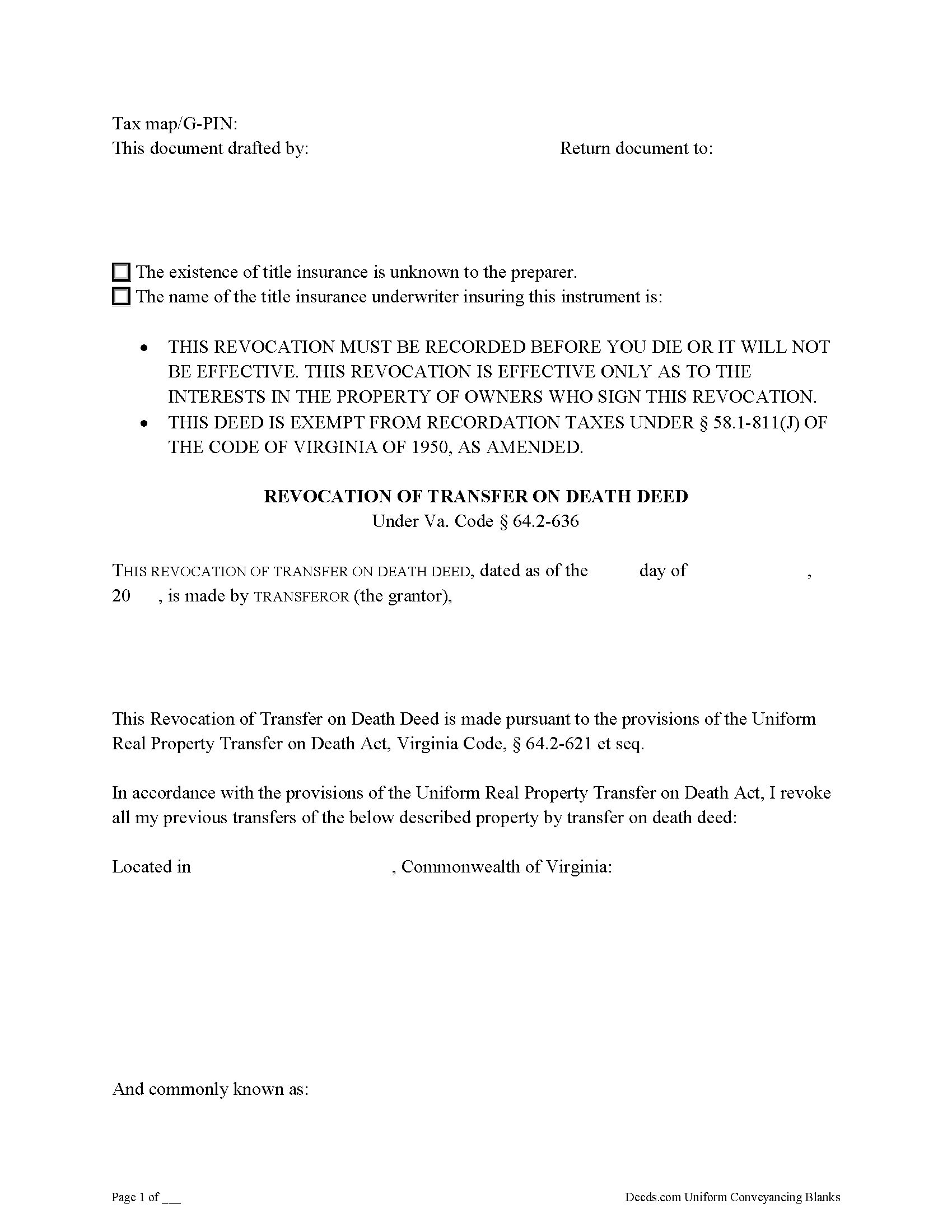

Hanover County Transfer on Death Revocation Form

Hanover County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

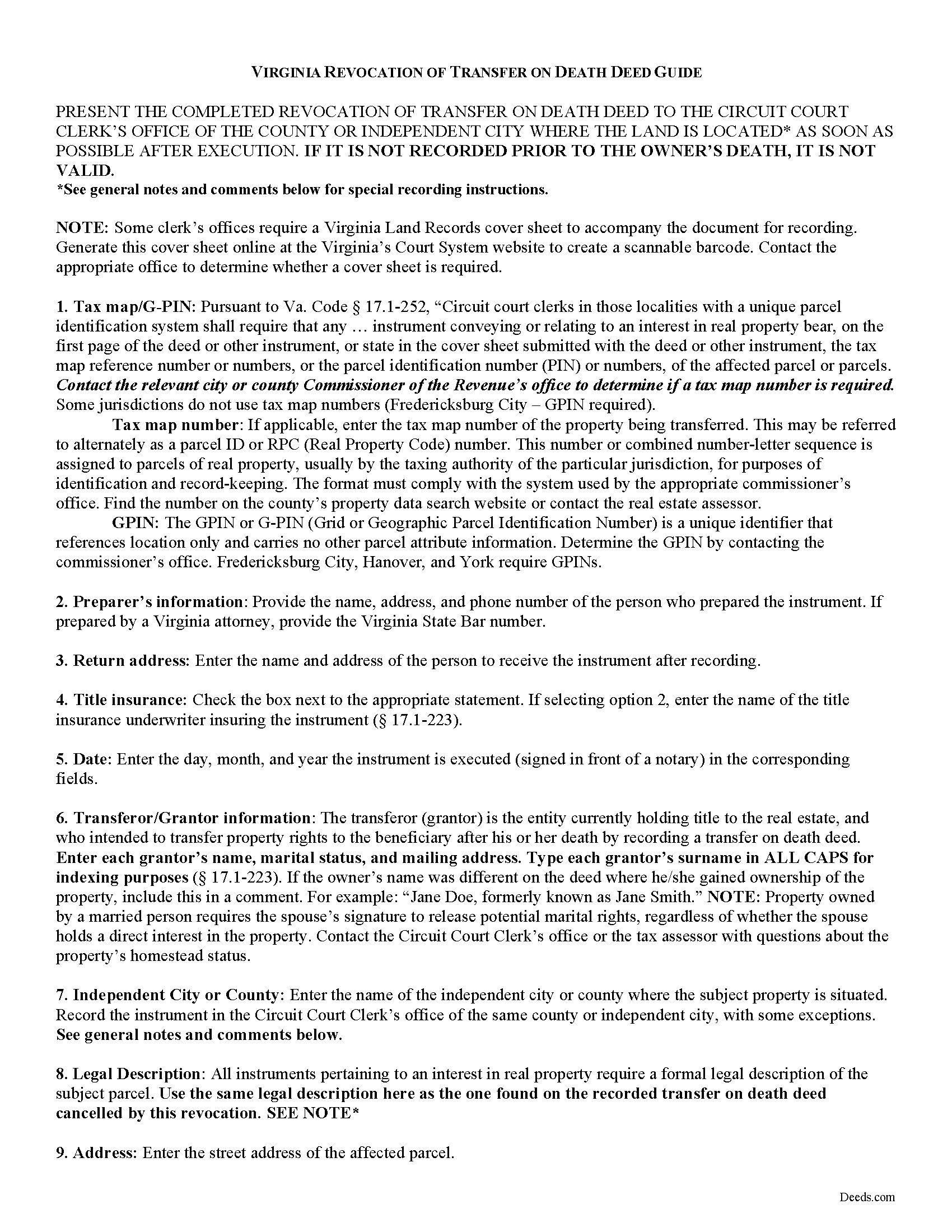

Hanover County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

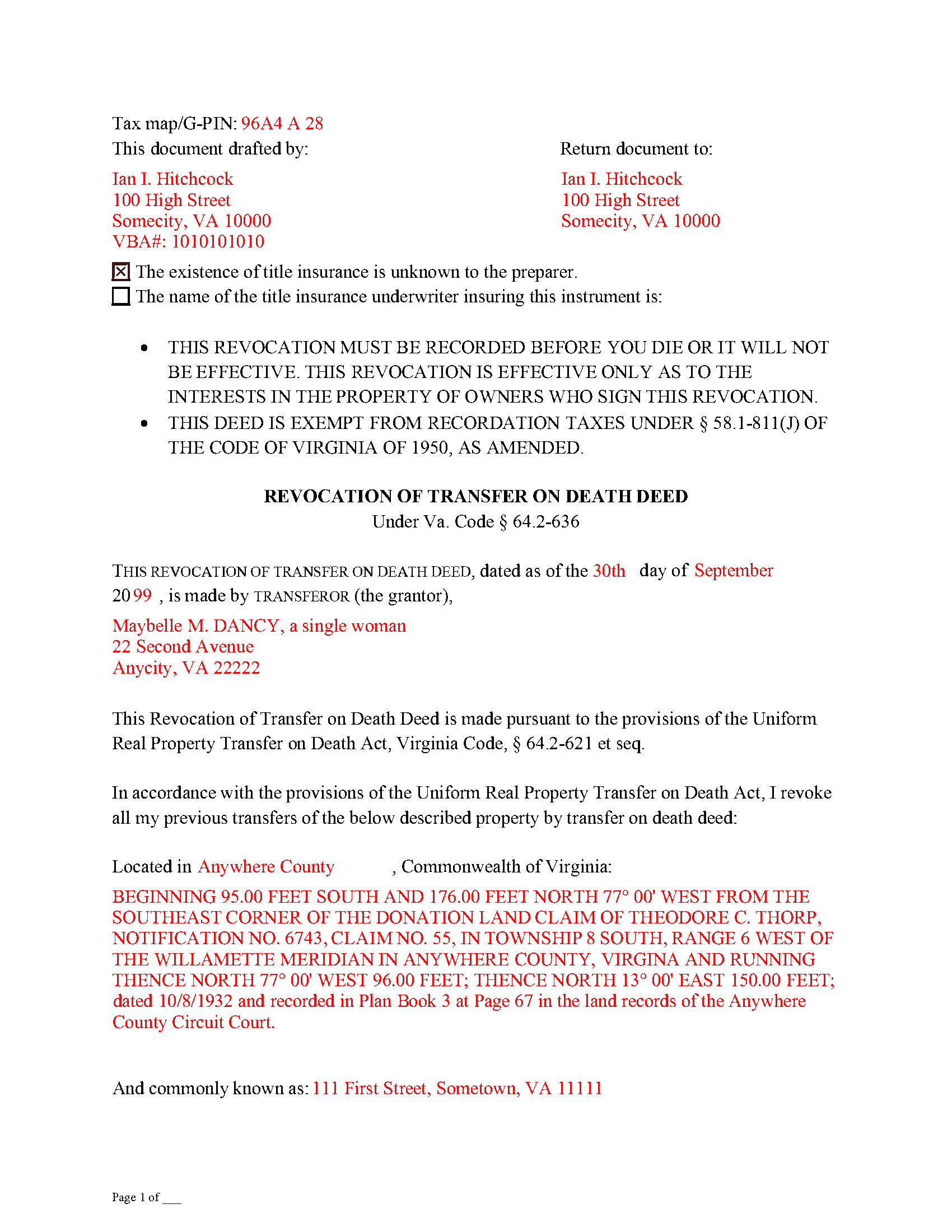

Hanover County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Virginia and Hanover County documents included at no extra charge:

Where to Record Your Documents

Hanover Clerk of Circuit Court

Hanover, Virginia 23069-0039

Hours: 8:00 to 4:30 M-F

Phone: (804) 365-6150 or 6151

Recording Tips for Hanover County:

- Ask about their eRecording option for future transactions

- Recording fees may differ from what's posted online - verify current rates

- Leave recording info boxes blank - the office fills these

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Hanover County

Properties in any of these areas use Hanover County forms:

- Ashland

- Beaverdam

- Doswell

- Hanover

- Mechanicsville

- Montpelier

- Rockville

- Studley

Hours, fees, requirements, and more for Hanover County

How do I get my forms?

Forms are available for immediate download after payment. The Hanover County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hanover County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hanover County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hanover County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hanover County?

Recording fees in Hanover County vary. Contact the recorder's office at (804) 365-6150 or 6151 for current fees.

Questions answered? Let's get started!

As of July 1, 2013, Virginia joined the growing number of states allowing transfer on death deeds. These instruments are governed by the Uniform Real Property Transfer on Death Act (URPTODA), which is incorporated into the Virginia statutes at 64.2-621 et seq.

One of the most useful characteristics of this estate planning tool is its flexibility. Life is unpredictable, and it's important to update wills and other documents dealing with what happens after death. For most deeds, once the owner/transferor signs and records the document, the transfer of title is completed and permanent. With transfer on death deeds, though, recording the executed form sets out the owner's intended plans for the property, but only after his/her death -- while alive, the owner maintains absolute control over and possession of the real estate. Because the conveyance is only for a potential future interest, and generally involves no consideration (money or something else of value given in exchange for the property), these deeds can be revoked for any reason, and at any time during the owner's life.

The Virginia statutes define the processes available for revoking a transfer on death deed at 64.2-630. The primary methods are executing a new transfer on death deed that explicitly revokes or changes the named beneficiary on one that was previously recorded; executing a revocation instrument; or executing an inter vivos deed, permanently transferring ownership of the real property to another owner. All of the methods require that the instrument changing the status of a transfer on death deed be executed and recorded DURING THE OWNER'S LIFE.

Each situation is unique, so carefully review all the options and their potential advantages and consequences before deciding on the appropriate method for revoking a transfer on death deed.

(Virginia Revocation of TOD Package includes form, guidelines, and completed example)

Important: Your property must be located in Hanover County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Hanover County.

Our Promise

The documents you receive here will meet, or exceed, the Hanover County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hanover County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4591 Reviews )

Curtis T.

May 12th, 2020

Deeds support was awesome and constant. Thank you.

Thank you!

Frank W.

January 19th, 2023

Everything worked smoothly

Thank you!

Randy B.

February 3rd, 2019

The form was exactly what we needed and the directions were spot on and perfectly clear. Filling out government forms can be an experience filled with anxiety but deeds.com made it easy and practically worry free.

Thanks Randy, we really appreciate your feedback.

ALFRED B.

September 4th, 2020

The product was just what I needed. Not being the sharpest computer user I stumbled a little but after reading more carefully I navigated the process and I am very satisfied with my experience. deeds certainly saved me a lot of time.

Thank you!

Tai H.

September 21st, 2019

Great service. Save me a time and effort in filling out LA County Quitclaim Deed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alex J.

August 6th, 2020

Very simple to use. I am a private homeowner with no experience in such things and it was very easy to do which was quite a relief. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jaime S.

May 26th, 2021

To call an affidavit of minor correction a Correction Deed in your descriptions is incorrect. They are two different products. I did not intend to purchase an affidavit. I intended to purchase a Correction Deed.

Thank you!

Emanuel W.

December 16th, 2021

Excellent service! We surely use again

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn B.

November 1st, 2019

I do not use the internet much and really am not good with it, but your site which my brother told me about was really easy to use. I would recommend your service to others any time. Thanks for making it user friendly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Samy K.

March 2nd, 2022

I searched on line for the blank forms I needed, everyone that said it's free was a part m they wanted to sign me up for a monthly membership, deeds.com had the forms that I can download and fill in, I paid $24 and got more than I needed, very easy company to deal with, I highly recommend them.

Thank you for your feedback. We really appreciate it. Have a great day!

Kecia L.

February 9th, 2021

Great place to find much needed documents. A huge thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen B.

August 1st, 2025

Great forms! No issues at all at the recorder office. Will be back for sure if needed.

Wonderful to hear Karen. Thanks for taking the time to share your experience. Have a great day!

Trina F.

November 13th, 2020

Easy to purchase. Everything you need to get the job done!

Thank you!

Heather T.

January 21st, 2022

Thank you for making this so easy

Thank you!

Keith C.

April 12th, 2019

not worth anything to me as i could never get notary info on form to print along with other info

Sorry to hear that Keith. We have processed a refund for your order.