Franklin City Correction Deed Form

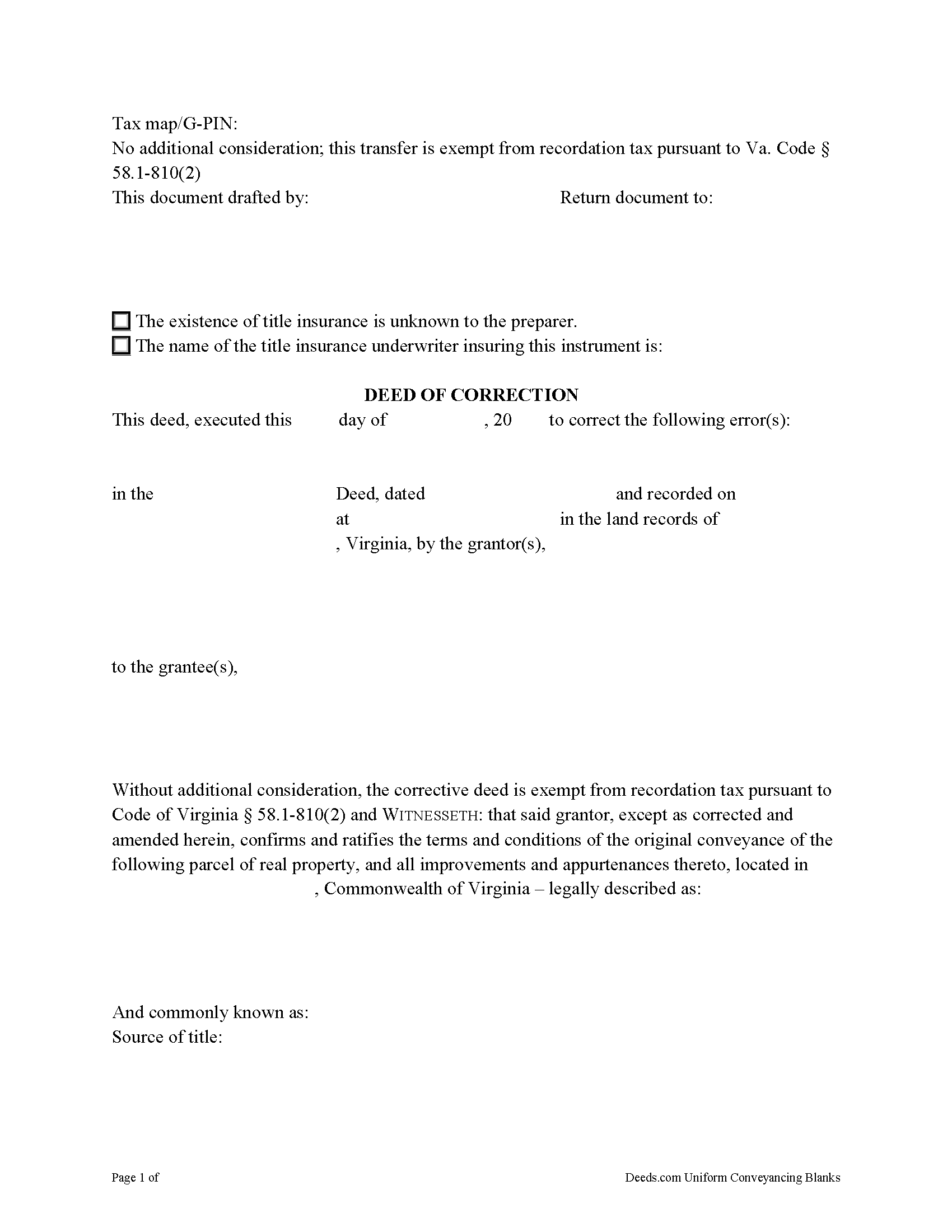

Franklin City Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

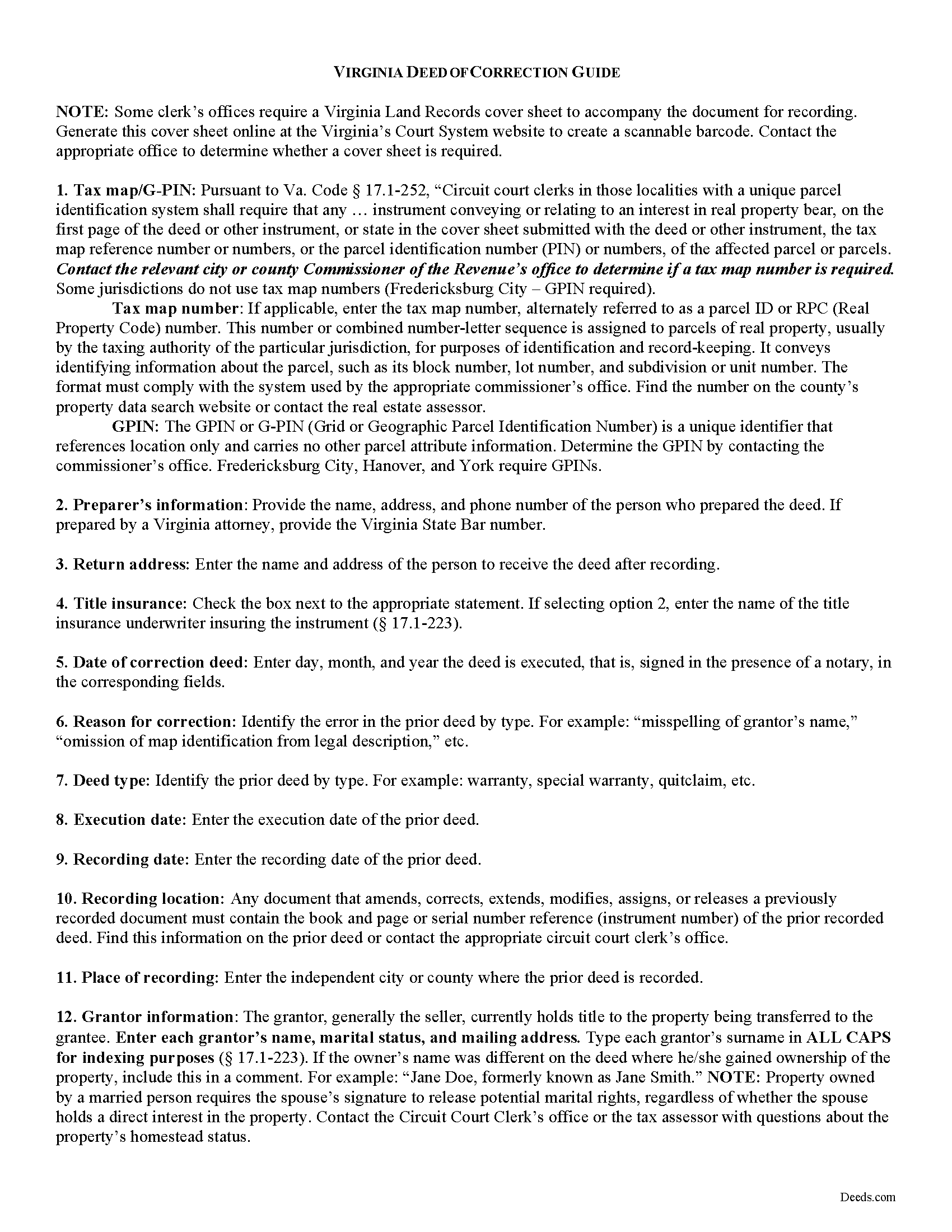

Franklin City Correction Deed Guide

Line by line guide explaining every blank on the form.

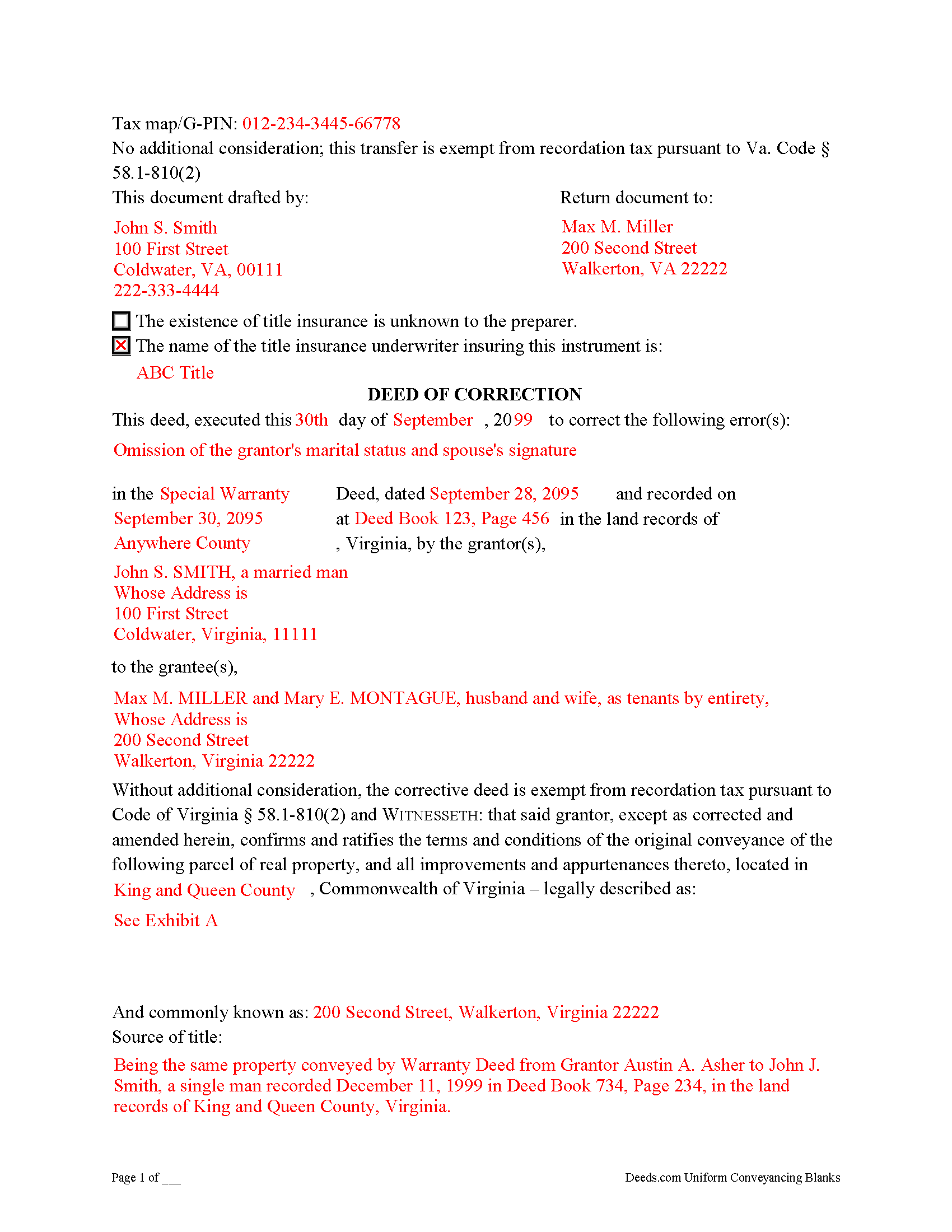

Franklin City Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Virginia and Franklin City documents included at no extra charge:

Where to Record Your Documents

Clerk of Circuit Court

Rocky Mount, Virginia 24151

Hours: Monday - Friday 8:30 am - 5:00 pm

Phone: (540) 483-3065

Recording Tips for Franklin City:

- Double-check legal descriptions match your existing deed

- Verify all names are spelled correctly before recording

- Ask if they accept credit cards - many offices are cash/check only

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Franklin City

Properties in any of these areas use Franklin City forms:

- Franklin

Hours, fees, requirements, and more for Franklin City

How do I get my forms?

Forms are available for immediate download after payment. The Franklin City forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Franklin City?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Franklin City including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Franklin City you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Franklin City?

Recording fees in Franklin City vary. Contact the recorder's office at (540) 483-3065 for current fees.

Questions answered? Let's get started!

Use a deed of correction from the original grantor to amend an error in a previously recorded deed in Virginia.

Errors in a previously recorded deed in Virginia may be cured by a deed of correction from the grantor to the grantee of the original deed. The new document identifies the error by type, the prior deed by date and recording number, and inserts the correct information; otherwise it duplicates the format of the original deed. The deed requires no consideration statement and is exempt from transfer tax. State the exemption on the face of the deed and refer to the relevant Virginia Code.

A deed of correction is most often used for minor mistakes such as misspelled names or variation in name by which the record title holder acquired title and a name by which he holder conveyed title. It can also be used for obvious errors in the property description. For example: errors transcribing courses and distances; errors incorporating a recorded plat or deed reference; errors in listing a lot number or designation; omitted exhibits that supply the legal description of the property.

Correction deeds can help to clarify the manner in which title to the property is held by the same, initially named grantee, but they cannot be used to change the grantee or to add or omit a grantee. Also, do not use a corrective deed to change a greater estate to a lesser estate, for example to transfer ownership to an heir while reserving a right to remain on the property for the remainder of the original grantee's life. In Virginia, the relation back principle is generally applied so that a correction deed is considered to relate back to the date of the first deed which it purports to correct.

(Virginia CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Franklin City to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Franklin City.

Our Promise

The documents you receive here will meet, or exceed, the Franklin City recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Franklin City Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

DARRYL B.

June 16th, 2020

Professional and convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

Donna R.

February 10th, 2021

Great service. Just started using Deeds.com yesterday. So far, so good.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia W.

September 12th, 2020

Had to have help because unable to put phone number in your format. Daughter figured a way around the problem. I am 80 years old but capable of filling out simple forms but not when the format creates problems.

Thank you for your feedback. We really appreciate it. Have a great day!

Darren G.

December 10th, 2021

Your beneficiary deed sample contains a error of the LDPS designation. I copied the designation of LPDS instead of the correct designation

Thank you for your feedback. We really appreciate it. Have a great day!

Charles Z.

February 23rd, 2021

I am very happy with the service and would use again. Super fast, efficient, and very helpful friendly staff. I would recommend and would use again.

Thank you for your feedback. We really appreciate it. Have a great day!

Rocio S.

March 4th, 2019

Great Help - very satisfied with the service - would recomend 100%

Thank you for the kind words Rocio. Have a wonderful day!

Laura J.

April 6th, 2021

Very satisfied. Highly recommend!

Thank you!

Maria G.

April 4th, 2019

Very easy and fast. Couldnt ask for anything better.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna B.

January 10th, 2019

Really liked the quick access to documents. Great service, thanks.

Thank you Donna, we appreciate you taken the time to leave your feedback. Have a great day!

Kathleen M.

April 14th, 2020

Your Service was excellent. Very responsive. Thank you.

Thank you!

Cecilia C.

June 2nd, 2023

So very easy to follow & the cost of the packet was reasonable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

REBECCA B.

May 8th, 2023

Documents arrived instantly. Performed exactly as stated. Will use website again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael M.

April 17th, 2024

Great service that satisfied all my needs. Great prices too.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

michael k.

February 24th, 2023

fast and easy to fill out forms.

Thank you!

Joan L. W.

June 9th, 2021

Excellent Service

Thank you!