Juab County Correction Deed Form

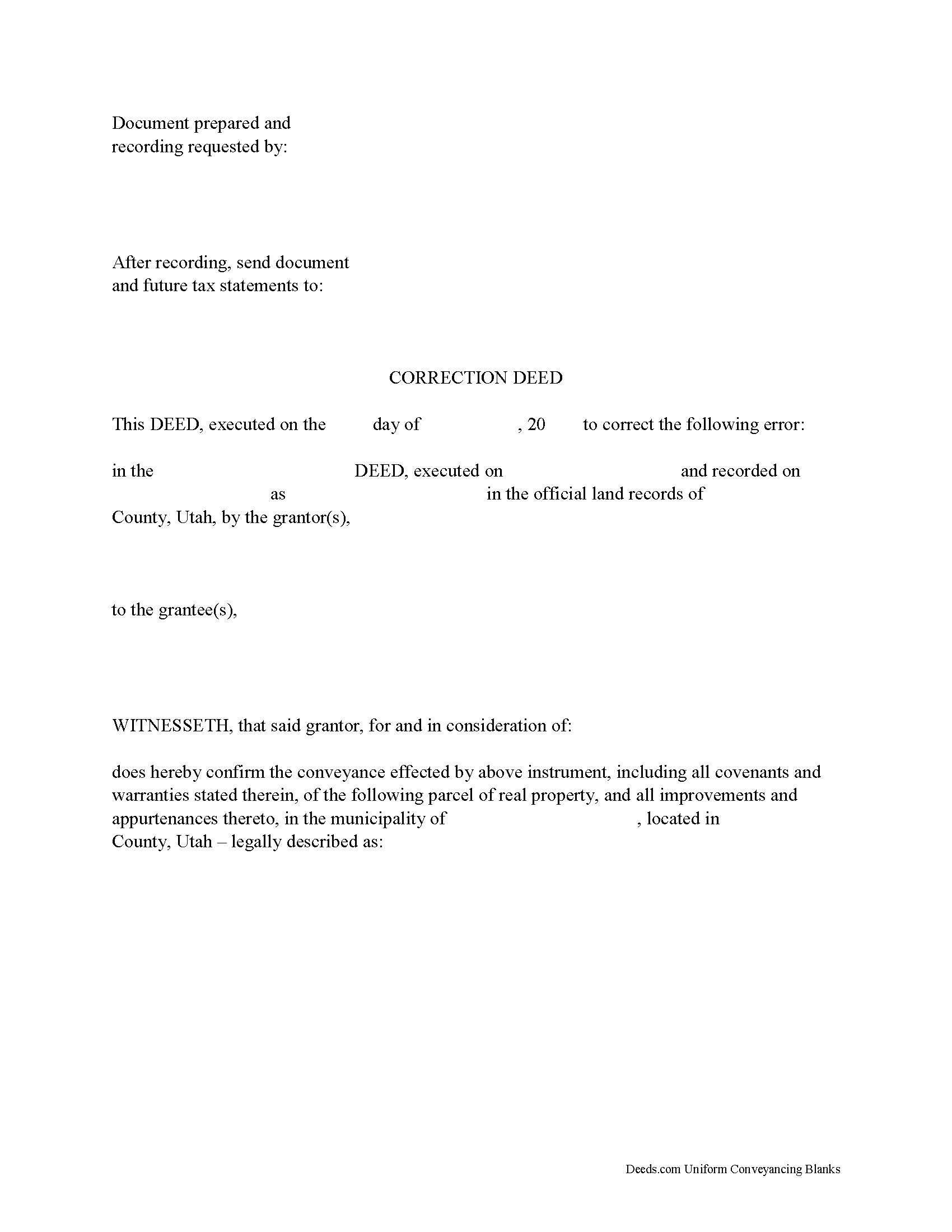

Juab County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

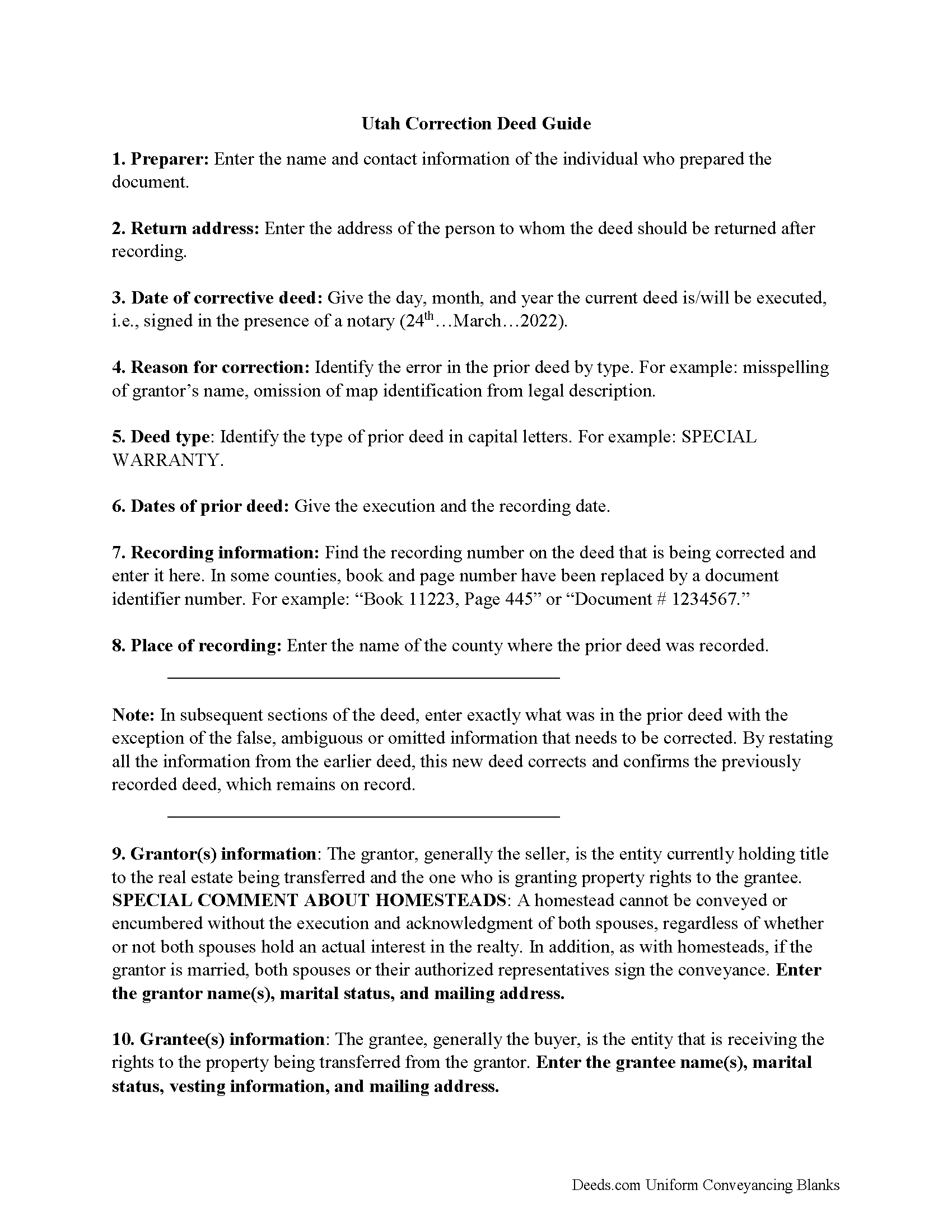

Juab County Correction Deed Guide

Line by line guide explaining every blank on the form.

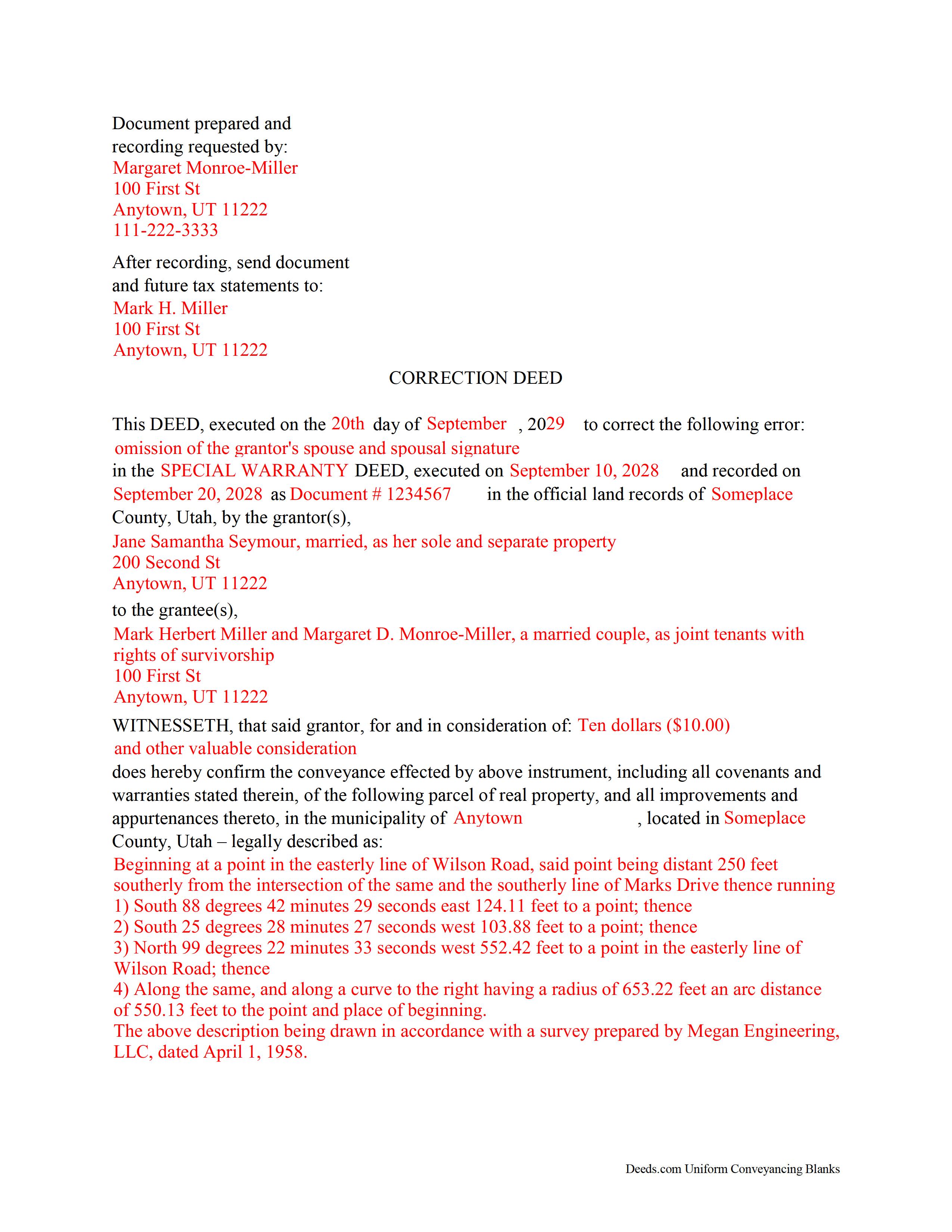

Juab County Completed Example of a Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Juab County documents included at no extra charge:

Where to Record Your Documents

Juab County Recorder

Nephi, Utah 84648

Hours: Monday - Thursday 7a.m. to 6 p.m.

Phone: (435) 623-3430

Recording Tips for Juab County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Juab County

Properties in any of these areas use Juab County forms:

- Eureka

- Levan

- Mona

- Nephi

Hours, fees, requirements, and more for Juab County

How do I get my forms?

Forms are available for immediate download after payment. The Juab County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Juab County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Juab County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Juab County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Juab County?

Recording fees in Juab County vary. Contact the recorder's office at (435) 623-3430 for current fees.

Questions answered? Let's get started!

Use the corrective deed to amend a previously recorded deed of conveyance with an error that could affect title.

An error in a document can be corrected in one of three ways in Utah: by recording an affidavit, by re-recording the original document, and by recording a new document. An affidavit can only be effective if it clarifies an ambiguity created in the original deed. It cannot add to or take away from the effect of the original recording. There are different types of affidavits, each used to correct different issues in a document.

For typographical errors, use a scrivener's affidavit. As far as correcting the legal description, omissions or obvious typographical errors that will not allow a point of beginning to be determined can be corrected by a scrivener's affidavit. However, if a point of beginning can be determined on the original document, whether or not it was the one intended by the executor of the document, an affidavit cannot change the point of beginning.

Another error in the legal description that can be corrected with an affidavit is the omission of a plat of a recorded subdivision, but the omission of the section, township, or range from the description, requires more than an affidavit to effect a change. If an error or omission occurred in the acknowledgment, a scrivener's affidavit, preferably from the notary, can be used for the correction.

Other affidavits are an affidavit of identity, which can be recorded by someone personally acquainted with a grantor or grantee of a previously recorded document in order to clarify that a person (a grantor or grantee) is "also known as" (aka) or was "formerly known as" (fka) another name. Finally, for an error in the survey, use a surveyor's affidavit. When recording an affidavit or when re-recording a document, include a notice containing the name and address to which real property valuation and tax notices should be sent.

A re-recorded document can correct all the errors mentioned above. Apart from correcting the original information or supplying omitted information, it must be re-signed by the original parties and re-acknowledged and contain a correction statement that gives the reason for the re-recording and refers to the prior recording by date, recording number and title. Keep in mind that adding extra pages for these required items and the re-execution will increase the overall page count of the re-recording and thus may affect recording fees.

By comparison, a new corrective deed may be the simpler and less expensive option to effect a correction of the record. It contains all the required elements of a re-recording within its two pages, i.e., it gives the reason for the correction, references the prior deed by date, recording number and title, and it provides a new signature and acknowledgement section. Furthermore, it presents the corrected or omitted information as part of its contents, instead of scribbled on the margins of the old deed, and for the most part, its contents restate and confirm the prior deed of conveyance.

Finally, keep in mind that certain changes may require a new deed of conveyance instead of a correction deed. Among those are the addition or omission of a grantor or grantee and of parts of the property, as well as a change in vesting. Seek legal advice when deciding on the right instrument to effect changes such as these that are of a material nature.

(Utah CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Juab County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Juab County.

Our Promise

The documents you receive here will meet, or exceed, the Juab County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Juab County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

John F.

January 28th, 2021

The document I purchased was perfect for what I needed done. Very easy to obtain the document. Website very easy to navigate. Would use again and would recommend to anyone who needs the documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Tamara H.

August 7th, 2021

Absolutely awesome, all the information and forms I needed Thanks Tamie Hamilton

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody P.

February 23rd, 2021

Thanks again for such excellent service, and always a pleasure!

Thank you!

Paul B.

March 13th, 2025

Very efficient and easy to use process

Paul, we’re glad to hear you had a smooth and efficient experience! Making things easy for our customers is always our goal.

Sara S.

January 8th, 2021

Deed.com was very user friendly, made recording convenient and fast responses. I do recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Lillian F.

September 13th, 2019

Very well satisfy with my results. I could not ask for better service d

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa P.

March 17th, 2021

Wonderful forms. It's nice that they were formatted perfectly for my county, it's real easy to miss a requirement (margines, font size, and so on) and end up with a rejection or higher recording fee. Good job folks!

Thank you!

Lance T. W.

August 23rd, 2019

All in all an easy, cost-effective approach to simple legal work.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly R.

March 18th, 2024

Love this site. Very informative and helpful!

Thank you for your feedback. We really appreciate it. Have a great day!

Alan E.

August 11th, 2021

I couldn't be happier with this service. They're helpful, quick and thorough. They make filing government documents very easy.

Thank you for your feedback. We really appreciate it. Have a great day!

DUINA F.

June 17th, 2025

Fast and Easy

Thank you for your feedback. We really appreciate it. Have a great day!

Deana A.

April 30th, 2020

Great forms and info, easy step-by-step guidance.

Thank you!

terrence h.

October 14th, 2023

Professional

Thank you!

Kristy T.

March 21st, 2019

Using your site made gifting personal property (land) so quick and easy. The forms were presented ready to complete and included detailed instructions. The "completed form" example was helpful. I definitely recommend your site to anyone who does not wish to pay expensive lawyer fees.

Thank you Kristy, we appreciate your feedback