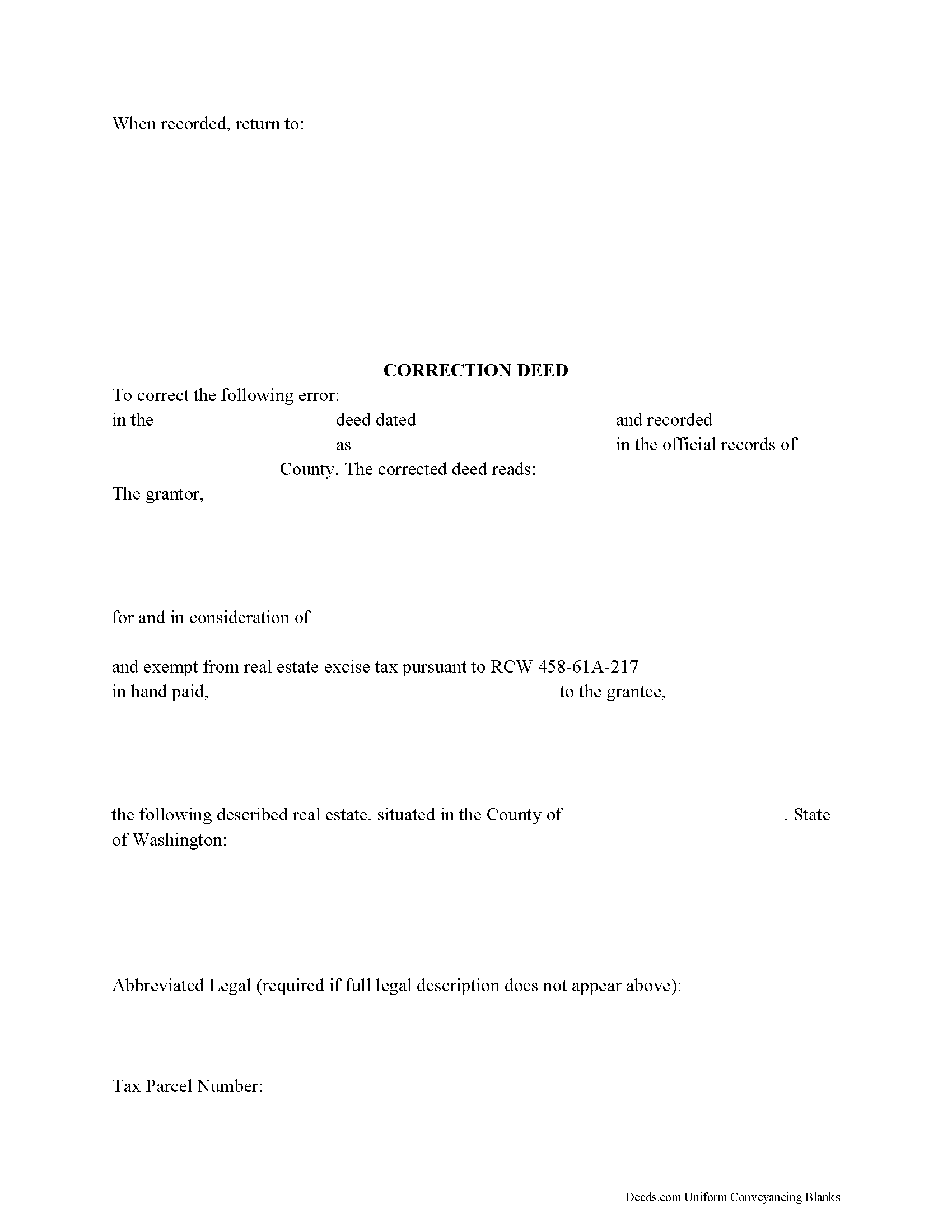

Pierce County Correction Deed Form

Pierce County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

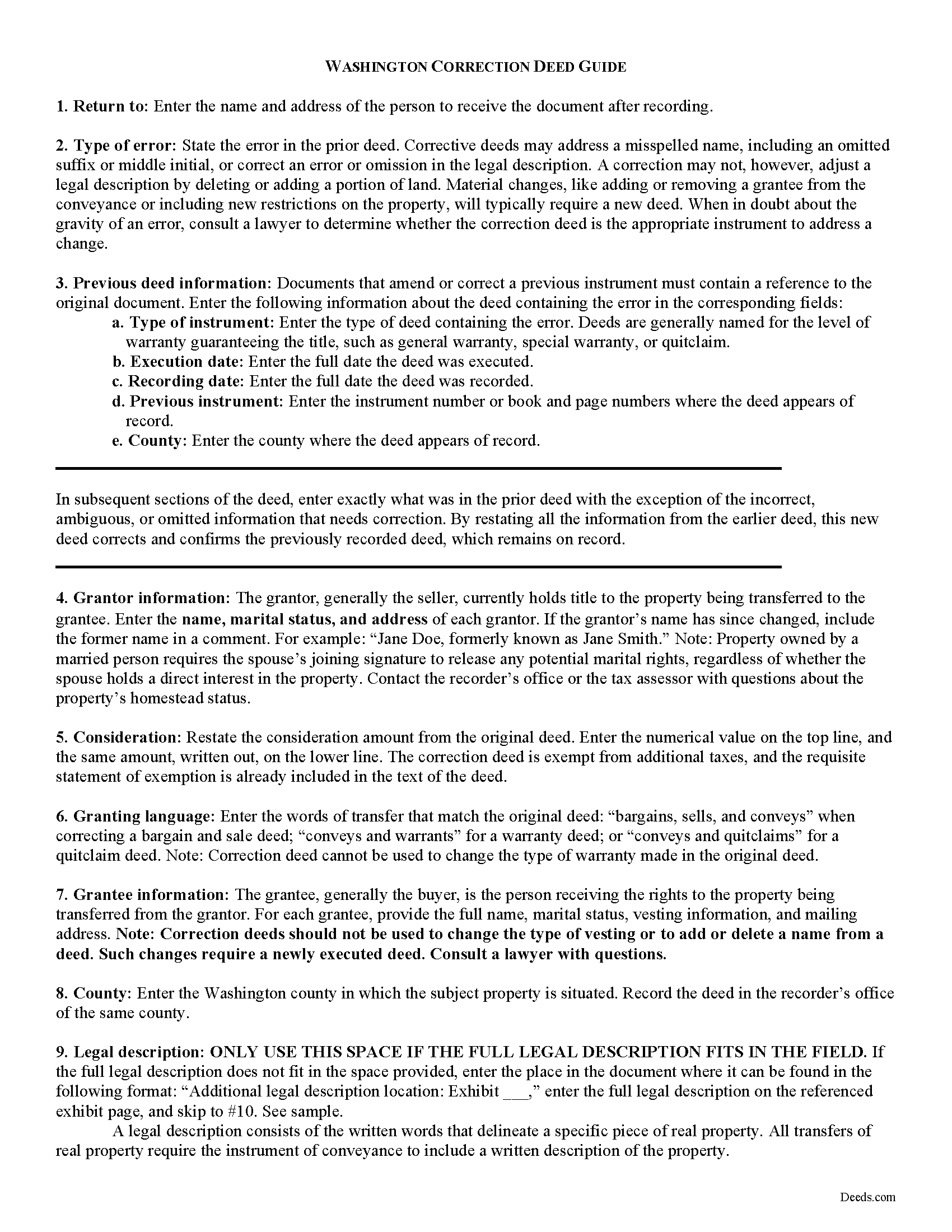

Pierce County Correction Deed Guide

Line by line guide explaining every blank on the form.

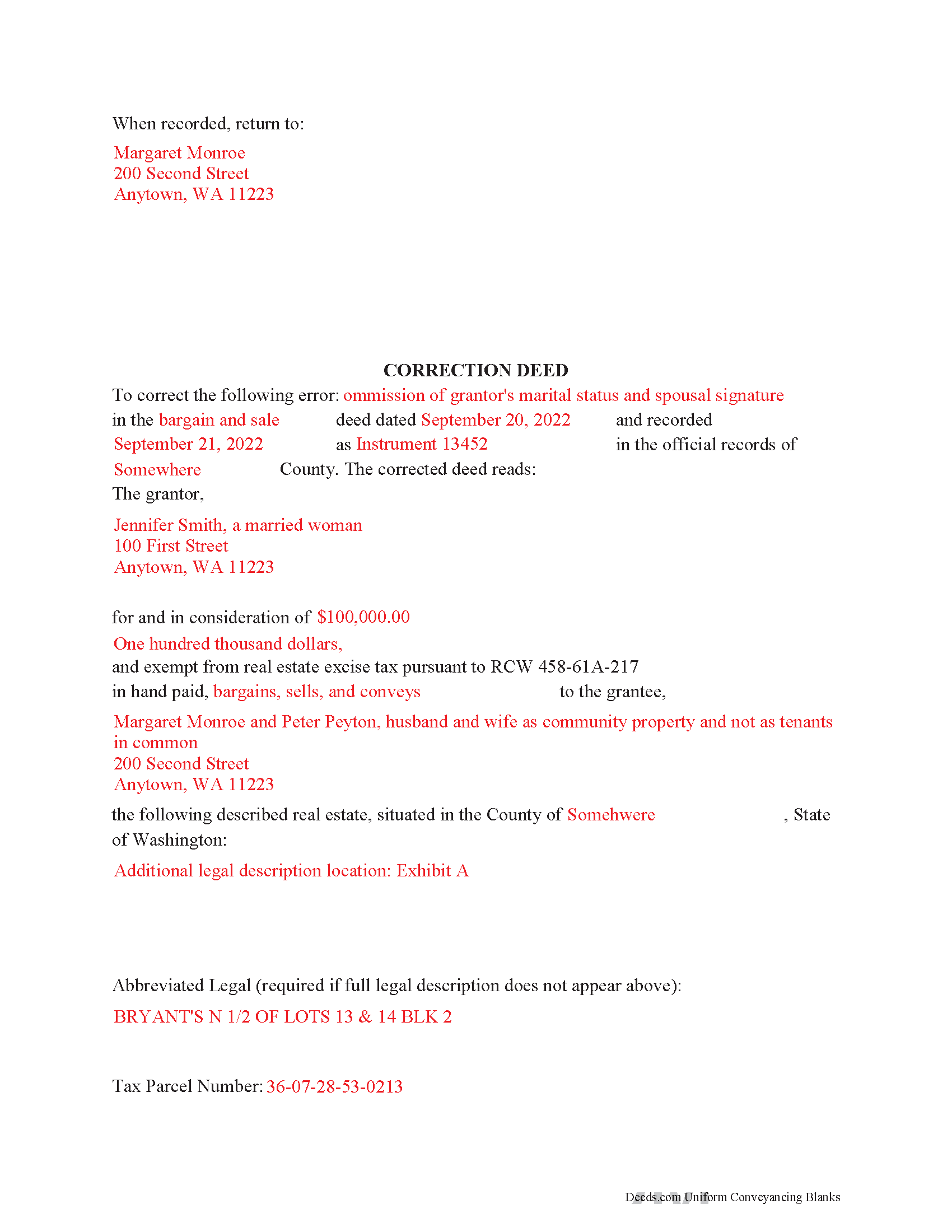

Pierce County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Washington and Pierce County documents included at no extra charge:

Where to Record Your Documents

Pierce County Auditor

Tacoma, Washington 98409

Hours: 8:30 to 4:30 Mon through Fri

Phone: 253.798.7440

Recording Tips for Pierce County:

- White-out or correction fluid may cause rejection

- Recording fees may differ from what's posted online - verify current rates

- Make copies of your documents before recording - keep originals safe

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Pierce County

Properties in any of these areas use Pierce County forms:

- Anderson Island

- Ashford

- Bonney Lake

- Buckley

- Camp Murray

- Carbonado

- Dupont

- Eatonville

- Elbe

- Fox Island

- Gig Harbor

- Graham

- Kapowsin

- La Grande

- Lakebay

- Lakewood

- Longbranch

- Longmire

- Mcchord Afb

- Mckenna

- Milton

- Orting

- Paradise Inn

- Puyallup

- Roy

- South Prairie

- Spanaway

- Steilacoom

- Sumner

- Tacoma

- University Place

- Vaughn

- Wauna

- Wilkeson

Hours, fees, requirements, and more for Pierce County

How do I get my forms?

Forms are available for immediate download after payment. The Pierce County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pierce County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pierce County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pierce County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pierce County?

Recording fees in Pierce County vary. Contact the recorder's office at 253.798.7440 for current fees.

Questions answered? Let's get started!

Use the corrective deed to correct an error in a previously recorded bargain and sale, warranty, or quitclaim deed in Washington State.

Once a deed has been recorded, it cannot be changed and remains part of the public record. It is possible, however, to amend that record by adding a newly executed deed. The method used depends upon the reasons for changing. For corrections of minor errors or omissions, a new correction deed or re-recording of the original deed will suffice. For larger errors or to include/omit a name from the existing deed, a standard conveyance, such as a warranty or quitclaim deed, may be more appropriate.

When re-recording the existing deed, use a cover sheet to reference the prior recording number, the reason for re-recording and the corrected information. The cover sheet, which is often provided by the county, must contain the following information: return address, document title or titles, reference numbers to other documents (here: the prior deed), names of grantors and grantees, entire or abbreviated legal description, assessor's property tax parcel number or account number.

A cleaner option for amending an error is the correction deed, especially in light of Washington State's strict legibility requirements and zero tolerance for any information spilling onto the margins of the document. By restating all the information from the earlier deed, this new deed of correction will reference and confirm the previously recorded deed, which remains on record. After identifying the type of error and identifying the earlier deed, enter exactly what was in that deed with the exception of the false, ambiguous or omitted information that needs to be corrected.

In both correction scenarios, submit a new excise tax affidavit, which must state the prior excise tax recording number. When filling out the affidavit, use exemption code WAC 458-61A-217, which also calls for "the recorded document number for the prior transaction" and an explanation for the re-recording.

(Washington CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Pierce County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Pierce County.

Our Promise

The documents you receive here will meet, or exceed, the Pierce County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pierce County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4579 Reviews )

Thomas M.

July 26th, 2021

The process of finding exactly what was needed was pretty painless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Victor K.

January 27th, 2023

The form I needed was correct and paginated as required. It was accepted w/o penalties. I was not happy about the information which I found way too scant. One sample form does not cover enough possibilities, more would be helpful. The instruction page is a bit better but sometimes it is not clear enough - sometimes it is not clear what the numbered items in the form correspond to. There is no guidance about the process and it would take very little to provide it. Example about "description", say where to find. There is a bunch of "free forms" attached but no guide on which are needed and when. Example: at the counter I was given a paper "conveyance" form and asked to fill it - I did not know it was needed and what it did and so I had not d

Thank you for your feedback. We really appreciate it. Have a great day!

Anita B.

April 15th, 2020

Service was fast and complete. Would use again.

Thank you!

Danelle S.

November 22nd, 2019

So easy and fast that even I could do it, and I'm technologically challenged! Thank you Deeds.com for taking care of the technical stuff so I can live and play. Definitely speedy delivery!

Thank you!

Jermaine H.

December 25th, 2021

Great informative site.... helped me find exactly what I was looking for. DETAILED information on my property!

Thank you for your feedback. We really appreciate it. Have a great day!

Jerome R.

July 22nd, 2021

great service clean and accurate

Thank you for your feedback. We really appreciate it. Have a great day!

Alfred D.

February 28th, 2023

The material was very usable and site was easy to navigate. Well worth the money. If I have similar needs, I'll ber back.

Thank you for your feedback. We really appreciate it. Have a great day!

ronald s.

April 27th, 2021

easy to use site, directions well laid out

Thank you for your feedback. We really appreciate it. Have a great day!

Kenneth H.

October 13th, 2021

The deeds.com website is incredibly easy to navigate and the nearly instantaneous chat function allowed me to quickly correct an entry error I made uploading a document. The day after enrolling and uploading the document I had a copy of the document properly filed. Very efficient; very effective.

Thank you for your feedback. We really appreciate it. Have a great day!

Bernadette K.

February 17th, 2021

Your system is completely unfriendly to the user. There is no clear way, unless you are a lawyer, to go through the the process without making mistakes. Very disappointed attempted user

Sorry to hear that we failed you Bernadette. We do hope that you were able to find something more suitable to your needs elsewhere.

Julie C.

July 21st, 2020

The process worked great! It's a great solution for recording documents at the county during the pandemic and in the future if you don't want to leave home!!

Thank you!

Mark R.

January 10th, 2019

Easy and simple to understand, had no trouble with the transaction or the forms. Recorded on the first try, not something that happens very often.

Great to hear that Mark. have an awesome day!

Lisa P.

October 23rd, 2020

Your forms are worth the investment. The guide and example were very helpful and thorough.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Wilma E.

July 18th, 2022

Very satisfied with service and form. Completed form, printed, and submitted to county for processing. Everything went well.

Thank you for your feedback. We really appreciate it. Have a great day!

Lori N.

August 16th, 2022

I ordered the document I needed and it was available for download within a half hour. Very pleased, thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!