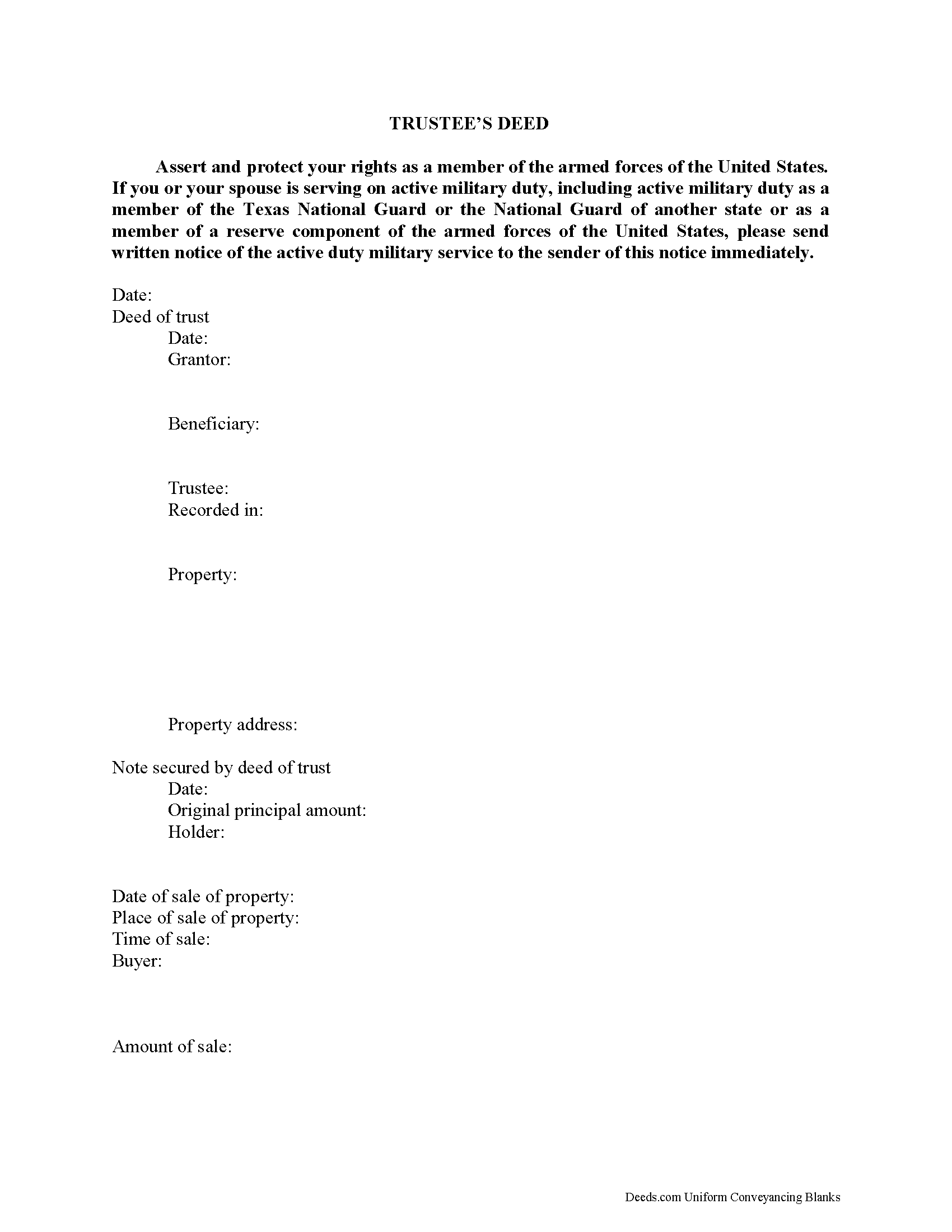

Winkler County Trustee Deed Form

Winkler County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

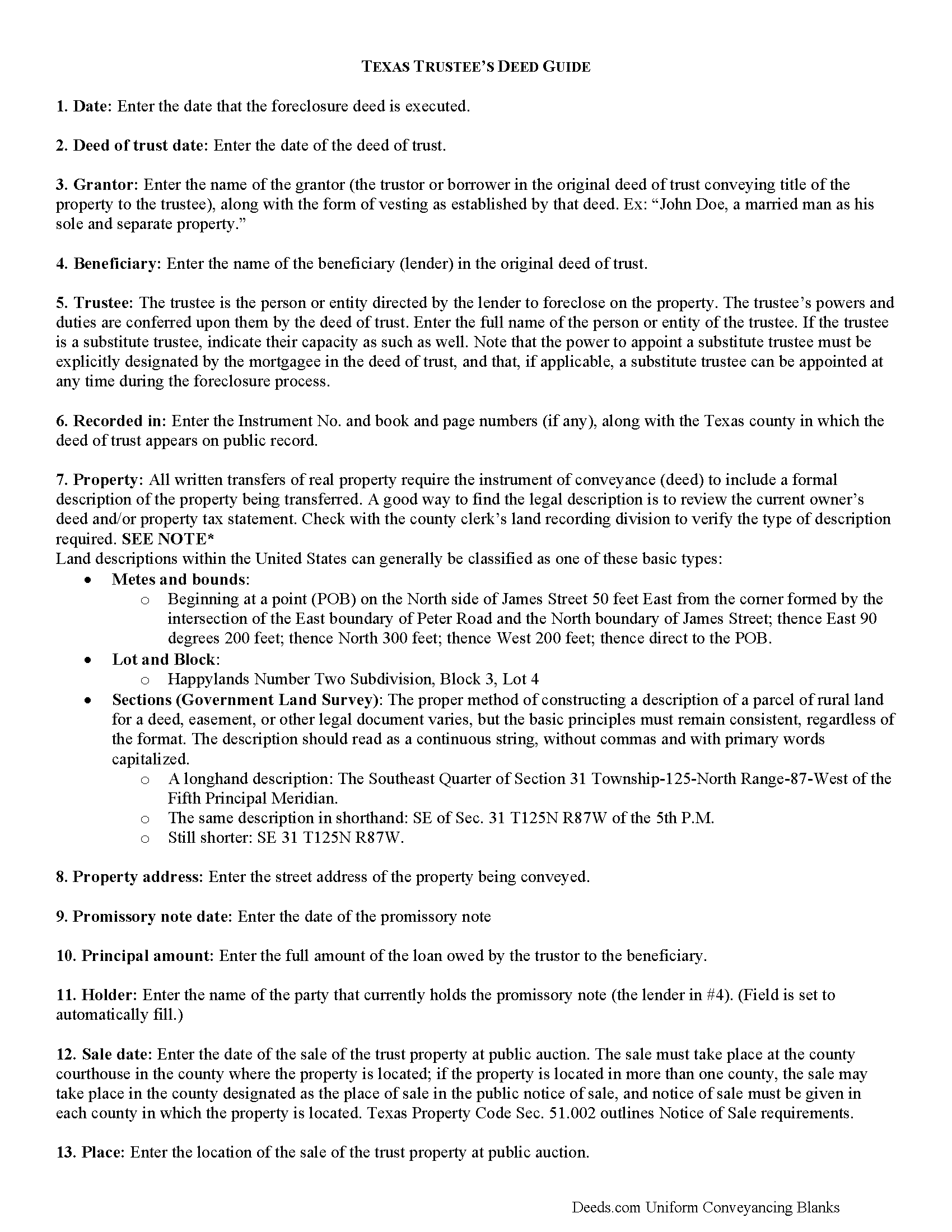

Winkler County Trustee Deed Guide

Line by line guide explaining every blank on the form.

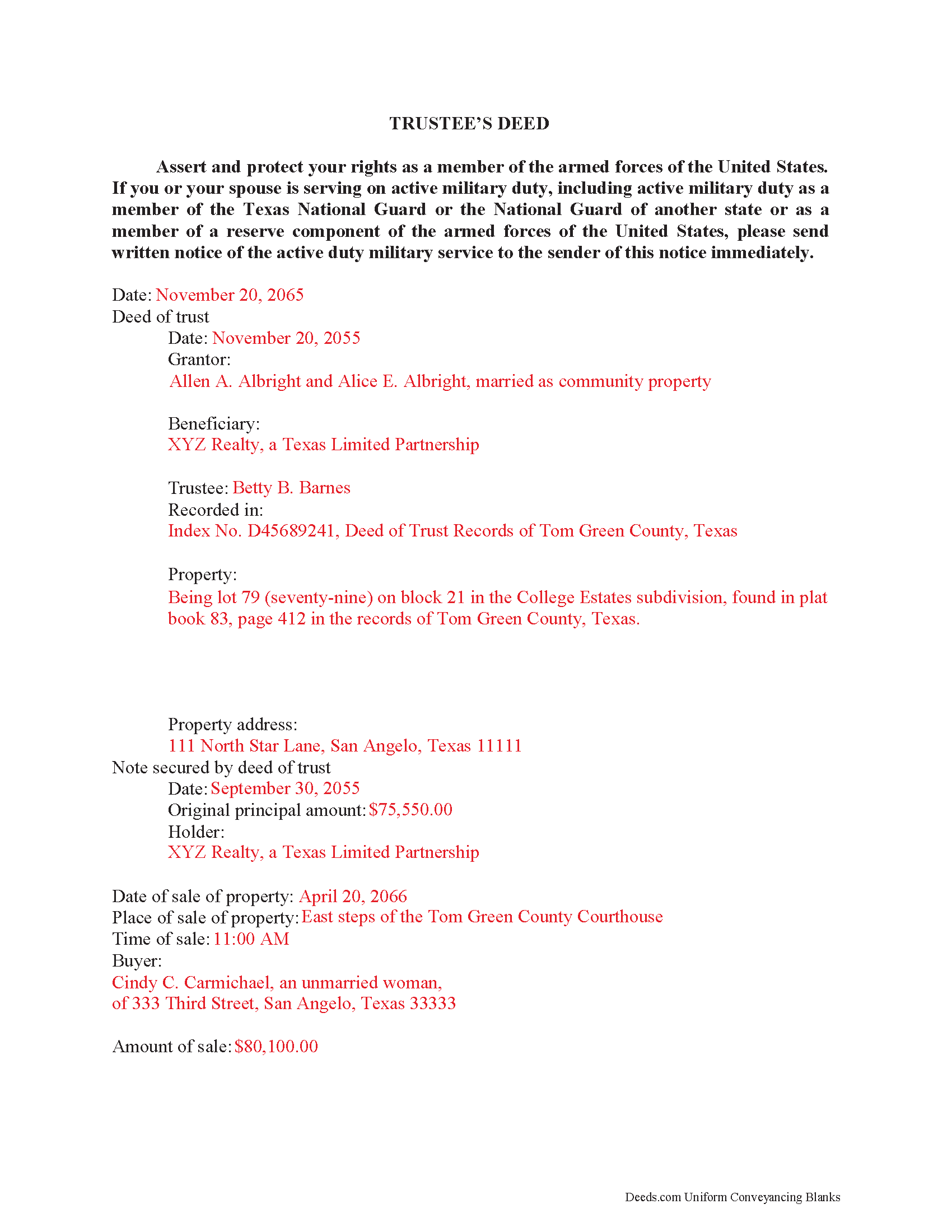

Winkler County Completed Example of a Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Winkler County documents included at no extra charge:

Where to Record Your Documents

Winkler County Clerk

Kermit, Texas 79745

Hours: 8:00 to 5:00 M-F

Phone: (432) 586-3401

Recording Tips for Winkler County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Check that your notary's commission hasn't expired

- Request a receipt showing your recording numbers

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Winkler County

Properties in any of these areas use Winkler County forms:

- Kermit

- Wink

Hours, fees, requirements, and more for Winkler County

How do I get my forms?

Forms are available for immediate download after payment. The Winkler County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Winkler County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Winkler County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Winkler County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Winkler County?

Recording fees in Winkler County vary. Contact the recorder's office at (432) 586-3401 for current fees.

Questions answered? Let's get started!

The majority of Texas foreclosures are non-judicial. They require a trustee's deed (alternately called a foreclosure deed or substitute trustee's deed, if applicable) to convey foreclosed property at a trustee's sale.

Trustee's deeds identify three primary parties: the grantor, who is the trustee in the deed of trust; the beneficiary, who is the lender and grantor in the deed of trust; and the buyer, who is the grantee and purchaser of the property at the foreclosure sale.

In a deed of trust, a trustee (the grantee under the original deed of trust instrument), appointed by the lender, holds the deed to the property as collateral for a loan to be repaid by the borrower (the trustor under the deed of trust). If the borrower fails to fulfill the terms of the deed of trust, the lender can direct the trustee to enforce the terms of the deed or begin the foreclosure process. This starts with a notice mailed to the borrower, now debtor, of the intent to accelerate. Notice of sale is also recorded and posted in the county where the subject property is located, as directed by Tex. Prop. Code 51.002 et seq.

A trustee's deed may sometimes be called a substitute trustee's deed, but it is functionally the same thing. The lender may appoint a substitute trustee if the original trustee is unable to administer the sale of property at public auction. A substitute trustee is a person named by the lender under the terms of the security instrument (deed of trust) to exercise the power of sale (Tex. Prop. Code 51.0001(7)). The power to appoint a substitute trustee must be expressly designated by the lender in the deed of trust, otherwise the appointment is invalid. A substitute trustee can be appointed at any time during the foreclosure process, so long as notice of the appointment is recorded. The foreclosing trustee, regardless, is generally an attorney for the lender. The trustee should identify in the deed whether they are serving as a trustee or substitute.

(Texas Trustee Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Winkler County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Winkler County.

Our Promise

The documents you receive here will meet, or exceed, the Winkler County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Winkler County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Cynthia W.

August 19th, 2022

I like the support documents that go along with the easement template and the fact that the format is specific to a state and county.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard L.

April 22nd, 2020

very useful

Thank you!

Larry M.

August 19th, 2021

Everything went well except that any information that I typed in on the computer download moves upward so that the letters or numbers are somewhat elevated above the line that should be even with the words on the form. I think it will be acceptable to the county recorder, but I don't especially like to submit things that appear uneven. I asked for help but just received a robotic reply that said to take steps that I already had done. So unless you know a way to correct this I likely won't use your forms again.

Thank you!

Ron M.

December 2nd, 2020

The download of forms, etc. was easy and the guides that were provided were good, but more information would have been nice as to where to find tax map #, parcel #, and district mentioned in Exemptions from Property Transfer Fees (and Declaration of Consideration or Value. In general, I was quite pleased with your product.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terrill M.

January 10th, 2020

Great forms and information

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David M.

July 6th, 2020

Best $20 ever spent. I'm a bit of an idiot with these things, thankfully there are professionals who know what they are doing so I don't screw things up...

Thank you!

Michael L. G.

October 1st, 2022

Thank you, Deed.com provided the needed forms to change county and state information after the passing of my father, saved me a trip to law office, especially after the lawyers would not return my calls, so I would recommend you check Deed.com for information, saved my family money for lawyer fees, would use Deed.com again. Mike

Thank you for your feedback. We really appreciate it. Have a great day!

Brian W.

February 20th, 2025

Quick, Simple and a Ton of Time Saved...

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Philippe B.

September 23rd, 2020

I purchased a Quit Claim Deed package a couple weeks ago. The included guide unfortunately didn't answer all the questions about my specific case of how to fill it out, so I sent them a couple questions on Sept 8. It's now the 23rd, and still no reply. The form is a useless waste of money if I don't know how to fill it out in a legally-accurate way.

We certainly do not want you to waste your money Philippe, to that end your order and payment has been canceled. We do hope that you seek the advice of a legal professional familiar with your specific situation. It should go without saying but just to be clear, our do it yourself forms do not include legal representation for $19. Have a wonderful day.

Joseph N.

September 17th, 2020

The site is easy to navigate and exceptional services. Unfortunately, they could find no information on a tract of land that I own, and they canceled the search and refunded my payment.

Sorry we were unable to help you find what you were looking for Joseph.

willie B.

May 21st, 2019

I love how you can get information you need online great program ,outstanding just love it....

Thank you!

CLAUDE G.

September 18th, 2019

just what I needed Thank You

Thank you!

Prentis T.

September 9th, 2019

So far so good

Thank you for your feedback. We really appreciate it. Have a great day!

Tyler B.

June 8th, 2022

Great!

Thank you!

Shawn B.

November 17th, 2021

Deeds.com support is very quick and responsive. Would use again and recommend to others in need of e-recording.

Thank you for your feedback. We really appreciate it. Have a great day!