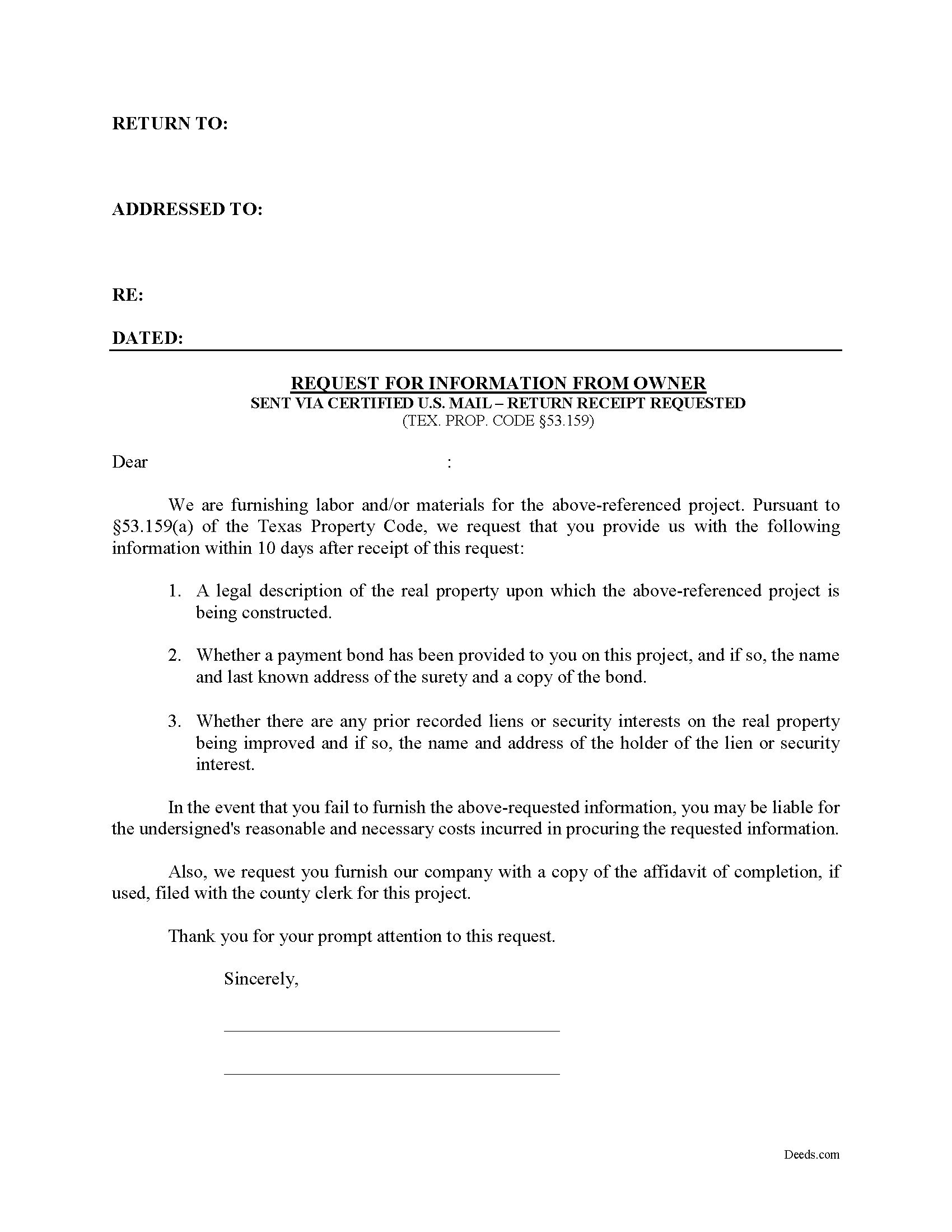

Deaf Smith County Request for Information from Owner Form

Deaf Smith County Request for Information from Owner Form

Fill in the blank Request for Information from Owner form formatted to comply with all Texas recording and content requirements.

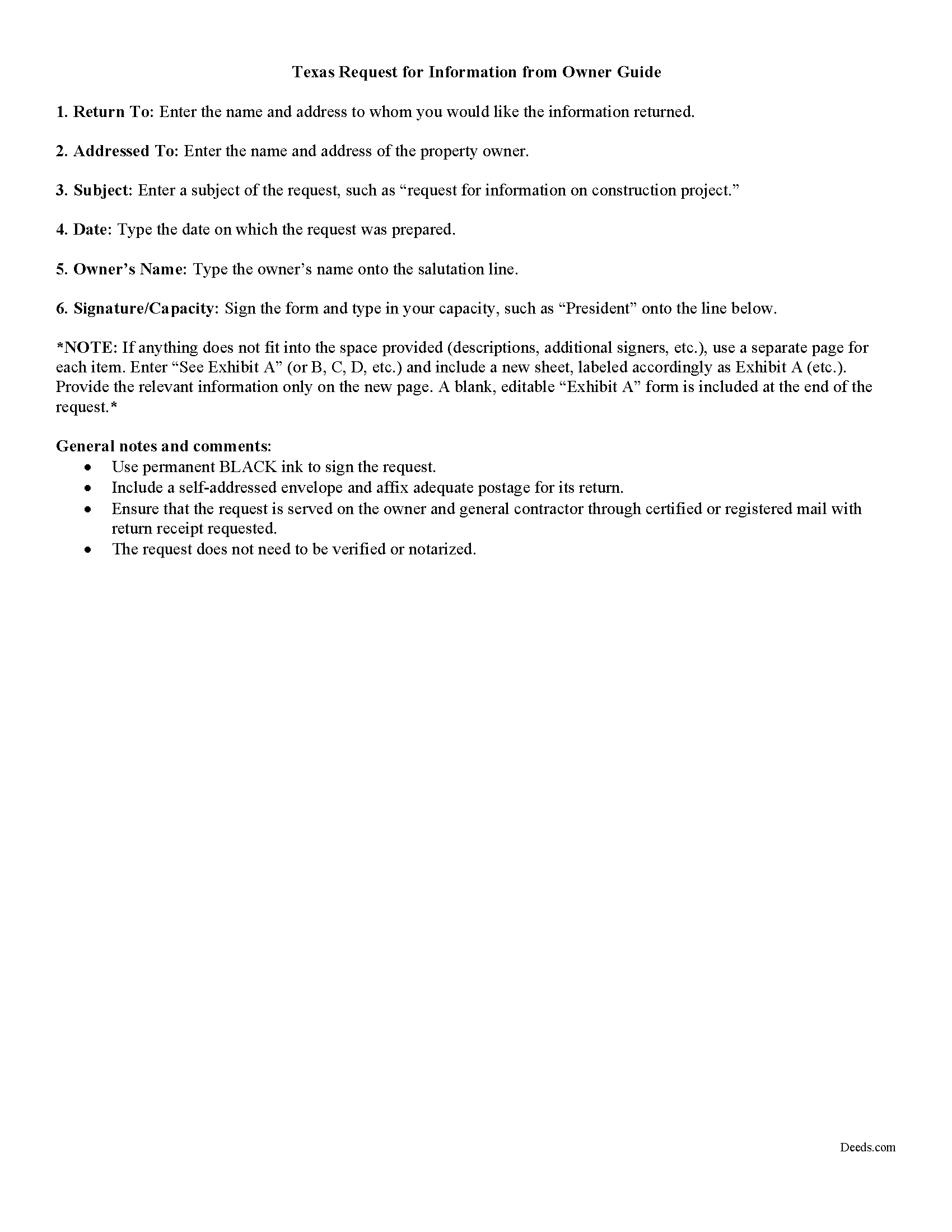

Deaf Smith County Request for Infomation from Owner Guide

Line by line guide explaining every blank on the form.

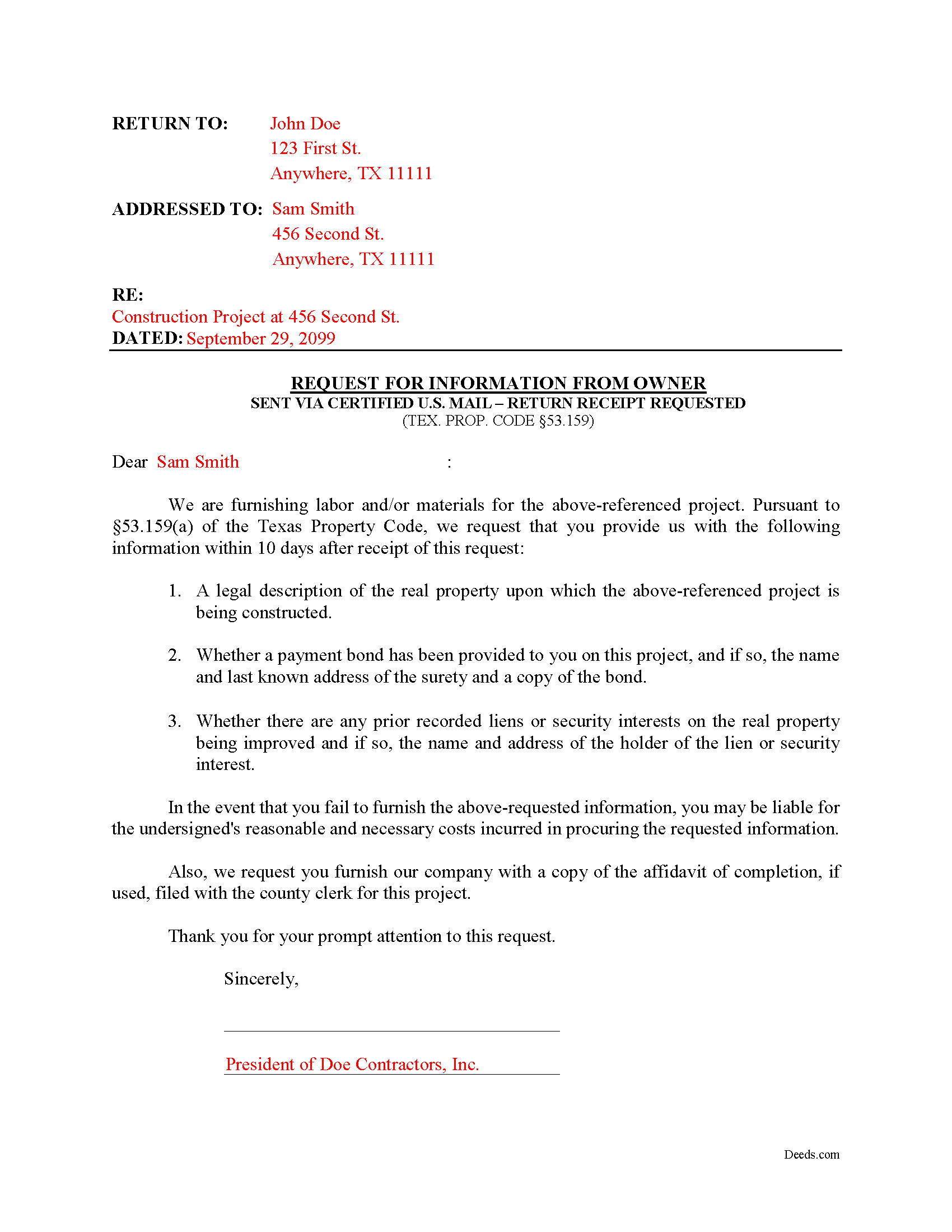

Deaf Smith County Completed Example of the Request for Information from Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Deaf Smith County documents included at no extra charge:

Where to Record Your Documents

Deaf Smith County Clerk's Office

Hereford, Texas 79045-5542

Hours: Monday - Friday 8:00am - 12:00 & 1:00 - 5:00pm

Phone: (806) 363-7077

Recording Tips for Deaf Smith County:

- Check that your notary's commission hasn't expired

- Documents must be on 8.5 x 11 inch white paper

- Verify all names are spelled correctly before recording

- Make copies of your documents before recording - keep originals safe

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Deaf Smith County

Properties in any of these areas use Deaf Smith County forms:

- Dawn

- Hereford

Hours, fees, requirements, and more for Deaf Smith County

How do I get my forms?

Forms are available for immediate download after payment. The Deaf Smith County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Deaf Smith County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Deaf Smith County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Deaf Smith County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Deaf Smith County?

Recording fees in Deaf Smith County vary. Contact the recorder's office at (806) 363-7077 for current fees.

Questions answered? Let's get started!

What information must the owner provide on a Texas construction project?

The Request for Information from Owner is a form letter used to obtain information from the property owner on a construction job. The required information from the owner includes a description of the real property, details of any surety bond posted, whether there are prior recorded liens or security interests on the property, and the date on which the original contract for the project was executed.

Under TEX. PROP. CODE 53.159(a), upon a written request, the property owner must provide the information within a reasonable time to anyone who furnished labor or materials. The owner must respond no later than the 10th day after the date the request is received.

If the requester is not in direct contractual relationship with the owner on the project, the owner may require payment of the actual costs in producing the information which cannot exceed $25.00. TEX. PROP. CODE 53.159(e). Therefore, some people choose to enclose a check with the request form, up to $25.00, to cover any costs.

If the owner fails to furnish the required information, he or she may be liable for reasonable and necessary costs incurred in procuring the requested information. TEX. PROP. CODE 53.159(f).

Each case is unique, and the Texas lien law is complex. Contact an attorney with specific questions about requesting information about a construction project from the property owner, or any other issues related to mechanic's liens.

Important: Your property must be located in Deaf Smith County to use these forms. Documents should be recorded at the office below.

This Request for Information from Owner meets all recording requirements specific to Deaf Smith County.

Our Promise

The documents you receive here will meet, or exceed, the Deaf Smith County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Deaf Smith County Request for Information from Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Joanne W.

January 20th, 2020

I was very pleased to find this service, as (another website) charges about $40 for the same service, so yours was a bargain.

Thank you!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia P.

October 29th, 2021

First time using this service and was totally happy with the results. Very user friendly and easy site to understand and upload all files. Very prompt and thorough responses to any questions I had and having my documents filed. I will definitely use them again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dale Mary G.

July 14th, 2020

This was an easy site to use - saving so much time and allowing me to complete what I needed to do. All the added information, guidelines and even a sample completed form. Great!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Darlene D.

June 21st, 2019

A little confusing to try to save your docouments and how to process them but once figured out easy to do.

Thank you!

Sally F.

January 22nd, 2020

Amazing forms, thanks so much for making these available.

Thank you!

nancy h.

April 10th, 2019

Once I figured out what I wanted it was great!

Thank you Nancy.

Linda M.

February 25th, 2022

Quick easy

Thank you!

Keli A.

June 3rd, 2021

Excellent site, super fast responses to messages, and great patience with a newbie user. Couldn't be more pleased. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen S.

March 18th, 2021

This is awesome. Making sure not only that everything is worded correctly but also formatted correctly is great. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Dave M.

March 10th, 2020

Service as needed. A bit expensive.

Thank you for your feedback. We really appreciate it. Have a great day!

Rebecca H.

August 6th, 2019

quick and easy. Perfect

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rick R.

February 5th, 2021

So far excellent service - I made a boo boo on the deed - no problem they made the change before they sent it off to be recorded. I will never drive to the Recorder's office again.

Thank you!

Jon G.

June 26th, 2021

Excellent service and professionalism

Thank you!

RICK M.

February 20th, 2020

great

Thank you!