Salt Lake County Quitclaim Deed Form

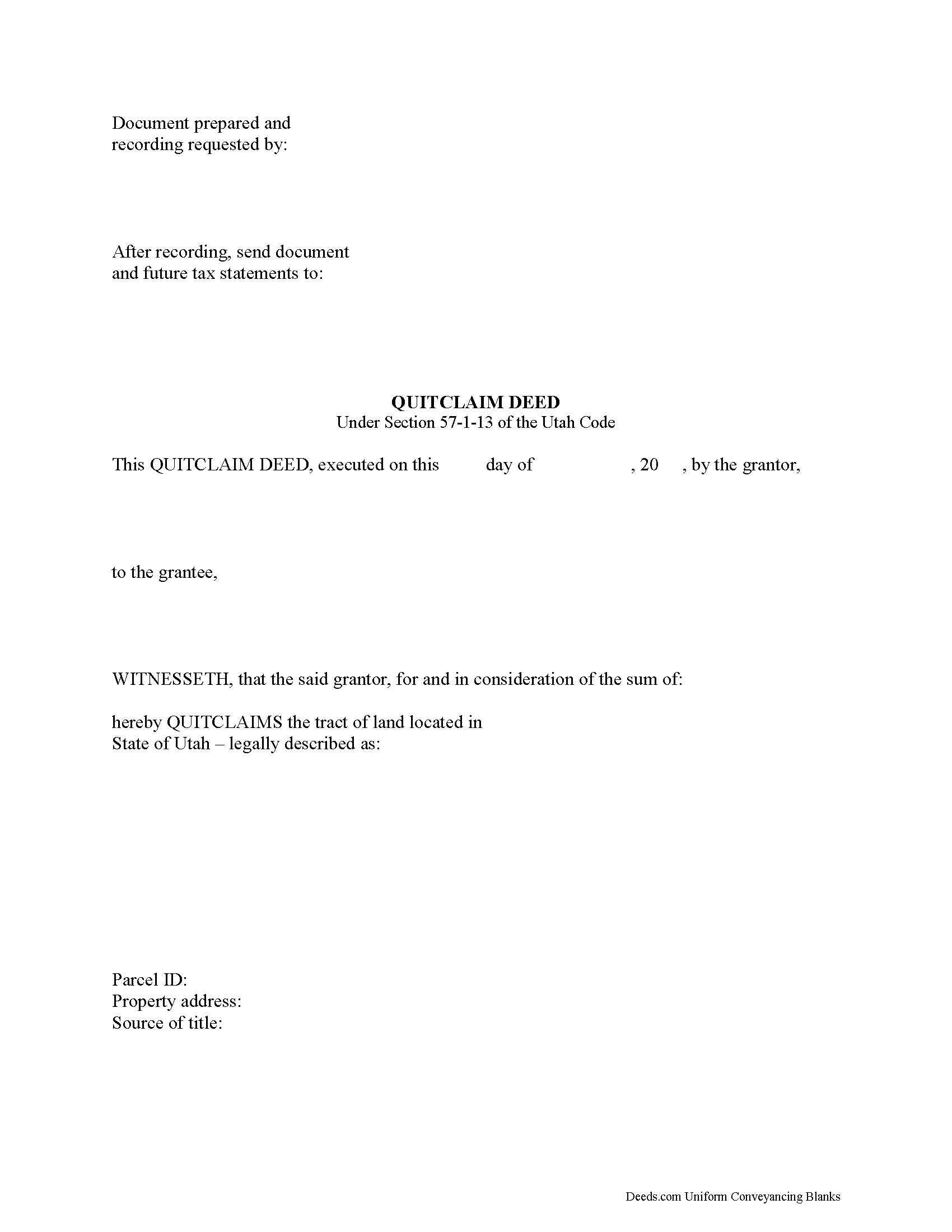

Salt Lake County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Utah recording and content requirements.

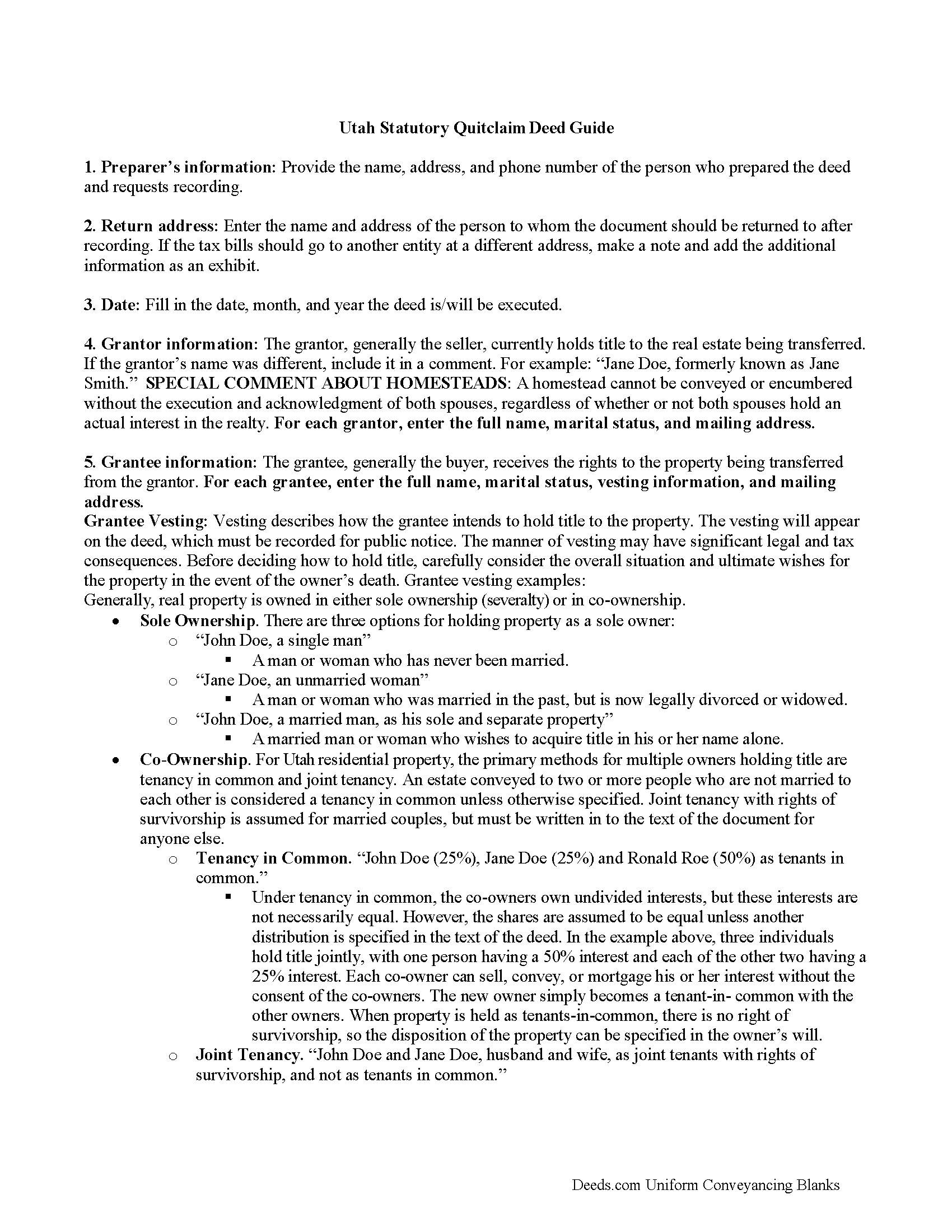

Salt Lake County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

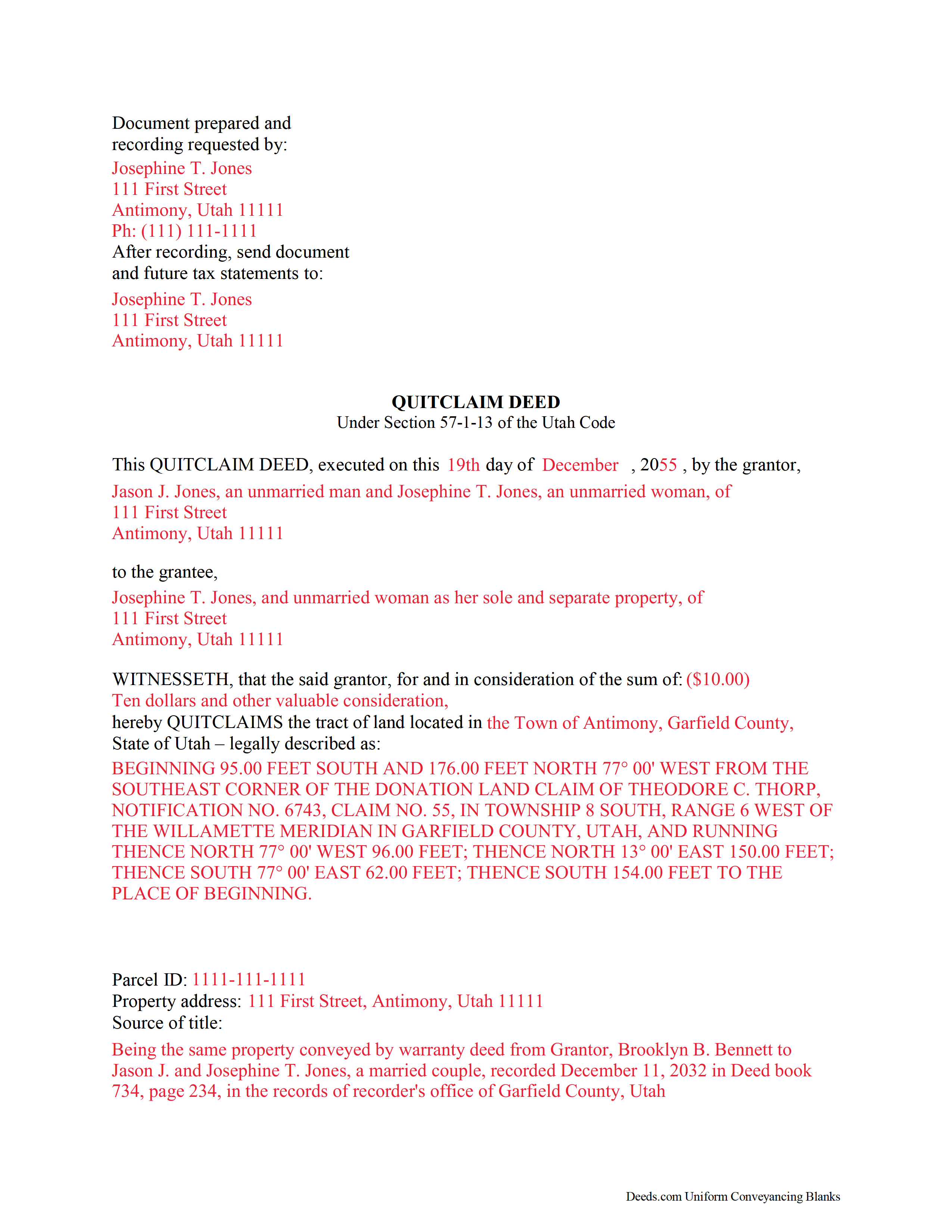

Salt Lake County Completed Example of the Quitclaim Deed Document

Example of a properly completed Utah Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Salt Lake County documents included at no extra charge:

Where to Record Your Documents

Salt Lake County Recorder

Salt Lake City, Utah 84190

Hours: 8:00 to 5:00 M-F

Phone: (385) 468-8145

Recording Tips for Salt Lake County:

- Ask if they accept credit cards - many offices are cash/check only

- Documents must be on 8.5 x 11 inch white paper

- Check that your notary's commission hasn't expired

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Salt Lake County

Properties in any of these areas use Salt Lake County forms:

- Bingham Canyon

- Draper

- Herriman

- Magna

- Midvale

- Riverton

- Salt Lake City

- Sandy

- South Jordan

- West Jordan

Hours, fees, requirements, and more for Salt Lake County

How do I get my forms?

Forms are available for immediate download after payment. The Salt Lake County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Salt Lake County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Salt Lake County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Salt Lake County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Salt Lake County?

Recording fees in Salt Lake County vary. Contact the recorder's office at (385) 468-8145 for current fees.

Questions answered? Let's get started!

A quitclaim deed executed in Utah must be signed by each grantor involved in the conveyance. A certificate of acknowledgment, proof of execution, jurat, or other certificate may be required in order to effectively record a quitclaim deed with a county recorder. A quitclaim deed may not be presented to an appropriate county recorder in Utah unless it contains a legal description of the real property, names the grantee, and recites a mailing address for assessment and taxation. Additional requirements may apply to a Utah quitclaim deed. For a thorough discussion, visit the county links, or go to the Utah Revised Code.

When a quitclaim deed is recorded in the county where the property is located, notice of its contents is imparted to all persons (57-3-102). The recording act in Utah stipulates that if a quitclaim deed is left unrecorded, it is void against subsequent purchasers of the same real property or any portion of it if (1) the subsequent purchaser bought the property in good faith and for valuable consideration and (2) the subsequent purchaser's document is recorded first.

(Utah QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Salt Lake County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Salt Lake County.

Our Promise

The documents you receive here will meet, or exceed, the Salt Lake County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Salt Lake County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Michelle A.

January 5th, 2025

deeds.com is user-friendly and very easy to navigate. Guides, samples, and free supplement forms are available for every State and are frequently updated. The cost is economical. I recommend these products

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cynthia G.

April 16th, 2019

Thank you for this service, very helpful

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephanie P.

December 9th, 2020

So far Deeds.com has done everything they say they'll do and very promptly.

Thank you for your feedback. We really appreciate it. Have a great day!

Melvin L.

June 8th, 2022

So easy, very simple to use. I was very pleased with the service Deeds provided. Would definely use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JAMES M.

July 17th, 2023

The forms are just what I needed! Easy to navigate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott W.

March 31st, 2020

Wow! That was easy! I was expecting a more difficult process. Upload your docs and wait for a response. Which was minutes later. I would give it 6 stars.

Thank you for your kind words Scott, glad we could help.

Kelly W.

March 26th, 2020

Great resource! Wish you could expand to more than just deeds, but then you would have to rename it. :) Thanks! Kelly

Thank you!

anthony r.

November 19th, 2020

Fast and easy

Thank you!

Evelyn A.

October 30th, 2021

Was easy to use. Just didnt find what i needed

Thank you for your feedback. We really appreciate it. Have a great day!

Ondina S.

December 28th, 2021

Am very happy with the wealth of forms that were available with my purchase! This site is an awesome resource which I plan to use in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terri A B.

July 17th, 2025

The process was easy and cost was reasonable. My only suggestion is to allow user the ability to shorten the space between the county and state and the space after the month. I needed to draw a line at the courthouse before they would file it.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Robert S.

January 23rd, 2019

The cost was well worth it. It was very easy to download, fill in the necessary information and then print the deed. I filed my need deed today and everything was complete and accurate because of the example you provided.

Thanks Robert, we appreciate your feedback!

NormaJean Q.

July 4th, 2021

Thank you, thie was very helpful. I did find the forms I needed.Very easy to use.,

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert S.

March 2nd, 2025

My Quick claim formsi downloaded had not come through so I contacted customer service and they provided me with the instructions on how to retrieve my forms, A plus service.

We are delighted to have been of service. Thank you for the positive review!

Stephen F.

September 3rd, 2020

Easy to use. Outstanding interface.

Thank you!