Johnson County Special Warranty Deed Form

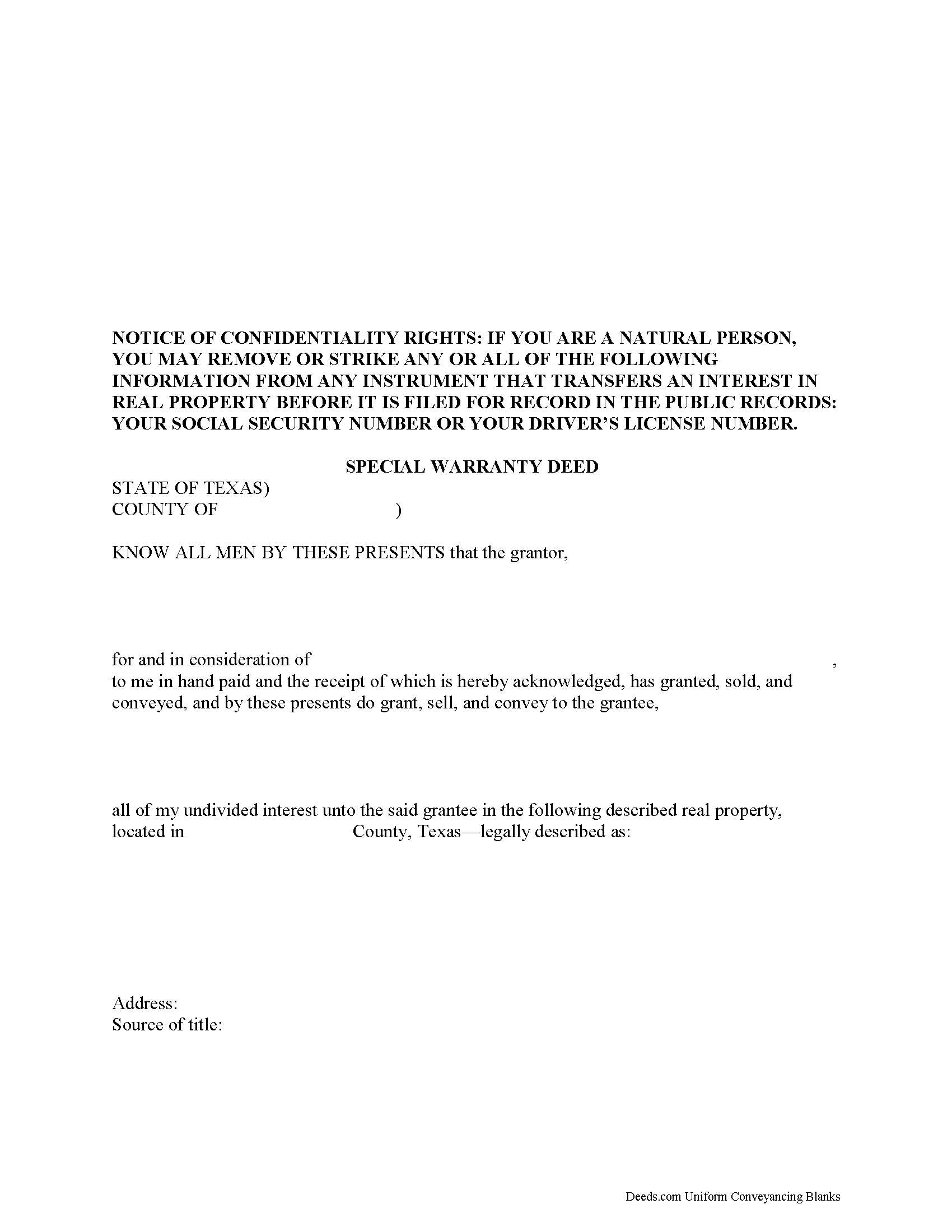

Johnson County Special Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

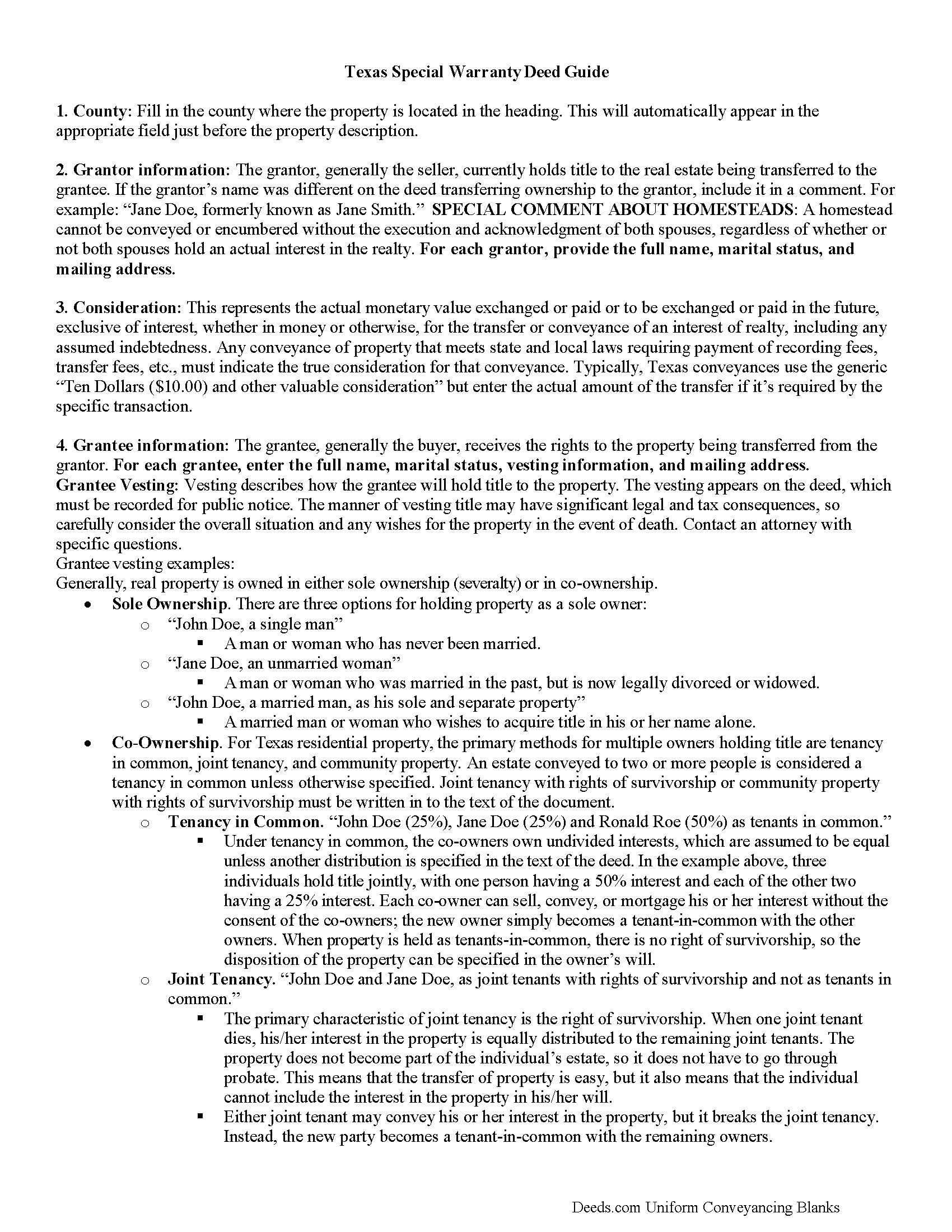

Johnson County Special Warranty Deed Guide

Line by line guide explaining every blank on the form.

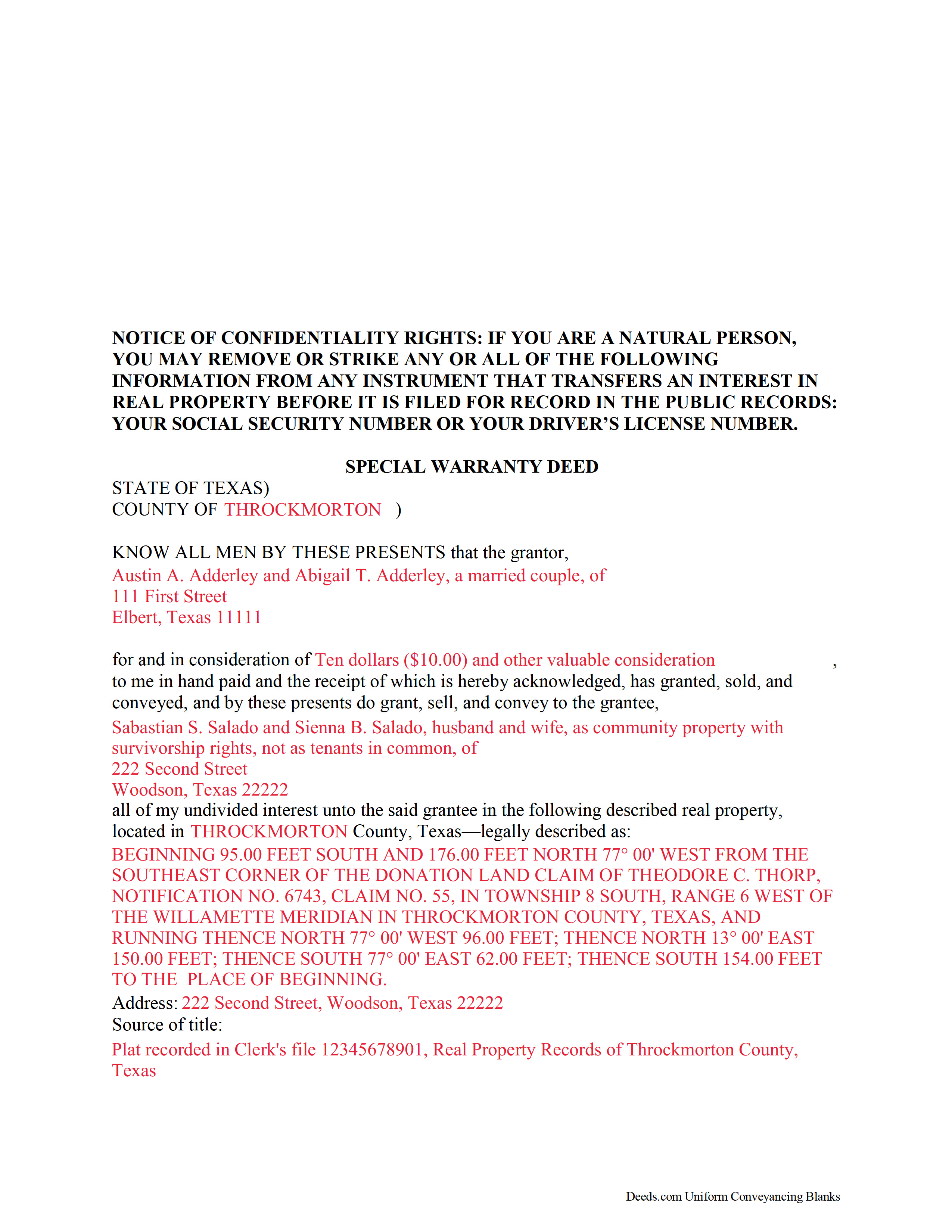

Johnson County Completed Example of the Special Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Johnson County documents included at no extra charge:

Where to Record Your Documents

Johnson County Clerk

Cleburne, Texas 76033

Hours: 8:00am to 4:30pm M-F

Phone: (817) 202-4000 x1625 or 556-6310

Recording Tips for Johnson County:

- White-out or correction fluid may cause rejection

- Ask if they accept credit cards - many offices are cash/check only

- Double-check legal descriptions match your existing deed

- Recorded documents become public record - avoid including SSNs

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Johnson County

Properties in any of these areas use Johnson County forms:

- Alvarado

- Burleson

- Cleburne

- Godley

- Grandview

- Joshua

- Keene

- Lillian

- Rio Vista

- Venus

Hours, fees, requirements, and more for Johnson County

How do I get my forms?

Forms are available for immediate download after payment. The Johnson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Johnson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Johnson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Johnson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Johnson County?

Recording fees in Johnson County vary. Contact the recorder's office at (817) 202-4000 x1625 or 556-6310 for current fees.

Questions answered? Let's get started!

A special warranty deed can be used in Texas to convey title to real property. Special warranty deeds in this state will contain both express and implied warranties. A special warranty deed in Texas only warrants against defects, liens, and encumbrances arising by, through, or under the grantor. Even if a conveyance does not have express covenants of warranty, the words "grant" and "convey" will imply only the following covenants from the grantor: (a) That prior to the execution of the conveyance, the grantor has not conveyed the estate or any interest in the estate to any person other than the grantee and (b) that at the time of execution of the conveyance, the estate is free from any encumbrances (5.023).

A real property instrument, such as a special warranty deed can be recorded if it has been acknowledged, sworn to with a proper jurat, or proved according to law (12.001). Original signatures are required. The failure of a notary public to attach an official seal to an acknowledgment or other proof taken in a state other than Texas will render the acknowledgment invalid only if the jurisdiction in which the acknowledgement is taken requires the notary public to attach a seal (12.001d).To be effectively recorded, an instrument relating to real property must be eligible for recording and must be recorded in the county where the property, or a part of the property, is located (11.001).

Recording an instrument is necessary to provide constructive notice. When a special warranty deed has been properly recorded in the county where the property is located, the instrument is deemed to impart constructive notice of the contents to all persons. Additionally, the instrument will be part of the public records and is open to inspection (Sec. 13.002). A special warranty deed will be void as to a creditor or subsequent purchaser for a valuable consideration without notice unless the deed has been acknowledged, sworn to, or proved and filed for record (Sec. 13.001). Unrecorded special warranty deeds are binding on the parties to the instrument, on the parties' heirs, and on a subsequent purchaser who does not pay a valuable consideration or who has notice of the instrument (Sec. 13.001c).

(Texas Special Warranty Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Johnson County to use these forms. Documents should be recorded at the office below.

This Special Warranty Deed meets all recording requirements specific to Johnson County.

Our Promise

The documents you receive here will meet, or exceed, the Johnson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Johnson County Special Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Steve V.

June 6th, 2025

Quick and easy. Quite the time saver.

Thanks, Steve! We're glad to hear the process was quick and easy—and that it saved you time. That’s exactly what we aim for!

Richard A.

February 17th, 2023

Deeds.com was easy to use and provided everything needed to do a quitclaim deed!

Thank you!

Nicholas B.

October 24th, 2020

A lot of information to read over but downloading process was great and ill definitely use the service again. Showed me my country and city that my forms would be valid in and the information is step by step with examples and that is great

Thank you for your feedback. We really appreciate it. Have a great day!

Michael M.

November 3rd, 2020

This company gets it right! All the forms you need for your jurisdiction along with guides, and more

Thank you for your feedback. We really appreciate it. Have a great day!

DON O.

December 16th, 2020

needs to be more user friendly

Thank you for your feedback. We really appreciate it. Have a great day!

Bryan C.

August 2nd, 2019

Fast and just as promised

Thank you for your feedback. We really appreciate it. Have a great day!

Tina C.

August 26th, 2021

Quick and easy ordering and download. Appreciated that I could get the form that is used in my county. Would have like to be able to add paragraphs to form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Wanda R.

January 22nd, 2019

Very satisfied with the ease of using your database. Excellent place to get help with deeds.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Matthew G.

February 19th, 2019

Second time using Deeds.com. Easy and professional

Thank you Matthew. Have a great day!

Nancy E.

May 4th, 2025

Took me awhile to figure out and get the information printed so I can use it later. Thank you.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

sonja E.

May 31st, 2019

It's very easy to find your way around on deeds.com, Excellent layout on this website and user friendly!

Thank you!

John W.

January 9th, 2019

The forms were easy to acquire and easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Donna C.

June 24th, 2021

I was very impressed with the system. Easy to navigate. Took less than 15 minutes to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dee R.

November 14th, 2019

Quick, Simple order process with many options of forms to download!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lynne B.

October 17th, 2020

It was very easy to navigate and very fast response time.

Thank you!