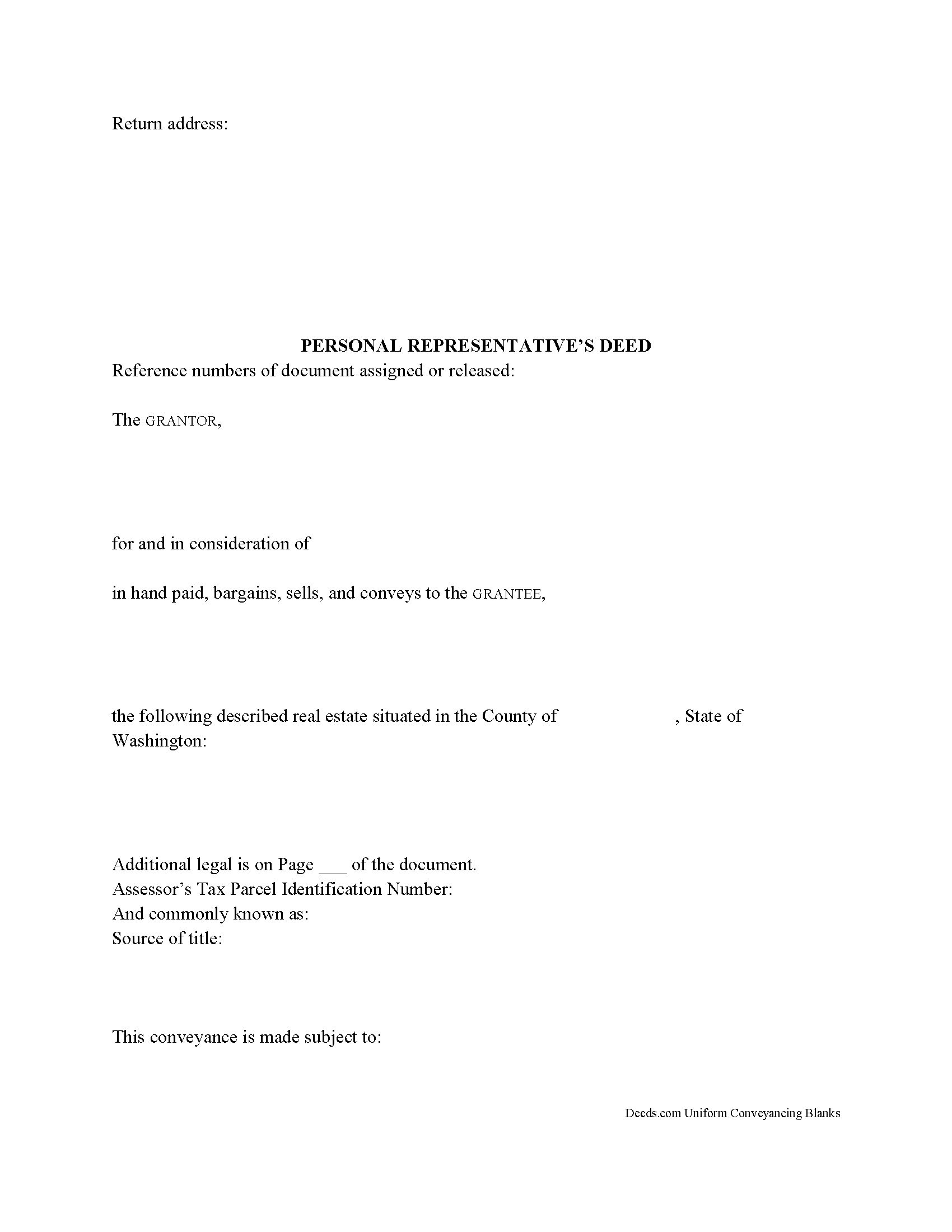

Pacific County Personal Representative Deed Form

Pacific County Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

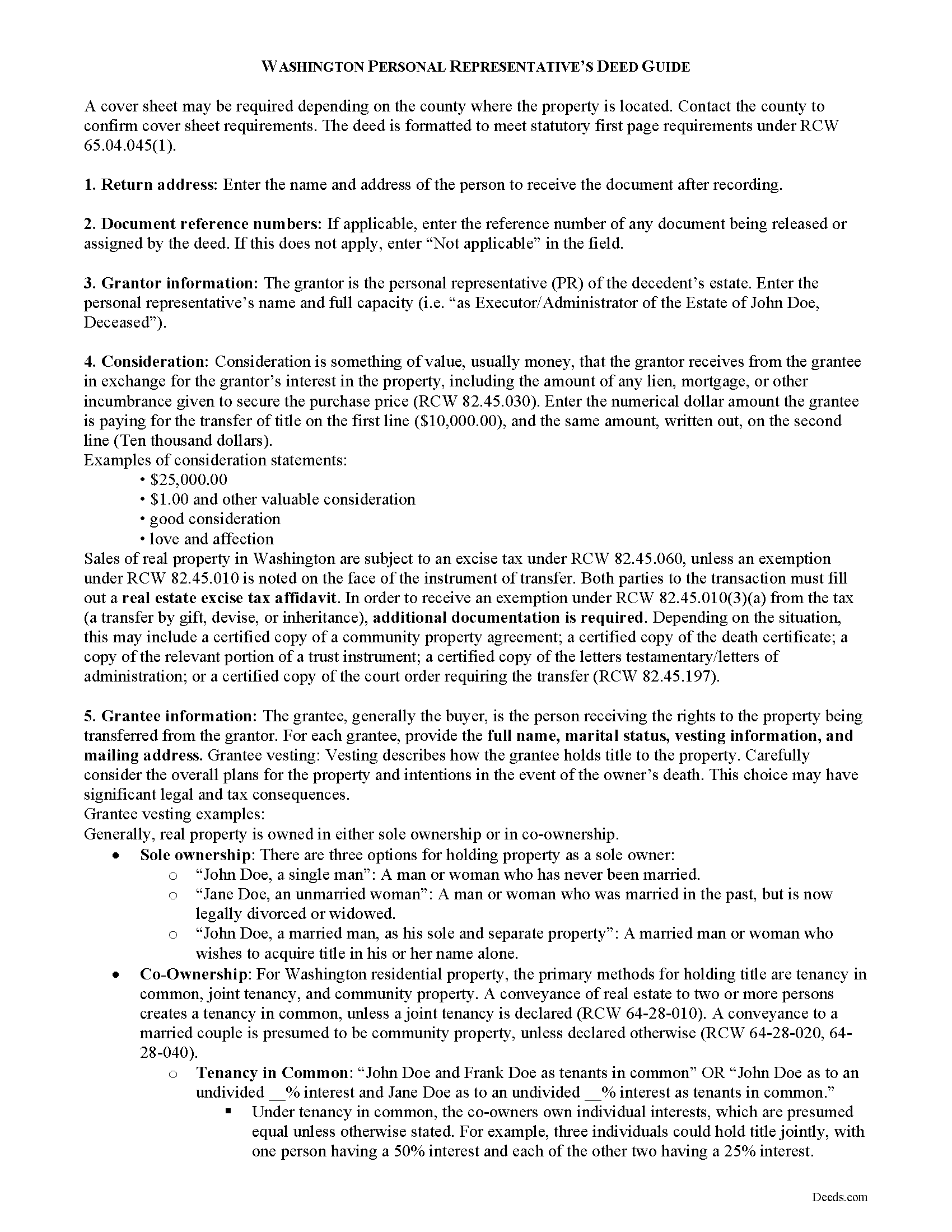

Pacific County Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

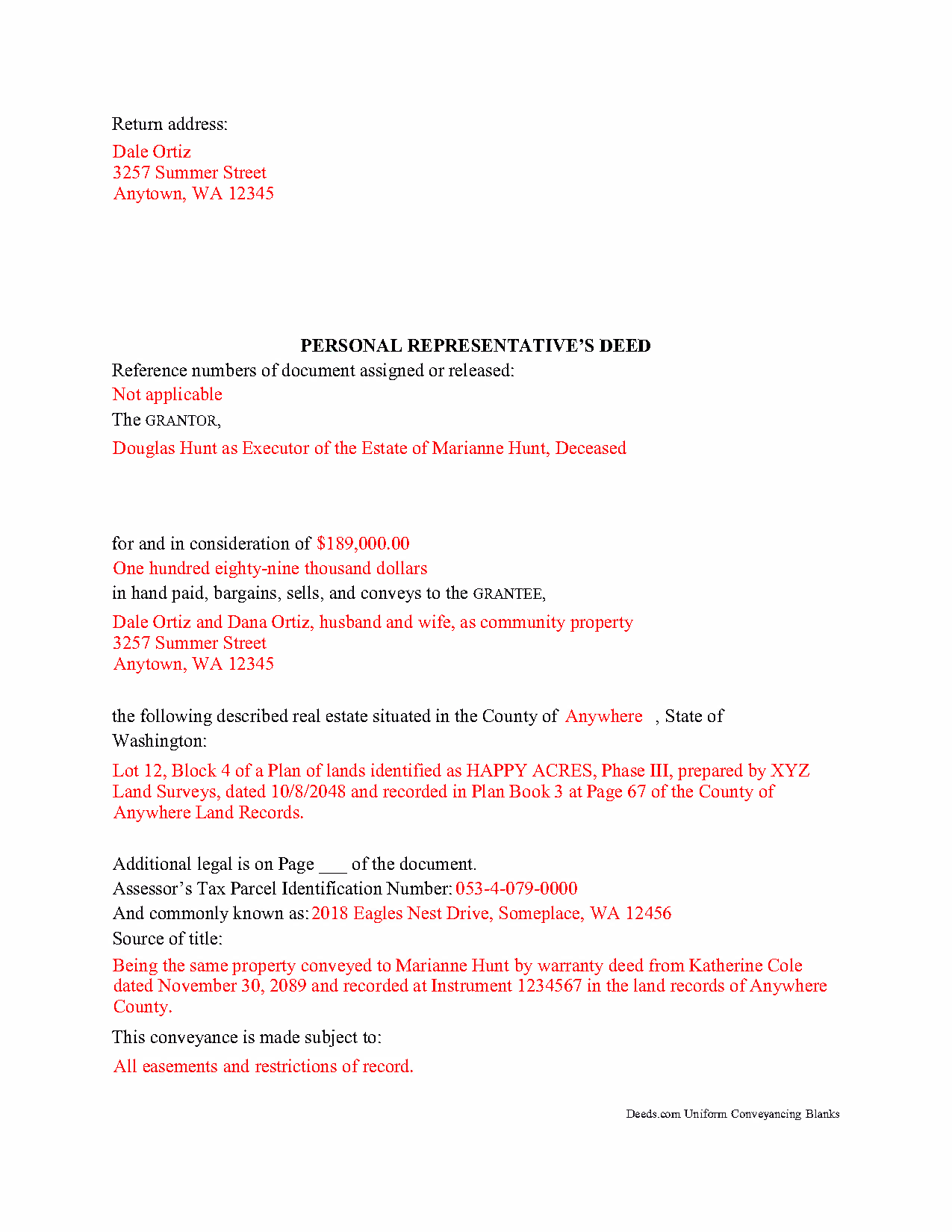

Pacific County Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Washington and Pacific County documents included at no extra charge:

Where to Record Your Documents

Pacific County Auditor: Recording

South Bend, Washington 98586

Hours: Monday through Friday 8:00am - 4:00pm

Phone: (360) 875-9318

Recording Tips for Pacific County:

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Pacific County

Properties in any of these areas use Pacific County forms:

- Bay Center

- Chinook

- Ilwaco

- Lebam

- Long Beach

- Menlo

- Nahcotta

- Naselle

- Ocean Park

- Oysterville

- Raymond

- Seaview

- South Bend

- Tokeland

Hours, fees, requirements, and more for Pacific County

How do I get my forms?

Forms are available for immediate download after payment. The Pacific County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Pacific County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pacific County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Pacific County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Pacific County?

Recording fees in Pacific County vary. Contact the recorder's office at (360) 875-9318 for current fees.

Questions answered? Let's get started!

Washington State Probate and Sales of Real Property

Probate is the legal process of settling a decedent's estate and transferring any remaining assets to those entitled to receive them. Procedures for probate of wills and distribution of estates are codified at RCW Title 11.

When a decedent dies leaving a will, the estate is said to be testate. If a decedent does not leave a will or the will is not found valid by the court, the estate is intestate. Persons named in a decedent's will to inherit a part of the estate are called devisees.

Any assets not disposed of by will are distributed to heirs at law in the order specified at RCW 11.04.015. Typically, all assets titled solely in the decedent's name are subject to probate. Nonprobate assets include interests that pass with a right of survivorship, by transfer on death, or by community property agreement, and assets held in a grantor trust (RCW 11.02.005(10)).

Washington is a community property state, meaning that, upon the death of the first spouse, a one-half share of the community property, property acquired during the marriage, succeeds to the surviving spouse, with the other one-half share subject to disposition by the decedent's will, or descending according to the laws of descent and distribution codified at chapter 11.04 RCW. All the community property is subject to probate administration, however; this means that it may be used for payment of debts of the community (11.02.070).

In Washington State, title to a decedent's real property vests in his heirs or devisees at the time of death, subject to debts, allowances, and expenses of administration (RCW 11.04.250). The probate process is necessary to settle claims against the estate and ensure the marketable transfer of title.

In a formal probate proceeding, the custodian of the will delivers the will to the appropriate court or the executor named in the will (RCW 11.20.010). To open probate, apply for probate and appointment of a personal representative to the judge of the court (11.20.020). The superior court of the county where the decedent resided at the time of death handles probate cases.

Short-form probates, or settlements without intervention, are also available under Washington probate law. Seek qualified legal advice when considering probate options.

Washington's Revised Code outlines the priority of persons to serve as personal representative (PR) of the estate. The PR serves in a fiduciary capacity to settle the estate under the supervision of the court. This includes filing all necessary legal paperwork, such as inventories, accountings, and notices, filing taxes, and paying claims, family allowances, and expenses of administration, among other duties.

The court issues letters testamentary to the executor named in the decedent's will. When the executor is unwilling or unable to serve, the court will issue letters of administration with the will annexed to the appointee (RCW 11.28.010). If the decedent died intestate, or without a will, an interested person may apply for letters of administration by filing a petition with court giving the names and address of heirs and fact that the deceased died without a will (11.28.110). Letters of administration are granted in the order established at RCW 11.28.120. A surviving spouse is entitled to administer any community property, unless the will provides otherwise (RCW 11.28.030). If the surviving spouse fails to apply for appointment within 40 days of the death, he or she is presumed to have waived the right to administer (11.28.030).

The appointed PR is required to provide written notice of appointment to each heir, legatee, and devisee within 20 days, with proof of notice given by affidavit filed with the court, and also give notice to the department of revenue within 60 days (11.28.237). RCW 11.40.020 establishes the requirements for filing notice of appointment to creditors.

Under the current laws, a personal representative is not authorized to make a sale of any property from an estate without an order of the court (RCW 11.56.010). The personal representative must present a petition to the court describing the estate's property and the amount of debts, obligations, and expenses of the estate so that the court may determine the necessity of the sale. No notice of the hearing of the petition for sale is required, unless the court should so order. Only when a will directs property to be sold or gives authority to the executor to sell property can the PR act without order of the court (11.56.250).

The court may order a sale to raise money to pay the debts and obligations of the estate and expenses of administration, estate taxes, or for the support of the family; to make distribution; or "for such other purposes as the court may deem right and proper" (RCW 11.56.010). Following a confirmation of the sale, the court directs the PR to execute and deliver the deed conveying title to the purchaser. A conveyance after confirmation of sale conveys all the estate, rights, and interests of the decedent at the time of death and any interest acquired by the estate (11.56.120).

A personal representative's deed follows the statutory form of a bargain and sale deed under RCW 64.04.040, containing covenants that the granting party is, at the time of the conveyance, seized in fee simple of the estate; that the estate is free from encumbrances made by the grantor; and for quiet enjoyment against the grantor, his heirs and assigns, unless otherwise limited by express words contained in the deed.

A PR deed names the PR as acting in a fiduciary capacity on behalf of the estate. A lawful deed includes the grantee's name, address, marital status, and vesting information, as well as a full legal description of the parcel, the consideration made for the transfer of title, a recitation of the derivation of title, and any restrictions on the property. A PR deed must meet standards of form and content for documents relating to real property in Washington. Include a cover sheet where applicable (RCW 65-04-045). The PR must sign in the presence of a notary public for a valid transfer and record the deed in the land records of the county where the real property is situated.

Sales of real property in Washington are subject to an excise tax under RCW 82.45.060, unless an exemption under RCW 82.45.010 is noted on the face of the instrument of transfer. Both parties to the transaction must fill out a real estate excise tax affidavit. In order to receive an exemption under RCW 82.45.010(3)(a) from the tax (a transfer by gift, devise, or inheritance), additional documentation is required. Depending on the situation, this may include a certified copy of a community property agreement; a certified copy of the death certificate; a copy of the relevant portion of a trust instrument; a certified copy of the letters testamentary/letters of administration; or a certified copy of the court order requiring the transfer (RCW 82.45.197).

Consult an attorney with questions about using a personal representative's deed, or for any other issues related to transferring a decedent's real property in Washington.

(Washington PRD Package includes form, guidelines, and completed example)

Important: Your property must be located in Pacific County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed meets all recording requirements specific to Pacific County.

Our Promise

The documents you receive here will meet, or exceed, the Pacific County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pacific County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

candy h.

June 18th, 2020

service was great!

Thank you!

Gary B.

September 28th, 2021

The whole experience was amazing. Your site was easy to work with and the staff was supper responsive. We were in and out in a flash!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Benjamin A.

November 27th, 2019

This method seems simple for me to complete. Wish me luck.

Thank you for your feedback. We really appreciate it. Have a great day!

Bill S.

March 10th, 2021

Very convenient and reasonably priced service. Excellent. A++

Thank you for your feedback. We really appreciate it. Have a great day!

Oldemar T.

June 23rd, 2020

You guys simplified my life. You offer very convenient services. Thank you.

Thank you!

Patricia P.

July 14th, 2021

Easy to use and super convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael S.

July 11th, 2019

So far, I'm happy with my experience. I'm still reviewing the guide for the docs I downloaded. Including the guide for the docs is indeed a plus.

Thank you Michael, we really appreciate your feedback.

Dale Mary G.

July 14th, 2020

This was an easy site to use - saving so much time and allowing me to complete what I needed to do. All the added information, guidelines and even a sample completed form. Great!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christina D.

March 31st, 2025

The papers allowed me to get done what I needed. But for the price I would expect a spell check. There were spelling errors when there should not have been any. Please proof read

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Shirley R J.

February 5th, 2019

Great website.....fast and easy access!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Zina J.

October 30th, 2019

Deeds.com supplied exactly what I needed to complete a quitclaim. Deeds.com saved me $180, supplied the necessary forms, and a sample page to use as a guide. I recommend Deeds.com.

Thank you!

Delba O.

January 4th, 2021

This was the easiest process ever. Thank you for making this so easy. No hassle, just upload your docs, pay the invoice and done. It didn't even take 2 business days to get my deed recorded. If I ever need to record anything I will definitely use your services again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael W.

February 7th, 2025

Excellent product. I am so happy I found Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Rhonda D.

February 24th, 2021

The boxes do not allow you to add the entire information. The after recording return to box would not let me add a zipcode.

Thanks for the feedback Rhonda, we’ll take a look at that input field.

Jose G.

April 12th, 2022

One of the best downloads ever. Very easy to do. For the price, well worth it. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!