

Thank you!

Rhonda L.

May 27th, 2020

This was one of the most simple but efficient process. Walked me thru every step. Total process was less than 2 weeks.

Thank you!

Maria M.

August 30th, 2021

EASY, PAINLESS, LOVED THE USER FRIENDLY INSTRUCTIONS

Thank you for your feedback. We really appreciate it. Have a great day!

Therese L.

September 20th, 2019

Good instructions and example

Thank you!

Delsina T.

October 9th, 2020

So helpful. Thank you so much for making this a smooth process.

Thank you!

William S.

June 4th, 2021

Contents were well done. Could not remove and replace the "Deeds/" footer, rendering the form unusable for filing with a court and county deed records. This should be corrected.

Thank you for your feedback. We really appreciate it. Have a great day!

Terrence R.

January 24th, 2020

So far so good I was able to find the documents I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!