Stafford County Deed of Trust and Promissory Note Form

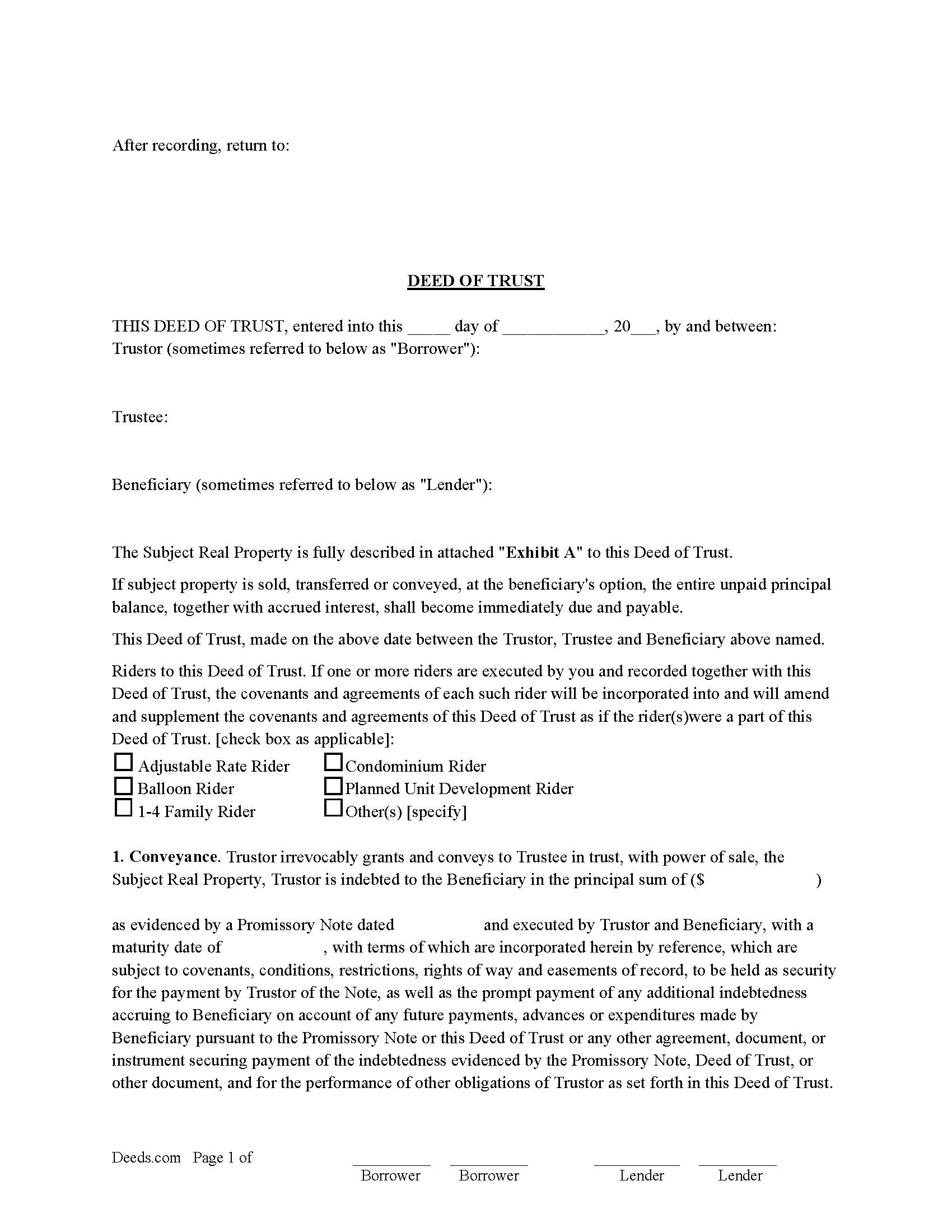

Stafford County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

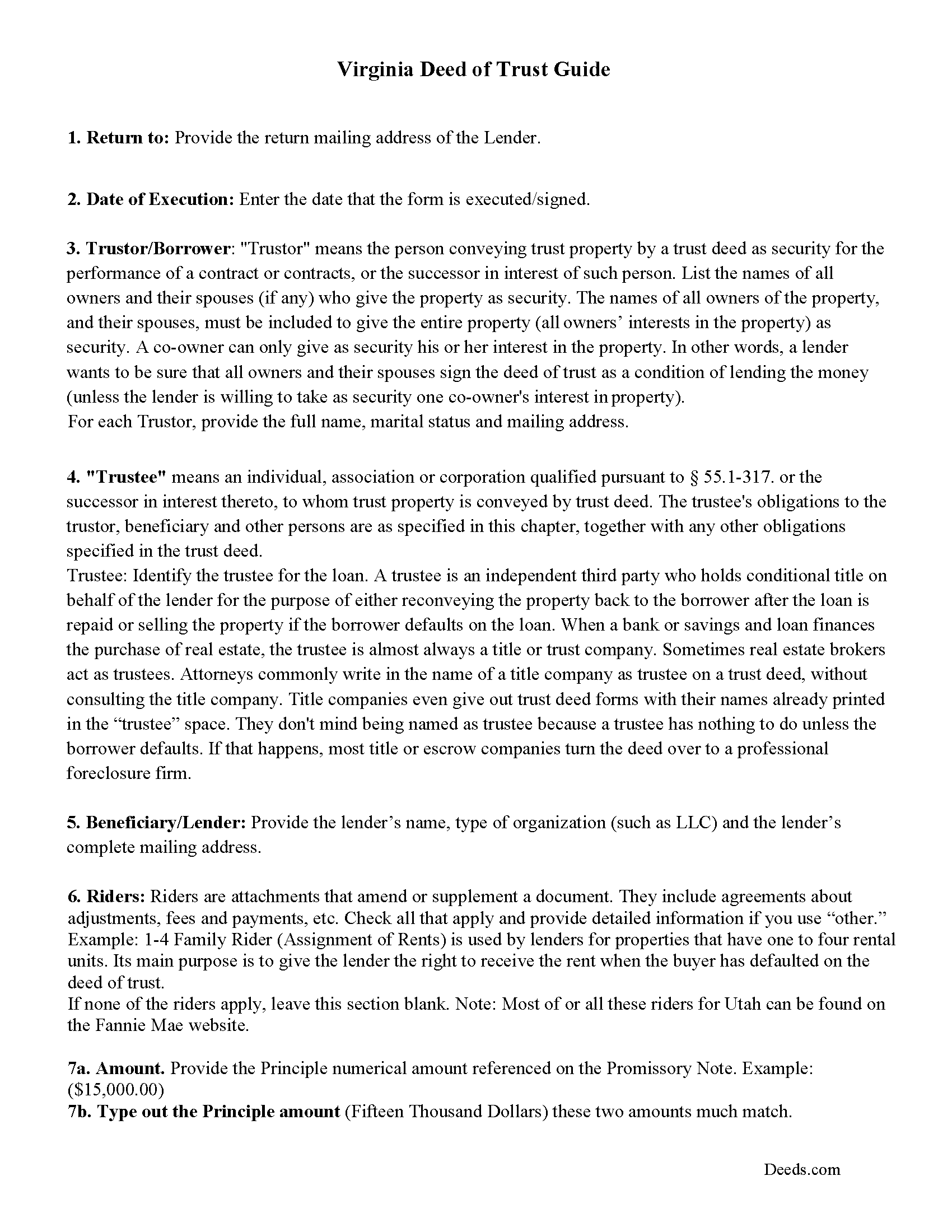

Stafford County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

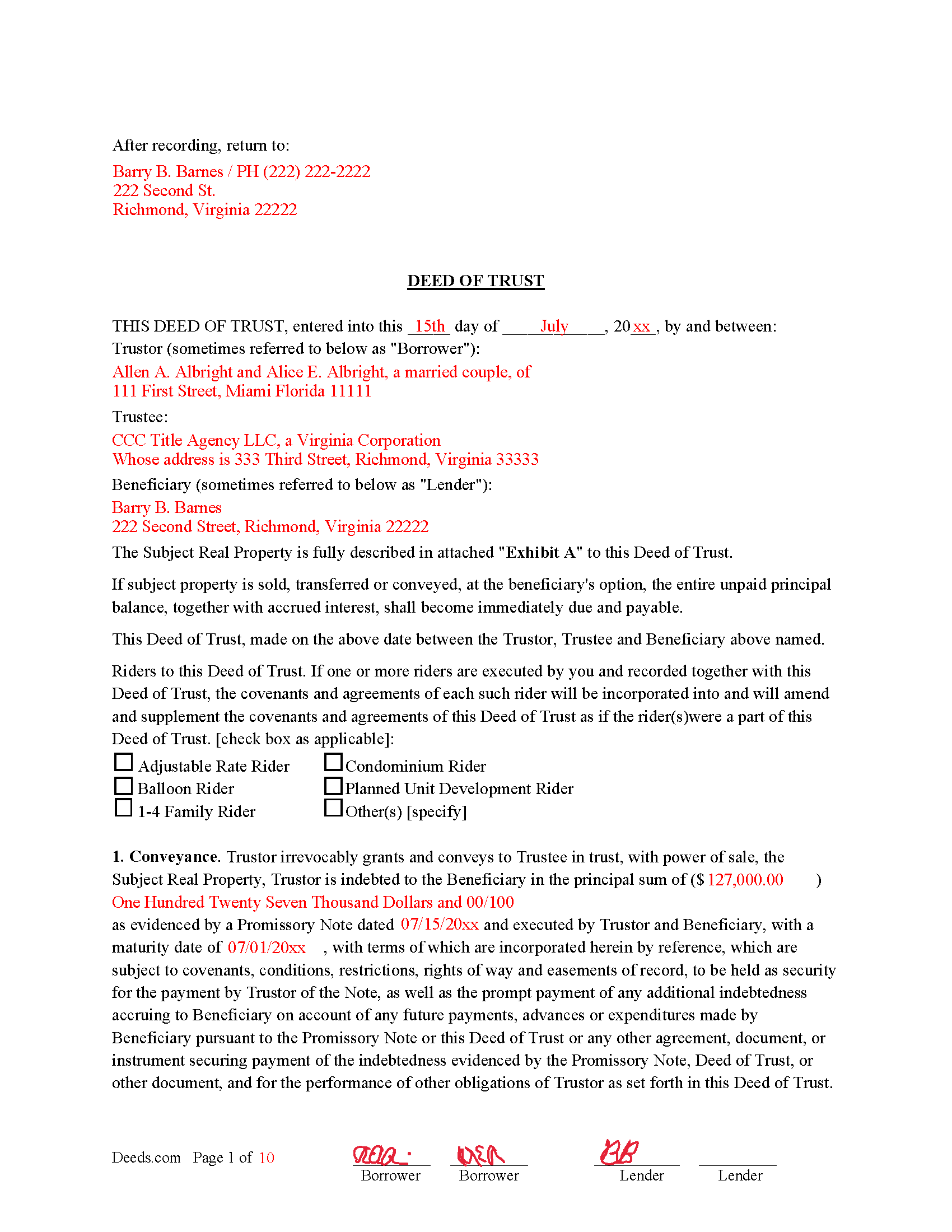

Stafford County Completed Example of the Deed of Trust

Example of a properly completed form for reference.

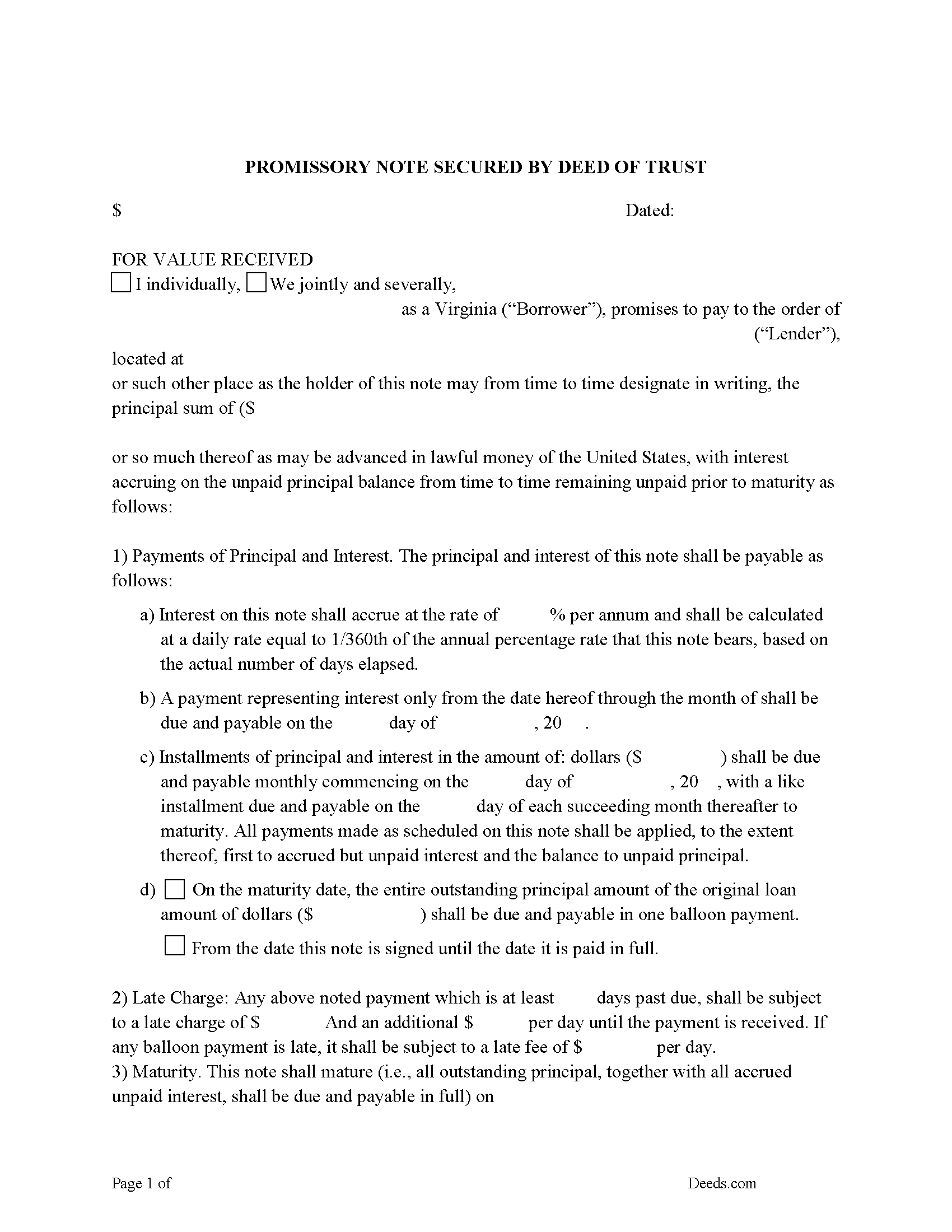

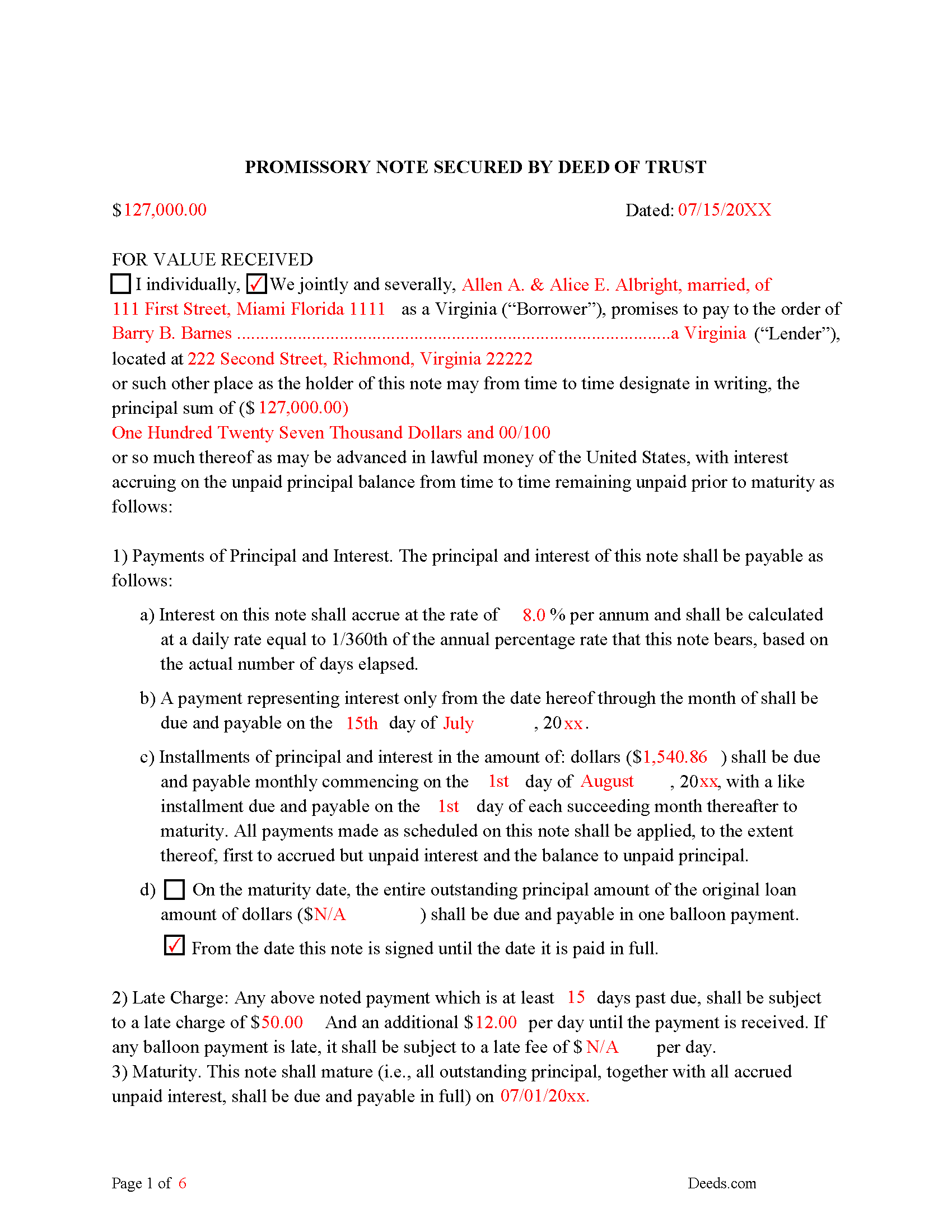

Stafford County Promissory Note Form

Note that is secured by the Deed of Trust.

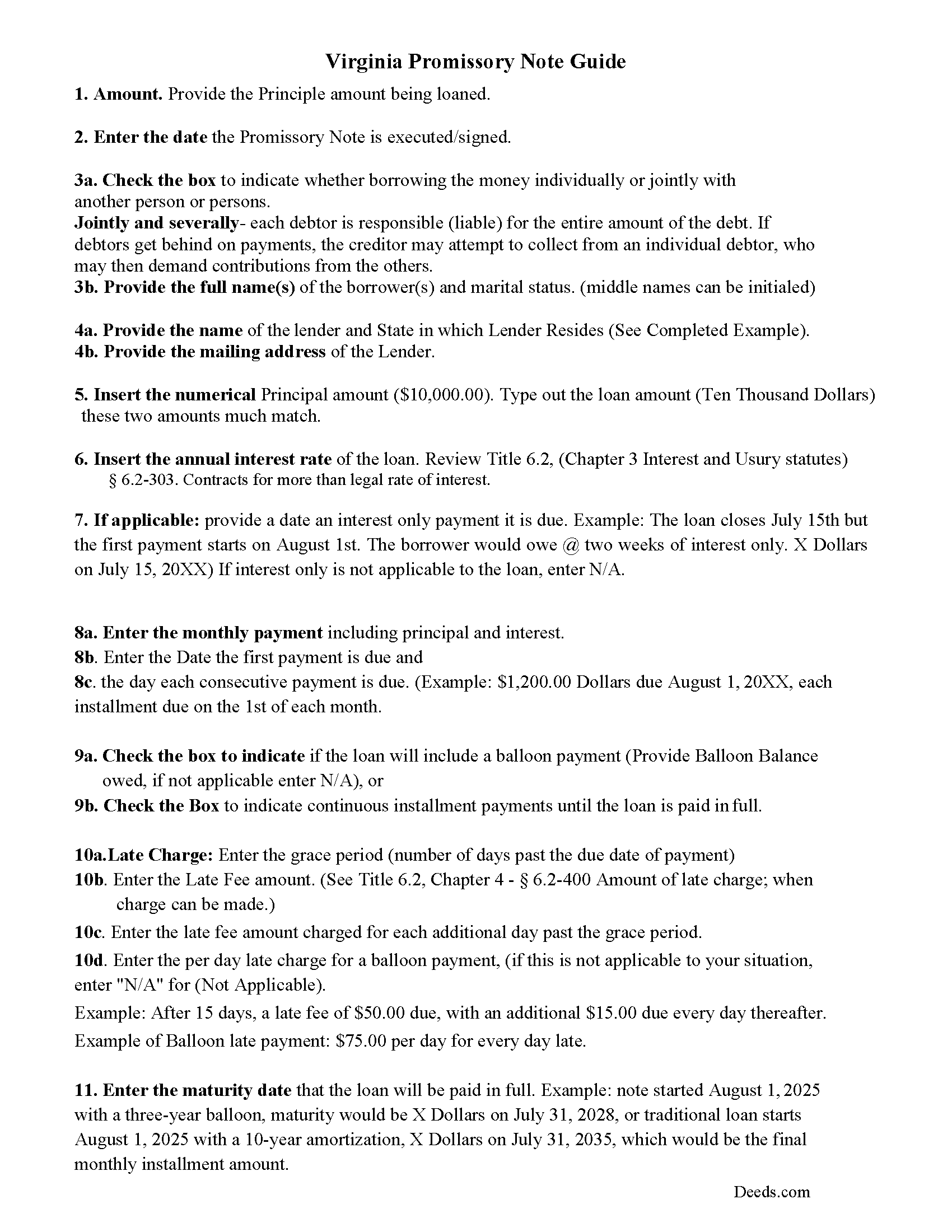

Stafford County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Stafford County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

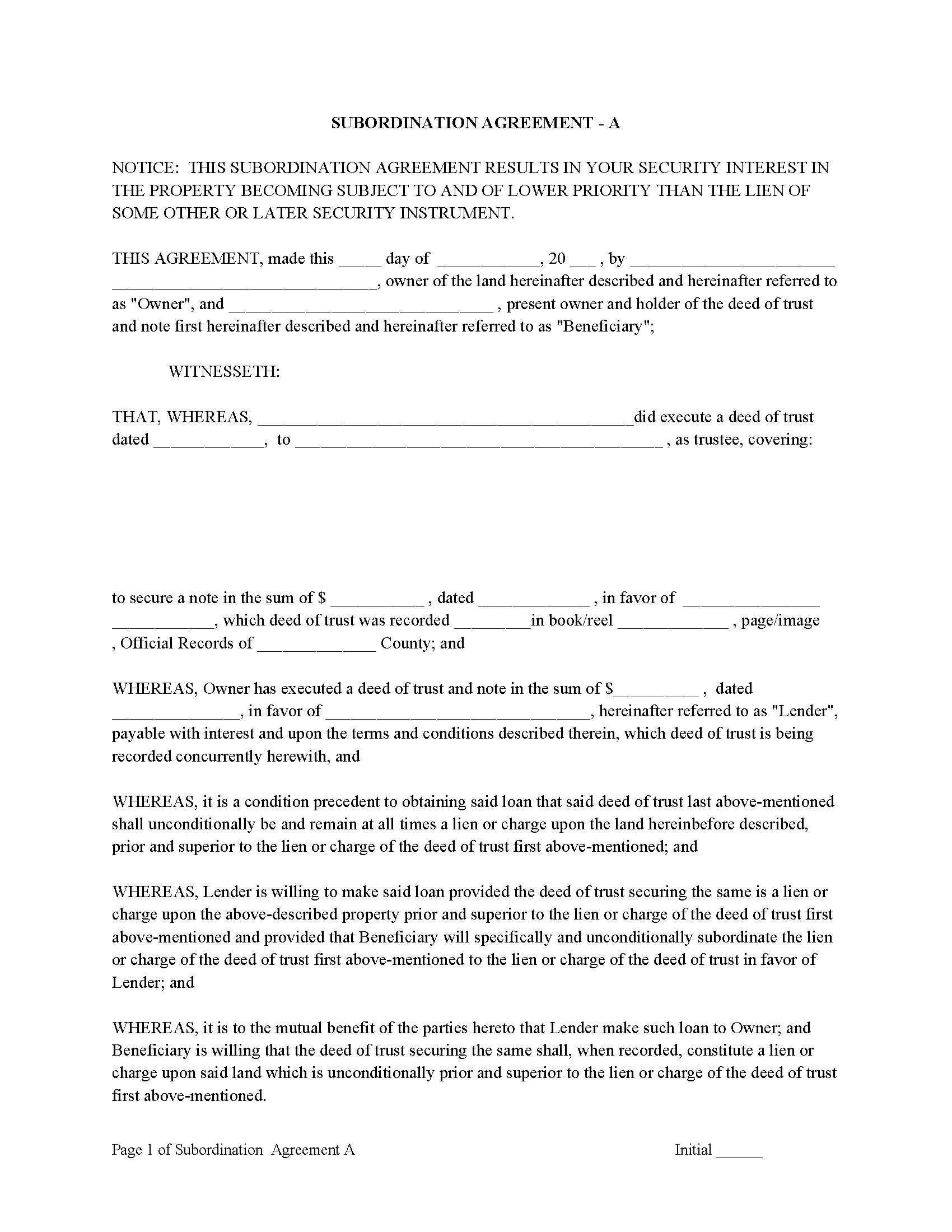

Stafford County Subordination Agreements

Used to place priority on claim of debt. Included are 4 clauses for unique situations. If needed, add to Deed of Trust as an addendum or rider.

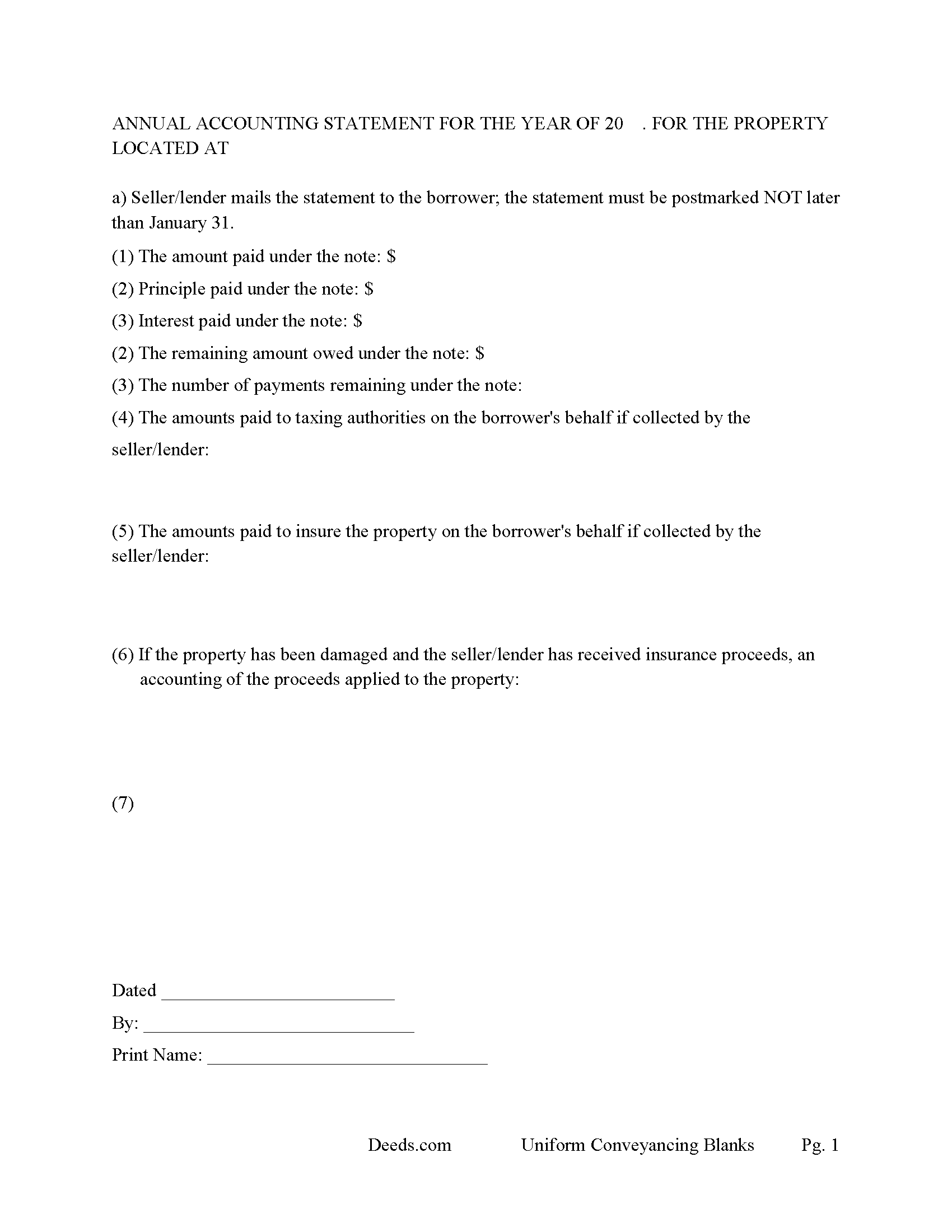

Stafford County Annual Accounting Statement

Mail to borrower for fiscal year reporting. (A request for payoff information under this section may be made one time within a 12-month period without charge) (6.2-418)

All 8 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Virginia and Stafford County documents included at no extra charge:

Where to Record Your Documents

Stafford Circuit Court Clerk

Stafford, Virginia 22554-0895

Hours: 8:00 to 4:00 M-F / Recording cut-off at 3:00

Phone: (540) 658-8752

Recording Tips for Stafford County:

- Documents must be on 8.5 x 11 inch white paper

- Leave recording info boxes blank - the office fills these

- Recording fees may differ from what's posted online - verify current rates

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Stafford County

Properties in any of these areas use Stafford County forms:

- Brooke

- Fredericksburg

- Garrisonville

- Hartwood

- Quantico

- Ruby

- Stafford

Hours, fees, requirements, and more for Stafford County

How do I get my forms?

Forms are available for immediate download after payment. The Stafford County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Stafford County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Stafford County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Stafford County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Stafford County?

Recording fees in Stafford County vary. Contact the recorder's office at (540) 658-8752 for current fees.

Questions answered? Let's get started!

A Deed of Trust (DOT), is a document that conveys title to real property to a trustee as security for a loan until the grantor (borrower) repays the lender according to terms defined in an attached promissory note. It's similar to a mortgage but differs in that mortgages only include two parties (borrower and lender).

In the Commonwealth of Virginia, a Deed of Trust is the most commonly used instrument to secure a loan. Foreclosure can be done non-judicially, saving time and expense. This process is called a Trustee Sale.

There are three parties in this Deed of Trust:

1- The Grantor (Borrower)

2- Beneficiary (Lender) and a

3- Trustee (Neutral Third Party) (Our guidelines will show how to choose a Trustee at little to no cost)

Basic Concept. The Trustor (Borrower) conveys property title to a Trustee (Neutral Party). A Trustee or beneficiary/Lender can take an action against any person for damages.

Due on Sale Clause: It allows the lender to call or modify the loan if the borrower conveys/sells the property. ("Notice - The debt secured hereby is subject to call in full or the terms thereof being modified in the event of sale or conveyance of the property conveyed.") Required format where (any loan is secured by a mortgage or deed of trust on real property comprised of one- to four-family residential dwelling units.) (VA. Revised Statutes 6.2-417)

These forms are flexible, they can be used for financing residential property, agricultural property, rental property, condominiums, and or small office buildings, with or without existing liens and encumbrances.

A "Special Provisions" section is included for any information specific to your transaction.

The Promissory Note offers options of financing, conventional installments, or installments combined with a balloon payment, common with Owner Financing transactions. Late Charges and Default rates are set within.

(Any lender or seller may impose a late charge for failure to make timely payment of any installment due on a debt, whether installment or single maturity, provided that such late charge does not exceed five percent of the amount of such installment payment and that the charge is specified in the contract between the lender or seller and the debtor.) (6.2-400 (B))

In addition to any other remedies available to Lender if this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee, which fee shall be due at the time this Note is otherwise paid in full. The "Overdue Loan Fee" shall be determined based upon the outstanding principal balance of this Note as of the Maturity Date and shall be:

(a) one percent (1.0%) Of such principal balance if the Note is paid in full on or after thirty (30) days after the Maturity Date but less than sixty (60) days after the Maturity Date, or

(b) two percent (2.0%) of such principal balance if the Note is paid in full on or after sixty (60) days after the Maturity Date.

A Deed of Trust secured by a Promissory Note that includes stringent default terms, can be advantageous to the Lender and favorable to Owner Financing.

(Virginia DOT Package includes forms, guidelines, and completed examples) For use in the Commonwealth of Virginia only.

Important: Your property must be located in Stafford County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Stafford County.

Our Promise

The documents you receive here will meet, or exceed, the Stafford County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Stafford County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Jeff R.

December 10th, 2020

Easy process to receive service. thank you

Thank you!

Michael R.

July 5th, 2022

Very simple to use and everything included

Thank you for your feedback. We really appreciate it. Have a great day!

David C.

January 17th, 2020

Very fast service

Thank you!

Scott s.

September 2nd, 2022

Information requested was provided and time to reply was quick!

Thank you!

Raymond C.

June 8th, 2021

Fast and relaible service every time. I wouldn't use any other service. I love deeds.com

Thank you for your feedback. We really appreciate it. Have a great day!

Michael P.

February 4th, 2024

WOW!! Thank you for making the availability and access to these forms an unpainful experience at a competitive price. Well done!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

matthew h.

June 6th, 2022

Totally awesome. Useless waste of time looking anywhere else for real estate deed forms. All the stars!!

Thank you!

Richard T.

February 8th, 2020

Easy forms for DIYers

Thank you!

Robert h.

February 25th, 2019

excellent and simple to use. Great price for this.

Thank you Robert! We really appreciate your feedback.

Jan H.

October 15th, 2020

This is a great service. It was easy to find and the instructions were complete and easy to follow.

Thank you!

Wayne S.

March 12th, 2025

The website is quick and easy to navigate and the downloading of forms is a simple process.

Thank you, Wayne! We're thrilled to hear that you found our website quick and easy to navigate. Making the process simple for our customers is our goal! If you ever need anything, we're here to help. Appreciate your support!

Kelly Y.

September 1st, 2022

The document was easy to locate, pay for and download. I hope it will be this easy to process by the County!

Thank you!

Peter R.

February 26th, 2020

Great site makes this procedure easy to do,thanks

Thank you!

Samantha A.

April 19th, 2023

This company is a super time saver for our firm and our client! Their website was easy to use and their staff was fast and efficient. Their fees are very reasonable. I would most certainly use their services again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sterling H.

September 17th, 2024

I liked being able to drill down to state and county. Just simply the search for all property records

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.