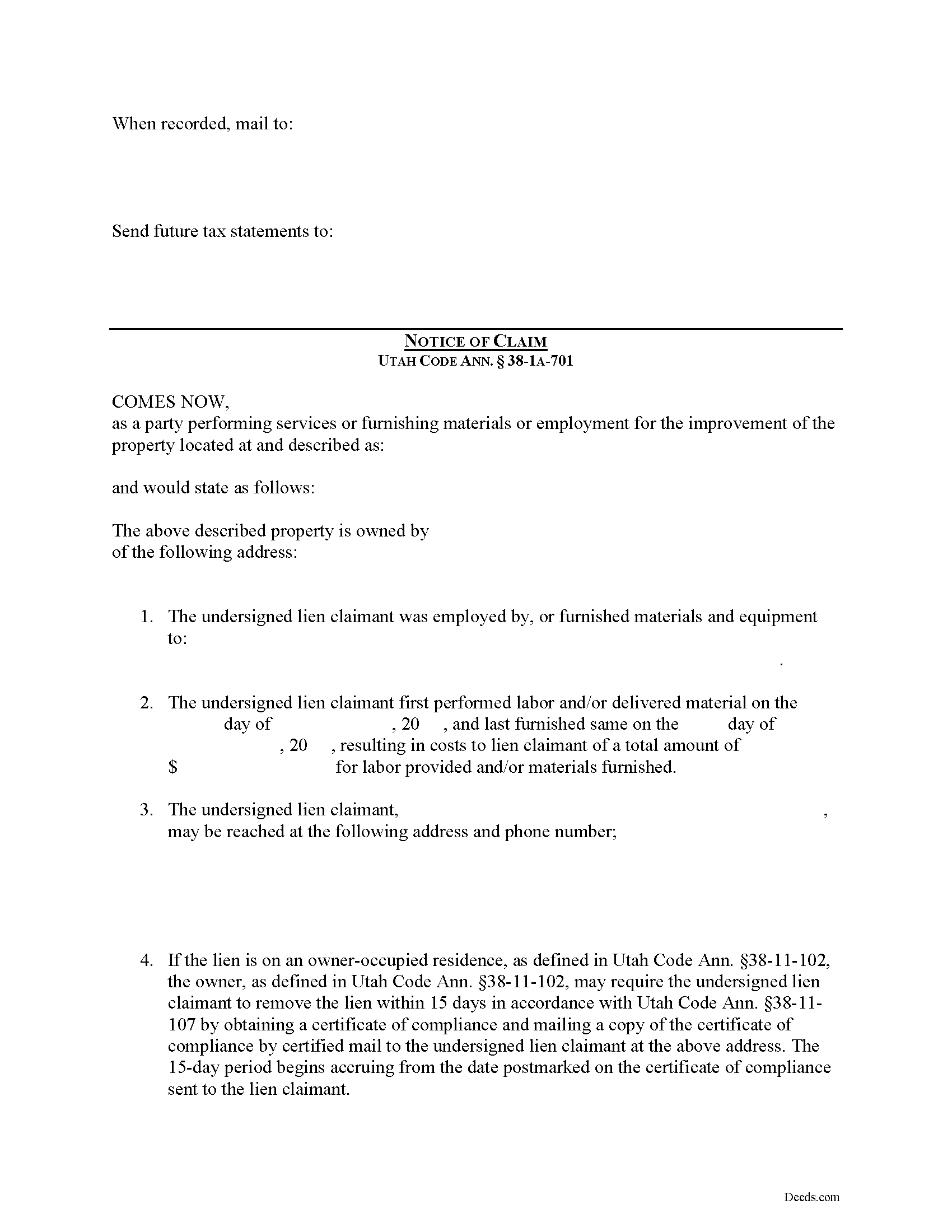

Duchesne County Notice of Claim Form

Duchesne County Notice of Claim Form

Fill in the blank Notice of Claim form formatted to comply with all Utah recording and content requirements.

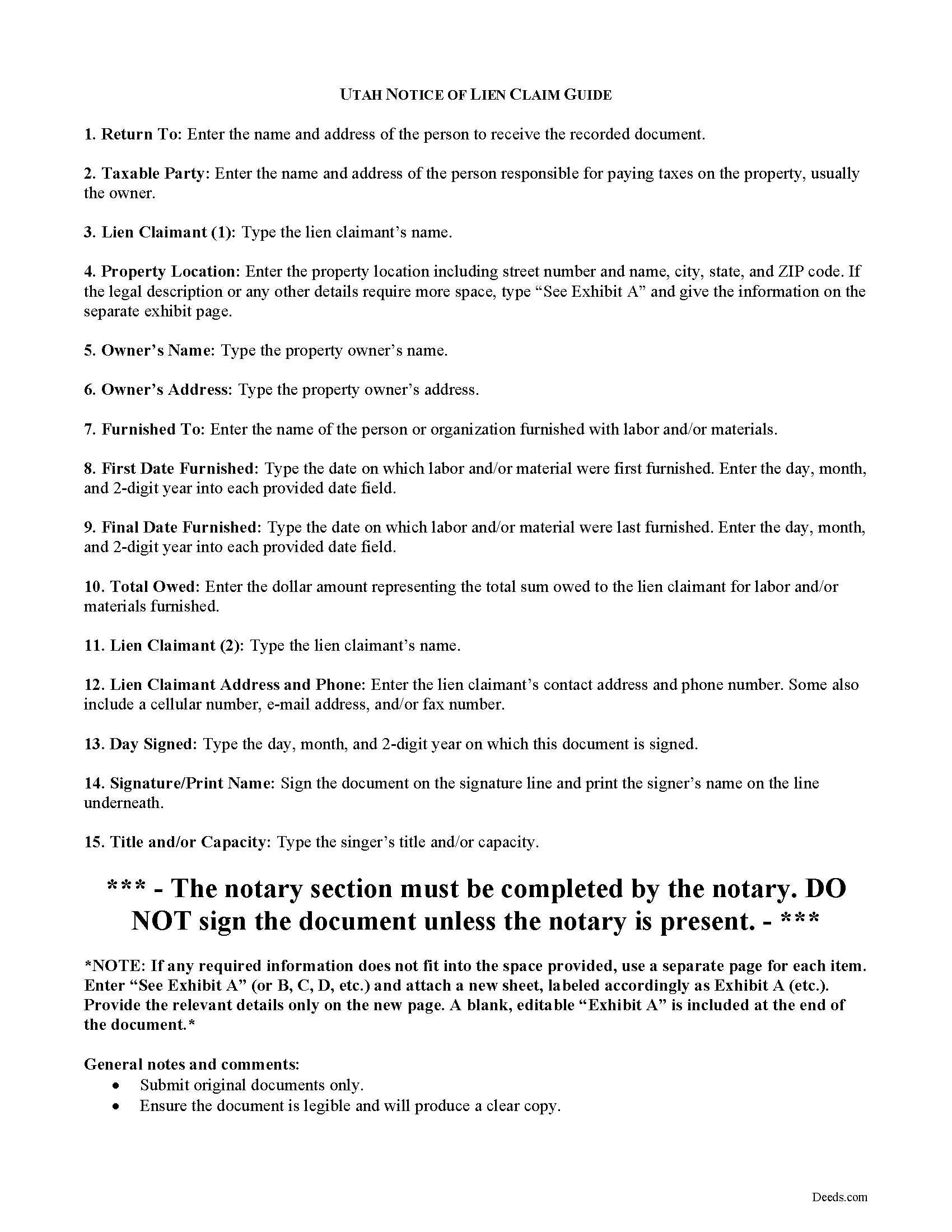

Duchesne County Notice of Claim Guide

Line by line guide explaining every blank on the form.

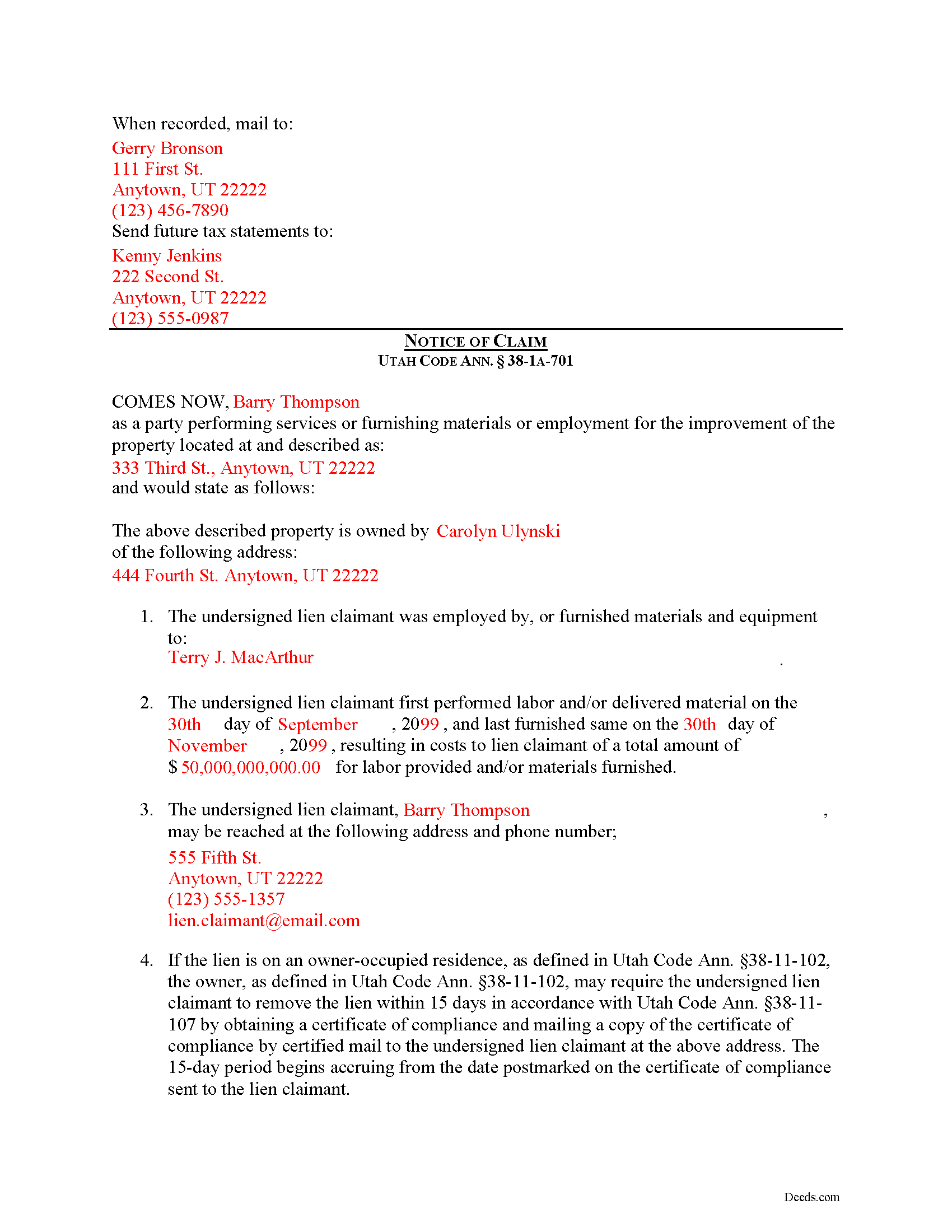

Duchesne County Completed Example of the Notice of Claim Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Duchesne County documents included at no extra charge:

Where to Record Your Documents

Duchesne County Recorder

Duchesne, Utah 84021

Hours: 8:30 to 5:00 M-F

Phone: (435) 738-1166

Recording Tips for Duchesne County:

- Check margin requirements - usually 1-2 inches at top

- Avoid the last business day of the month when possible

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Duchesne County

Properties in any of these areas use Duchesne County forms:

- Altamont

- Altonah

- Bluebell

- Duchesne

- Fruitland

- Hanna

- Mountain Home

- Myton

- Neola

- Roosevelt

- Tabiona

- Talmage

Hours, fees, requirements, and more for Duchesne County

How do I get my forms?

Forms are available for immediate download after payment. The Duchesne County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Duchesne County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Duchesne County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Duchesne County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Duchesne County?

Recording fees in Duchesne County vary. Contact the recorder's office at (435) 738-1166 for current fees.

Questions answered? Let's get started!

Claiming a Construction Lien in Utah

In Utah, mechanic's liens are governed under Title 38, Chapter 1A of the Utah Code.

Construction liens, also known as mechanic's liens, are used the put a block or burden on an owner's title when construction work or materials delivery has taken place on the owner's property and the person or company providing the work or materials is not paid according to the contract. In Utah, a construction lien means a lien for construction work. Utah Code Ann. 38-1A-102(8). Construction work means labor, service, material, or equipment provided for the purpose and during the process of constructing, altering, or repairing an improvement; and includes scheduling, estimating, staking, supervising, managing, materials testing, inspection, observation, and quality control or assurance involved in constructing, altering, or repairing an improvement. 38-1A-102(11).

To enforce a preconstruction lien or construction lien in Utah, a claimant shall file an action to enforce the lien within 180 days after the day on which the claimant files: (i) a notice of preconstruction lien, for a preconstruction lien; or (ii) a notice of construction lien, for a construction lien. Utah Code Ann. 38-1A-701(2)(a). Each notice must be filed with the county recorder in the county where the property is located. However, if an owner files for protection under the bankruptcy laws of the United States before the expiration of the 180-day period, the lien must be filed within 90 days after the automatic stay under the bankruptcy proceeding is lifted or expires. 38-1A-701(2)(b).

A claimant shall file for record with each applicable county recorder a notice of the pendency of the action. Utah Code Ann. 38-1A-701(3)(a)(i). If a claimant fails to file for record a notice of the pendency of the action, the preconstruction lien or construction lien, as applicable, is void, except as to persons who have been made parties to the action and persons having actual knowledge of the commencement of the action. 38-1A-701(3)(a)(ii). The burden of proof is upon the claimant and those claiming under the claimant to show actual knowledge. 38-1A-701(3)(b). A preconstruction lien or construction lien is automatically and immediately void if an action to enforce the lien is not filed within the time required. 38-1A-701(4)(a).

If a claimant files an action to enforce a preconstruction or construction lien involving a residence, the claimant must, when serving the complaint to the owner, include: (i) instructions relating to the owner's rights under Title 38, Chapter 11, Residence Lien Restriction and Lien Recovery Fund Act; and (ii) a form to enable the owner of the residence to specify the grounds upon which the owner may exercise those available rights. Utah Code Ann. 38-1A-701(6)(a). If a claimant fails to provide the instructions and form as required, the claimant is barred from maintaining or enforcing the preconstruction or construction lien upon the residence. 38-1A-701(6)(c).

This article is provided for informational purposes only and should not be relied upon as a substitute for advice from an attorney. Please contact a Utah attorney with questions about filing a notice of claim, or with any other issues regarding construction liens.

Important: Your property must be located in Duchesne County to use these forms. Documents should be recorded at the office below.

This Notice of Claim meets all recording requirements specific to Duchesne County.

Our Promise

The documents you receive here will meet, or exceed, the Duchesne County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Duchesne County Notice of Claim form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Dan B.

June 6th, 2022

Excellent service even faster then I expected. Very pleased and a reasonable priced document. I encourage people too use Deeds.Com

Thank you for your feedback. We really appreciate it. Have a great day!

Michael W.

February 7th, 2025

Excellent product. I am so happy I found Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Alison B.

March 17th, 2021

The Deed of trust form was fine but the promissory note was less user friendly since I needed to change a few things that were fixed in the template. I ended up using white-out after I got no response when I emailed the help site that was provided in one of your emails, so it looks a little odd but should be usable

Thank you for your feedback. We really appreciate it. Have a great day!

Linda S.

March 8th, 2019

I am quite pleased with this website. I was able to complete my task with relative ease thanks to all the help these forms provided .The example forms really helped me to navigate the process. I would recommend this service highly.

Thank you Linda, we really appreciate your feedback.

Kevin V.

January 5th, 2022

Quick and trouble free experience!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael S.

July 11th, 2019

So far, I'm happy with my experience. I'm still reviewing the guide for the docs I downloaded. Including the guide for the docs is indeed a plus.

Thank you Michael, we really appreciate your feedback.

Dorothy B.

November 4th, 2020

Love your deed service. Simple and easy.

Thank you!

Steven C.

May 1st, 2019

Easy but a little overpriced

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles C.

November 2nd, 2020

I found this site to be very easy to use . I found and printed what I needed in just a few minutes after getting on the sit . Good work setting up this site . Thank you .

Thank you!

Thomas H.

August 31st, 2023

Absolute crap. I would give it 0 stars for user-friendliness.

Sorry to hear that we failed you Thomas. We do hope that you found something more suitable to your needs elsewhere.

Joseph B.

September 8th, 2022

All very good

Thank you!

Tyrone L.

April 24th, 2025

Great time saver fast service

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

TEDDY Y.

January 29th, 2022

this experience was made possible with the ease of using your service thank you

Thank you!

Lori W.

July 28th, 2023

Timely, efficient and easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ming Z.

September 28th, 2022

Definitely 5 Stars !

Thank you!