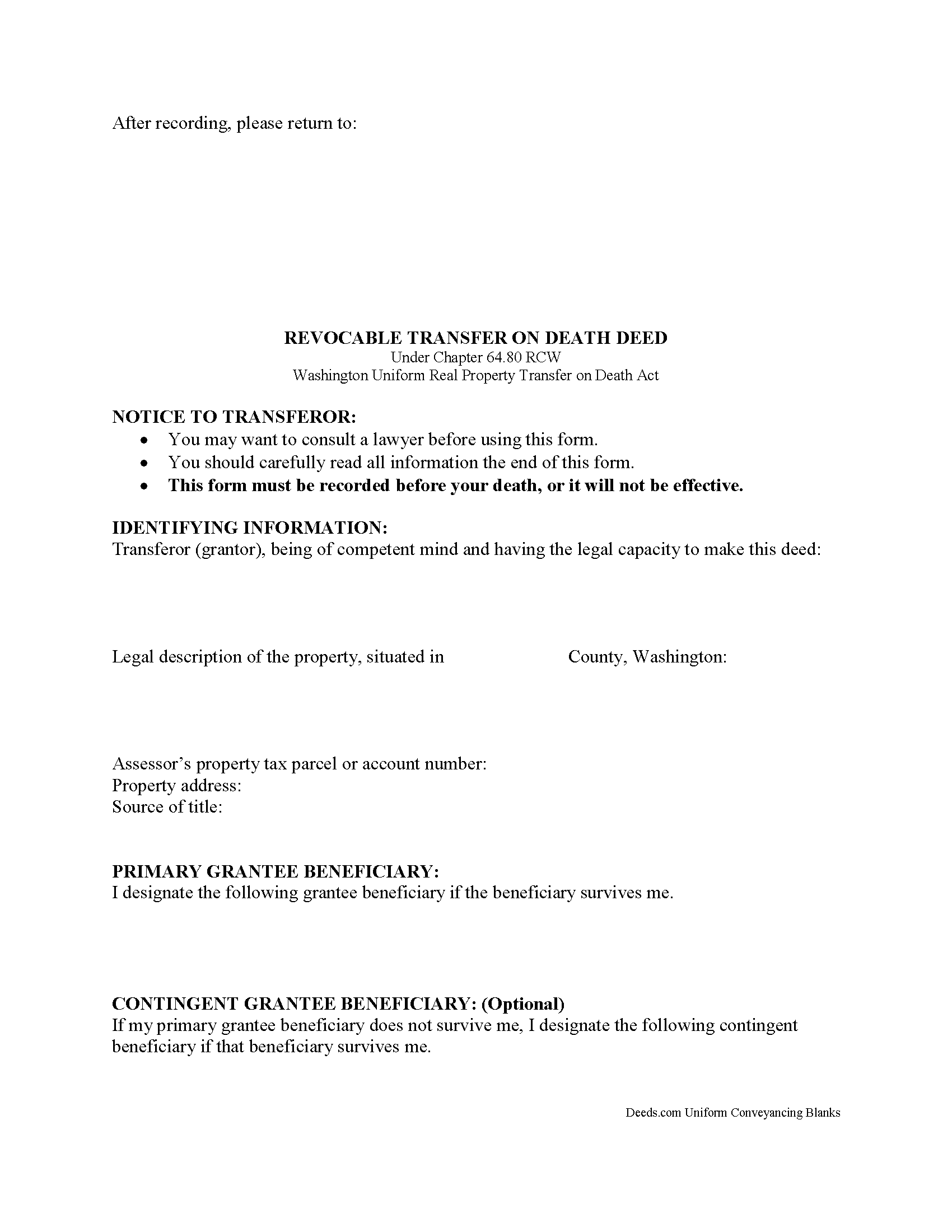

Island County Transfer on Death Deed Form

Island County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

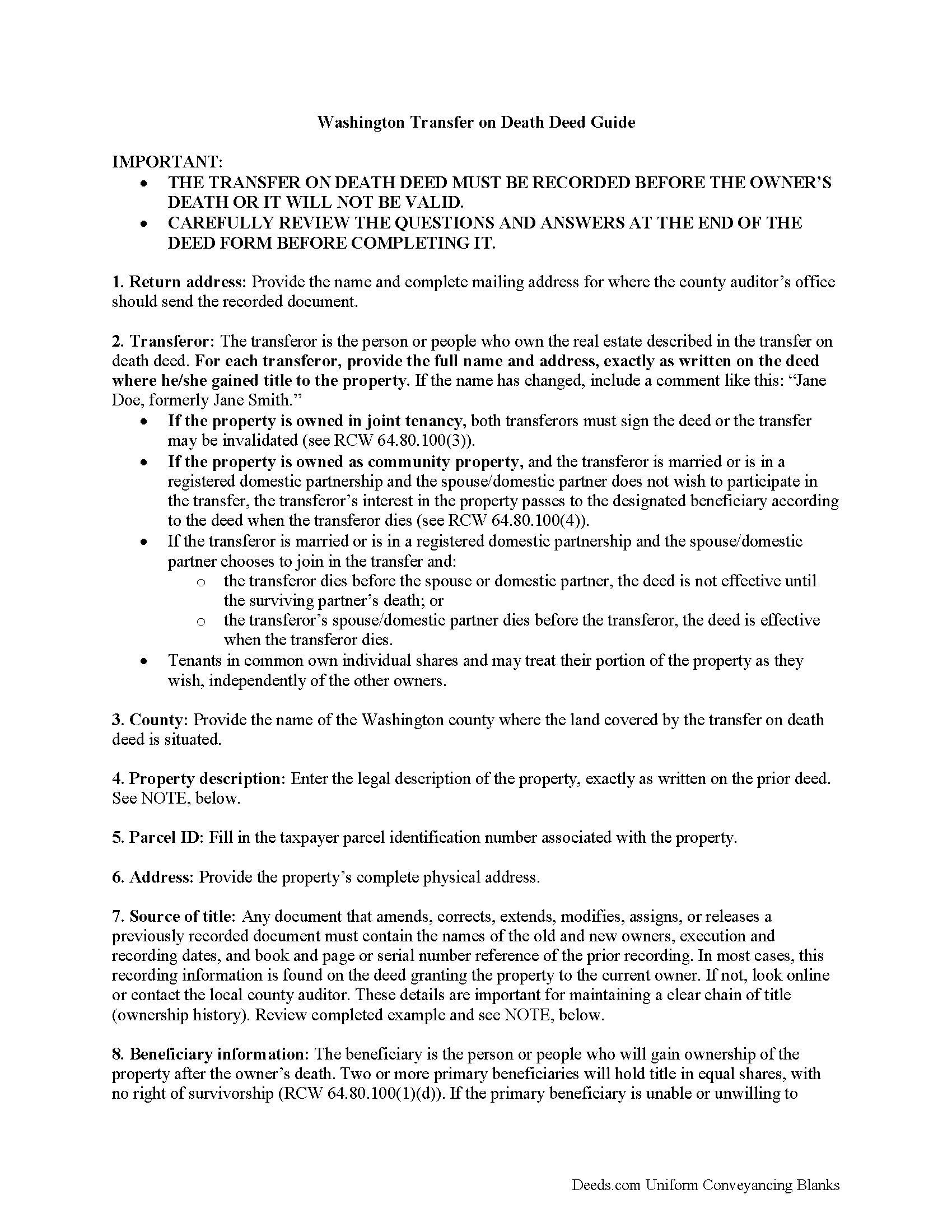

Island County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

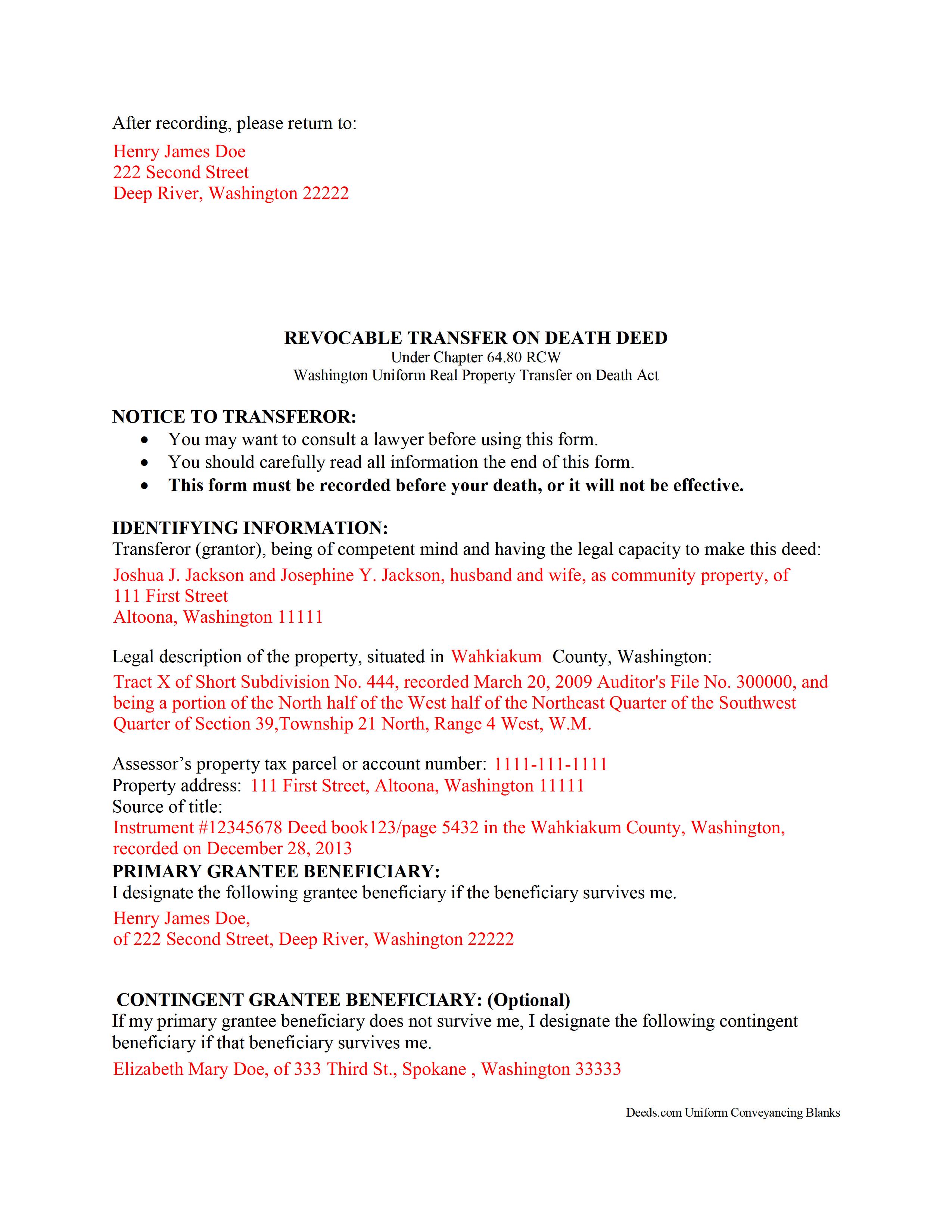

Island County Completed Example of the Transfer on Death Deed Document

Example of a properly completed Washington Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Washington and Island County documents included at no extra charge:

Where to Record Your Documents

Island County Auditor: Recording

Coupeville, Washington 98239-5000

Hours: 8:00 a.m. - 4:30 p.m. Mon-Fri

Phone: (360) 240-5549

Recording Tips for Island County:

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

- Check margin requirements - usually 1-2 inches at top

- Leave recording info boxes blank - the office fills these

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Island County

Properties in any of these areas use Island County forms:

- Camano Island

- Clinton

- Coupeville

- Freeland

- Greenbank

- Langley

- Oak Harbor

Hours, fees, requirements, and more for Island County

How do I get my forms?

Forms are available for immediate download after payment. The Island County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Island County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Island County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Island County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Island County?

Recording fees in Island County vary. Contact the recorder's office at (360) 240-5549 for current fees.

Questions answered? Let's get started!

Real estate owners in Washington have an estate planning option: the transfer on death deed (TODD). Find the full text in the Revised Statutes of Washington at Chapter 64.80.

This statute is based on the Uniform Real Property Transfer on Death Act (URPTODA). Along with Washington, a growing number of states are choosing to adopt the provisions of the URPTODA. The new law allows landowners to direct the distribution of what is often their most significant asset, their real estate, with a correctly executed and recorded transfer on death deed.

Transfer on death deeds are nontestamentary, which means ownership of the property passes to the beneficiary without instructions in a will or the need for probate (64.80.040). Unnecessary conflicts are likely to add confusion and expense, so best practices dictate that landholders should take care to ensure that their wills and TODDs lead to the same outcomes.

Washington's version of the URPTODA sets out the specific requirements for lawful transfer on death deeds:

- The capacity required to make or revoke a transfer on death deed is the same as the capacity required to make a will (64.80.050, 11.12.010).

- It must contain the essential elements and formalities of a properly recordable inter vivos deed, such as warranty or quitclaim deed (64.80.060(1))

- It must state that the transfer to the designated beneficiary is to occur at the transferor's death (64.80.060(2))

- It must be recorded before the transferor's death in the office of the clerk of the county commission in the county where the property is located (64.80.060(3)).

The named beneficiary gains no present rights to the property, only a potential future interest. Instead, the transferors retain absolute control during their lives. This includes the freedom to sell or transfer it to someone else, and to modify or revoke the intended transfer on death (64.80.090). These details, along with the fact that TODDs only convey the property rights remaining, if any, at the owner's death, explain why they do not require notice or consideration (64.80.070).

According to 64.80.100(1)(a), the beneficiary gains equitable interest in the property ONLY when the owner dies. Note, however, that the beneficiary must be alive at the time of the transferor's death or the interest returns to the estate (64.80.100(1)(b)). To prevent this from happening, the owner may identify one or more contingent beneficiaries. All beneficiaries take title subject to any obligations (contracts, easements, etc.) associated with the property when the transferor dies (according to 64.80.100(2)).

With the new transfer on death deeds, real property owners in Washington have access to a convenient, flexible tool for managing one aspect of a comprehensive estate plan. Even so, a TODD may not be appropriate for everyone. Since each situation is unique, contact an attorney with specific questions or for complex circumstances.

(Washington TODD Package includes form, guidelines, and completed example)

Important: Your property must be located in Island County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Island County.

Our Promise

The documents you receive here will meet, or exceed, the Island County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Island County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Renee M.

September 15th, 2021

My sister in law is in a hospital ICU with Covid, so we were trying to get her affairs in order. Deeds.com made this difficult situation so much better by making this process very easy to understand and do.

Glad we could help Renee, hoping the very best for you and your family.

Kimberley H.

July 14th, 2021

This was crazy easy to do...such a fantastic service! Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nancy C.

April 3rd, 2024

Easy to use, found what I was looking for.

We are grateful for your feedback and looking forward to serving you again. Thank you!

William W.

April 22nd, 2022

No fuss-No muss. Very easy!

Thank you!

Frank K.

July 27th, 2023

One thing I suggest is use the nomenclature Borrower / Lender / instead of Mortgatator / Mortgatee… Had to google which is which ? !

Thank you for your feedback. We really appreciate it. Have a great day!

Della M.

July 7th, 2019

Very easy to purchase with immediate use of all of the forms that you need for probate of property. My parents had died and left equal shares of their home to my 2 brothers and I.

Thank you!

irene a.

February 8th, 2019

good forms thanks, irene

Thank you Irene.

Anita L.

January 22nd, 2020

Found this site very easy to navigate and customer service very supportive and quickly answers any questions you have regarding forms. Best of all you can get the forms you need and only pay for those forms, not tied to some ongoing fee that you must cancel if you have no further need beyond forms you've already purchased.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ARNOLD E.

May 3rd, 2019

SO FAR SO GOOD! I AM STILL COMPLETING THE QUIT CLAIM DEED. THANKS....ARNIE

Thank you Arnold, we really appreciate your feedback.

Michelle G.

April 26th, 2021

EXCEPTIONAL CUSTOMER SERIVCE!!! THANK YOU!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Melissa W.

July 29th, 2021

So easy to use!

Thank you!

Mark M.

October 20th, 2022

Quick, easy everything that i was looking for and then some.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan A.

April 23rd, 2021

The warranty deed form, the explanation and the example were well worth the price, as they gave me more confidence I was filling the deed out correctly. I cross referenced all of it with the county registrars website and the previous warranty deed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael L.

April 6th, 2022

Thumbs up. Very pleased with service. Easy process.

Thank you!

Fabio S.

May 27th, 2020

Fast, Easy and with great assistance! I will definitely use their services again!

Thank you for your feedback. We really appreciate it. Have a great day!