Millard County Grant Deed Form

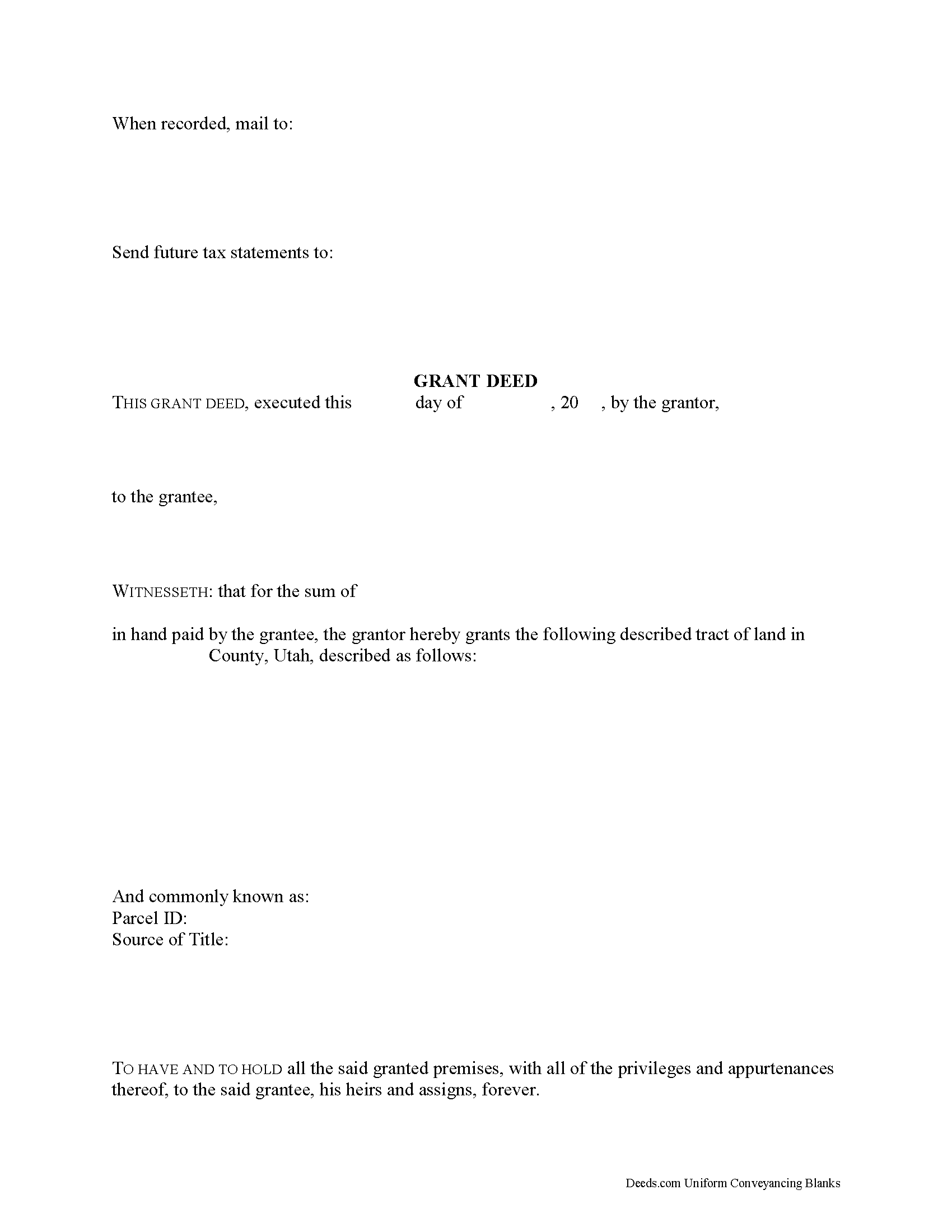

Millard County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

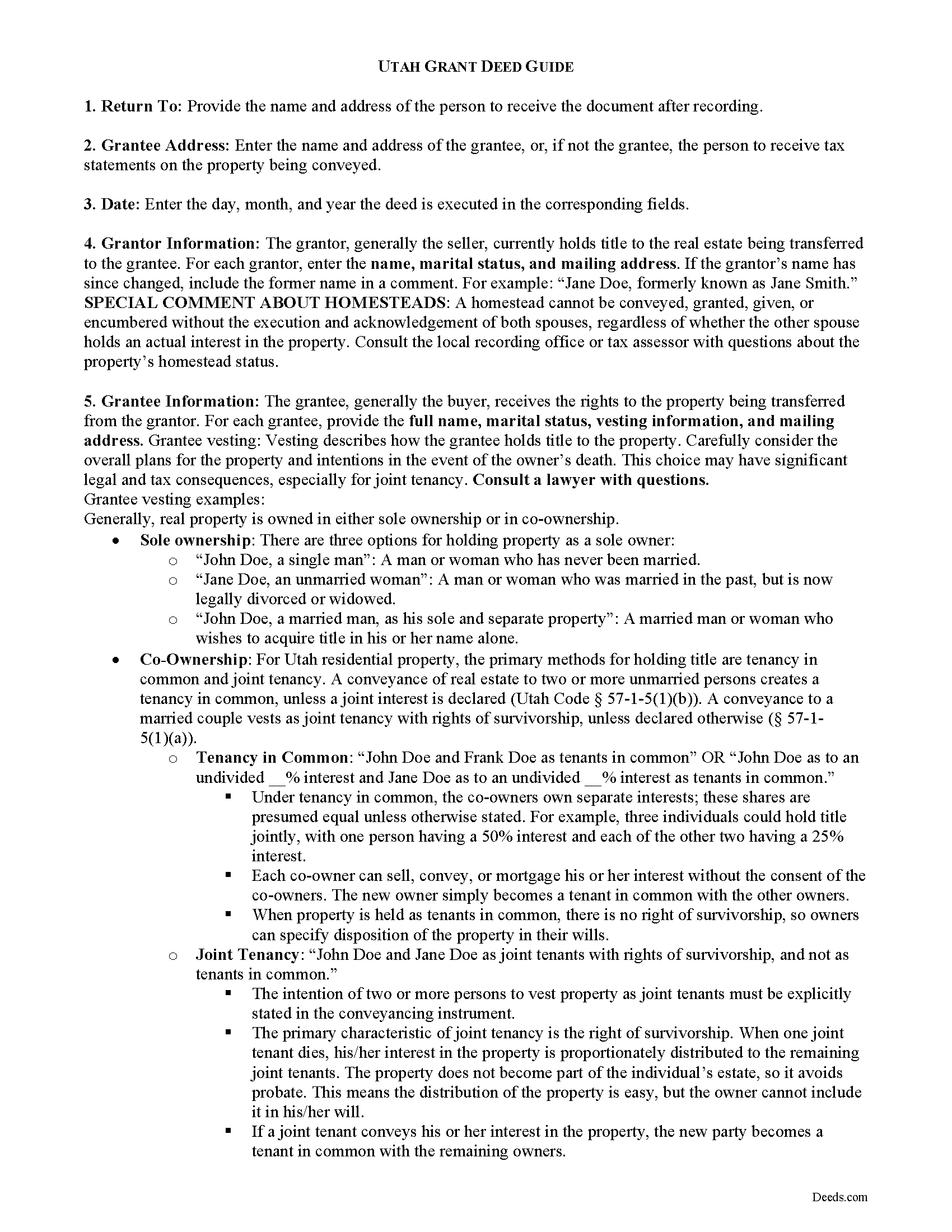

Millard County Grant Deed Guide

Line by line guide explaining every blank on the form.

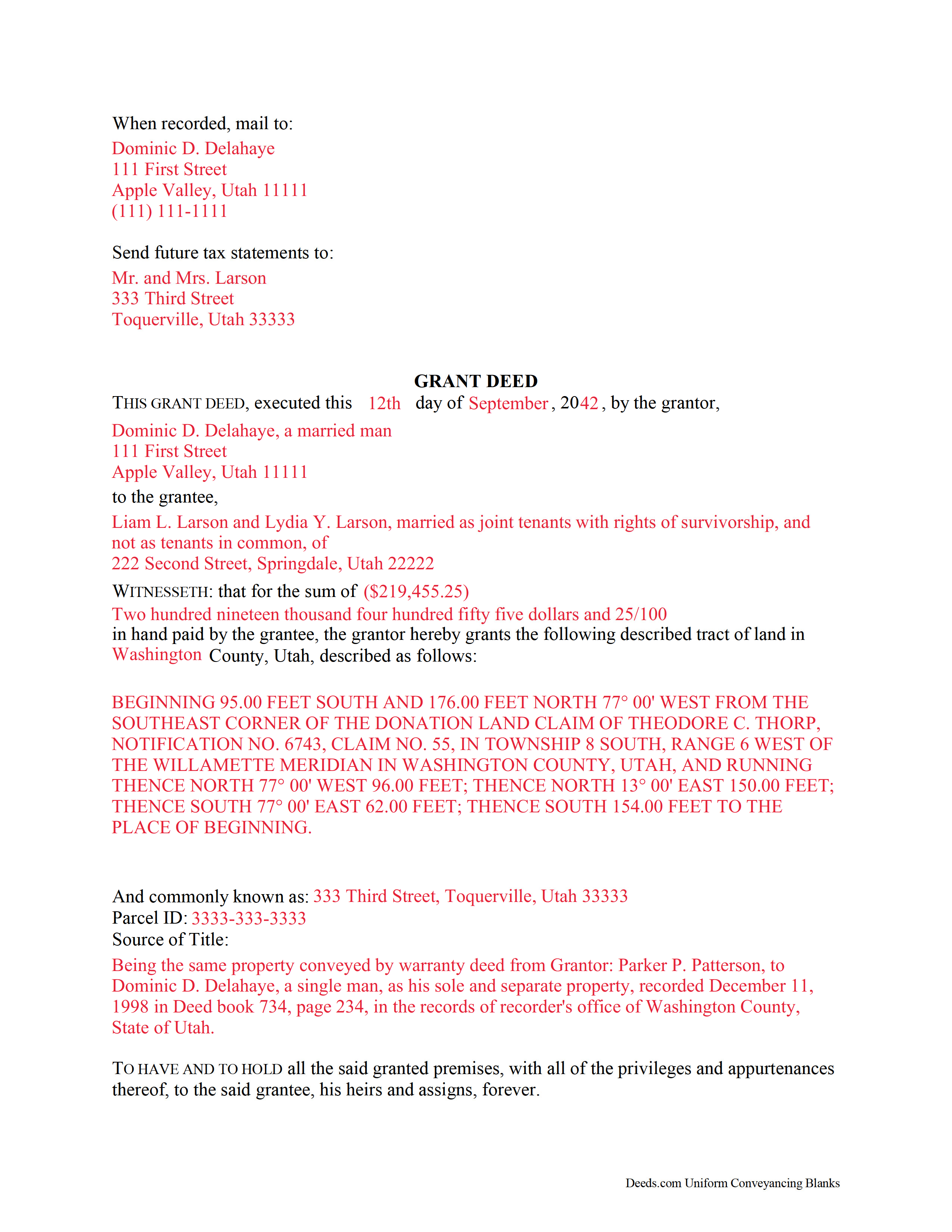

Millard County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Millard County documents included at no extra charge:

Where to Record Your Documents

Millard County Recorder

Fillmore, Utah 84631

Hours: 8:00 to 5:00 M-F

Phone: (435) 743-6210

Recording Tips for Millard County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Check margin requirements - usually 1-2 inches at top

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Millard County

Properties in any of these areas use Millard County forms:

- Delta

- Fillmore

- Garrison

- Hinckley

- Holden

- Kanosh

- Leamington

- Lynndyl

- Meadow

- Oak City

- Scipio

Hours, fees, requirements, and more for Millard County

How do I get my forms?

Forms are available for immediate download after payment. The Millard County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Millard County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Millard County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Millard County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Millard County?

Recording fees in Millard County vary. Contact the recorder's office at (435) 743-6210 for current fees.

Questions answered? Let's get started!

In Utah, title to real property can be transferred from one party to another by executing a grant deed. Use a grant deed to transfer a fee simple interest with some covenants of title. The word "grant" in the conveyancing clause typically signifies a grant deed, but it is not a statutory form in Utah.

Grant deeds offer more protection for the purchaser (grantee) than quitclaim deeds, but less than warranty deeds. A grant deed differs from a quitclaim deed in that the latter offers no warranty of title, and only conveys any interest that the grantor may have in the subject estate. Grant deeds guarantee through implied covenants that the title is free of any encumbrances (except for those stated in the deed) and that the grantor holds an interest in the property and is free to convey it. A warranty deed offers more surety than a grant deed because it requires the grantor to defend against claims to the title.

A lawful grant deed includes the grantor's full name, mailing address, and marital status; the consideration given for the transfer; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Utah residential property, the primary methods for holding title are tenancy in common and joint tenancy. A conveyance of real estate to two or more unmarried persons creates a tenancy in common, unless a joint interest is declared (Utah Code 57-1-5(1)(b)). A conveyance to a married couple vests as joint tenancy with rights of survivorship, unless declared otherwise (57-1-5(1)(a)).

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel (57-3-105). Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The completed deed must be acknowledged by the grantor (and his or her spouse, if applicable) in the presence of a notary. Finally, it must meet all state and local standards for recorded documents.

Record the original completed deed, along with any additional materials, at the recorder's office in the county where the property is located. Contact the same office to verify recording fees and accepted forms of payment.

A water rights addendum under 57-3-109 is required for all applicable deeds. Applicable deeds include any conveyance in fee simple of title to land or any conveyance of water rights. This form must be completed and signed by the grantor and joined by the grantee to acknowledge receipt.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Utah lawyer with any questions related to the transfer of real property.

(Utah Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Millard County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Millard County.

Our Promise

The documents you receive here will meet, or exceed, the Millard County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Millard County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Brian H.

May 1st, 2019

Forms are good. But need to be able to fill in information and blanks so these can be filed. Disappointed.

Thank you for your feedback. The forms are fill in the blank, Adobe PDFs. As is noted on the site, make sure you download the documents to your computer and open them with Adobe. Sounds like you may be trying to complete them online in your browser.

ed d.

December 23rd, 2020

Fast efficient hassle free

Thank you for your feedback. We really appreciate it. Have a great day!

Kathyren O.

April 25th, 2019

Very helpful and I will be using your services in the near future. Thank you Kathyren Oleary

Thanks Kathyren, we really appreciate your feedback.

Francis L.

February 8th, 2023

You have duplicate documents in your listing of documents. please clean up.

Thank you!

Gerald C.

May 25th, 2019

Pros, quick purchase and document availability including instructions and examples. Cons, For the cert. of trust, the form would not accept the length of our trust name with no way to get around. The pdf file printing did not meet the requirements for 2.5" top margin and .5" other margins as well as the 10pt font size as the form information was shrunk down even when normal printing.

Thank you for your feedback. We really appreciate it. Have a great day!

Erika H.

December 14th, 2018

The service was fast and efficient. So glad I stumbled upon this website!

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara J.

February 27th, 2020

I haven't actually used any forms yet, but I am very pleased with the simplicity of the website. I love the nmber and variety of forms offered. Thank you for such a great website,

Thank you!

randy j.

December 15th, 2018

the deed format and fill-in language are very specific to one type of easement and are not generally applicable to any other type; in other words it is not useful in a majority of situations and i would recommend against purchase unless you are creating an easement for an appurtenant landowner ONLY

Thank you for your feedback. We really appreciate it. Have a great day!

Eddy C & Tina H.

May 11th, 2021

did not use, much to expensive.

Thank you for your feedback. We do hope that you found something more suitable to your needs elsewhere. Have a wondaful day.

Kim L.

August 26th, 2020

Got the quit claim forms, amazing really. Easy to understand, looked great when completed, accepted without question for recording. Nice job!

Thank you!

Philip F.

August 2nd, 2024

Quick, user-friendly, and complete! Thank you

We are grateful for your feedback and looking forward to serving you again. Thank you!

Laverne C.

September 2nd, 2020

Great service. The issue I had was uploading the file of several pages. Once I learned, everything became clear and easier. The support group have been extremely prompt and helpful, I would surely use the service again and recommend the serivce.

Thank you!

Jack A.

March 26th, 2021

First time user. Great service. If I need other forms, I'll definitely be using Deeds.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donald S.

March 16th, 2021

Guidelines somewhat helpful. Forms fillable but not editable unless you buy an Adobe conversion service subscription. End product looks crude and amateurish. Fields can't be reduced or enlarged to accommodate unique data. Very disappointing.

Thank you for your feedback. We really appreciate it. Have a great day!

Wava B.

January 8th, 2021

Obtaining the form was quick and easy. Thank You

We appreciate your business and value your feedback. Thank you. Have a wonderful day!