Salt Lake County Disclaimer of Interest Form

Salt Lake County Disclaimer of Interest Form

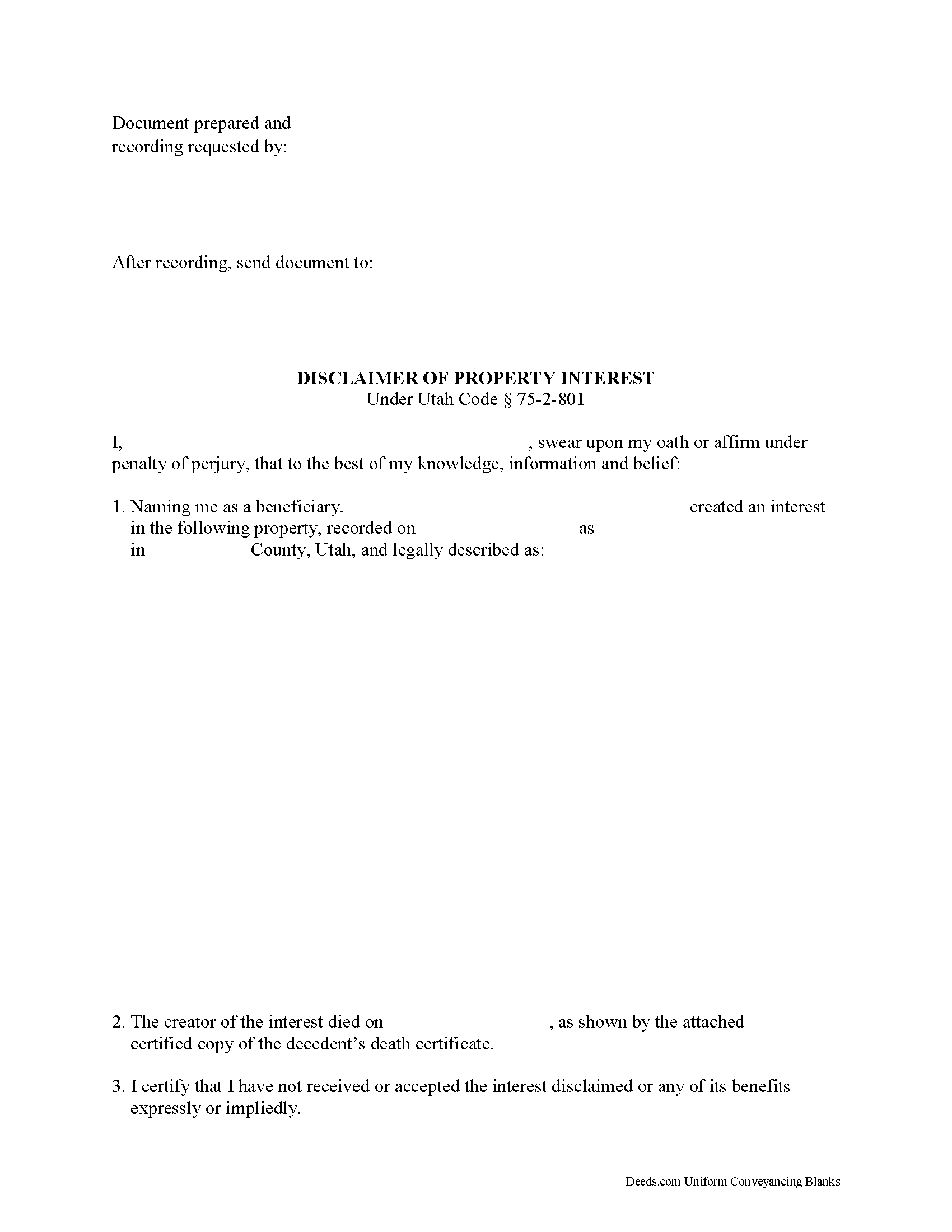

Fill in the blank form formatted to comply with all recording and content requirements.

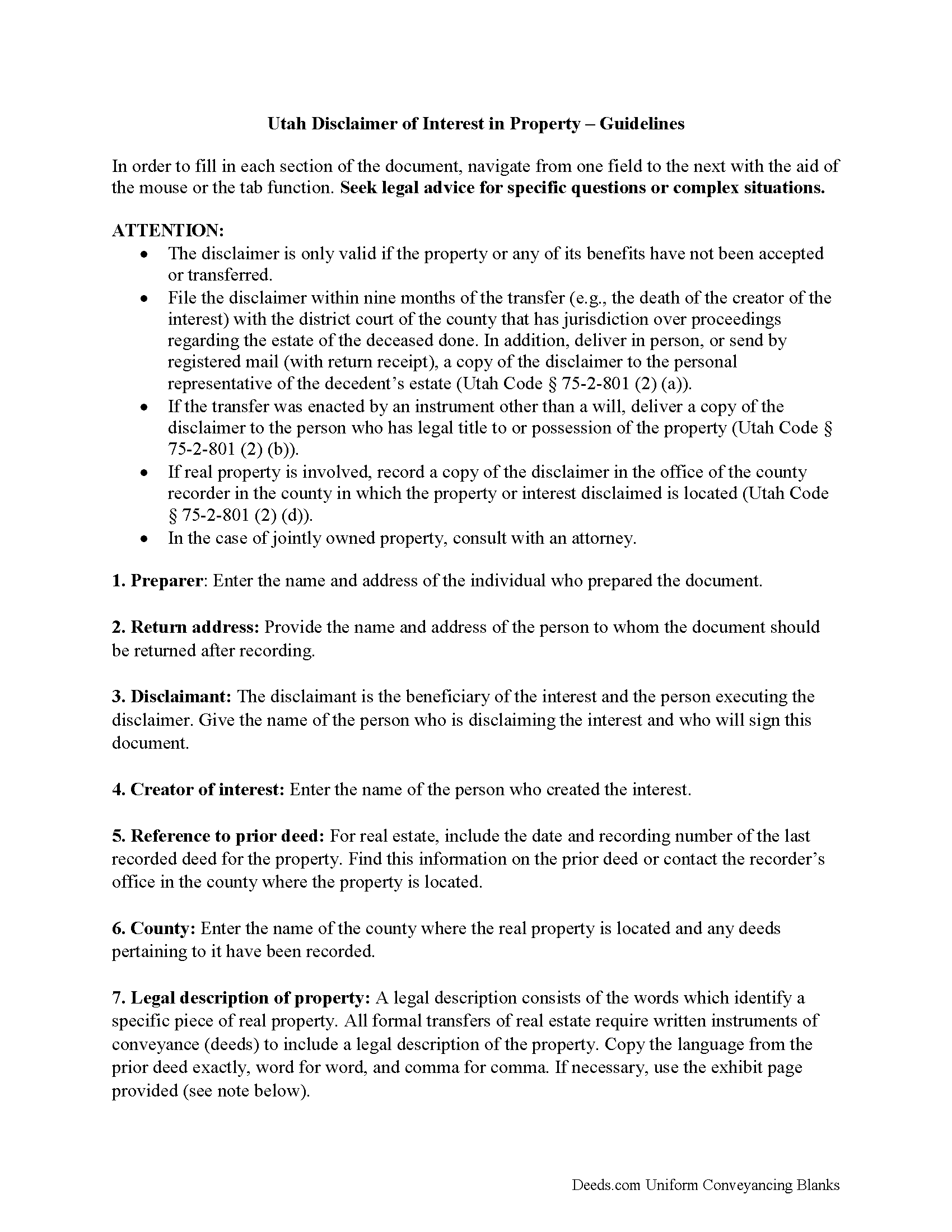

Salt Lake County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

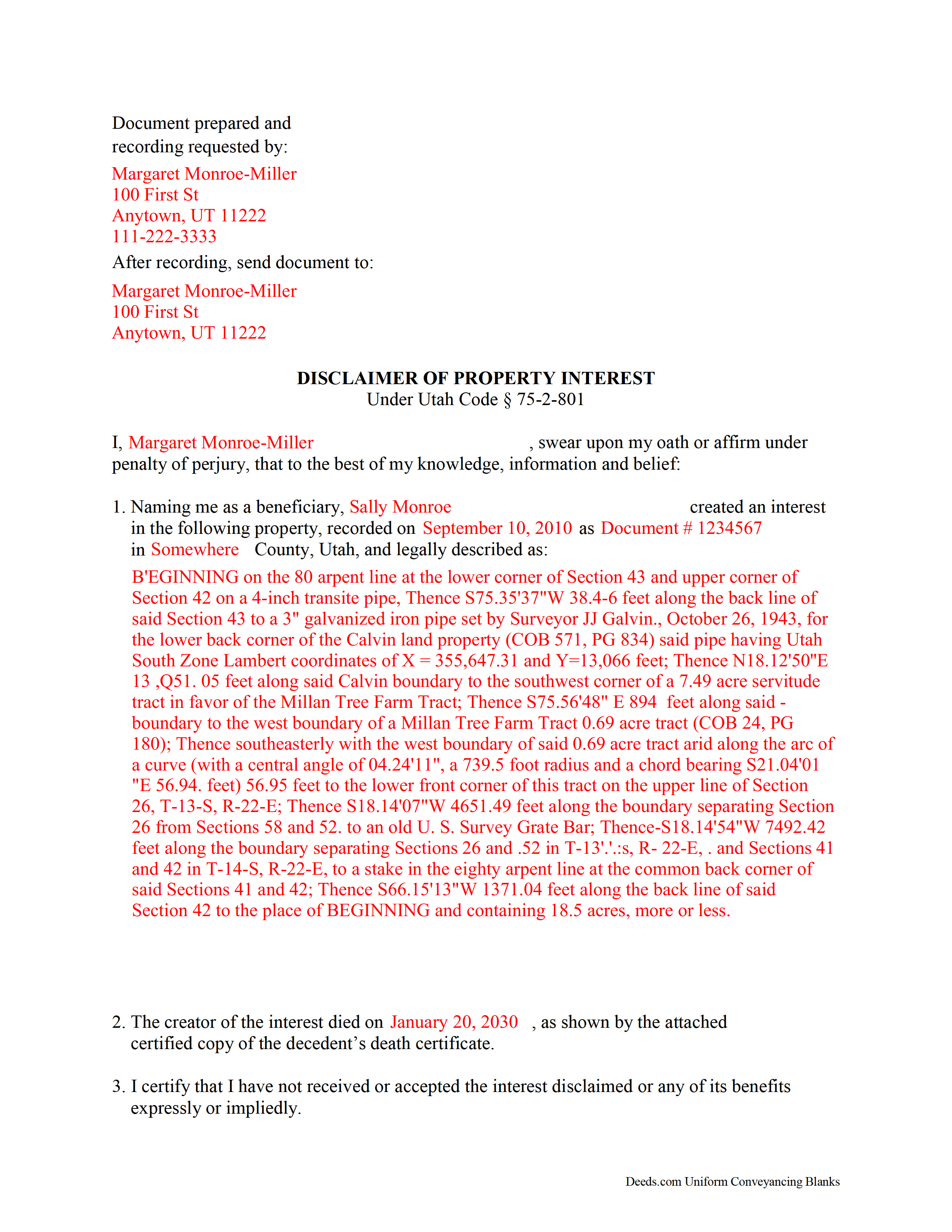

Salt Lake County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Salt Lake County documents included at no extra charge:

Where to Record Your Documents

Salt Lake County Recorder

Salt Lake City, Utah 84190

Hours: 8:00 to 5:00 M-F

Phone: (385) 468-8145

Recording Tips for Salt Lake County:

- Ensure all signatures are in blue or black ink

- Avoid the last business day of the month when possible

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Salt Lake County

Properties in any of these areas use Salt Lake County forms:

- Bingham Canyon

- Draper

- Herriman

- Magna

- Midvale

- Riverton

- Salt Lake City

- Sandy

- South Jordan

- West Jordan

Hours, fees, requirements, and more for Salt Lake County

How do I get my forms?

Forms are available for immediate download after payment. The Salt Lake County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Salt Lake County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Salt Lake County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Salt Lake County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Salt Lake County?

Recording fees in Salt Lake County vary. Contact the recorder's office at (385) 468-8145 for current fees.

Questions answered? Let's get started!

As part of the Utah Uniform Probate Code, the beneficiary of an interest in property may renounce the gift, either in part or in full (Utah Code 75-2-801). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest (Utah Code 75-2-801 (5)).

The disclaimer must be in writing and include a description of the interest, a declaration of intent to disclaim all or a defined portion of the interest, and be signed by the disclaimant (Utah Code 75-2-801 (3)).

File the disclaimer within nine months of the transfer (e.g., the death of the creator of the interest) with the district court of the county that has jurisdiction over proceedings regarding the estate of the deceased donor. In addition, deliver a copy of the disclaimer in person or send it by registered mail to the personal representative of the decedent's estate (Utah Code 75-2-801 (2) (a)). If the transfer is enacted by an instrument other than a will, deliver a copy of the disclaimer to the person who has legal title to or possession of the property (Utah Code 75-2-801 (2) (b)). If real property is involved, record a copy of the disclaimer in the office of the county recorder in the county in which the property or interest disclaimed is located (Utah Code 75-2-801 (2) (d)).

A disclaimer is irrevocable and binding for the disclaiming party and his or her creditors (Utah Code 75-2-801 (4) (c)), so be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property. If the disclaimed interest arises out of jointly-owned property, seek legal advice as well.

(Utah DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Salt Lake County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Salt Lake County.

Our Promise

The documents you receive here will meet, or exceed, the Salt Lake County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Salt Lake County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Janice S.

August 31st, 2022

All instructions and forms are very easy to read and fill-out. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

David D.

May 20th, 2021

Very easy to us & thanks for all the info to fill out the form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julia M.

March 9th, 2019

Your PDF form Personal Representative's Deed was exceedingly helpful.

Thank you Julia. Have a fantastic day!

Karelia W.

February 14th, 2024

Was a bit skeptical because I'd never heard of it, but just got something submitted and confirmed recorded in less than 24 hrs. UI could use some work but other than that, straightforward and works!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Herbert R.

November 12th, 2022

Your website was very helpful. Hopefully, I will have it completed correctly prior to use.

Thank you for your feedback. We really appreciate it. Have a great day!

James T.

July 12th, 2021

Very easy to use. Straightforward and informative

Thank you for your feedback. We really appreciate it. Have a great day!

Audra W.

December 16th, 2021

Excellent source for obtaining documents and instructions.

Thank you!

Cindy H.

January 16th, 2021

It was easy and quick. Such a pleasure to use since we live out of town. So convenient. Definitely would recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Scott G.

June 4th, 2024

Frankly, if our tax dollars were being used to run government "services" correctly, we wouldn't need Deeds.com Since the sun will burn out before government is run correctly, Deeds.com provides an important, efficient, time-saving service that, all things considered, offers big savings over time-and-soul-draining struggles with government agencies.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Melinda P.

January 4th, 2020

I received my documents immediately! Thats was a huge relief!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara C.

September 5th, 2021

I have used these forms now at least 3 times in order to sell the same parcel of land. The forms are great and I'm happy that I could use them more than once. To no fault of Deeds.com I used them many times to sell the same land. First the man died that was buying, before it got recorded. Then his wife was going to finish it, but then decided it should be sold to another party who was a friend of hers.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard H.

October 14th, 2022

It was a waste of time. I asked a question via your chat service. I received an acknowledgement that you received the question, that you might or might not answer it, and don't bother to reply to you email, as no one would read it. Confirming my belief that customer service is an oxymoron for most companies. (I doubt this review will ever appear on the site, or anyuhere else.)

Thank you!

JOHN F.

May 24th, 2023

Quick and easy! I had previously prepared a Lady Bird deed, submitted it through Deeds.com and it was accepted/recorded by my county in just a few hours. The Deed.com $21 fee was well worth it as I saved fuel, tolls and parking costs not to mention at least 2-3 hours of my time that it would've taken to get downtown and back home!

Thanks for the feedback John. We appreciate you taking the time to share your experience. Have an amazing day!

Karen L.

October 3rd, 2022

Good service could give a little more detail on where to location some of the information needed. Overall fairly simply to use.

Thank you for your feedback. We really appreciate it. Have a great day!

SHARON R.

September 12th, 2019

Excellent Service! Please note that form Realty Transfer Tax Statement of Value does not print completely. Part of the pages are cut off. Otherwise, excellent service.

Thank you for your feedback. We really appreciate it. Have a great day!