Hamilton County Texas Affidavit of Heirship Form

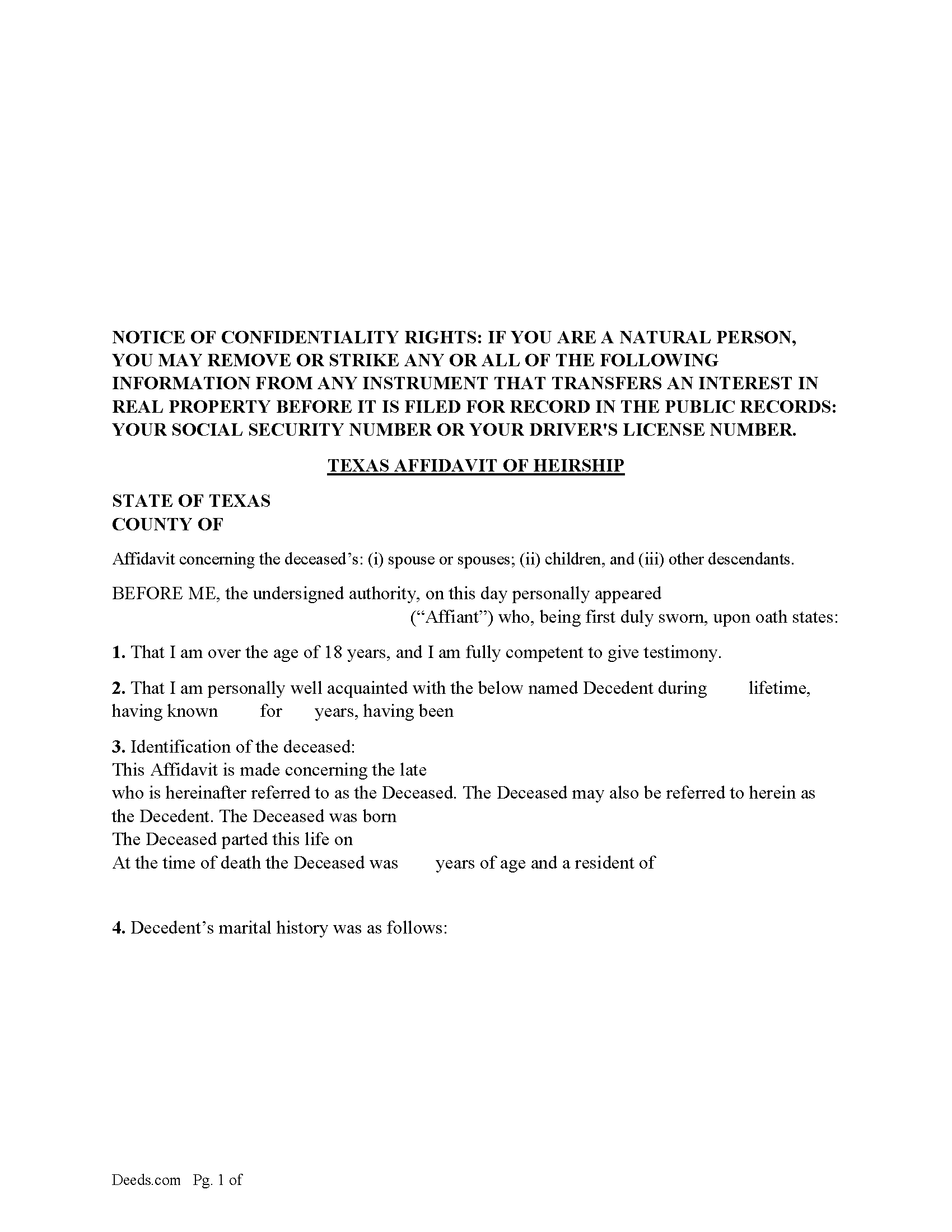

Hamilton County Affidavit of Heirship Form

Fill in the blank form formatted to comply with all recording and content requirements.

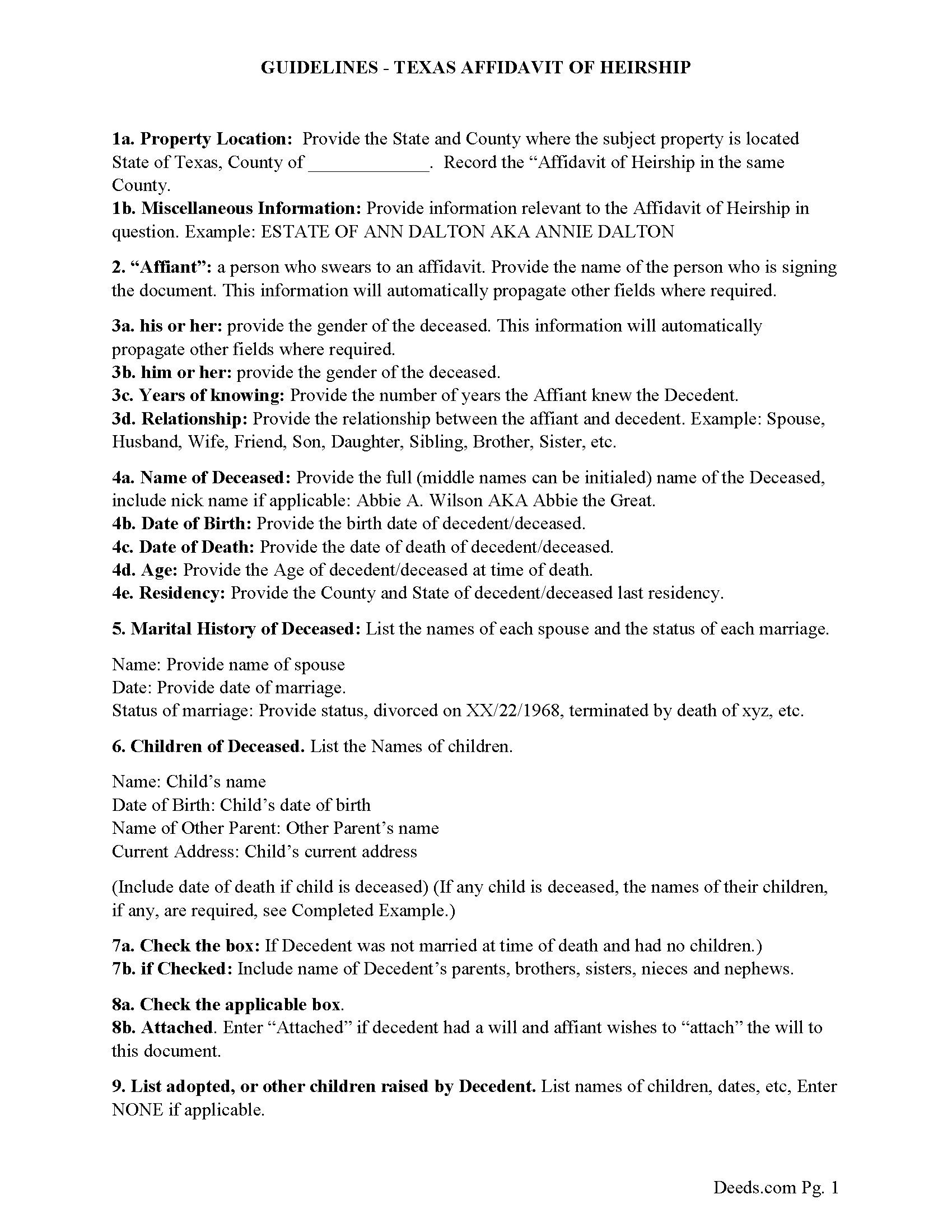

Hamilton County Guidelines for Texas Affidavit of Heirship

Line by line guide explaining every blank on the form.

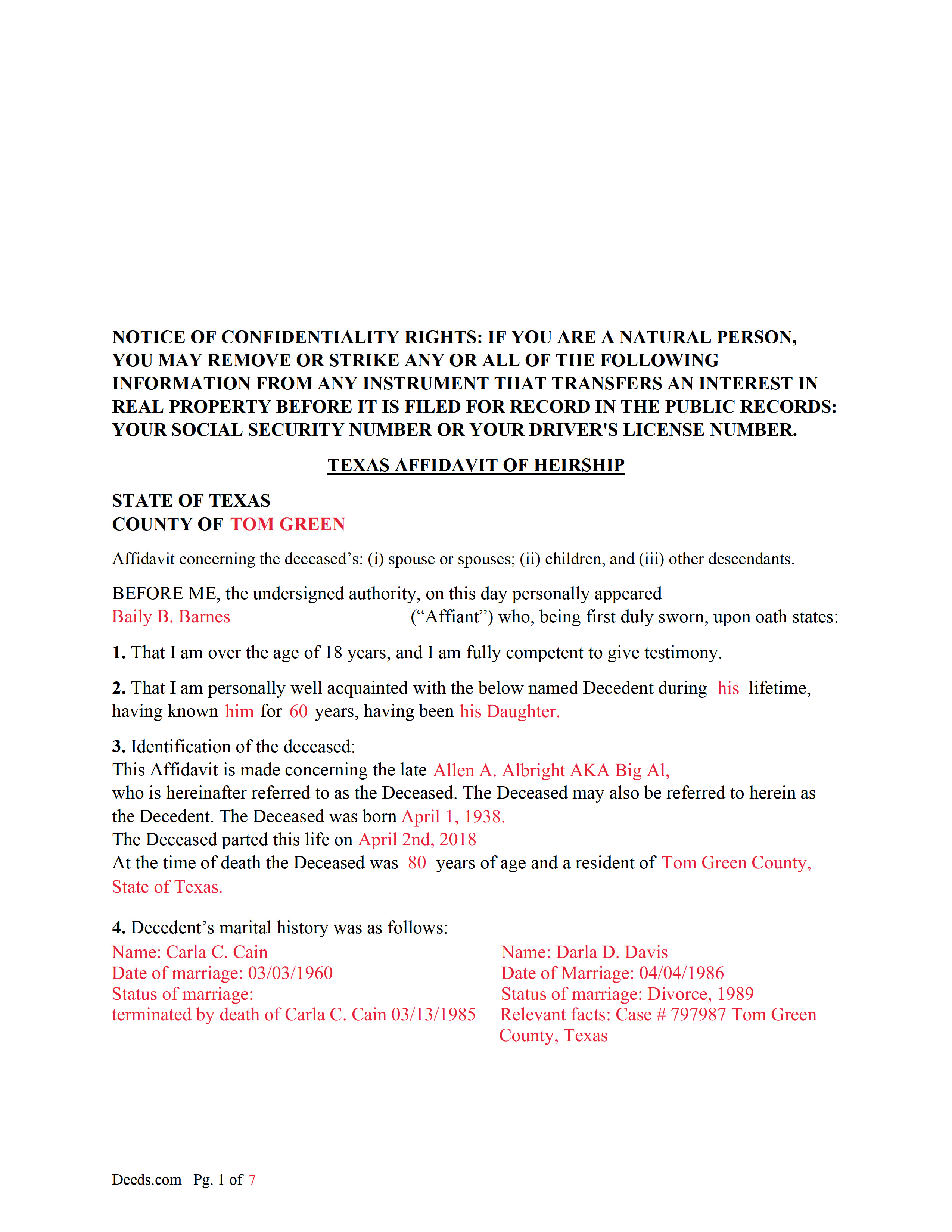

Hamilton County Completed Example of a Texas Affidavit of Heirship Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Hamilton County documents included at no extra charge:

Where to Record Your Documents

Hamilton County Clerk

Hamilton, Texas 76531-1909

Hours: Monday - Friday 8:00am - 4:30pm

Phone: (254)386-1205

Recording Tips for Hamilton County:

- White-out or correction fluid may cause rejection

- Bring extra funds - fees can vary by document type and page count

- Avoid the last business day of the month when possible

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Hamilton County

Properties in any of these areas use Hamilton County forms:

- Carlton

- Hamilton

- Hico

- Pottsville

Hours, fees, requirements, and more for Hamilton County

How do I get my forms?

Forms are available for immediate download after payment. The Hamilton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hamilton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hamilton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hamilton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hamilton County?

Recording fees in Hamilton County vary. Contact the recorder's office at (254)386-1205 for current fees.

Questions answered? Let's get started!

This form is typically used when the deceased did NOT leave a will or estate plan. The Affidavit of Heirship is a sworn statement used to establish the heirs of a property, with a goal of putting the property in their name. Sometimes this form is used to bypass probate when the deceased left a will that leaves the property solely to the direct descendants of the deceased or when 4 years have passed since the death of the owner, the general time frame to probate a will in Texas. An Affidavit of Heirship can be filed anytime. An Affidavit of Heirship alone does not transfer property title. It identifies the heirs of the property.

General parameters for a Texas Affidavit of Heirship document:

No valid will, or if beneficiaries and/or heirs agree to disregard the will.

Only real estate needs to be transferred to heirs.

The deceased does not have any debts.

No administration of estate required.

(Texas Affidavit of Heirship Package includes form, guidelines, and completed example)

Important: Your property must be located in Hamilton County to use these forms. Documents should be recorded at the office below.

This Texas Affidavit of Heirship meets all recording requirements specific to Hamilton County.

Our Promise

The documents you receive here will meet, or exceed, the Hamilton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hamilton County Texas Affidavit of Heirship form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

George A.

September 4th, 2019

Excellent Service.

Thank you for your feedback. We really appreciate it. Have a great day!

Lloyd T.

September 13th, 2023

Example deed given did not apply to married couples as joint owners with both being grantors. The example and directions also did not show how to write more than one grantee as equal grantees. Both would have been helpful when husband and wife are granting their property to their children equally. Also when attaching the exhibit A with the property description the example did not say "see exhibit A"in the property description area, so I didn't write that. Luckily the recorder of deeds allowed me to write it in. I think directions and examples for multiple scenarios would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Heather W.

October 11th, 2019

Easy to use Example provided Clear instructions

Thank you for your feedback. We really appreciate it. Have a great day!

Paul B.

March 13th, 2025

Very efficient and easy to use process

Paul, we’re glad to hear you had a smooth and efficient experience! Making things easy for our customers is always our goal.

Shari N.

March 1st, 2022

Super easy to order and save a document!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

maria b.

November 1st, 2020

really easy and and helpful.

Thank you!

Helen B.

January 15th, 2021

Very Good!

Thank you!

Byron G.

June 23rd, 2022

So easy to use. Would recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Donna C.

April 1st, 2022

Easy to use.

Thank you!

John T.

May 5th, 2022

Great site, I was able to navigate with ease. We appreciate all those who contributed in making this possible

Thank you!

DAVID JOHN M.

February 25th, 2019

The Transfer On Death Deed did work for New Mexico! Though I did have to add the long property description to the "Exhibit" page that was included with the document. Great website! Will use again! Thanks!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gerald M.

November 25th, 2021

So easy to do. The examples and guides are well worth the few $$ this cost. Highly recommend!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ottomar H.

January 15th, 2022

Deeds site was easy to use and allowed me to print the forms I needed. No need to change anything.

Thank you!

Geraldine B.

December 7th, 2019

Top notch real estate forms. Easy to use, printed out nice, and the guide and example are priceless. You're not going to find anything better anywhere.

Thank you for the kind words Geraldine! Have an incredible day!

virginia a.

May 15th, 2022

Thank you for the prompt instructions on the download and installation. The only problem I had was trying to input data into the form once I renamed the form.and saved it. I was unable to change the size of the font and was very frustrated. In the end I finally had to redo the entire form through Word using your format.

Thank you!