Shelby County Transfer on Death Revocation Form

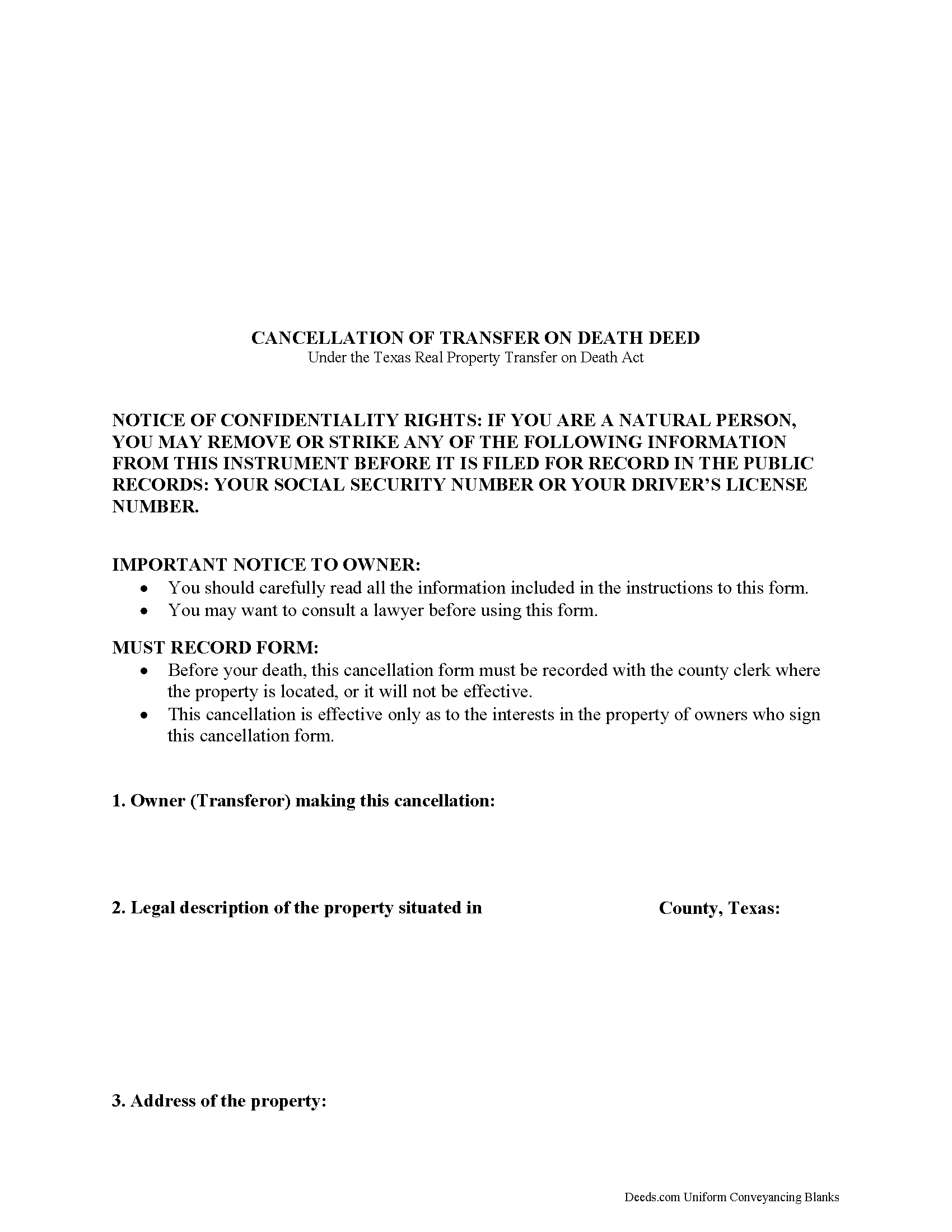

Shelby County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

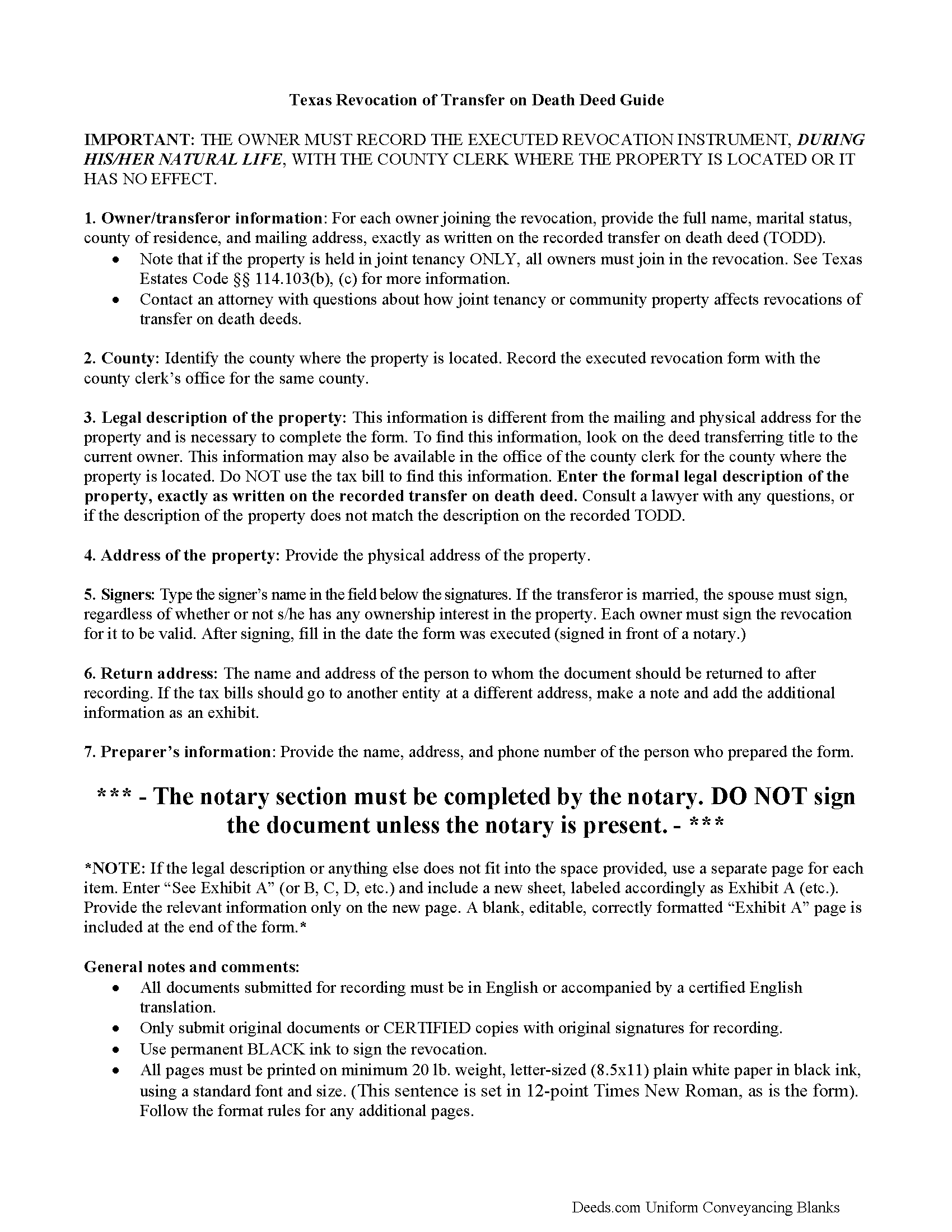

Shelby County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

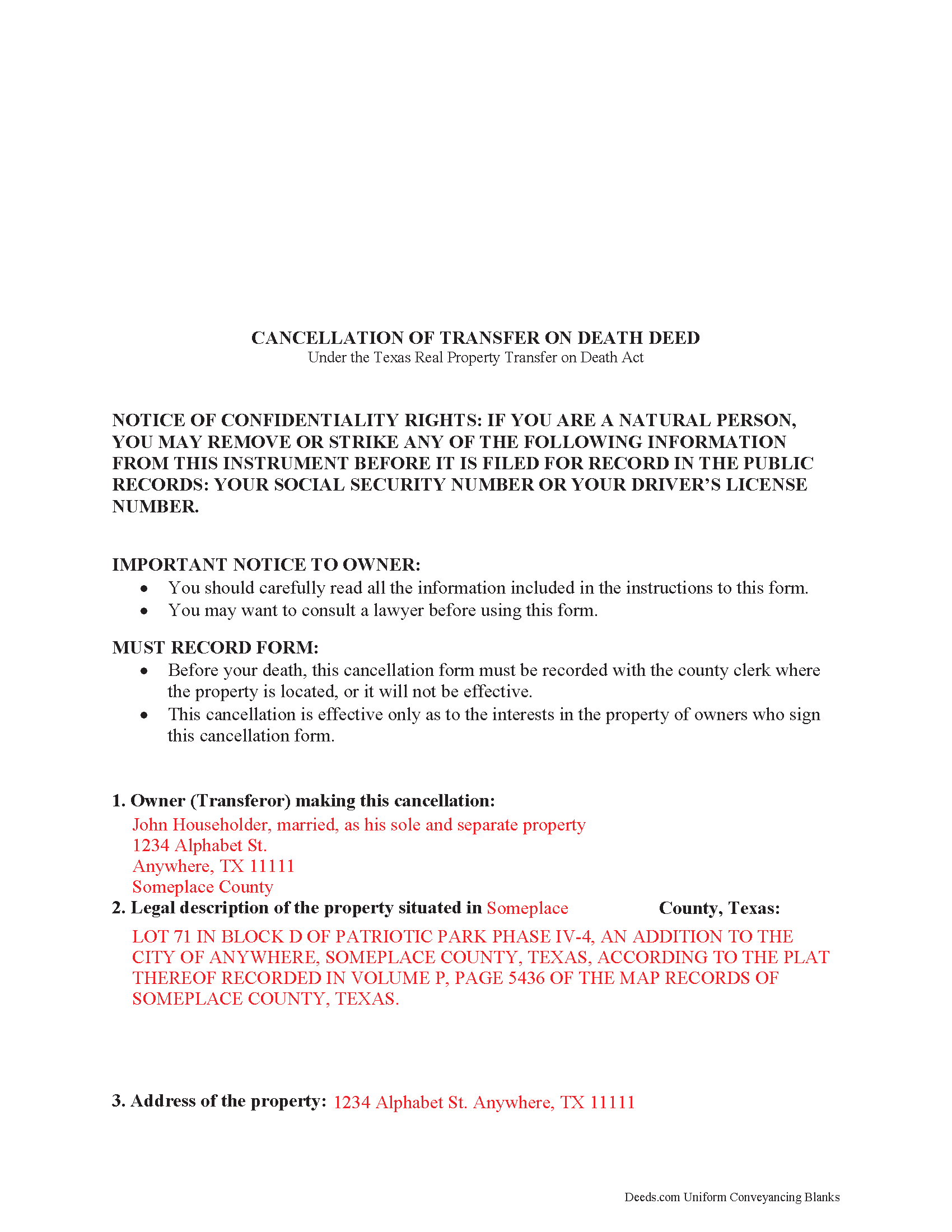

Shelby County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Shelby County documents included at no extra charge:

Where to Record Your Documents

Shelby County Clerk

Center, Texas 75935

Hours: 8:00 to 4:30 Monday through Friday

Phone: (936) 598-6361

Recording Tips for Shelby County:

- Check that your notary's commission hasn't expired

- Verify all names are spelled correctly before recording

- Bring extra funds - fees can vary by document type and page count

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Shelby County

Properties in any of these areas use Shelby County forms:

- Center

- Joaquin

- Shelbyville

- Tenaha

- Timpson

Hours, fees, requirements, and more for Shelby County

How do I get my forms?

Forms are available for immediate download after payment. The Shelby County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Shelby County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Shelby County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Shelby County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Shelby County?

Recording fees in Shelby County vary. Contact the recorder's office at (936) 598-6361 for current fees.

Questions answered? Let's get started!

Revoking Transfer on Death Deeds in Texas

On September 1, 2015, owners of real property in Texas gained access to a useful estate planning tool: the statutory transfer on death deed (TODD). Modeled after the Uniform Real Property Transfer on Death Act and located at Chapter 14 of the Texas Estates Code, the Texas Real Property Transfer on Death Act governs the use of transfer on death deeds in the State of Texas.

IMPORTANT: TRANSFER ON DEATH DEEDS AND ASSOCIATED REVOCATIONS MUST BE RECORDED WHILE THE OWNER IS ALIVE OR THEY HAVE NO EFFECT.

Transfer on death deeds are nontestamentary instruments (not using a will). They allow transferors/owners to retain absolute ownership of and control over their land during their lives -- they may sell, mortgage, rent, or otherwise use the real estate as they desire, with no penalty for waste or obligation to notify the beneficiaries (114.101).

By recording the executed TODD, property owners may also take advantage of one of the most unique aspects of these instruments: revocability (114.052). Revocability is possible for two primary reasons: there is no obligation to notify the beneficiaries about the potential future interest they stand to gain when the owner dies; and these conveyances do not generally involve consideration (something of value given in exchange for the property) (114.056).

The statute provides several methods for revoking a transfer on death deed. The owner may execute and record a new TODD, cancelling the prior deed and designating a different beneficiary. The owner may also sell the real estate to someone else using a standard inter vivos conveyance such as a warranty deed or a quitclaim deed that contains a comment revoking the TODD. A third option uses a revocation form, which, after recording, cancels all previously recorded TODDs (114.057).

While the first two options are effective, it makes sense to file an instrument of revocation, because it provides a start and end point to a recorded TODD, which should reduce confusion in future title searches. For additional clarity, best practices dictate that an efficient estate plan does not contain conflicting directions, so make sure that wills, etc., reflect the most current information and the related documents can work together to reinforce the owner's intent.

Before revoking a transfer on death deed, consider the effect it will have on the comprehensive estate. Each situation is unique, so for complex circumstances or additional questions, contact a local attorney.

Important: Your property must be located in Shelby County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Shelby County.

Our Promise

The documents you receive here will meet, or exceed, the Shelby County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Shelby County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Eileen C.

October 14th, 2020

Easy, fast, affordable. Satisfied customer

Thank you!

Therese L.

September 20th, 2019

Good instructions and example

Thank you!

Susan S.

May 19th, 2020

Ordered the forms, completed them, had them notarized, then erecorded all in under 2 hours. Would have been faster but had to wait for the bank to open for notary. Might try the online notary next time. Fantastic experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Candy A.

June 27th, 2020

Super simple to download all necessary forms. BIG thank you for this service.

Thank you!

Lori N.

August 16th, 2022

I ordered the document I needed and it was available for download within a half hour. Very pleased, thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas W.

February 4th, 2020

The serevice was fast and accurate. I would highly recommend Deeds.com to my friends and associates.

Thank you!

Jeanette S.

January 2nd, 2020

Easy to use and instructions were very clear. If possible, it would be nice to be able to download the entire package at one time - it was a little cumbersome to download each item separately. (Of course, I didn't know which of the items I needed, so downloaded them all)

Thank you for your feedback. We really appreciate it. Have a great day!

OLGA R.

October 30th, 2020

Excellent Service for E-Recording. They work with you and guide you on every aspect.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nancy B.

August 23rd, 2020

Deeds.com is a godsend! Being able to download the pertinent state and county specific forms reassured me of having the correct t forms in which to proceed. The cost was most reasonable. Thanks for this service.

Thank you!

Abram A.

February 26th, 2019

Very easy to navigate around and to obtain desired forms and service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia W.

August 30th, 2022

I am working with the document to complete it. It's taking me some time but I'll get it.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan S.

April 4th, 2019

Very quick, easy and readily available forms. No wait, no advertisements, no pressure to purchase MORE. I expected to only get part of the information I needed, and for there to be a hidden cost to get the complete package, but surprisingly, I got immediate access to all the forms I ordered, AND THERE WERE NO ADDITIONAL HIDDEN COSTS! How refreshing!

Thank you Susan, we really appreciate your feedback.

Thomas H.

April 15th, 2023

I had an initial problem of downloading the form. After contacting the website, I got an answer very quickly, and they fixed the problem.

Thank you for your feedback. We really appreciate it. Have a great day!

ROBERT W.

June 30th, 2019

Very good service .I recommend it if you need your documentation on a weekend or when offices are closed.Very fast service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John F.

May 30th, 2019

Excellent service, very reliable.

Thank you for your feedback. We really appreciate it. Have a great day!