Weber County Transfer on Death Deed Form

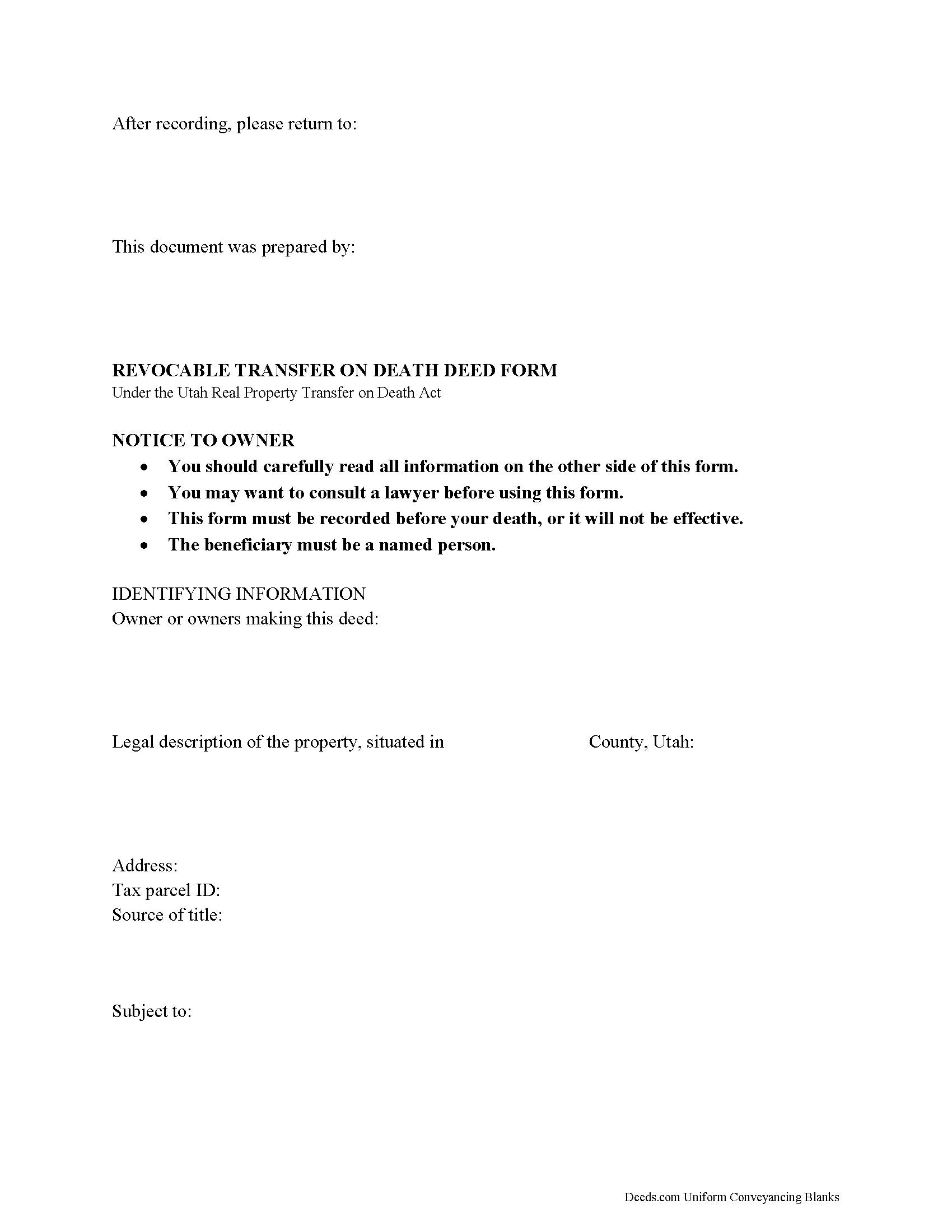

Weber County transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

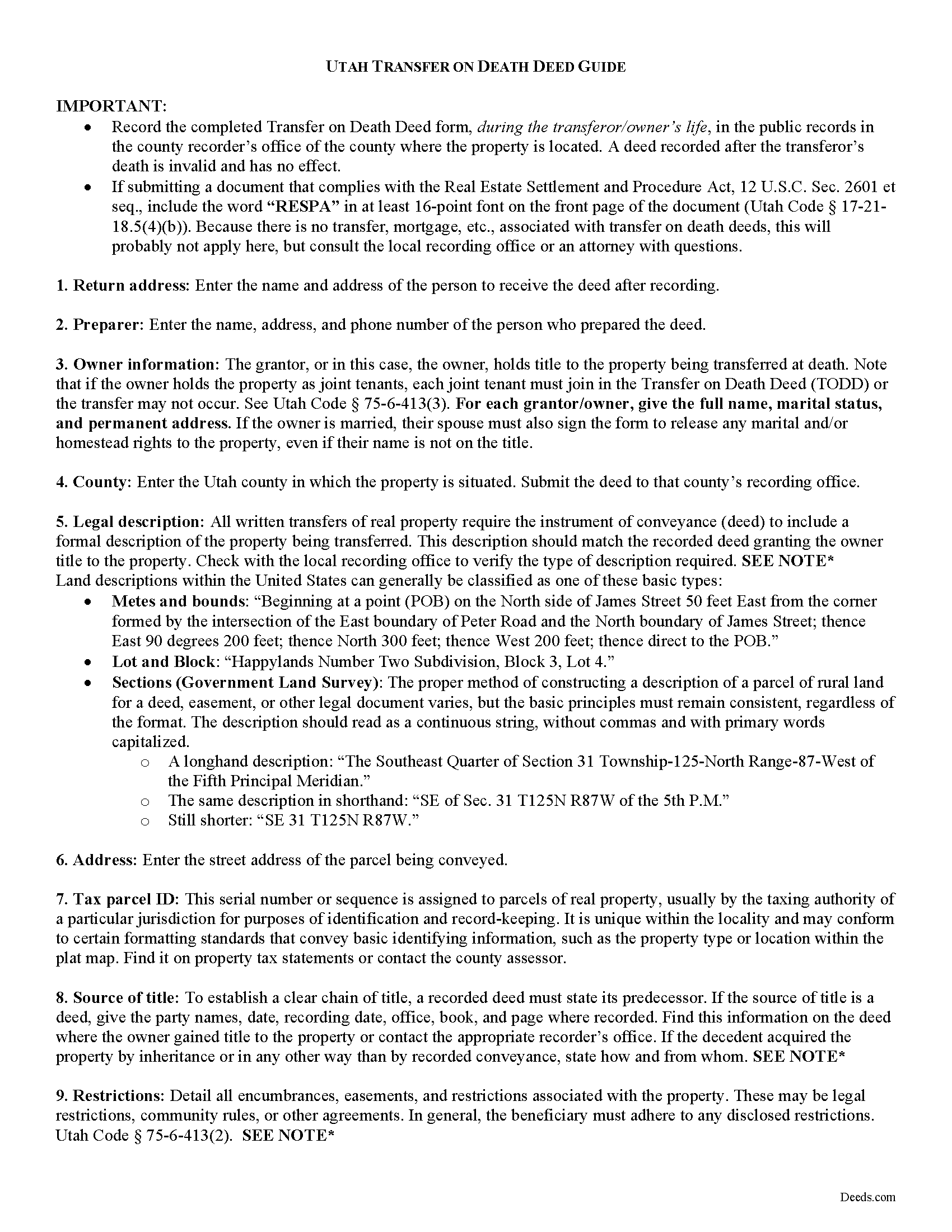

Weber County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

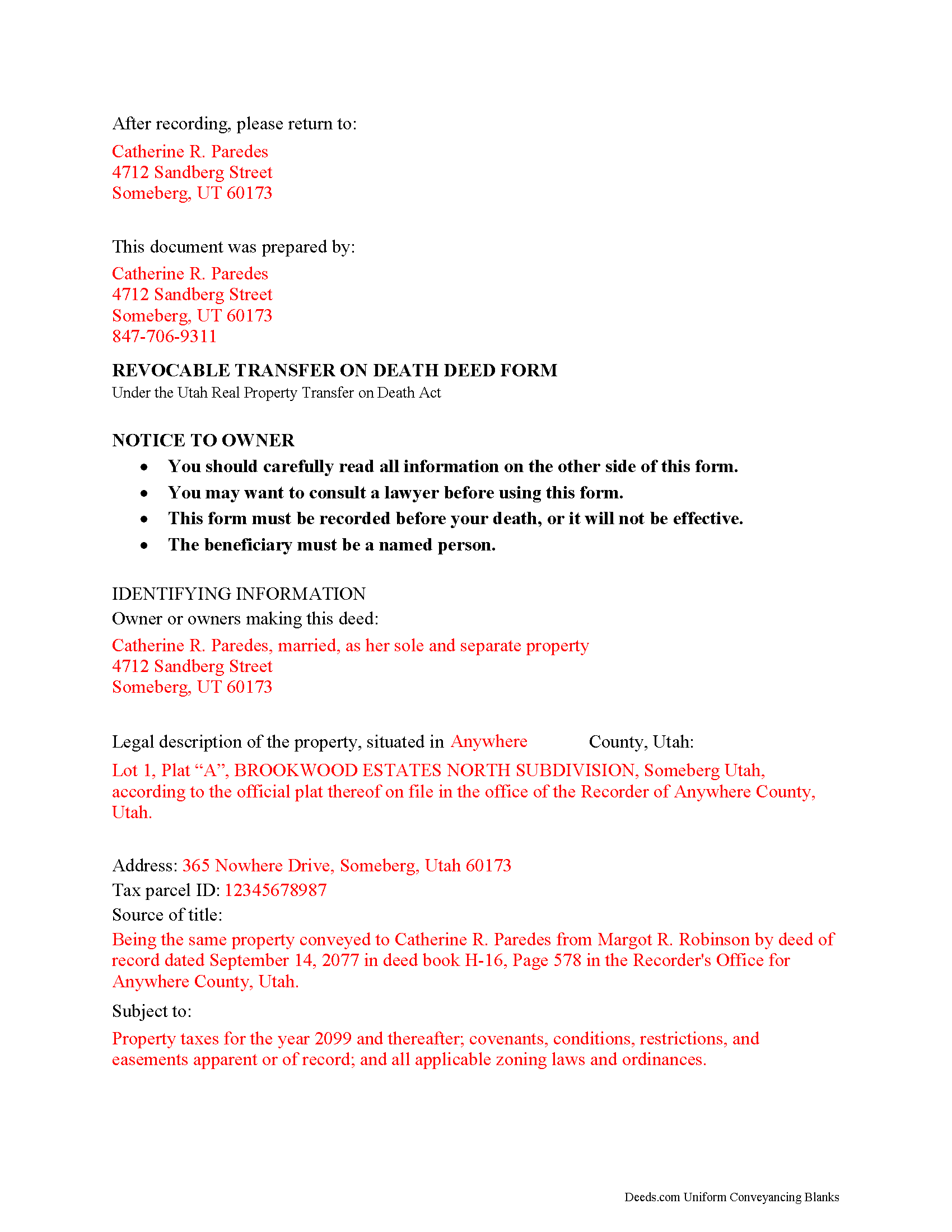

Weber County Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Weber County documents included at no extra charge:

Where to Record Your Documents

Weber County Recorder

Ogden, Utah 84401

Hours: 8 a.m. to 5 p.m. Monday - Friday

Phone: (801) 399-8441

Recording Tips for Weber County:

- Verify all names are spelled correctly before recording

- Make copies of your documents before recording - keep originals safe

- Bring extra funds - fees can vary by document type and page count

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Weber County

Properties in any of these areas use Weber County forms:

- Eden

- Hooper

- Huntsville

- Ogden

- Roy

Hours, fees, requirements, and more for Weber County

How do I get my forms?

Forms are available for immediate download after payment. The Weber County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Weber County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Weber County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Weber County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Weber County?

Recording fees in Weber County vary. Contact the recorder's office at (801) 399-8441 for current fees.

Questions answered? Let's get started!

Utah code 75-6-405. Transfer on death deed authorized.

(1) An individual may transfer property to one or more named beneficiaries effective at the transferor's death by a transfer on death deed.

Use this form to transfer real estate at death, but outside of a will and without the need for probate distribution. Execute the TODD form, then record it during the course of your life.

75-6-409. Requirements.

A transfer on death deed shall:

(1) contain the essential elements and formalities of a properly recordable inter vivos deed;

(2) state that the transfer to the designated beneficiary is to occur at the transferor's death; and

(3) be recorded before the transferor's death in the public records in the county recorder's office of the county where the property is located.

Overall, the Simple Revocable Transfer on Death Deed offers a convenient, flexible option to consider as part of an overall estate plan. Even so, they may not be appropriate in all cases. Contact an attorney for complex situations or with any questions.

(Utah TODD Package includes form, guidelines, and completed example)

Important: Your property must be located in Weber County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Weber County.

Our Promise

The documents you receive here will meet, or exceed, the Weber County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Weber County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

REBECCA B.

May 8th, 2023

Documents arrived instantly. Performed exactly as stated. Will use website again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ping O.

September 5th, 2019

Thank you for making this easy!

Thank you!

Terri S.

October 16th, 2019

Form was easy to complete, price was reasonable and everything worked out just fine. Would absolutely use this service again if needed, Thank you :)

Thank you for your feedback. We really appreciate it. Have a great day!

William V.

July 18th, 2021

I finally got it. Thanks, William Vickery

Thank you!

Mark S.

June 28th, 2022

The forms were easy to fill in and file. I've never filed anything like this before and the forms made it extremely easy. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Karin G.

January 28th, 2021

All went well. Forms easy to download and instructions were super. Very pleased with the service.

Thank you!

Kathryn G.

December 21st, 2023

This was extremely helpful!

We are motivated by your feedback to continue delivering excellence. Thank you!

Yunyan B.

November 12th, 2019

Great website, fraction of the price if doing title research elsewhere

Thank you for your feedback. We really appreciate it. Have a great day!

Clay H.

July 11th, 2022

The provided docs and guide were very helpful. Well worth the price in my opinion.

Thank you for your feedback. We really appreciate it. Have a great day!

Sean M.

January 2nd, 2023

This was exactly what I needed. For $25-$30 it gave me the formatted document I needed and made it so easy to input the info. I wouldn't recommend it to someone who has no clue what they're doing, but for somebody who knows all the info and just needs a formatted page to input it onto, this is perfect.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Daron S.

July 2nd, 2019

A download in word format would be a lot better than the pdf download.

Thank you for your feedback. We really appreciate it. Have a great day!

Paul A.

March 27th, 2020

Your service is awesome!

Thank you!

Ruth L.

June 4th, 2020

Extremely convenient for a moderate fee. Will definitely use Deeds.com for my recording needs going forward. Will also share with my team on their projects. Thanks a bunch!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Annette A.

March 21st, 2019

I requested a property report and it was completed fast and accurately. I would highly recommend this service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melvin M.

June 6th, 2019

loads of forms and instructions....for a good buy...it would help to know where to send the forms after completing them...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!