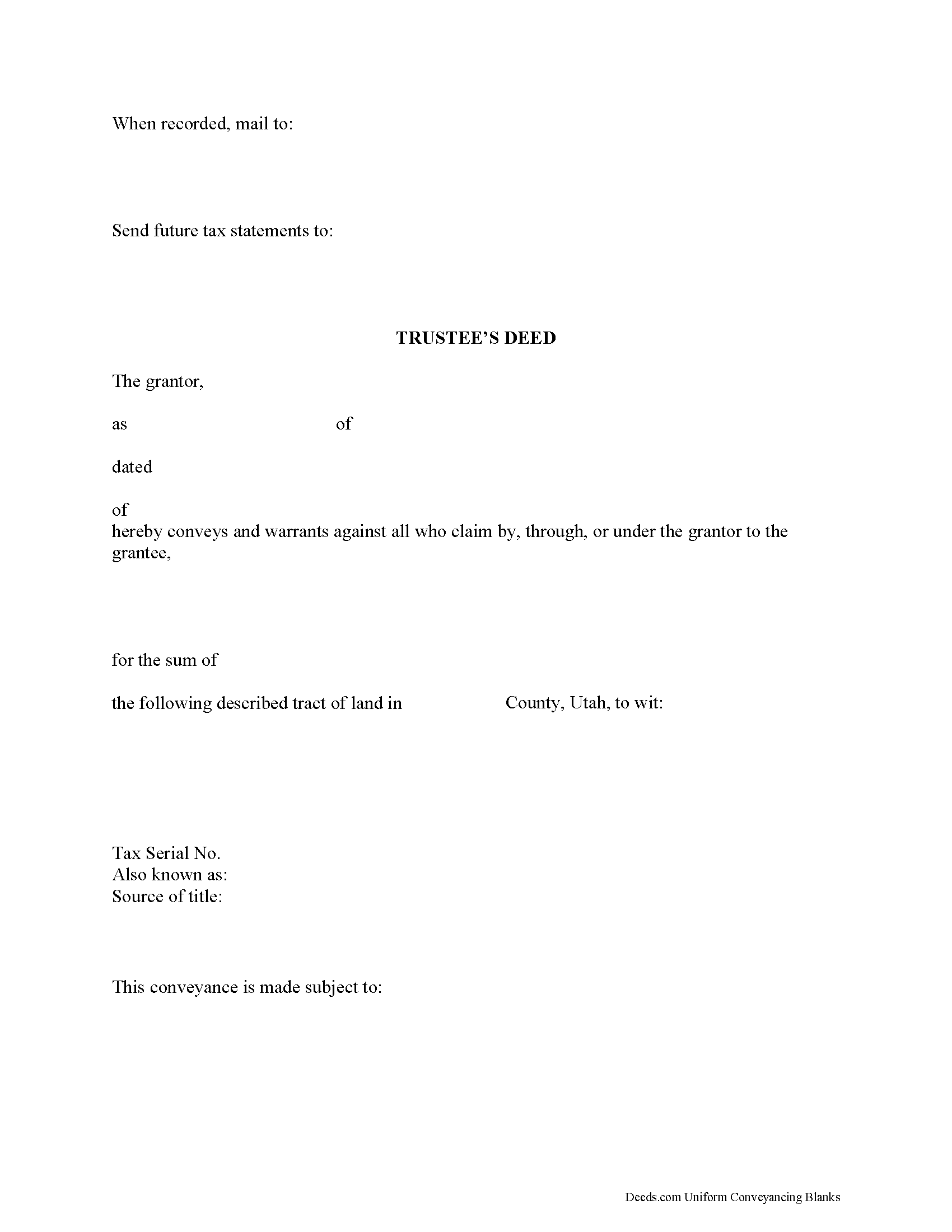

Iron County Trustee Deed Form

Iron County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

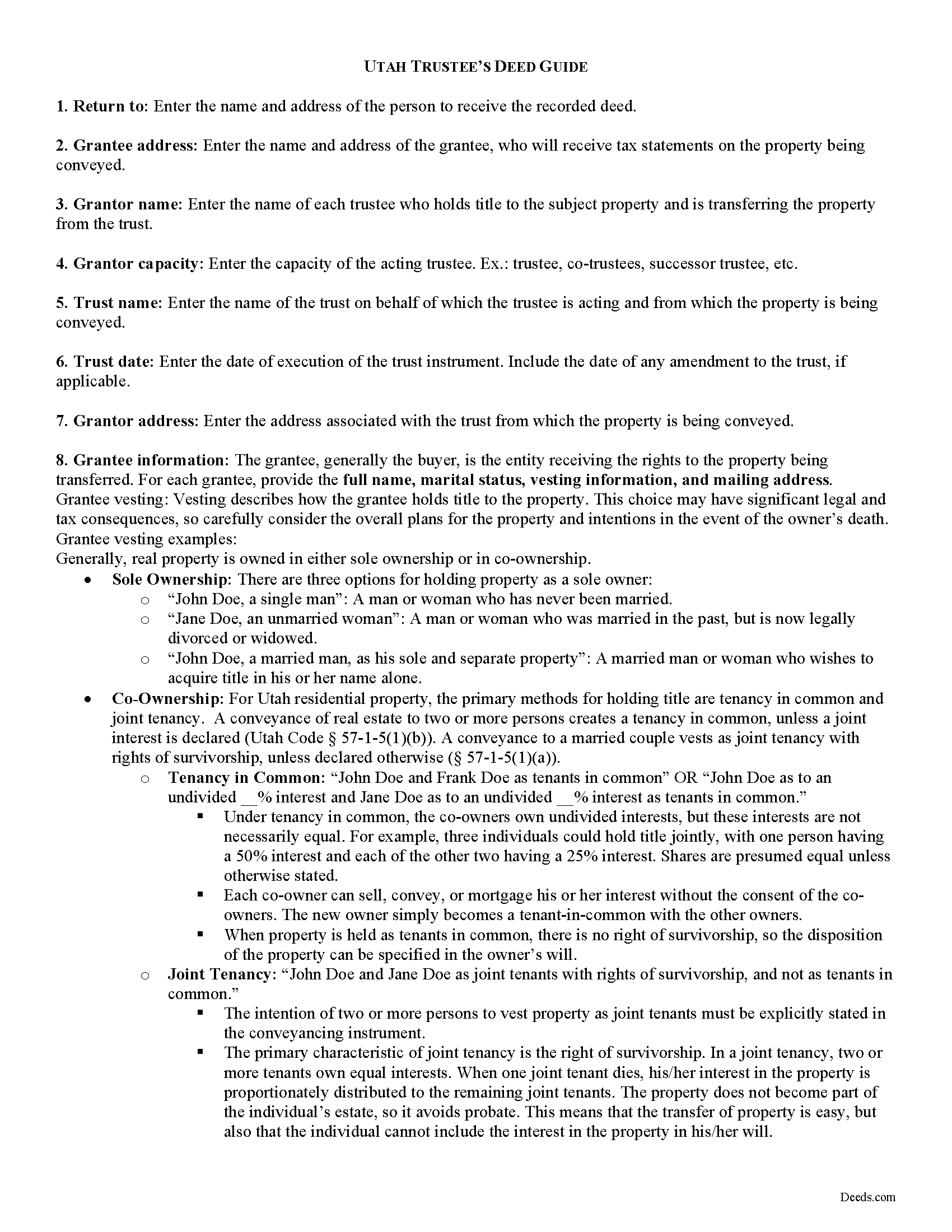

Iron County Trustee Deed Guide

Line by line guide explaining every blank on the form.

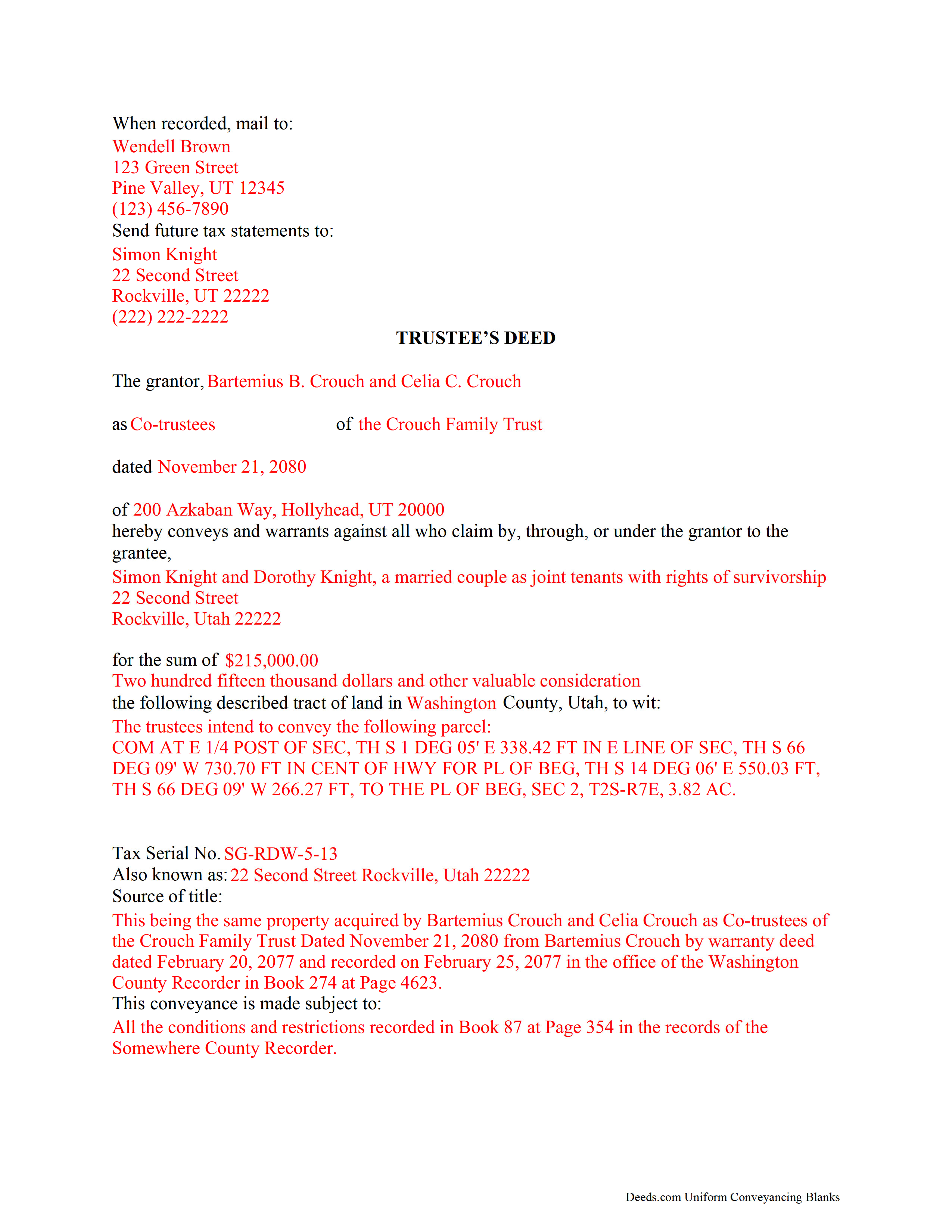

Iron County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Iron County documents included at no extra charge:

Where to Record Your Documents

Iron County Recorder

Parowan, Utah 84761

Hours: 8:00 to 5:00 M-F

Phone: (435) 477-8350

Recording Tips for Iron County:

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Iron County

Properties in any of these areas use Iron County forms:

- Beryl

- Brian Head

- Cedar City

- Kanarraville

- Modena

- Newcastle

- Paragonah

- Parowan

- Summit

Hours, fees, requirements, and more for Iron County

How do I get my forms?

Forms are available for immediate download after payment. The Iron County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Iron County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Iron County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Iron County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Iron County?

Recording fees in Iron County vary. Contact the recorder's office at (435) 477-8350 for current fees.

Questions answered? Let's get started!

Transferring Real Property to and from Living Trusts in Utah

The Utah Uniform Trust Code, codified at Utah Code 75-7, governs trusts in Utah. A trust is an alternate method of holding title to property. In a trust arrangement, one person (the settlor) transfers property to another (the trustee), who administers the trust for the benefit of a third (the beneficiary). A transfer of property to a trustee during the settlor's lifetime results in a living (inter vivos) trust, and a transfer to a trustee pursuant to the terms of a settlor's will creates a testamentary trust.

A trust is valid only when the settlor has a capacity to create the trust and indicates an intention to do so; the trust has a definite beneficiary; the trustee has duties to perform; and the same person is not both sole trustee and sole beneficiary of the trust ( 75-7-402). The trust must be created for lawful purposes that are possible to achieve and for the benefit its beneficiaries ( 75-7-404).

A living trust is an estate planning tool allowing the settlor to determine how his assets will be distributed without the oversight of the probate court upon his death. The trust is governed by a trust instrument, a (typically) unrecorded document executed by the settlor that outlines the scope of the trust and the trust's terms. The settlor may concurrently transfer assets into the trust and/or transfer property into the trust at a later date.

In order to convey real property into trust, the settlor executes a deed titling property in the name of the trustee on behalf of the trust. Regarding real property transferred into trust, the deed of transfer requires recitation of the name and address of the trustee, and the name and date of the trust ( 75-7-816). Alternately, the trust instrument, signed by the grantor, may be recorded in the appropriate county recorder's office.

Unless otherwise limited by the terms in the trust instrument, the trustee holds the power to sell property held in trust ( 75-7-814(1)(b)). Because the trustee holds legal title to real property as the trust's administrator, the trustee executes a deed to convey interest to real property out of the trust. A trustee's deed to convey real property from a living trust is a form of special warranty deed, named after the executing party. Apart from conveying fee simple interest in the subject property to the grantee, a special warranty deed contains the grantor's covenants that the property is free from encumbrances by the grantor, and the grantor promises to warrant and defend the property's title against lawful claims arising from persons claiming by, through, or under the grantor (but none other).

The trustee's deed requires the basic information of the trust, including the name and date of trust instrument and the trustee's name and address. As with all conveyances of real property, the trustee's deed should include a legal description of the subject property. The deed must be signed by the granting party and notarized before it is recorded, if applicable, in the appropriate county. All requirements for form and content of documents pertaining to real property should be met before the document is recorded.

Recipients of a trustee's deed may require further proof of the trust's existence and the trustee's authority to transfer real property on behalf of the trust (See 75-7-1013 on certificates of trust). The information contained within this article is not a substitute for legal guidance. Consult a lawyer for regarding living trusts and conveyances of real property interests in the State of Utah, as each situation is unique.

(Utah TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Iron County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Iron County.

Our Promise

The documents you receive here will meet, or exceed, the Iron County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Iron County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Blaine G.

February 4th, 2022

Pretty good promissory note...but unable to delete some of the not needed stuff. Fill in blanks are fine but not all the template language is appropriate in my situation

Thank you for your feedback. We really appreciate it. Have a great day!

Cynthia B.

July 21st, 2023

So simple to e-record my two documents. The communication was fast and very helpful. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Carolyn N.

March 21st, 2023

It worked! It was exactly what I needed and was easily understood.

Thank you!

Vita L.

January 28th, 2021

A coworker recommended this service to me and I was hesitant to try it. Turned out to be a life saver, they filed my document in 24 hours. No standing in line and no confusing government websites to navigate.

Thank you!

Toni C.

June 10th, 2021

The system was simple to use. The rep that answered my questions could have been a little more forthcoming, but that being said I would use the service again.

Thank you!

Ernest S.

July 30th, 2019

Took it to the Courthouse and the Register of Deeds said,"well Done" Thanks you so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

laura s.

February 2nd, 2023

thanks for providing my with exactly what I needed, almost instantly!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alan K.

September 4th, 2020

All I needed was a simple Certificate of Trust. Deeds.com had a template for exactly what I needed. I didn't have to make an appt with an attorney, wait for one to be available, nor pay a ridiculous amount for a standardized document. Super easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Cheryl C.

September 1st, 2021

Very pleased. I spent a fair amount of time chasing a blank form only to be told it couldn't be given to me - I had to go through my attorney. Going thru the deeds.com was a breeze; the blank form looked exactly like one I had filed before :-)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia E.

June 8th, 2020

Easy to understand and download!

Thank you!

Robert B.

February 21st, 2020

Couldn't be more simple. Good product

Thank you!

Laurence D.

October 26th, 2020

Quick and easy, and a good value for the money. Thanks, Deeds.com!

Thank you!

Gertrude H.

October 1st, 2019

I used this form and guide a couple years ago and found it helpful and easy to fill out. Had good results at the Recorder's Office. Would recommend Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Frank B.

March 16th, 2023

Great website, super easy to use, user friendly to navigate. Will definitely use for future needs, and will definitely refer to other customers. F. Betancourt Texas

Thank you!

Omar F.

February 1st, 2021

Great! Thank you!

Thank you!