Emery County Deed of Distribution Form

Emery County Deed of Distribution Form

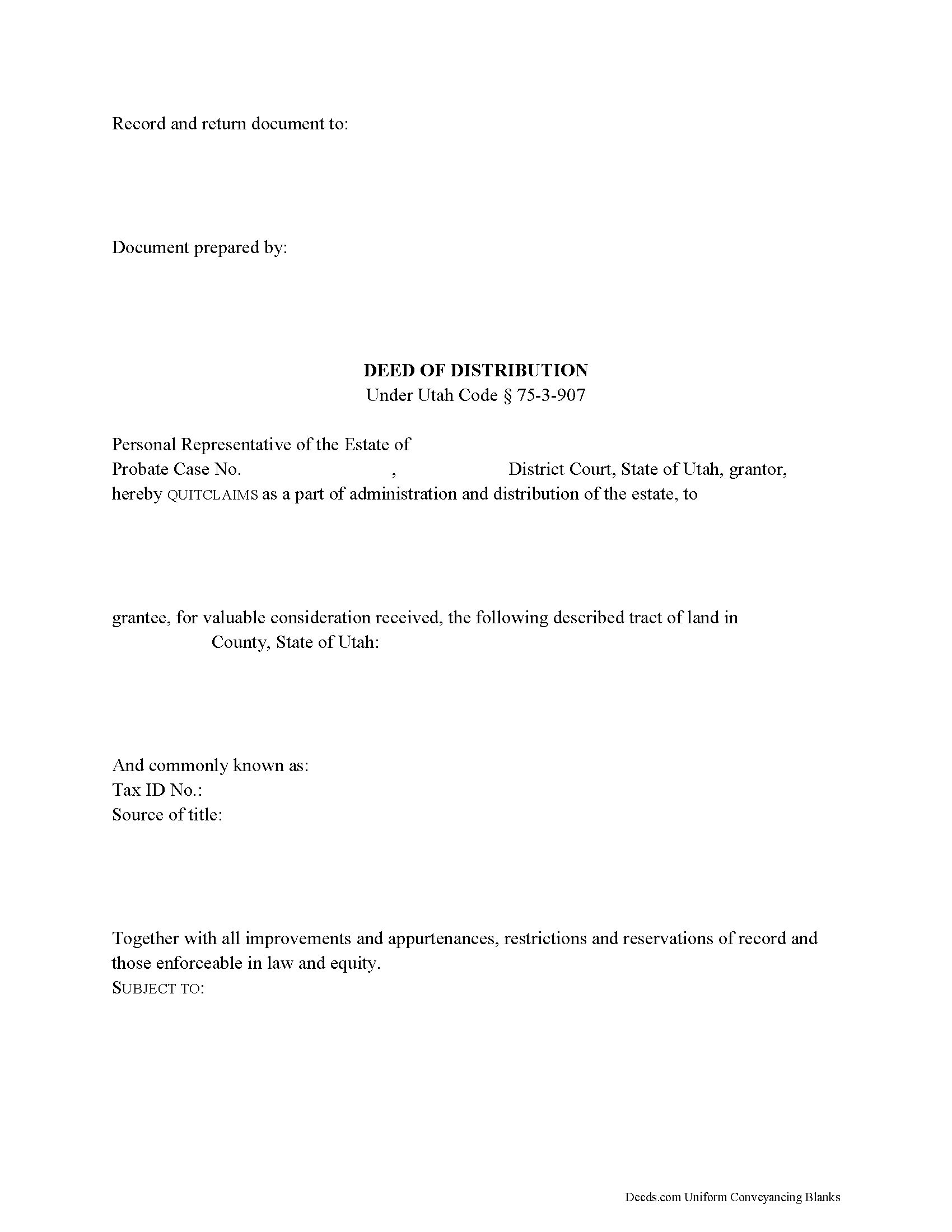

Fill in the blank form formatted to comply with all recording and content requirements.

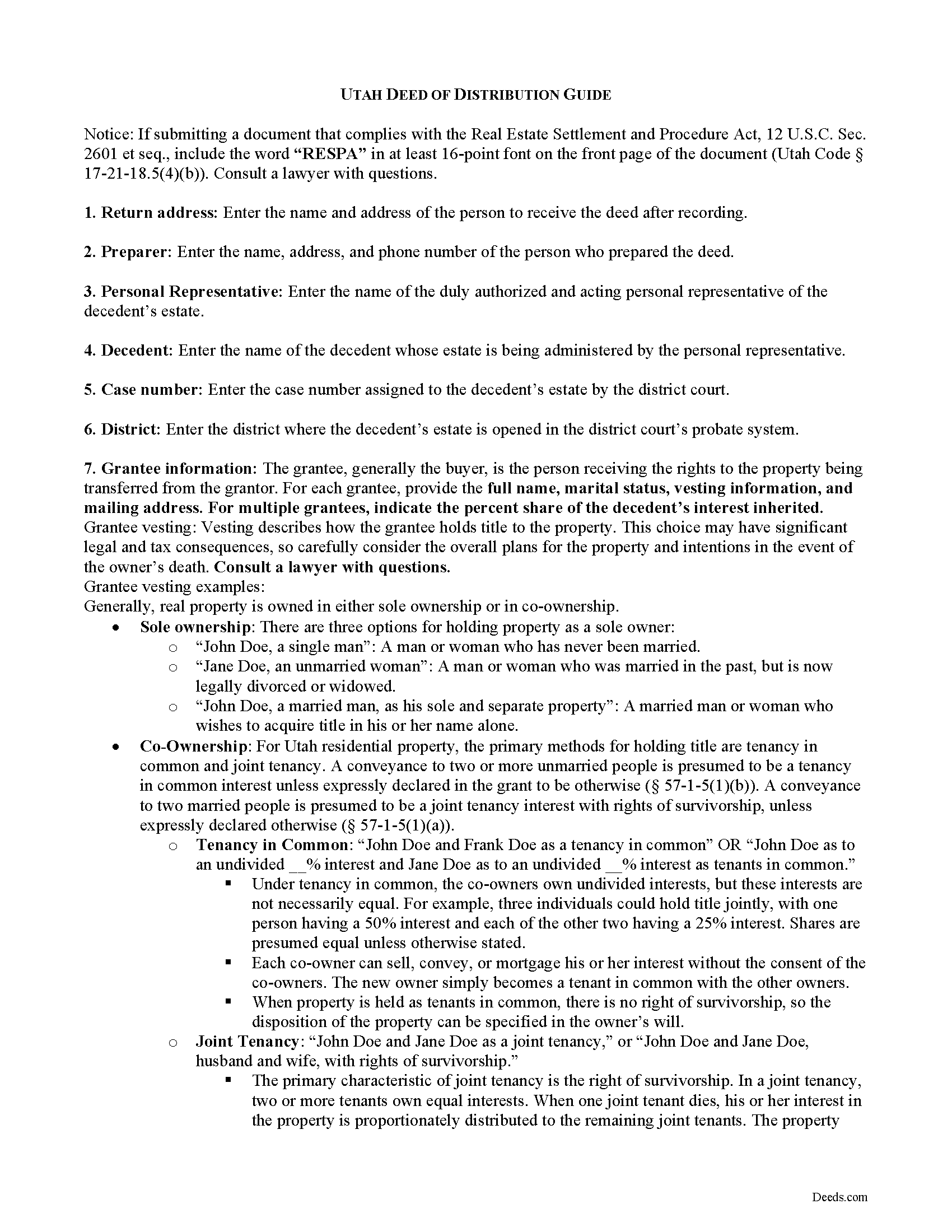

Emery County Deed of Distribution Guide

Line by line guide explaining every blank on the form.

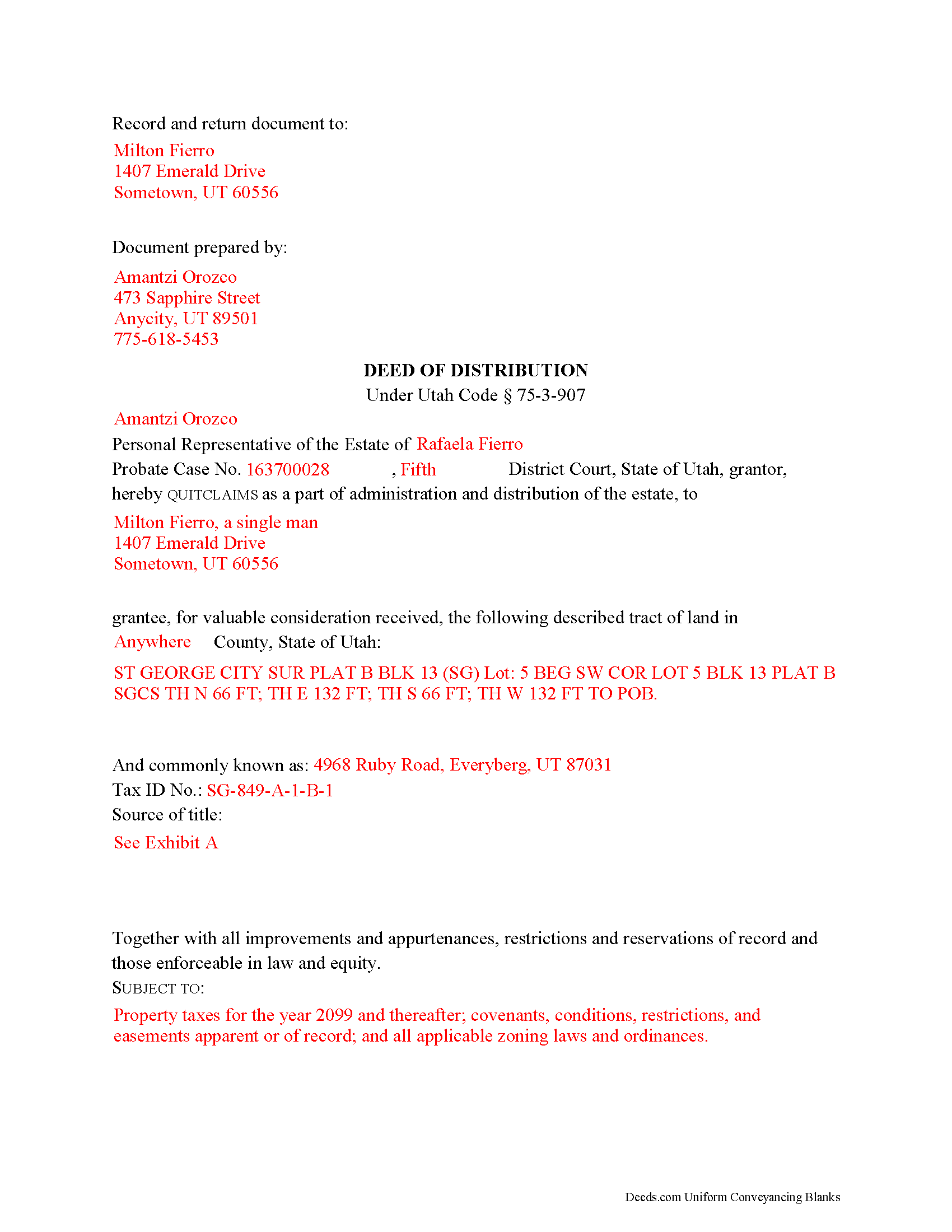

Emery County Completed Example of the Deed of Distribution Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Emery County documents included at no extra charge:

Where to Record Your Documents

Emery County Recorder

Castle Dale, Utah 84513

Hours: 8:30am to 5:00pm M-F

Phone: (435) 381-3520

Recording Tips for Emery County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Check margin requirements - usually 1-2 inches at top

- Recording fees may differ from what's posted online - verify current rates

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Emery County

Properties in any of these areas use Emery County forms:

- Castle Dale

- Clawson

- Cleveland

- Elmo

- Emery

- Ferron

- Green River

- Huntington

- Orangeville

Hours, fees, requirements, and more for Emery County

How do I get my forms?

Forms are available for immediate download after payment. The Emery County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Emery County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Emery County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Emery County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Emery County?

Recording fees in Emery County vary. Contact the recorder's office at (435) 381-3520 for current fees.

Questions answered? Let's get started!

A deed of distribution is a legal instrument of conveyance recorded as part of probate proceedings. Probate is the process of settling and distributing a decedent's estate. The Utah Uniform Probate Code is codified at Title 75 of the Utah Code.

Following the payment of claims against the estate, the personal representative (PR) may execute a deed of distribution under 75-3-907 to transfer fee simple title to real property to the distributee of an estate. A recorded deed of distribution is "conclusive evidence that the distributee has succeeded to the interest" in the property "as against all persons interested in the estate" (75-3-908). The deed releases the PR's power over the property and establishes marketable title. The instrument is functionally equivalent to a quitclaim deed and carries no warranties.

Deeds of distribution name the personal representative as the granting party, reference the decedent by name, and cite information about the probated estate, including the district court in which probate is opened and the case number assigned to the estate. To properly transfer title, include the grantee's full name, mailing address, and vesting information. All documents must meet state and county recording standards for form and content.

As with all documents pertaining to an interest in realty, the deed of distribution requires a legal description of the subject parcel, the tax identification number assigned by the taxing authority, and a recitation of the grantor's source of title. Note any restrictions associated with the property on the face of the deed. The PR must sign the deed in the presence of a notary public before recording in the appropriate county.

Include a water rights addendum under 57-3-109. This form must be completed and signed by the grantor. Submit the deed and any required supporting documents, such as a copy of the PR's letters and the decedent's death certificate, to the recording office of the county where the real property is situated.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Utah with questions regarding deeds of distribution and probate procedures in that state, as each situation is unique.

(Utah DOD Package includes form, guidelines, and completed example)

Important: Your property must be located in Emery County to use these forms. Documents should be recorded at the office below.

This Deed of Distribution meets all recording requirements specific to Emery County.

Our Promise

The documents you receive here will meet, or exceed, the Emery County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Emery County Deed of Distribution form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Pamela B.

May 29th, 2021

The process was not difficult but I don't think that it suited my needs. There were several fields that were not applicable to me but I had to enter something to proceed. I also filled out the other form and mailed it in with some documentation that the electronic service did not ask for. Questions of my attempt are still unanswered. I hope I didn't waste time with this process. We shall see. Thank you.

Thank you!

Kim K.

December 11th, 2020

Your service was easy to use and fee was reasonable. I would recommend to other lawyers who are in private practice.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ed C.

June 16th, 2025

I purchased the DIY quitclaim deed forms for Florida and couldn’t be happier. The forms were clear, professional, and easy to follow. I had everything filled out and recorded without a single issue. Worth every penny — the site is great, and the forms are exactly what I needed. Highly recommend!

Thanks so much, Ed! We’re thrilled to hear that the Florida quitclaim deed forms worked perfectly for you and that the recording process went smoothly. We appreciate your trust and recommendation!

Ruthea M.

March 18th, 2025

It was easy to download, but you need to open an account before doing so. That was not clear.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Eva L.

June 19th, 2020

So far so good! I haven't had an opportunity to populate the forms but they seem to be very easy to do. The sample deed serves very well. Ordering the forms were very easy, I was impressed with the ease of doing so.

Thank you!

Maggie C.

April 29th, 2020

Easy to use fantastic website. Immediately found the Sheriff's Deed I needed.

Thank you!

Martin E.

February 16th, 2021

documents and guidance need to properly comply with court

Thank you!

Paul S.

October 23rd, 2020

Directions were good. It was an easy process. Thank You.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard H.

October 14th, 2022

It was a waste of time. I asked a question via your chat service. I received an acknowledgement that you received the question, that you might or might not answer it, and don't bother to reply to you email, as no one would read it. Confirming my belief that customer service is an oxymoron for most companies. (I doubt this review will ever appear on the site, or anyuhere else.)

Thank you!

Wanda C.

August 20th, 2020

Site is very well laid out and easy to use. My only issue is that it wouldn't allow me to change my password, so I'm stuck with the "temporary" one. Not a big deal, but I would have preferred to change it.

Thank you for your feedback. We really appreciate it. Have a great day!

Janet S.

April 7th, 2021

I would've done this years ago if I'd known how easy it was! The plus is it's not expensive either. Thank you deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ellen O K.

April 25th, 2019

Good experience. Easy peasy. :)

Thank you Ellen, have a wonderful day!

Dorothea B.

October 2nd, 2019

The Affidavit- Death of Joint Tenant form you provided is not the same form as showed on the Los Angeles County property tax website. It appears that the LA county form requires entering additional info that is not included in your form.

Thank you!

Cynthia E.

June 1st, 2019

good source

Thank you!

Sherry C.

September 9th, 2020

The experience was great. It was so easy to get my document recorded and it was done the same day!

Thank you!